=====================================================

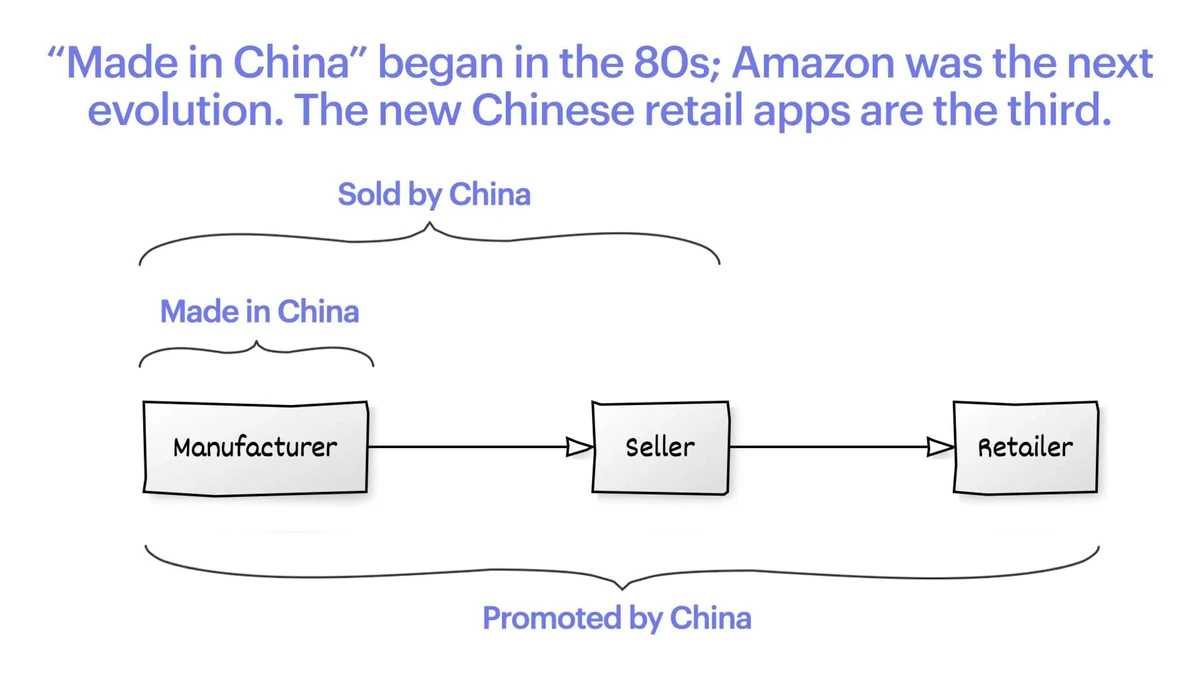

Introduction

In the world of financial markets, market impact is one of the most overlooked yet critical factors influencing the performance of trading strategies. Market impact refers to the change in an asset’s price caused by the act of trading itself. For example, when an institutional investor places a large buy order, it can push the price higher, increasing the cost of execution. Conversely, a large sell order may depress the price, reducing returns.

This article explores why market impact is important in trading strategies, reviews different methods to measure and mitigate it, and compares two dominant approaches—execution algorithms and order-splitting techniques. We will also connect the discussion with broader concepts such as how market impact affects quantitative trading and where to find data on market impact for trading.

By the end, readers—whether retail traders, institutional investors, or academic researchers—will gain a deep understanding of market impact and learn actionable methods to integrate it into their decision-making frameworks.

What Is Market Impact?

Definition and Scope

Market impact is the measurable effect of a trade on the asset’s market price. It occurs due to supply-demand imbalances, liquidity availability, and trader behavior.

Types of Market Impact

- Temporary Impact: Short-term distortion caused by immediate execution, often reverting as the market absorbs the order.

- Permanent Impact: Long-lasting shift in equilibrium price caused by information leakage or signaling effects of large trades.

Market impact curve showing temporary and permanent effects of large trades

Why Market Impact Matters in Trading Strategies

Reduced Profitability

Ignoring market impact can turn profitable strategies into unprofitable ones. A theoretical Sharpe ratio might collapse once real-world execution costs are included.

Execution Risk

In fast-moving markets, delayed or poorly executed orders can amplify slippage, magnifying losses.

Strategic Relevance

For algorithmic traders, understanding market impact for algorithmic traders is essential because strategies that ignore execution costs risk long-term failure.

Measuring Market Impact

Quantitative Models

- Linear Models: Estimate impact as a function of order size relative to market volume.

- Square Root Models: Empirical studies show impact often scales with the square root of trade size.

- Simulation Models: Agent-based simulations recreate realistic order-book dynamics.

Data Sources

Traders can use tick-level order book data, execution reports, and specialized vendor datasets. Knowing where to find data on market impact for trading helps researchers calibrate models effectively.

Strategy 1: Execution Algorithms

How It Works

Execution algorithms like VWAP (Volume-Weighted Average Price) and TWAP (Time-Weighted Average Price) distribute trades over time to reduce visibility and minimize price impact.

Pros

- Reduces large one-off trades.

- Matches execution to market volume.

- Commonly supported by brokers and platforms.

Cons

- Vulnerable to market manipulation (e.g., gaming VWAP).

- May not fully avoid permanent impact.

Strategy 2: Order-Splitting and Dark Pools

How It Works

Breaking large orders into smaller chunks and executing them in alternative venues (e.g., dark pools) helps reduce information leakage.

Pros

- Conceals trading intent.

- Avoids public order-book signaling.

- Reduces both temporary and permanent impact.

Cons

- Lower transparency of dark pools introduces counterparty risk.

- Slower execution speed in illiquid assets.

Comparing Execution Algorithms vs. Order-Splitting

| Feature | Execution Algorithms | Order-Splitting/Dark Pools |

|---|---|---|

| Transparency | High | Low |

| Speed | Medium | Variable |

| Market Impact Reduction | Moderate | High |

| Best Use Case | Liquid, high-volume assets | Illiquid or block trades |

Recommendation: For liquid assets like equities, VWAP/TWAP execution remains efficient. For illiquid markets, order-splitting with dark pool execution is preferable. Ideally, traders should combine both methods for a balanced approach.

Market Impact Across Asset Classes

- Equities: Strong market impact due to centralized exchanges and visible order books.

- Forex: Lower impact because of decentralized, deep liquidity pools.

- Commodities: Highly sensitive to large trades in futures due to lower depth.

- Options: Market makers adjust implied volatility, creating indirect impact.

Understanding how market impact varies across asset classes helps tailor execution strategies.

Risk Management and Market Impact

Market impact is not just a cost—it’s a risk factor. Failing to manage it introduces systematic biases in performance attribution. Institutional risk frameworks often model both volatility and liquidity risks together.

For example, hedge funds use market impact analysis for institutional traders to monitor strategy viability under stress conditions.

Industry Trends in Market Impact Analysis

- Machine Learning Applications: Predicting impact based on historical order-book features.

- Algorithmic Adaptation: Dynamic adjustment of execution schedules in real time.

- Regulatory Oversight: Market regulators now monitor large trades to prevent unfair manipulation.

Algorithmic execution workflow for reducing market impact

Best Practices for Minimizing Market Impact

- Trade in highly liquid markets.

- Use broker-provided algorithms tailored for asset class.

- Split orders intelligently across time and venues.

- Apply predictive models for impact estimation.

- Continuously monitor execution slippage.

FAQ: Market Impact in Trading

1. How does market impact affect quantitative trading?

Market impact directly reduces theoretical profits from quantitative models. A strategy may look profitable in backtests but fail in real life once transaction costs and impact are included. Quants must model impact alongside risk and volatility.

2. How to calculate market impact in trading?

Market impact is often estimated as the difference between execution price and benchmark prices such as VWAP, TWAP, or arrival price. Advanced methods use regression or square-root functions tied to trade volume.

3. How to minimize market impact in trading algorithms?

Traders can minimize impact by using execution algorithms, order-splitting, dark pools, and adaptive ML-based execution models. The best approach depends on asset class liquidity and order size.

Conclusion

Market impact is one of the most critical yet underestimated aspects of trading strategies. Ignoring it can lead to inflated expectations, flawed risk management, and underperforming portfolios. Whether you’re a retail trader, institutional investor, or quant researcher, integrating market impact optimization strategies into your workflow is essential.

Now it’s your turn:

👉 Have you experienced unexpected market impact in your trades?

👉 What strategies worked best for you to reduce it?

Share your thoughts in the comments below, and don’t forget to forward this article to peers who could benefit from understanding why market impact is important in trading strategies.

0 Comments

Leave a Comment