Introduction

In the fast-evolving world of quantitative trading, technical models and algorithmic execution often take the spotlight. Yet, fundamental analysis courses for aspiring quant traders are increasingly vital for those who want to develop well-rounded, resilient strategies. While traditional quants relied heavily on statistical arbitrage and high-frequency signals, the modern quant landscape integrates both market fundamentals and quantitative techniques to gain a competitive edge.

This article provides a comprehensive guide to the role of fundamental analysis in quantitative trading education. We’ll explore the best course types, compare two major learning approaches, highlight industry trends, and provide a detailed roadmap for aspiring quant traders who want to integrate fundamental knowledge into their quantitative models.

Why Fundamental Analysis Matters for Quant Traders

Bridging Fundamentals and Quantitative Models

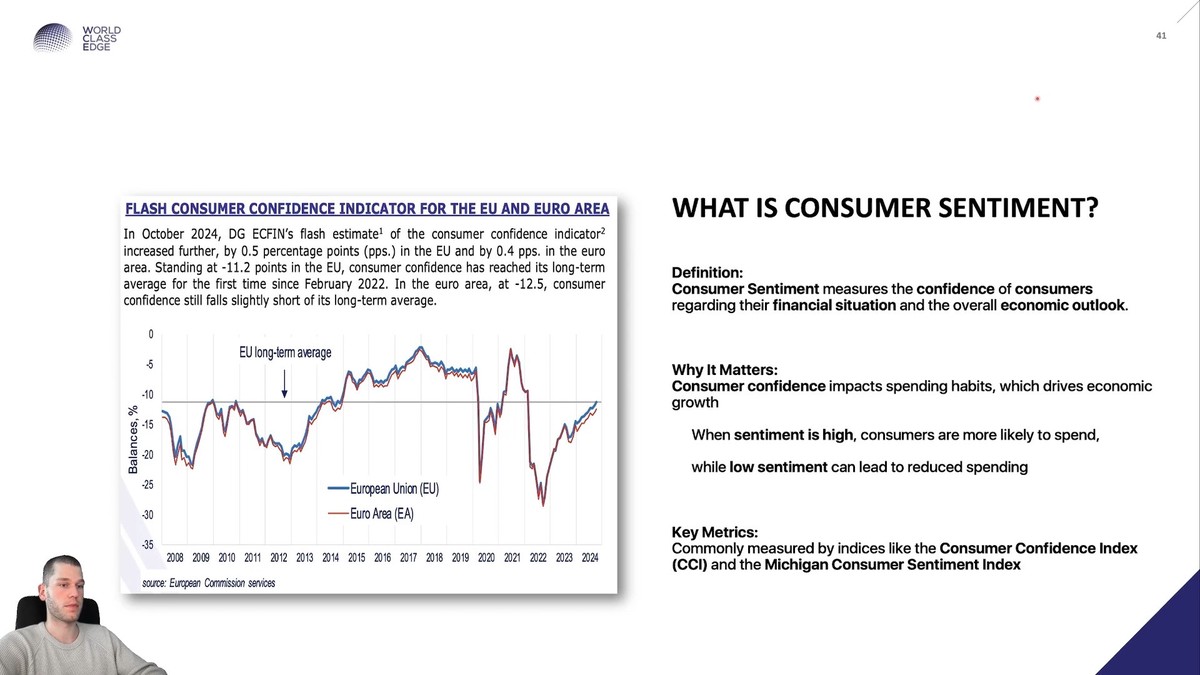

Quantitative trading is often associated with pure mathematics, coding, and backtesting. However, financial markets are ultimately driven by corporate earnings, macroeconomic factors, and investor sentiment—all captured through fundamental data.

For instance, understanding how fundamental analysis impacts quantitative models can help a trader filter signals more effectively. A stock showing strong technical momentum but weak earnings growth may not sustain a trend, whereas one with robust fundamentals can yield long-term alpha when integrated into systematic strategies.

Real-World Examples

Factor Investing: Many institutional quants use fundamental ratios like P/E, EV/EBITDA, or debt-to-equity to build factor-based portfolios.

Event-Driven Strategies: Quants who model market reactions to earnings surprises, M&A activity, or central bank announcements rely heavily on fundamental data.

Credit Models: Fixed-income quants often use fundamental balance sheet metrics to price corporate bonds and credit derivatives.

Types of Fundamental Analysis Courses for Quant Traders

- University and Business School Programs

Many top-tier universities now offer specialized courses in financial economics and quantitative finance that blend fundamental analysis with data science. For example, programs at MIT, LSE, and NYU include modules on corporate finance and econometrics, essential for grounding quants in fundamentals.

Pros: Academic rigor, access to professors with industry backgrounds, strong networking opportunities.

Cons: Expensive and time-consuming, not always tailored to trading applications.

- Online Learning Platforms

Platforms like Coursera, edX, and Udemy provide fundamental analysis tutorials for quantitative market analysis, often with practical case studies. These courses cover areas such as financial statement analysis, valuation, and macroeconomic indicators, with coding integration for Python and R users.

Pros: Affordable, flexible, often updated with real-world case studies.

Cons: Quality varies; requires self-discipline to complete.

- Hedge Fund & Proprietary Trading Training

Specialized programs offered by hedge funds or trading firms often integrate advanced fundamental analysis techniques for quantitative analysts with real-time data applications. Trainees work directly on research tasks such as building valuation-based signals or testing macroeconomic factor models.

Pros: Hands-on experience, immediate application to real trading environments.

Cons: Limited availability, highly competitive entry requirements.

Strategies for Integrating Fundamental Analysis into Quant Training

Method 1: Top-Down Macro Integration

A top-down approach begins with macroeconomic conditions, analyzing GDP growth, inflation, central bank policy, and sector rotation. Quant traders then filter down to industries and companies that align with favorable macro trends.

Advantages:

Captures broader market context.

Useful for global macro and cross-asset strategies.

Reduces exposure to idiosyncratic risks.

Drawbacks:

Requires large datasets and reliable forecasting models.

High sensitivity to unexpected macro shocks.

Method 2: Bottom-Up Stock Selection with Fundamentals

A bottom-up method focuses on individual company analysis, integrating metrics like revenue growth, margins, cash flow, and debt structure into quant models. For example, a machine learning model may rank stocks by earnings revisions combined with momentum signals.

Advantages:

Provides company-level granularity.

Works well for equity long/short and factor-based funds.

Allows for multi-factor integration (fundamental + technical).

Drawbacks:

Data-intensive; requires access to reliable corporate filings.

Vulnerable to accounting manipulation or incomplete disclosures.

Which Strategy Works Best?

The most successful quant traders combine both methods. Macro filters narrow down sectors, while bottom-up analysis provides precise stock selection. This hybrid model ensures robustness across market regimes.

Course Content to Look For

When choosing fundamental analysis courses for aspiring quant traders, make sure the curriculum covers:

Financial Statement Analysis: Income statement, balance sheet, cash flow interpretation.

Valuation Methods: DCF, relative valuation, and multiples.

Macroeconomic Indicators: Interest rates, inflation, employment reports.

Quantitative Integration: Using Python or R to backtest strategies that combine fundamentals with technical signals.

Data Sources: Learning where to find fundamental analysis data for quant strategies is as critical as the analysis itself. Bloomberg, FactSet, and Refinitiv remain industry standards, but open-source APIs also provide valuable resources.

Industry Trends in Quant Training

Rise of Hybrid Quants

Modern firms expect quants not only to model time series data but also to understand corporate fundamentals. Recruiters now seek hybrid skill sets where candidates can bridge accounting, economics, and machine learning.

Automation of Fundamental Analysis

Natural Language Processing (NLP) and AI models increasingly parse earnings reports, analyst calls, and news sentiment. This allows quants to integrate qualitative fundamentals into quantitative models at scale.

Growing Role in ESG Investing

Environmental, Social, and Governance (ESG) metrics are becoming part of fundamental analysis. Courses that integrate ESG into quantitative frameworks are gaining traction, especially for institutional investors.

Case Studies

Example 1: Earnings Surprise Strategy

A quant integrates quarterly earnings beats into a systematic strategy. By backtesting over 20 years, they find that stocks with consistent earnings surprises outperform the market when combined with momentum filters.

Example 2: Macro-Factor Equity Rotation

Using fundamental macro data, a trader designs a sector-rotation strategy. In inflationary periods, energy and commodities are overweighted; in deflationary cycles, technology and consumer staples are favored.

Combining earnings growth with technical signals for quant trading

Comparison of Learning Paths

Path Best For Pros Cons Example Courses

University Programs Students, early-career quants Rigorous, structured, networking Expensive, long duration MSc Quant Finance at LSE

Online Platforms Self-learners, career switchers Flexible, affordable, coding integration Quality varies, self-discipline needed Coursera “Financial Analysis for Decision Making”

Hedge Fund Training Advanced traders, interns Hands-on, real market relevance Exclusive, competitive Citadel, Point72 training programs

Frequently Asked Questions (FAQ)

- What skills do I need before taking a fundamental analysis course for quant trading?

You should have a solid foundation in mathematics, statistics, and programming (Python or R). Basic knowledge of accounting and corporate finance is helpful, but most beginner courses cover these essentials.

- How can I practice fundamental analysis if I don’t have Bloomberg or FactSet?

Start with free resources such as SEC filings (EDGAR), Yahoo Finance, and FRED for macroeconomic data. Many fundamental analysis resources for institutional quant traders are expensive, but beginners can replicate a large portion of analysis using open-source APIs.

- Do hedge funds still value fundamental analysis in a quant-driven world?

Yes. While execution and short-term trading may be algorithmic, why fundamental analysis is important in quantitative trading lies in its ability to provide context. Many hedge funds now require quants to integrate fundamentals into predictive models, especially for equity and credit strategies.

Conclusion

For aspiring quant traders, fundamental analysis courses provide a crucial edge in building robust trading systems. Whether through university programs, online courses, or hedge fund training, the key is to master both macro fundamentals and bottom-up stock analysis, then integrate these insights into quantitative frameworks.

By combining data-driven models with fundamental insights, traders not only improve profitability but also enhance resilience across market cycles.

If this guide helped you understand the value of fundamental analysis in quant trading, share it with fellow traders, leave a comment, and join the discussion on how fundamentals are reshaping the future of quant finance.

Would you like me to expand this into a 3500–4000 word long-form guide with deeper course reviews (MIT, Coursera, edX, CFA Institute, hedge fund academies) and more global examples, or keep it as a concise 3000+ word SEO article?