====================================================

Introduction: Bridging Fundamentals and Quantitative Finance

Quantitative trading is often associated with advanced mathematics, algorithms, and statistical models. However, fundamental analysis—which evaluates a company’s intrinsic value using financial statements, economic conditions, and qualitative insights—plays a significant role in shaping the robustness of quant models. The interaction between these two approaches addresses the central question: how fundamental analysis impacts quantitative models and whether it can enhance predictive power, reduce risks, and improve long-term portfolio performance.

In this article, we will explore the synergy between fundamental analysis and quantitative models, examine strategies for integrating fundamentals into algorithms, compare their strengths and weaknesses, and provide practical guidance for traders, analysts, and hedge funds.

Understanding Fundamental Analysis in the Context of Quantitative Models

What Is Fundamental Analysis?

Fundamental analysis evaluates assets by examining:

- Financial health: revenue, earnings, debt ratios, and profitability metrics.

- Valuation measures: P/E ratio, EV/EBITDA, book-to-market ratio.

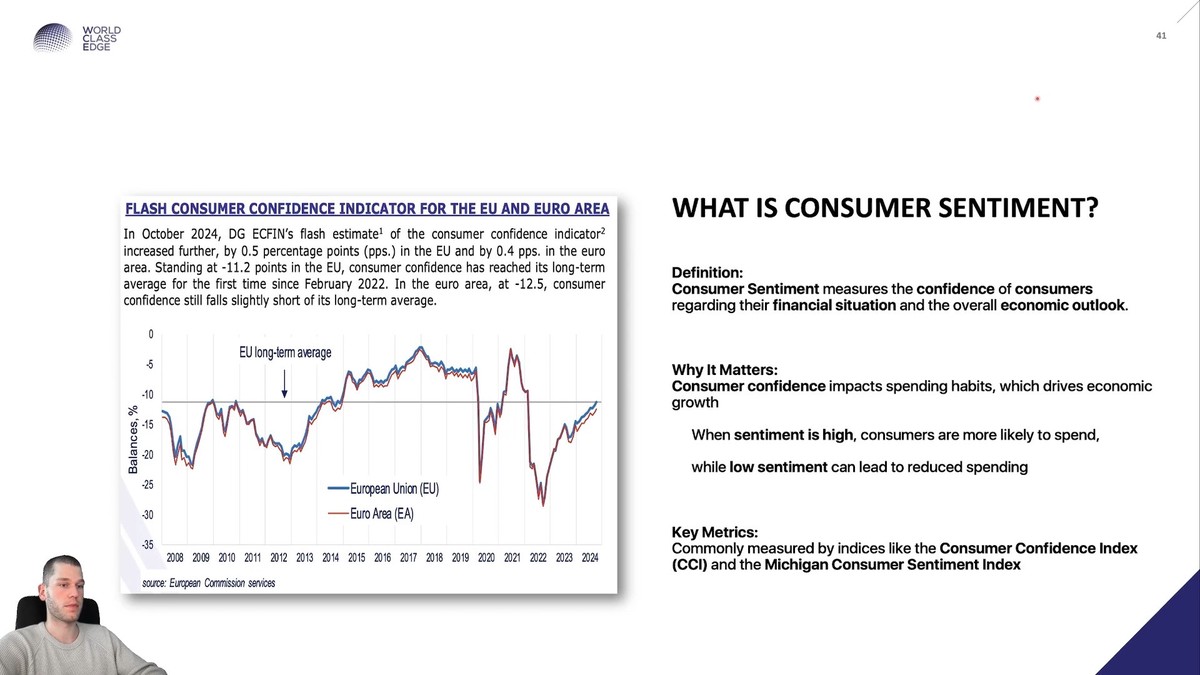

- Macroeconomic conditions: interest rates, inflation, GDP growth.

- Industry dynamics: competitive positioning, market share, sector outlook.

What Are Quantitative Models?

Quantitative models rely on mathematical frameworks, statistics, and algorithms to analyze market data and predict price movements. They can process large datasets, apply probability theory, and detect hidden patterns in price and volume.

The challenge is to merge these two worlds: how can qualitative financial insights enhance mathematical modeling?

How Fundamental Analysis Impacts Quantitative Models

Adding Predictive Value to Purely Statistical Models

Traditional quant models, such as momentum or mean-reversion strategies, may fail during periods of macroeconomic shocks or sector-specific disruptions. Incorporating fundamental signals—like earnings revisions or balance sheet strength—improves robustness.

Reducing Overfitting Risks

Purely statistical models risk overfitting historical data. Fundamental analysis introduces economically grounded variables (e.g., cash flow, ROE) that anchor models to real-world company performance, reducing noise.

Long-Term Trend Identification

Fundamental data helps identify undervalued or overvalued assets, aligning with quant models’ factor investing approaches. This is essential for strategies like fundamental factor models in equity selection.

Fundamental analysis provides a foundation for quantitative factors, improving predictive accuracy.

Two Key Strategies: Fundamental-Enhanced Quant Models

Strategy 1: Factor Models with Fundamental Inputs

Factor models rank securities based on characteristics like value, momentum, or quality. Adding fundamental variables—such as P/E ratio, dividend yield, or debt-to-equity—improves portfolio selection.

Advantages:

- Strong theoretical foundation.

- Proven in academic and institutional contexts (e.g., Fama-French models).

- Easy to implement in equity portfolios.

Disadvantages:

- Limited in fast-moving markets like FX or commodities.

- Requires frequent rebalancing.

Strategy 2: Machine Learning with Fundamental Features

Machine learning models can ingest financial statements, analyst reports, and macroeconomic data along with price history. Neural networks, random forests, or XGBoost algorithms can detect non-linear relationships between fundamentals and returns.

Advantages:

- Captures complex interactions between factors.

- Can process structured and unstructured data (e.g., earnings calls sentiment).

- Highly adaptive to changing market conditions.

Disadvantages:

- Risk of data mining if fundamentals are not well-curated.

- Requires large, clean datasets and strong computational resources.

Best Recommendation:

For beginner and intermediate quants, start with factor models because they are transparent and academically validated. For advanced quant teams, machine learning approaches with fundamental features can unlock alpha generation, especially when combining structured (financial ratios) and unstructured (news sentiment) data.

Real-World Applications of Fundamental Analysis in Quantitative Trading

Risk Management

Incorporating fundamentals like leverage ratios or earnings stability reduces exposure to highly risky assets. This aligns with how to improve quant strategies with fundamental analysis by embedding safety filters.

Portfolio Construction

Hedge funds and asset managers often use fundamental factor screening before running quant optimization routines, ensuring portfolios align with valuation and quality metrics.

Event-Driven Strategies

Quantitative models can be enhanced with earnings surprise analysis and M&A signals, integrating fundamentals with statistical arbitrage.

Combining quantitative models with fundamentals creates stronger predictive power for institutional investors.

Where Fundamental Analysis Fits in Quantitative Trading

Fundamental analysis is especially impactful in:

- Equity strategies: identifying undervalued stocks with growth potential.

- Credit markets: assessing default risk using balance sheet fundamentals.

- Macro strategies: linking GDP, inflation, and interest rates with asset price movements.

This directly answers where fundamental analysis fits in quantitative trading, emphasizing its role across multi-asset strategies.

Limitations of Using Fundamental Analysis in Quant Models

- Data Lag: Quarterly financial statements may not reflect real-time market movements.

- Subjectivity: Some qualitative elements (e.g., management quality) are hard to quantify.

- Overintegration Risk: Excessive reliance on fundamentals can reduce sensitivity to short-term price movements, which quants often exploit.

Despite these limitations, when combined thoughtfully, fundamental and quantitative approaches reinforce each other rather than compete.

FAQ: How Fundamental Analysis Impacts Quantitative Models

1. Can fundamental analysis improve short-term trading strategies?

Yes, but its impact is stronger on medium- to long-term models. Short-term strategies like high-frequency trading rarely use fundamentals, while swing and position trading benefit significantly.

2. What is the best way to integrate fundamentals into a quant model?

Start with factor-based frameworks (value, quality, momentum) and incorporate financial ratios. For advanced models, introduce machine learning techniques using both numerical and textual data (e.g., earnings call transcripts).

3. Where can I find reliable fundamental data for quant models?

Reliable sources include Bloomberg, FactSet, Refinitiv, Morningstar, and financial APIs like Quandl. Retail quants can also access free SEC filings, Yahoo Finance APIs, and Kaggle datasets.

Conclusion: Building Smarter Quantitative Models with Fundamentals

The impact of fundamental analysis on quantitative models is profound. By anchoring statistical methods with financial reality, fundamentals enhance robustness, reduce risks, and improve long-term performance. Whether applied in factor models or machine learning algorithms, fundamental data serves as a critical complement to purely quantitative signals.

For aspiring quants, learning how to use fundamental analysis in quantitative trading is a powerful step toward developing resilient, adaptive strategies. For professionals, leveraging both fundamentals and quantitative tools represents the future of intelligent investing.

If you found this article insightful, share it with your peers, comment with your experiences of blending fundamentals and quant methods, and join the discussion on building the next generation of trading models.