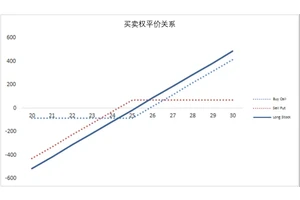

Put-Call Parity Calculation Methods: A Comprehensive Guide for Traders

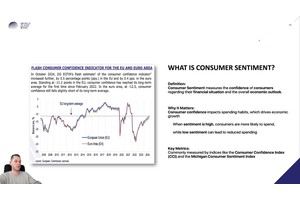

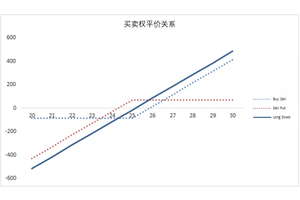

Put-call parity is a fundamental concept in options pricing and financial markets. It establishes a relationship between the prices of European call options, European put options, and the underlying

Put-Call Parity Application Examples: Understanding and Implementing the Concept in Trading

Put-call parity is a fundamental concept in options pricing and trading. It describes a relationship between the prices of put and call options that share the same strike price and expiration date.

Put-Call Parity Analysis Tools: A Comprehensive Guide for Traders and Analysts

Understanding put-call parity is essential for options traders, financial analysts, and investors aiming to identify arbitrage opportunities, price options accurately, and optimize trading

Comprehensive Guide to Put-Call Parity Analysis Tools

Introduction In modern options trading, understanding put-call parity is fundamental for accurate pricing, arbitrage opportunities, and risk management. Traders and financial analysts rely on

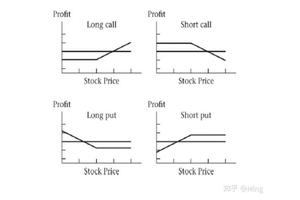

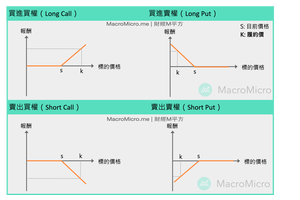

Proven Methods to Handle Asymmetrical Risk

Asymmetrical risk is a critical concept for traders, investors, and financial professionals who aim to optimize returns while minimizing downside exposure. Unlike symmetrical risk, where potential