=========================================================================

Understanding how to calculate intrinsic value of a stock is one of the most fundamental skills for any serious investor. Unlike market price, which reflects current supply and demand dynamics, intrinsic value represents the true underlying worth of a company based on its financial performance, growth potential, and risk profile.

In this article, we’ll explore different methods for calculating intrinsic value, explain their advantages and drawbacks, provide practical examples, and share insights from industry experience. We’ll also include FAQs to address common investor concerns and show you how intrinsic value can guide smarter investment decisions.

What is Intrinsic Value?

Intrinsic value refers to the estimated fair value of a stock based on objective analysis rather than market fluctuations. Investors calculate intrinsic value to determine whether a stock is undervalued (buying opportunity) or overvalued (risk of losses).

For example, if a company’s intrinsic value is calculated at \(100 per share while its market price is \)80, the stock may be considered undervalued and attractive to buy. Conversely, if the market price is $120, it might be overvalued.

This concept underpins value investing strategies popularized by Warren Buffett, who consistently emphasizes buying businesses below their intrinsic worth.

Why Calculate Intrinsic Value Before Investing

Market prices are influenced by speculation, short-term sentiment, and macroeconomic factors. Calculating intrinsic value provides a rational, disciplined foundation for making decisions, instead of reacting emotionally to price swings.

- For long-term investors: It ensures that you don’t overpay for growth stocks or miss undervalued opportunities.

- For traders: It helps identify when momentum diverges from fundamentals.

- For portfolio managers: It adds a risk-adjusted anchor when building diversified allocations.

When considering why intrinsic value is important, it’s because it offers clarity amid market noise, giving investors a benchmark to measure whether they are making decisions on speculation or on real financial worth.

Key Methods to Calculate Intrinsic Value of a Stock

There are several approaches to calculating intrinsic value. Below, we explore two of the most widely used methods:

1. Discounted Cash Flow (DCF) Model

The DCF model is one of the most robust methods for estimating intrinsic value. It calculates the present value of all expected future cash flows, discounted back using the company’s cost of capital or required rate of return.

Steps to calculate intrinsic value using DCF:

- Estimate future free cash flows (FCF) for 5–10 years.

- Select a discount rate, often based on the weighted average cost of capital (WACC).

- Calculate terminal value, representing cash flows beyond the forecast horizon.

- Discount future cash flows and terminal value to today’s value.

- Sum all values and divide by shares outstanding to get intrinsic value per share.

Pros:

- Widely respected and detailed.

- Incorporates company-specific fundamentals.

Cons:

- Highly sensitive to assumptions (growth rate, discount rate).

- Requires deep financial knowledge.

Example (Simplified):

- Expected annual free cash flow: $10 million

- Growth rate: 5%

- Discount rate: 10%

- Intrinsic value ≈ \(120 million total / 10 million shares = **\)12 per share**.

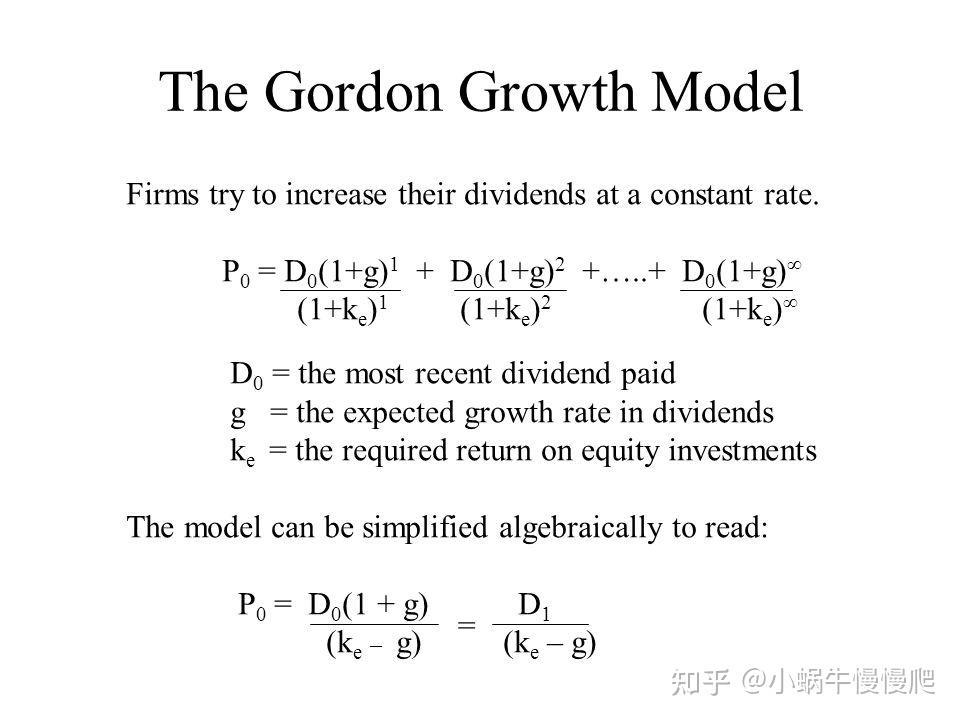

2. Dividend Discount Model (DDM)

The DDM is ideal for companies that pay consistent dividends. It values a stock by calculating the present value of future dividends.

Formula (Gordon Growth Model):

Intrinsic Value=D1r−gIntrinsic\ Value = \frac{D_1}{r - g}Intrinsic Value=r−gD1

Where:

- D1D_1D1 = expected dividend next year

- rrr = required rate of return

- ggg = dividend growth rate

Pros:

- Straightforward and simple.

- Works well for stable dividend-paying firms.

Cons:

- Not applicable to companies with no dividends.

- Sensitive to small changes in growth or discount rates.

Example:

- Dividend = $2 per share

- Growth = 4%

- Required return = 10%

- Intrinsic value = \(2 ÷ (0.10 – 0.04) = **\)33.33 per share**.

Comparing DCF vs DDM

| Feature | DCF Model | DDM Model |

|---|---|---|

| Best for | Growth companies, cash-flow-driven firms | Stable dividend-paying companies |

| Complexity | High (requires detailed forecasts) | Moderate (focuses on dividends) |

| Limitations | Sensitive to assumptions | Limited to dividend stocks |

Both methods are valuable. However, if you’re evaluating companies like Apple or Amazon with strong cash flow but inconsistent dividends, the DCF model is superior. For utilities or mature banks, the DDM is a better fit.

Practical Insights: Combining Models

In practice, professional analysts often use multiple methods to triangulate intrinsic value. For instance:

- Use DCF for cash flow estimates.

- Compare with DDM if the company pays dividends.

- Adjust with relative valuation multiples (P/E, EV/EBITDA).

This blended approach reduces reliance on one set of assumptions and increases confidence in the final estimate.

Where to Find Intrinsic Value Calculator

While manual calculations provide deeper understanding, many investors prefer to use intrinsic value calculators. These tools automate the math and save time. Options include:

- Brokerage platforms (e.g., Fidelity, TD Ameritrade).

- Independent finance websites (e.g., Gurufocus, Simply Wall St).

- Spreadsheet templates (Excel or Google Sheets).

Using these tools allows retail and professional investors to validate assumptions, run sensitivity analyses, and compare outputs across models.

Common Pitfalls When Calculating Intrinsic Value

- Over-optimistic growth assumptions – assuming 15% growth forever inflates value unrealistically.

- Ignoring risk factors – failing to adjust discount rates for industry volatility.

- Over-reliance on one method – using only DDM or DCF without considering limitations.

- Not updating calculations – intrinsic value must be recalculated regularly as new financial data becomes available.

FAQ: How to Calculate Intrinsic Value of a Stock

1. What is the most reliable way to calculate intrinsic value?

The DCF model is generally considered the most reliable, but only when accurate cash flow forecasts are available. For dividend-paying stocks, the DDM is simpler and practical. Many professional analysts combine methods for cross-validation.

2. How often should I recalculate intrinsic value?

At minimum, recalculate after quarterly earnings reports or when major changes occur (e.g., mergers, interest rate shifts, or new industry risks). Active traders may update weekly; long-term investors may update semi-annually.

3. Why does intrinsic value differ from market value?

Market value reflects current investor sentiment, liquidity, and speculation, while intrinsic value is based on fundamentals. For example, hype around AI stocks may drive market prices well above their intrinsic values, creating bubbles. This gap is why investors must always check intrinsic worth before committing capital.

Conclusion

Learning how to calculate intrinsic value of a stock is crucial for avoiding emotional investment decisions and building long-term wealth. Whether you use the DCF model for growth companies or the DDM for stable dividend payers, the goal remains the same: determine whether a stock is worth buying, holding, or selling.

By applying intrinsic value techniques, using calculators for efficiency, and regularly updating your analysis, you can gain a competitive edge in today’s volatile markets.

👉 If you found this guide useful, share it with fellow investors and comment below with your favorite method for valuing stocks. Let’s build smarter, data-driven investing communities together!

DCF vs DDM models help investors decide which valuation method best suits a company

Visual representation of market price vs intrinsic value in value investing

0 Comments

Leave a Comment