=====================================

Introduction

Quantitative trading is one of the most lucrative and competitive fields in finance. As a quant trader, your compensation reflects not only your technical expertise but also your ability to negotiate effectively. A well-prepared quant trader salary negotiation guide can help you secure a package that matches your skills, experience, and market value.

In this article, we will provide a comprehensive step-by-step framework for negotiating quant salaries, compare different strategies, analyze industry trends, and share insights from personal experience. Whether you’re a new graduate entering the quant world or an experienced professional moving to a hedge fund, this guide will help you approach negotiations with confidence.

Understanding Quant Trader Compensation

1. Base Salary

The fixed component of your compensation, often benchmarked against industry standards and your years of experience.

2. Bonus

In trading roles, bonuses can exceed base salary. They are usually tied to personal performance, team results, or overall firm profitability.

3. Equity or Profit Sharing

Some firms—particularly proprietary trading shops—offer profit-sharing arrangements or equity stakes. This can significantly increase long-term wealth if the firm performs well.

4. Benefits Package

Healthcare, retirement contributions, relocation support, and signing bonuses should also be factored into total compensation.

Quant trader compensation breakdown

Research: Knowing Your Market Value

Before entering any negotiation, it’s critical to benchmark your expected salary. Reliable sources include:

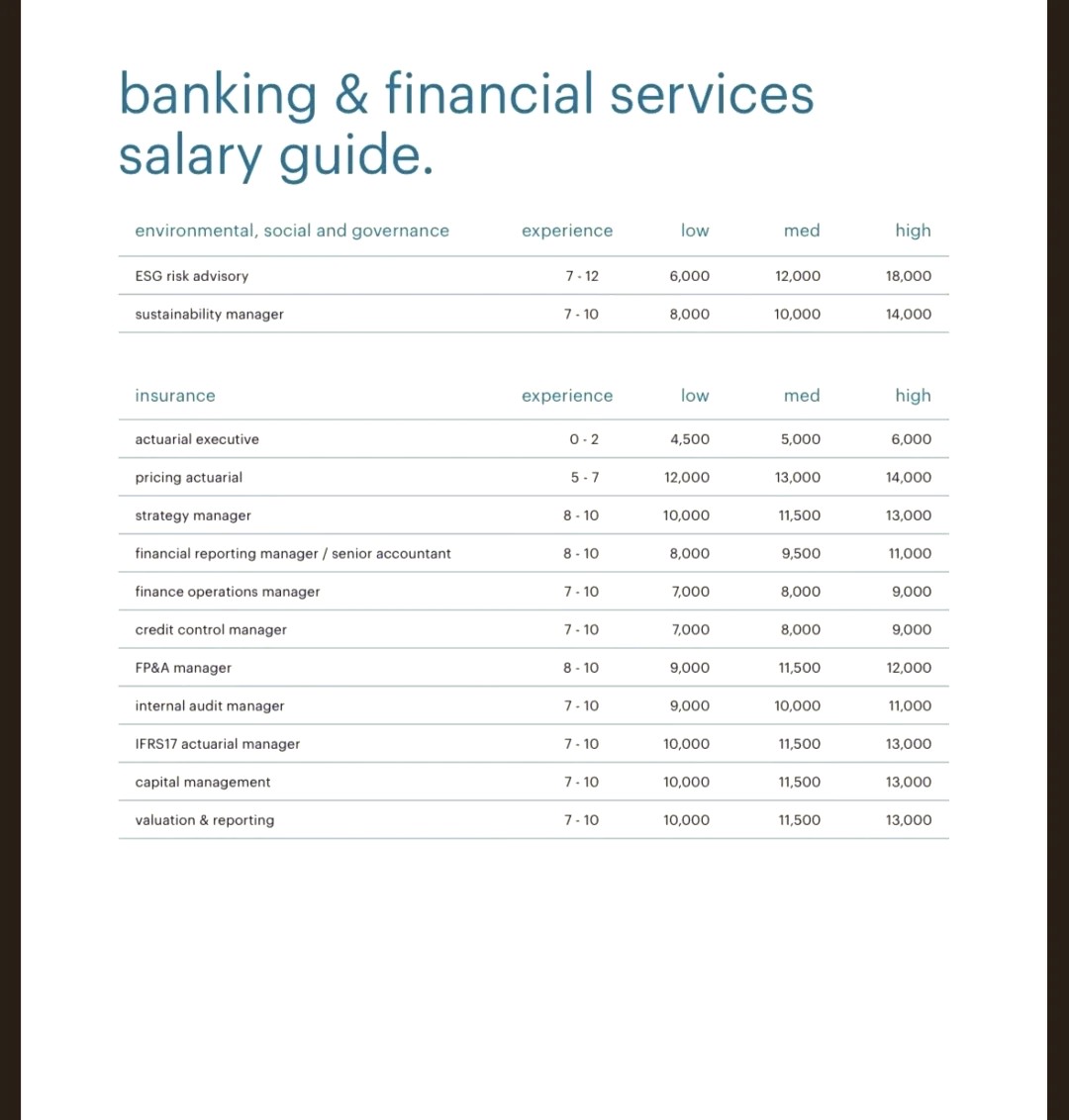

- Industry reports and salary surveys published by financial recruitment firms.

- Online communities such as Reddit discussions on how much quant traders earn on Reddit.

- Professional networking sites (e.g., Glassdoor, Levels.fyi, eFinancialCareers).

- Speaking with recruiters who specialize in quantitative finance.

For experienced professionals, understanding how quant trader salaries vary by location is also key. For example, a quant role in New York or London may pay significantly more than one in Singapore or Hong Kong, though cost of living adjustments should be considered.

Strategies for Salary Negotiation

Strategy 1: Data-Driven Negotiation

How It Works

You gather salary benchmarks from multiple sources (recruiters, surveys, online forums) and use this data to present a compelling case.

Pros

- Objective and fact-based, reducing emotional pushback.

- Demonstrates preparation and professionalism.

- Especially effective for early-career quants.

Cons

- Limited by availability and accuracy of public data.

- Recruiters may discount “internet sources” if not from recognized reports.

Strategy 2: Value-Based Negotiation

How It Works

Instead of only discussing salary benchmarks, you frame the conversation around your unique contributions—trading strategies developed, alpha generated, or coding infrastructure improved.

Pros

- Highlights personal performance and potential ROI.

- More persuasive for experienced quant traders.

- Can justify above-average compensation packages.

Cons

- Requires solid track record and quantifiable achievements.

- Risk of overselling yourself if not backed by measurable results.

Comparison of Strategies

| Criteria | Data-Driven Negotiation | Value-Based Negotiation |

|---|---|---|

| Best for | New graduates, juniors | Mid-career & senior traders |

| Evidence Required | Market salary benchmarks | Personal performance metrics |

| Negotiation Power | Limited, benchmark-focused | Strong, ROI-focused |

| Risk | Data may be challenged | Overselling without proof |

From my own experience, the best approach is combining both methods. Start with solid data to establish a baseline, then highlight personal value to push compensation above median benchmarks.

Timing Your Negotiation

1. Pre-Offer

If asked for salary expectations during interviews, avoid giving numbers too early. Instead, emphasize flexibility and interest in overall compensation.

2. Post-Offer

Once you receive a formal offer, negotiation leverage is higher. This is the moment to counter with data and personal value points.

3. Performance Review Cycles

Even if you accept the initial package, you can renegotiate during annual reviews or after major achievements.

Salary negotiation timing

Latest Trends in Quant Trader Salaries

- Hedge Funds vs. Banks: Hedge funds and proprietary trading firms often pay higher bonuses but with more performance risk. Banks provide more stability but sometimes lower upside.

- Geographic Disparities: New York and London remain the highest-paying markets, while Singapore and Hong Kong are growing hubs with competitive packages.

- Skill Premiums: Quants with machine learning, reinforcement learning, and crypto trading experience often command higher salaries.

- Remote Work: Some firms offer partial remote arrangements, though in-office presence is often preferred for trading roles.

Negotiation Mistakes to Avoid

- Accepting the first offer without discussion.

- Overemphasizing base salary while ignoring bonus structures.

- Failing to research firm-specific pay structures.

- Bringing personal financial needs into the conversation instead of focusing on professional value.

- Burning bridges with aggressive or inflexible negotiation.

Case Example: Junior Quant vs. Experienced Quant

- Junior Quant Analyst: Uses data-driven negotiation, cites where to find quant trader salary data from reputable sources, negotiates a modest signing bonus.

- Senior Quant with Track Record: Leverages value-based negotiation, highlighting millions generated through a systematic strategy, successfully negotiates higher base plus performance-linked bonus.

Best Practices for Successful Negotiation

- Do thorough research: Benchmark salaries using multiple sources.

- Frame negotiations positively: Focus on value creation, not entitlement.

- Consider total compensation: Salary, bonus, benefits, equity.

- Be prepared to walk away: Especially if competing offers exist.

- Practice negotiation scripts: Confidence matters as much as numbers.

FAQ: Quant Trader Salary Negotiation

1. How much room is there to negotiate a quant trader salary?

On average, base salary adjustments range from 10-20% above the initial offer, while bonuses are often negotiable based on expected performance. Senior roles can see even larger movements.

2. Should I negotiate salary as a beginner quant trader?

Yes. Even entry-level quants should negotiate. A small increase early in your career compounds significantly over time. Focus on industry benchmarks and overall compensation instead of demanding excessive raises.

3. What if the employer refuses to negotiate?

If an employer refuses outright, evaluate whether the package is fair compared to benchmarks. You can still request non-salary benefits like flexible work, professional development budgets, or early performance reviews.

Conclusion

Negotiating a quant trader salary requires research, preparation, and confidence. By combining data-driven benchmarks with value-based achievements, you can secure a package that truly reflects your worth.

Remember, compensation is not just about base salary—it includes bonuses, equity, and long-term career growth. Mastering negotiation early ensures exponential financial benefits throughout your quant career.

Successful quant trader negotiation

💬 Have you successfully negotiated a quant trader salary? Share your experience in the comments below, and don’t forget to share this guide with fellow quants who want to maximize their career earnings.

0 Comments

Leave a Comment