======================================================

Introduction

Quantitative traders, or quant traders, occupy some of the most lucrative positions in the financial industry. With their expertise in mathematics, data science, and financial modeling, they help firms maximize profits through algorithmic trading and risk management. Yet, despite the high-paying nature of these roles, salary negotiations remain one of the most crucial—and sometimes overlooked—parts of a quant’s career journey.

This comprehensive guide focuses on quant trader salary negotiation tips, drawing from personal experiences, industry trends, and insider strategies. It will help both entry-level and experienced quant traders understand compensation structures, master negotiation strategies, and achieve salaries that truly reflect their value.

Why Negotiation Matters for Quant Traders

Negotiation isn’t just about pushing for higher pay—it’s about aligning compensation with skill level, market value, and firm profitability. For quant traders, salary discussions can also impact bonuses, equity participation, and career trajectory.

- Base Salary: The guaranteed amount you’ll earn annually.

- Bonus Structure: Performance-linked pay, often significant in trading roles.

- Equity/Profit-Sharing: Ownership stakes or revenue sharing, common in hedge funds.

By mastering negotiation, you not only increase short-term earnings but also set yourself up for long-term financial security.

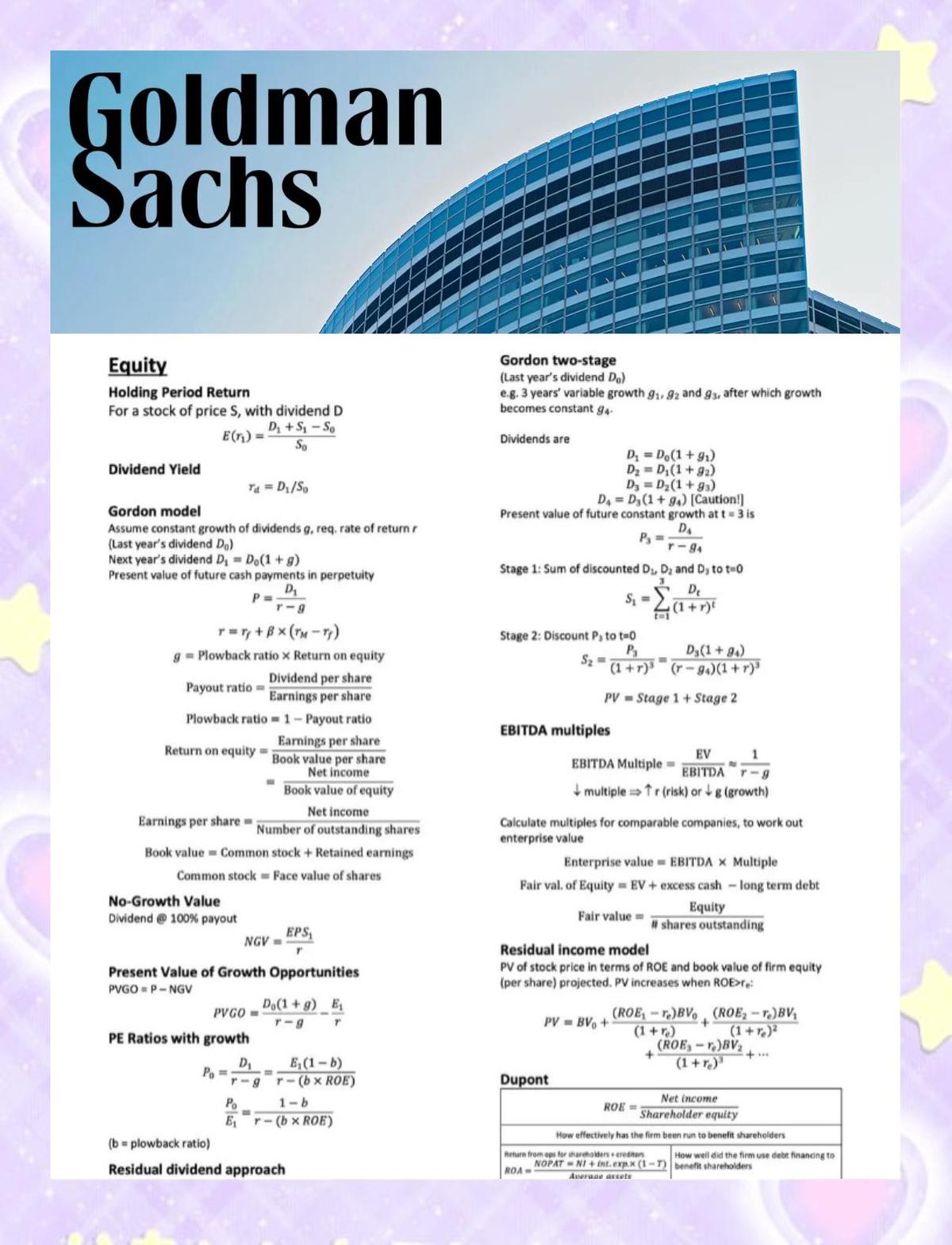

Understanding Quant Trader Salaries

Before negotiating, it’s vital to understand industry benchmarks. Salaries vary by experience, firm type, and location.

- Entry-level quant trader salary in the US → \(120,000–\)180,000 plus bonuses.

- Experienced quant trader salary in the US → \(200,000–\)400,000 base, with bonuses exceeding base pay in some cases.

- Senior quant trader salary in the US → $500,000+ including performance-linked incentives.

👉 For more insights, check out How much do quant traders make on average in the US?, which explores detailed compensation ranges across roles.

Key Factors Influencing Negotiations

1. Location

Compensation differs significantly across cities. For example, a quant trader salary in New York is generally higher than in Chicago, due to cost of living and market competition.

2. Firm Type

- Investment banks: Higher stability, structured pay.

- Hedge funds & prop trading firms: High-risk, high-reward, with bonuses linked to firm performance.

- Tech-driven quant firms: Often combine salary with stock options.

3. Experience and Skills

Employers pay a premium for specialized skills like:

- Machine learning for trading models.

- High-frequency trading (HFT) expertise.

- Advanced risk modeling.

Quant Trader Salary Negotiation Tips

Tip 1: Research Market Benchmarks

Knowledge is power. Use resources like Glassdoor, Levels.fyi, and industry salary surveys to benchmark offers. Firms expect you to be informed.

Tip 2: Emphasize Your Value Proposition

Quant firms thrive on measurable performance. Highlight your:

- Proven trading strategies.

- Backtested models with consistent returns.

- Risk management innovations.

Tip 3: Negotiate Beyond Base Salary

Focus not only on salary but also:

- Signing bonuses.

- Annual bonuses tied to performance.

- Equity or revenue-sharing arrangements.

Tip 4: Time Your Negotiations

The best time to negotiate is after proving your value (e.g., during a job offer or after a strong trading year).

Tip 5: Prepare to Walk Away

Having multiple offers strengthens your position. Always negotiate with alternatives in hand.

Two Salary Negotiation Strategies Compared

Strategy 1: Data-Driven Negotiation

This method relies heavily on market research and quantifiable achievements. Candidates present hard evidence of performance and align it with salary benchmarks.

- Pros: Objective, professional, hard to refute.

- Cons: Relies on access to accurate market data.

Strategy 2: Value-Added Negotiation

Here, candidates frame themselves as indispensable assets by highlighting unique skills or contributions (e.g., building a trading model that improved firm returns by 15%).

- Pros: Persuasive, highlights uniqueness.

- Cons: May appear subjective without numbers.

Recommended Approach

A hybrid method works best: start with data-driven facts to anchor your case, then use value-added arguments to differentiate yourself from compe*****s.

Real-World Example of a Negotiation

A junior quant trader in Chicago received an initial offer of $150,000 base + 20% bonus. After presenting competing offers and demonstrating backtested strategies, they negotiated:

- $170,000 base.

- 30% performance bonus potential.

- Relocation allowance.

Result: An overall package worth 25% more than the original offer.

Industry Trends Impacting Negotiations

- Remote Work Flexibility: Some firms now offer location-adjusted salaries.

- Profit-Sharing Structures: Smaller prop firms increasingly link pay to performance.

- AI-Driven Trading: Specialists in machine learning command premium salaries.

👉 To explore job availability, check Where to find quant trading jobs in the US?, which details platforms and regions hiring actively.

Common Mistakes in Salary Negotiation

- Accepting the first offer without research.

- Overemphasizing money without showing value.

- Ignoring long-term incentives like equity or career development.

- Being confrontational instead of collaborative.

FAQ: Quant Trader Salary Negotiation

1. Should I negotiate as a junior quant trader?

Yes. Even at the entry level, you can negotiate base pay or signing bonuses. Be realistic—firms may not offer huge increases, but small adjustments compound over time.

2. How important are bonuses in quant trading compensation?

Extremely important. In many firms, bonuses can exceed base salary. Always negotiate bonus structures with clear, transparent performance metrics.

3. What if I have multiple offers?

Leverage them carefully. Mentioning competing offers signals demand for your skills, but always remain professional and avoid ultimatums.

Conclusion

Negotiating a quant trader salary is both an art and a science. By researching benchmarks, demonstrating unique value, and carefully timing negotiations, you can maximize both short-term and long-term compensation.

Remember: salary is just one part of the package. Bonuses, equity, and career growth opportunities often outweigh base pay.

If this guide has helped you, please share it with peers, comment with your own negotiation experiences, and help other quant traders navigate this critical career skill.

Visual References

Quant trader salary progression from junior to senior roles.

A hybrid strategy combining data-driven and value-added approaches.

Typical breakdown of quant trader compensation: base, bonus, and equity.

0 Comments

Leave a Comment