Neural Network Algorithms for Market Prediction: A Comprehensive Guide

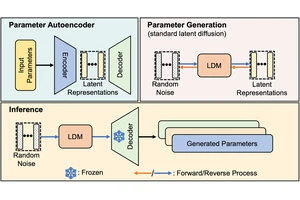

In the world of quantitative trading, the application of machine learning (ML) and neural networks (NN) has revolutionized how financial markets are analyzed and predicted. Neural networks are now

Monte Carlo Trading Simulations Explained

Monte Carlo simulations are a cornerstone of quantitative finance, offering traders and analysts a robust method to model uncertainty, forecast potential outcomes, and optimize trading strategies.

Monte Carlo Tools for Risk Managers: Advanced Strategies and Applications

In today’s dynamic financial markets, risk management has evolved into a critical discipline for both institutional and professional traders. Monte Carlo tools for risk managers have become

Monte Carlo Tools for Risk Managers: Enhancing Financial Decision-Making

Risk management is the cornerstone of modern finance, particularly in fast-paced trading environments and complex institutional portfolios. One of the most powerful methodologies for assessing risk,

Monte Carlo Tools for Risk Managers: Advanced Techniques for Optimizing Financial Risk Assessment

In the ever-evolving landscape of financial markets, risk managers require advanced analytical tools to forecast potential losses and safeguard portfolios. Monte Carlo simulation has emerged as a

Monte Carlo Techniques for Trading Profitability

In modern financial markets, where volatility, uncertainty, and complex dynamics dominate, Monte Carlo techniques for trading profitability have emerged as a cornerstone for quantitative analysts

Monte Carlo Techniques for Trading Profitability

Monte Carlo techniques have become an essential part of modern quantitative finance, providing traders and analysts with powerful tools to test strategies, assess risk, and optimize trading

Monte Carlo Techniques for Financial Analysts: A Complete Guide to Risk Modeling and Strategy Optimization

Monte Carlo techniques have become an essential toolkit for financial analysts who need to model uncertainty, assess risk, and optimize trading or investment strategies. By using random sampling and

Monte Carlo Techniques for Financial Analysts: A Comprehensive Guide

Monte Carlo simulations have become an indispensable tool for financial analysts, enabling precise risk assessment, portfolio optimization, and predictive modeling. This article explores why Monte

Monte Carlo Strategies for Hedge Fund Managers

Monte Carlo simulations have become a cornerstone of modern quantitative finance, especially for hedge fund managers looking to assess and optimize their trading strategies. By simulating a wide