Summary

The fusion of algorithmic trading with big data has transformed global financial markets. Algorithms can now process millions of data points per second, uncover hidden patterns, and execute trades in milliseconds. This article provides a deep dive into the latest tools, methods, and strategies in big data-driven algorithmic trading. Drawing from personal experience, we compare two distinct approaches—rule-based vs. machine learning—and recommend the most effective path for traders in 2025.

Introduction: Why Big Data Matters in Algorithmic Trading

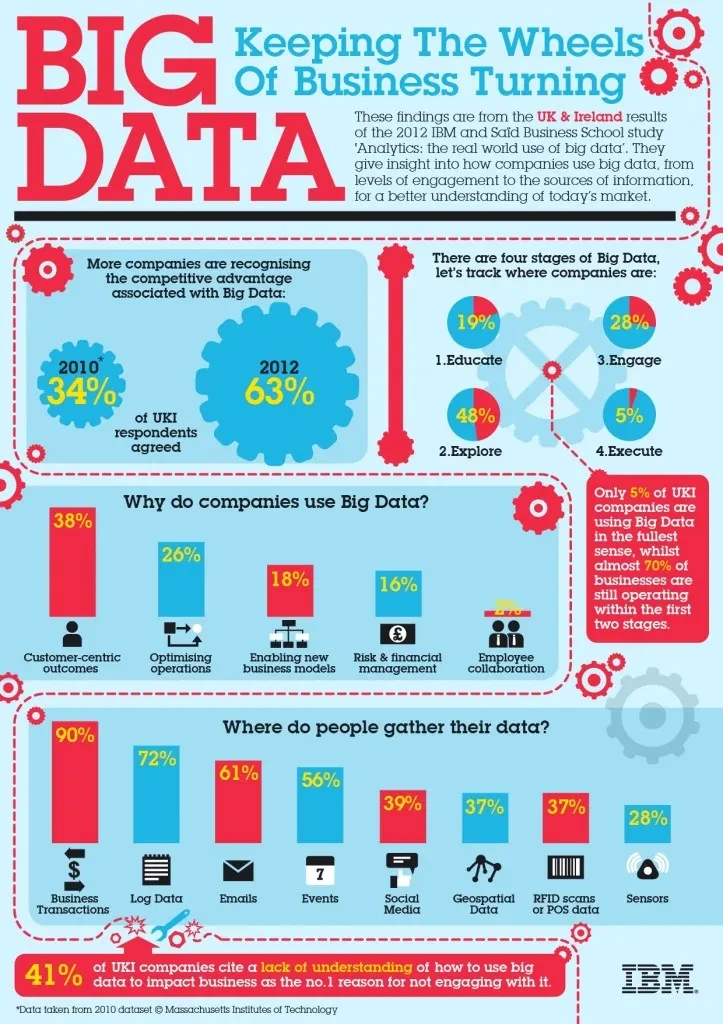

Financial markets are information-driven. Traditional technical analysis once relied on price, volume, and basic indicators. Today, big data includes alternative datasets such as social media sentiment, satellite imagery, credit card transactions, and ESG metrics. Algorithmic trading systems harness this vast data to generate alpha.

The size, velocity, and variety of big data fundamentally reshape strategies. For quants and institutions, ignoring big data is no longer an option—it’s the competitive edge.

Core Components of Algorithmic Trading with Big Data

- Data Acquisition

Big data sources include:

Market data feeds (tick-by-tick trades, quotes)

Alternative data (satellite, sentiment, IoT)

Macroeconomic datasets (GDP, employment, rates)

ESG and fundamental data

- Data Storage and Processing

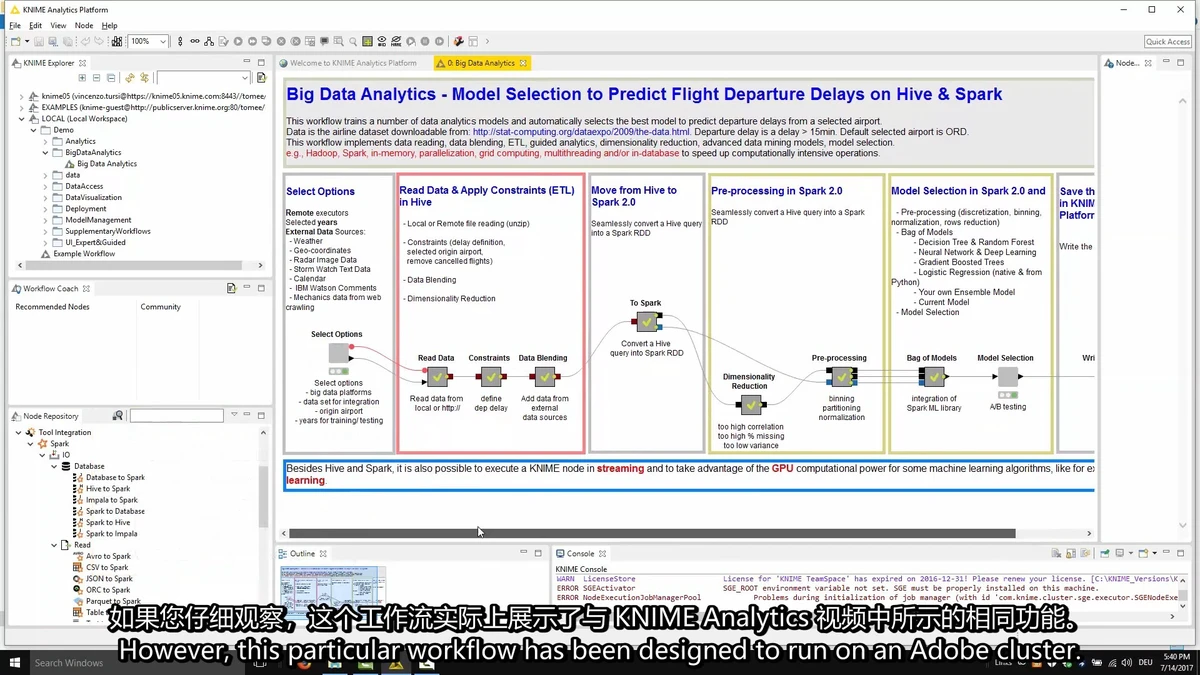

Distributed systems like Hadoop and Spark, or cloud services like AWS and Google BigQuery, allow scalable data management.

- Feature Engineering

Raw data must be transformed into meaningful signals—volatility clusters, factor exposures, sentiment indices.

- Model Development

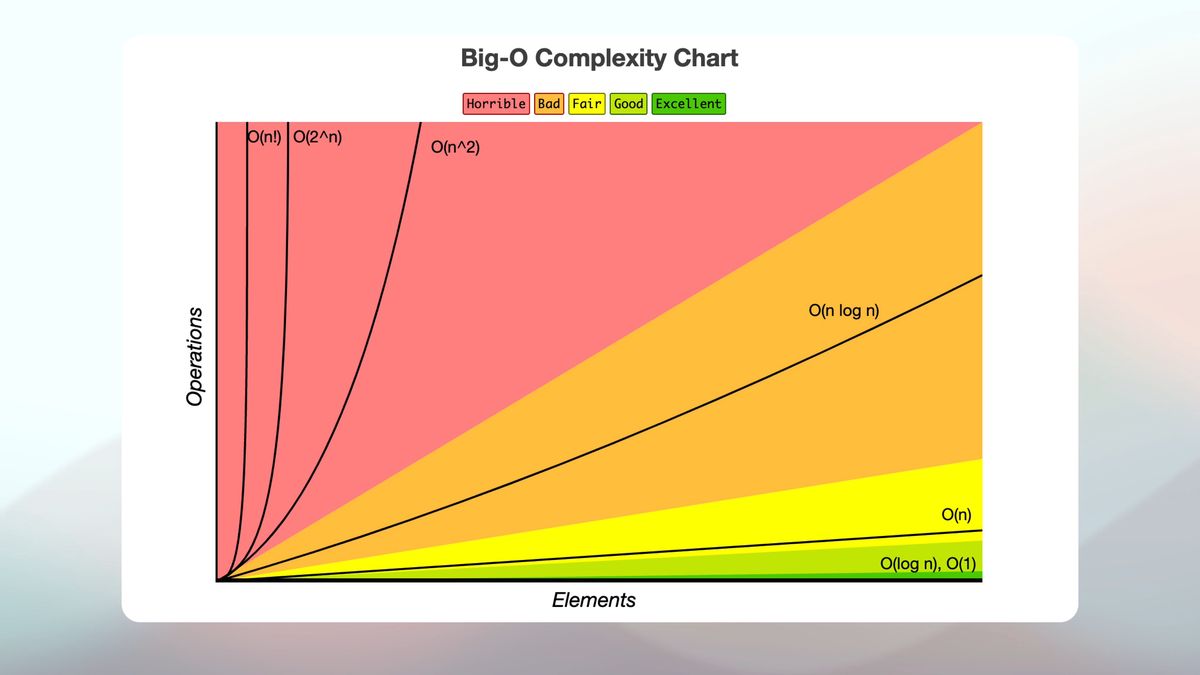

Quant models range from regression and ARIMA to deep learning and reinforcement learning algorithms.

- Execution Systems

Low-latency infrastructure ensures signals become trades instantly, often within microseconds.

Personal Experience: From Traditional Backtesting to Big Data Models

When I started algorithmic trading in 2016, my strategies were built on simple moving averages and RSI signals. They worked briefly, but performance decayed as markets adapted.

In 2020, I began integrating big data—specifically Twitter sentiment and Google Trends. I built a pipeline in Python, feeding data into XGBoost models. The shift was remarkable: my strategy detected momentum shifts hours before they appeared in price action.

Lesson learned: big data is not just an enhancement—it’s a paradigm shift. Traders who adopt it early gain a structural advantage.

Comparing Two Major Approaches: Rule-Based vs. Machine Learning

Rule-Based Algorithmic Trading

These strategies rely on fixed rules (e.g., moving averages, Bollinger Bands).

Pros:

Easy to implement

Transparent decision-making

Works in stable, predictable environments

Cons:

Limited adaptability

Breaks down in regime shifts

Ignores unstructured big data

Machine Learning with Big Data

This approach leverages algorithms like random forests, neural networks, and reinforcement learning to adaptively learn from vast datasets.

Pros:

Processes structured and unstructured data

Adapts to changing market conditions

Finds hidden, non-linear relationships

Cons:

Requires high-quality data and infrastructure

Risk of overfitting

Less transparent (“black box”)

Best Method Recommendation

In 2025, machine learning with big data is the superior path. While rule-based systems still have niche uses, adaptive models driven by alternative datasets deliver more sustainable alpha.

Latest Trends in Algorithmic Trading with Big Data (2025)

Alternative Data Boom – Satellite images of store parking lots, shipping traffic data, and IoT signals are now standard for hedge funds.

Real-Time Sentiment Analysis – NLP models scan social media, news, and transcripts for trading signals.

Cloud-Native Quant Platforms – Big data pipelines are shifting from local servers to scalable cloud environments.

AI-Driven Risk Management – Algorithms dynamically adjust leverage and stop-losses using predictive analytics.

Integration with ESG Investing – Big data helps algorithms optimize not just for profit, but sustainability.

Top Tools for Algorithmic Trading with Big Data

- Python (Pandas, Scikit-learn, TensorFlow, PyTorch)

Most flexible and widely used

Excellent for machine learning with financial datasets

- Apache Spark

Distributed computing for massive data sets

Handles structured and unstructured data

- Bloomberg Terminal + Quant APIs

Institutional-grade data feeds

Integrates with custom models

- AWS & Google BigQuery

Cloud solutions for scalable big data pipelines

Ideal for quants without on-premise servers

- QuantConnect

Backtesting and live execution with access to multiple datasets

Community-driven innovation

Related Insights on Big Data in Trading

Understanding how to use big data for quantitative trading is crucial: it means integrating multiple datasets into one cohesive pipeline, then building models that balance predictive accuracy with robustness.

Equally important is knowing where to find big data for trading algorithms. Sources include paid providers (Bloomberg, Refinitiv, Quandl) and open datasets (Google Trends, SEC filings, Twitter API).

These two aspects—data integration and sourcing—are the foundations of big data-powered algorithmic trading.

FAQs: Algorithmic Trading with Big Data

- How do traders avoid overfitting when using big data?

Use out-of-sample testing, cross-validation, and walk-forward analysis. Always prioritize model generalization over short-term backtest performance.

- What kind of big data is most useful for trading?

It depends on the strategy. Sentiment data works for momentum trading, satellite imagery aids retail forecasts, while credit card data is valuable for consumer sector analysis.

- Do retail traders have access to big data tools?

Yes. While hedge funds use premium datasets, retail traders can use free APIs (Twitter, Google Trends) and cloud services like AWS for scalable analysis.

- How does big data impact high-frequency trading (HFT)?

Big data enhances signal generation, but HFT still depends heavily on infrastructure (colocation, microsecond latency). Big data plays a secondary role compared to speed in HFT.

- Can machine learning models replace human traders?

Not entirely. Algorithms excel at pattern recognition, but humans remain essential for strategy design, ethical considerations, and adapting to black swan events.

Final Thoughts

The integration of algorithmic trading with big data is redefining financial markets. Traders who master data pipelines, machine learning models, and alternative datasets will thrive in 2025 and beyond.

My advice: start small with open-source datasets, build your pipeline in Python, and progressively integrate advanced tools like Spark or cloud solutions. The future of trading belongs to those who turn information into execution.

Call to Action

If this guide helped you, share it with your trading community! The more we exchange ideas on big data in algorithmic trading, the stronger the ecosystem becomes. Comment with your favorite big data source or your most successful strategy experiment.

| Aspect | Key Points |

|---|---|

| Definition | Platform enabling firms to quote bid and ask prices, ensuring liquidity |

| Core Features | Ultra-low latency, automated quoting, risk management, API integration |

| Importance of Comparison | Determines speed, risk tools, tech stack, regulatory compliance |

| Approach 1: In-House Development | Custom systems, full control, latency optimization, high cost |

| Approach 2: Third-Party Platforms | Vendor solutions, faster deployment, lower cost, less flexibility |

| Hybrid Solutions | Combine third-party infrastructure with custom strategy modules |

| Key Platforms | Proprietary builds, institutional vendors, crypto market makers, retail APIs |

| Platform Strengths | Low latency, regulatory tools, 24⁄7 liquidity, accessibility |

| Platform Weaknesses | High cost, less flexibility, volatility risk, limited speed for HFT |

| Technology Trends | AI/ML integration, cloud-based, DeFi market making, API-first platforms |

| Risk Management | Delta hedging, position limits, circuit breakers, predictive AI monitoring |

| Lessons Learned | Prioritize monitoring and compliance; start with simulations for retail |

| FAQ Highlights | Institutional platforms suit compliance; crypto platforms vary; test latency |

| Conclusion | Choose based on scale, risk tolerance, combine risk management with tech |

0 Comments

Leave a Comment