Introduction

In the world of investing and trading, understanding alpha is critical to evaluating the performance of portfolios, stocks, and investment strategies. Alpha represents the excess return of an investment relative to a market index or benchmark, adjusted for risk. It is often used to gauge how well a portfolio manager or strategy is performing above the market average.

This article will explain the Alpha Calculation Formula in-depth, compare two different methods for calculating alpha, and offer guidance on how to apply alpha in real-world trading. We’ll also explore some advanced techniques for improving alpha and discuss its importance in investment decision-making.

What is Alpha in Investment?

Alpha is a key performance metric that helps investors understand whether a strategy or portfolio has outperformed or underperformed a market benchmark after accounting for risk. In simple terms, it measures the value added by a portfolio manager or strategy in excess of the market return.

Alpha vs. Beta

Before diving into the Alpha Calculation Formula, it’s important to differentiate between alpha and beta.

Alpha measures the excess return relative to the benchmark.

Beta measures the volatility or risk relative to the benchmark.

For example, a portfolio with an alpha of +2% has generated 2% more return than the benchmark, while a portfolio with a beta of 1.5 would have 50% more volatility than the market.

The Alpha Calculation Formula

The alpha formula is a simple way to calculate the excess return of an investment. The basic formula for alpha is:

α=Ri−(Rf+β⋅(Rm−Rf))

α=R

i

−(R

f

+β⋅(R

m

−R

f

))

Where:

Ri

R

i

= Return of the investment or portfolio

Rf

R

f

= Risk-free rate (typically the return of government bonds)

β

β = Beta of the portfolio (market sensitivity)

Rm

R

m

= Return of the market or benchmark index

Breaking Down the Formula

Risk-Free Rate (

Rf

R

f

): This is the return you would earn on a “safe” investment, like a U.S. Treasury bond. It serves as the baseline for calculating excess returns.

Market Return (

Rm

R

m

): This is the return of a broad market index, like the S&P 500, that is used as a benchmark.

Beta (

β

β): Beta measures how much your portfolio moves relative to the market. A beta of 1 means your portfolio moves in sync with the market, while a beta of 2 means your portfolio is twice as volatile.

Excess Return: The formula calculates the excess return by subtracting the expected return (based on the risk-free rate and beta-adjusted market return) from the actual return of the portfolio.

Example

Let’s assume:

Portfolio return (

Ri

R

i

) = 12%

Risk-free rate (

Rf

R

f

) = 2%

Market return (

Rm

R

m

) = 10%

Portfolio beta (

β

β) = 1.5

Now, plugging these values into the formula:

α=12%−(2%+1.5⋅(10%−2%))

α=12%−(2%+1.5⋅(10%−2%))

α=12%−(2%+1.5⋅8%)

α=12%−(2%+1.5⋅8%)

α=12%−(2%+12%)

α=12%−(2%+12%)

α=12%−14%=−2%

α=12%−14%=−2%

In this case, the portfolio underperformed the benchmark by 2%, which means the alpha is negative.

Different Approaches to Alpha Calculation

While the formula described above is the classic method for calculating alpha, there are alternative approaches and variations to consider.

- The Jensen’s Alpha Model

The Jensen’s Alpha model is a widely used variation of the basic alpha formula. It is often used in the Capital Asset Pricing Model (CAPM) to measure a portfolio’s performance.

Jensen’s Alpha formula is similar to the one above but often uses excess returns over a risk-free rate. The formula is expressed as:

α=Ri−[Rf+β(Rm−Rf)]

α=R

i

−[R

f

+β(R

m

−R

f

)]

This method adjusts for the market return in a way that provides a more accurate reflection of the risk-adjusted return of the portfolio.

- The Fama-French Alpha

Developed by Eugene Fama and Kenneth French, this method adds more factors into the alpha calculation. Instead of using just the market return, it incorporates factors like:

SMB (Small Minus Big): The size factor.

HML (High Minus Low): The value factor.

This approach is often used to account for more complex market dynamics that influence returns, providing a deeper and more nuanced calculation of alpha.

How Alpha Affects Portfolio Performance

Importance of Alpha in Active Management

Alpha is one of the most widely used metrics for evaluating active portfolio management. A positive alpha suggests that the manager has outperformed the market after adjusting for risk, while a negative alpha indicates underperformance.

For investors, a high alpha is a signal that an investment strategy is successfully beating the market and providing value-added performance. This is a key component of successful alpha generation techniques.

Alpha for Risk Management

Alpha can also be used as a risk management tool. If a strategy has a consistent, positive alpha, it is often considered a low-risk investment because it has proven to outperform the market even during challenging times.

Portfolio Diversification and Alpha

Investors can also use alpha to determine the diversification of their portfolio. By focusing on assets or strategies that generate positive alpha, investors can enhance their portfolio’s overall return without increasing risk.

Common Mistakes in Alpha Calculation

While calculating alpha might seem straightforward, there are common pitfalls to avoid:

Misestimating Beta: Beta is crucial to the alpha calculation. If beta is misestimated (using outdated data, for example), the alpha will be inaccurate.

Ignoring Fees: The formula assumes no transaction costs or management fees, which may lead to inflated alpha results.

Overlooking Risk-Free Rate: The risk-free rate should be updated to reflect the most recent data. A constant rate might not be accurate if the interest rate environment has changed significantly.

FAQ

- Why is alpha important in investing?

Alpha is important because it represents the value added by a portfolio manager or strategy beyond what the market or benchmark would deliver. A positive alpha indicates that a manager or strategy is outperforming the market, adjusted for risk, which is a key measure of investment success.

- How can I improve my alpha generation techniques?

Improving alpha involves focusing on market inefficiencies and developing strategies that capture excess returns. Some approaches include:

Momentum-based strategies that take advantage of trending assets.

Statistical arbitrage strategies that exploit pricing discrepancies.

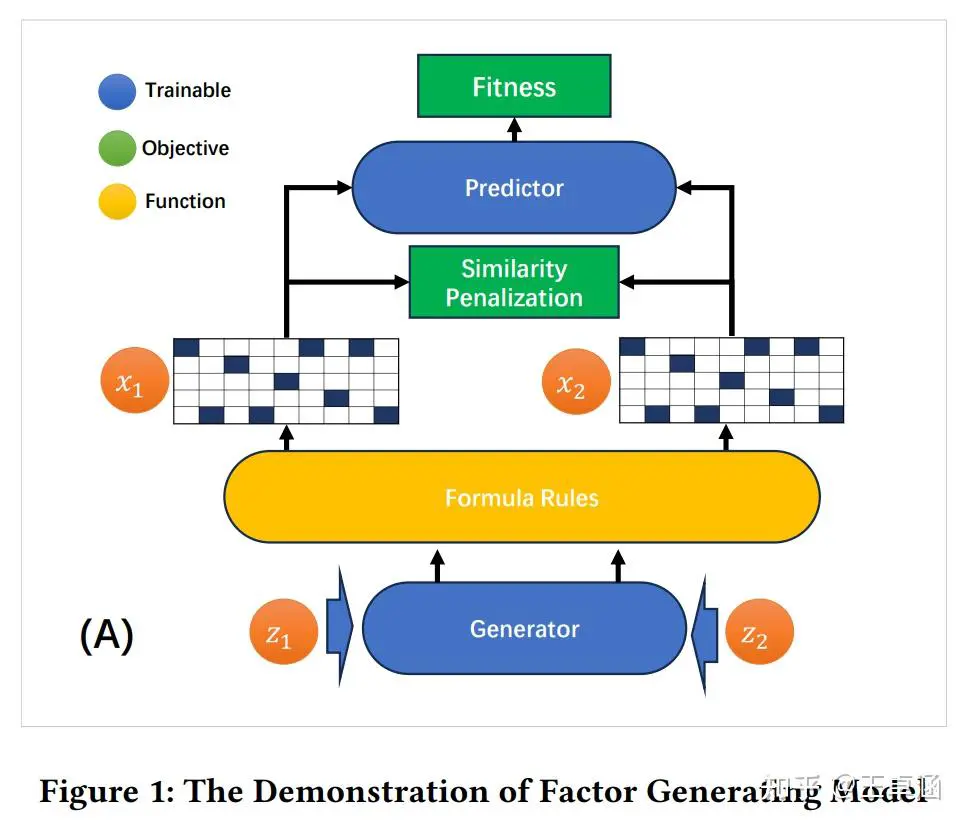

Machine learning models to optimize risk-adjusted returns.

- Is it possible to generate alpha in passive investing?

While traditional passive investing strategies (like index funds) aim to track the market, it is possible to generate alpha through active management or by identifying niche opportunities within the broader market. For example, factor investing (like value or momentum strategies) can be used to improve returns beyond a standard index.

Conclusion

Understanding alpha and how to calculate it is essential for investors who want to evaluate portfolio performance accurately. By using the Alpha Calculation Formula, you can determine whether an investment has outperformed its benchmark after adjusting for risk. Whether you are using the basic alpha formula or exploring more advanced techniques like Jensen’s Alpha or Fama-French Alpha, gaining insight into alpha generation will enhance your decision-making and overall strategy.

| Aspect | Key Points |

|---|---|

| Definition | Platform enabling firms to quote bid and ask prices, ensuring liquidity |

| Core Features | Ultra-low latency, automated quoting, risk management, API integration |

| Importance of Comparison | Determines speed, risk tools, tech stack, regulatory compliance |

| Approach 1: In-House Development | Custom systems, full control, latency optimization, high cost |

| Approach 2: Third-Party Platforms | Vendor solutions, faster deployment, lower cost, less flexibility |

| Hybrid Solutions | Combine third-party infrastructure with custom strategy modules |

| Key Platforms | Proprietary builds, institutional vendors, crypto market makers, retail APIs |

| Platform Strengths | Low latency, regulatory tools, 24⁄7 liquidity, accessibility |

| Platform Weaknesses | High cost, less flexibility, volatility risk, limited speed for HFT |

| Technology Trends | AI/ML integration, cloud-based, DeFi market making, API-first platforms |

| Risk Management | Delta hedging, position limits, circuit breakers, predictive AI monitoring |

| Lessons Learned | Prioritize monitoring and compliance; start with simulations for retail |

| FAQ Highlights | Institutional platforms suit compliance; crypto platforms vary; test latency |

| Conclusion | Choose based on scale, risk tolerance, combine risk management with tech |

0 Comments

Leave a Comment