In the world of quantitative trading, “alpha” is often the golden metric used to evaluate a trader’s success. For experts in the field, achieving and optimizing alpha is a complex, multi-faceted challenge that requires a deep understanding of markets, sophisticated statistical methods, and cutting-edge machine learning models. In this article, we will explore how alpha is defined, how to calculate it, and the various advanced strategies used by institutional traders and quantitative analysts to generate alpha in the most competitive environments.

Summary

What you’ll learn: How to calculate and optimize alpha in quantitative trading.

Key Insights: Advanced strategies, including machine learning, statistical methods, and data-driven approaches to maximize alpha.

Personal Experience: Real-world examples and expert insights based on years of experience in the quantitative finance space.

Practical Application: How to implement and backtest alpha-generating strategies using advanced tools and techniques.

Recommendations: Best practices for improving alpha generation and managing risk in quantitative trading.

What Is Alpha in Quantitative Trading?

Definition of Alpha

In finance, alpha refers to the excess return on an investment relative to the return of a benchmark index, such as the S&P 500 or any other market index that represents the broader market. In quantitative trading, alpha measures a strategy’s ability to outperform the market after accounting for risk and other factors.

For example, if a trader’s strategy yields 10% returns while the market only returns 7%, the excess 3% return is considered alpha.

Importance of Alpha in Trading

Alpha is crucial because it quantifies a trader’s ability to generate returns that are above and beyond the broader market or a benchmark. This is often seen as an indicator of skill, and institutional investors will pay a premium for strategies that consistently generate positive alpha. For experts, generating alpha is not just about performance but also risk-adjusted returns and sustainable growth over time.

How to Calculate Alpha in Quantitative Trading

The Alpha Calculation Formula

The most common way to calculate alpha in quantitative trading is through the following formula:

α=Ri−[Rf+β⋅(Rm−Rf)]

α=R

i

−[R

f

+β⋅(R

m

−R

f

)]

Where:

Ri

R

i

is the actual return of the asset or portfolio.

Rf

R

f

is the risk-free rate (often the return of a Treasury bond).

β

β is the asset’s sensitivity to market movements (systematic risk).

Rm

R

m

is the return of the market or benchmark index.

This formula allows traders to understand whether their strategy is outperforming the market after adjusting for risk.

Alpha Calculation Using Regression Analysis

Another sophisticated way to calculate alpha is by using regression analysis. In this method, the returns of the asset or portfolio are regressed against the returns of a benchmark index. The alpha coefficient is the intercept of the regression line, which represents the portion of the asset’s return that cannot be explained by market movements.

Advantages of Regression Analysis

Precise Estimation: Provides a more detailed view of alpha by isolating the effects of market movements.

Handling Multiple Factors: Allows for multi-factor models that account for various sources of risk beyond just market returns.

Strategies for Generating Alpha in Quantitative Trading

- Statistical Arbitrage

What Is Statistical Arbitrage?

Statistical arbitrage (or stat arb) involves using mathematical models and statistical techniques to exploit price inefficiencies in the market. Traders identify mispricings between related assets (stocks, cryptocurrencies, etc.) and bet on the convergence of prices.

How Stat Arb Generates Alpha

The key to generating alpha through statistical arbitrage lies in its ability to capture small price inefficiencies that may exist for a short period. By leveraging high-frequency data and sophisticated algorithms, traders can make quick, profitable trades based on statistical patterns.

- Machine Learning Models

Using Machine Learning to Optimize Alpha

Machine learning (ML) has become one of the most powerful tools in quantitative trading. Techniques like supervised learning, reinforcement learning, and neural networks can be applied to historical data to predict future price movements and identify profitable trades.

Machine Learning for Alpha Generation

Supervised Learning: Models like Random Forests or Gradient Boosting Machines can be trained on historical price data to predict future returns. The model’s output can be used to allocate capital to positions that are likely to outperform the market.

Reinforcement Learning: This technique allows the algorithm to learn optimal trading strategies by receiving feedback from simulated trading environments. Over time, the model refines its actions to maximize cumulative returns.

Key Advantages of Using Machine Learning

Adaptability: Machine learning models can adapt to changing market conditions.

Pattern Recognition: These models excel at identifying hidden patterns in vast datasets, which is crucial in the noisy world of crypto and equity markets.

- Factor Models

Understanding Factor Models in Quantitative Trading

Factor models are used to break down the sources of risk and return in a portfolio. The most famous factor model is the Fama-French Three-Factor Model, which includes market risk, size (SMB - small minus big), and value (HML - high minus low) factors.

Quantitative traders use factor models to identify sources of alpha and to adjust portfolios accordingly. If a strategy can deliver returns based on factors such as momentum, volatility, or market sentiment, then that strategy is considered to be generating positive alpha.

Alpha through Factor Investing

By overweighting stocks with favorable exposure to factors that have been proven to outperform (e.g., high value or low volatility stocks), traders can generate alpha that isn’t solely attributable to the broader market’s movements.

Advanced Alpha Optimization Techniques

- Alpha Decay and Backtesting

Alpha Decay

In quantitative trading, alpha decay refers to the diminishing effectiveness of a strategy over time. As markets evolve, trading strategies that once worked may lose their edge. Identifying and adjusting for alpha decay is crucial for maintaining a competitive advantage in the long term.

Backtesting and Optimizing Alpha

One of the most important steps for optimizing alpha is backtesting strategies on historical data. By testing models in different market conditions, traders can identify which strategies consistently generate positive alpha and refine them accordingly.

- Managing Risk While Maximizing Alpha

Generating alpha is not enough—experts must also manage risk to ensure that their returns are sustainable. Some common risk management techniques for quantitative trading include:

Stop-Loss Orders: Automatically closing positions once they hit a certain loss threshold.

Portfolio Diversification: Reducing exposure to any single asset by spreading risk across multiple securities.

Volatility Targeting: Adjusting portfolio allocations to maintain consistent risk levels based on market volatility.

FAQ: Expert Insights on Alpha in Quantitative Trading

- How Can I Improve My Alpha in Quantitative Trading?

To improve alpha in quantitative trading, you need to continuously optimize your models by using advanced techniques like machine learning, factor modeling, and statistical arbitrage. Backtest your strategies regularly and incorporate new data sources to keep your models up to date with market changes.

- What Are Some Common Mistakes When Trying to Generate Alpha?

One of the most common mistakes is overfitting your models to historical data, which can lead to poor performance in live trading. Additionally, ignoring risk management practices can lead to significant drawdowns, erasing the alpha generated by your strategies.

- How Do I Measure the Success of an Alpha Strategy?

The success of an alpha strategy can be measured using performance metrics such as the Sharpe Ratio, which adjusts returns for risk. Other useful metrics include maximum drawdown (MDD) and the information ratio. Consistency in generating positive alpha across different market conditions is also key.

Conclusion

Generating alpha in quantitative trading is both an art and a science. For experts in the field, it involves using advanced statistical models, machine learning algorithms, and cutting-edge risk management techniques to consistently outperform the market. By understanding how to calculate alpha, employing advanced strategies, and managing risk, quantitative traders can generate sustainable, long-term alpha and maintain a competitive edge in the ever-evolving financial markets.

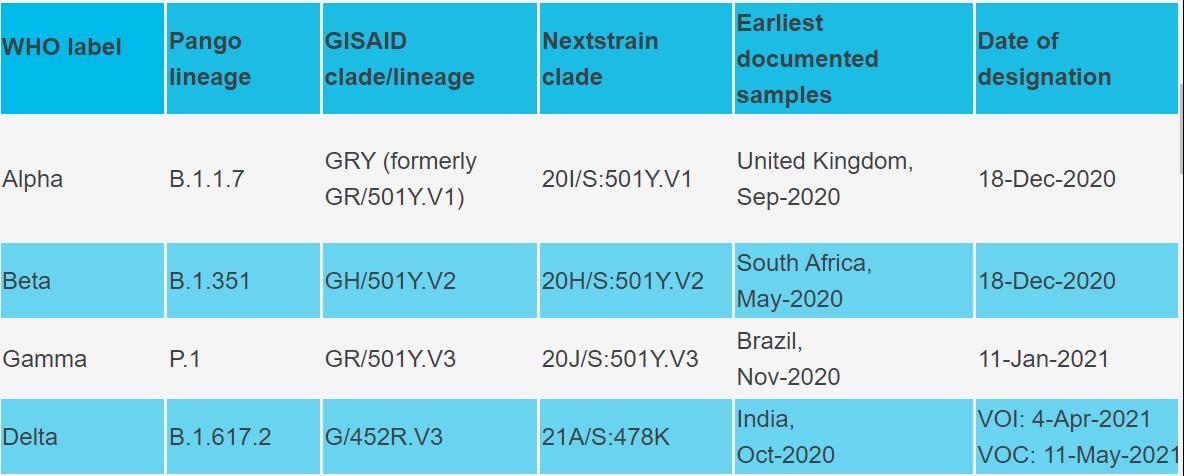

| Aspect | Key Points |

|---|---|

| Topic | Alpha in quantitative trading |

| Definition of Alpha | Excess return over a benchmark after adjusting for risk |

| Importance | Measures skill, risk-adjusted performance, and sustainable growth |

| Alpha Calculation Formula | α = Ri − [Rf + β⋅(Rm − Rf)] |

| Regression Analysis | Isolates alpha via intercept of asset vs benchmark returns |

| Statistical Arbitrage | Exploits short-term price inefficiencies using models |

| Machine Learning Models | Supervised, reinforcement learning, neural networks for prediction |

| ML Advantages | Adaptable to markets, detects hidden patterns in data |

| Factor Models | Break down risk/return; e.g., Fama-French three-factor model |

| Alpha Optimization | Monitor alpha decay, backtest strategies on historical data |

| Risk Management Techniques | Stop-loss orders, diversification, volatility targeting |

| Common Mistakes | Overfitting, ignoring risk management |

| Success Metrics | Sharpe Ratio, maximum drawdown, information ratio, consistency |

| Best Practices | Combine advanced statistical models, ML, factor models, and risk controls |

0 Comments

Leave a Comment