============================================

Introduction

In today’s fast-paced financial markets, the ability to extract value from vast amounts of information can define the difference between success and failure. Knowing how to analyze big data for trading insights is no longer a luxury—it is a necessity for traders, portfolio managers, and quantitative analysts. Big data offers a competitive edge by uncovering patterns, correlations, and predictive signals that traditional tools might miss.

This article will provide a comprehensive guide on analyzing big data for trading insights. We will cover essential techniques, compare two primary approaches, highlight their advantages and drawbacks, and recommend the most effective strategies. We will also integrate related concepts like how to use big data for quantitative trading and why big data analytics in quantitative finance to strengthen your understanding. By the end, you will know how to approach big data as a trader, whether you are an institutional investor, a quantitative analyst, or a retail trader leveraging advanced platforms.

Understanding Big Data in Trading

What is Big Data in Finance?

Big data refers to datasets so large and complex that conventional tools cannot process them efficiently. In trading, this includes:

- Market data: Tick-by-tick price movements, bid-ask spreads, order books.

- Alternative data: Social media sentiment, web traffic, news feeds, satellite imagery.

- Macroeconomic data: Global interest rates, inflation metrics, and employment reports.

- Transactional data: Payment flows, fund transfers, and blockchain analytics.

The key lies not only in collecting these datasets but also in analyzing them effectively for actionable trading insights.

Why Big Data Matters in Trading

- Alpha generation: Detecting signals invisible to traditional models.

- Risk management: Identifying anomalies that could indicate systemic risks.

- Execution optimization: Improving order routing and slippage control.

- Market forecasting: Enhancing models that predict price movements.

Methods for Analyzing Big Data for Trading Insights

Method 1: Statistical & Econometric Analysis

Statistical and econometric models are the foundation of financial big data analysis.

Key Techniques

- Regression models – Identify relationships between market variables.

- Factor models – Explain asset returns using macro or microeconomic factors.

- Time-series analysis – Forecast price movements with ARIMA, GARCH, or VAR.

Pros

- Well-grounded in finance theory.

- Transparent and interpretable.

- Efficient for structured financial data.

Cons

- Limited scalability for unstructured data.

- May fail to capture nonlinear relationships.

- Slower adaptation to fast-changing markets.

Method 2: Machine Learning & AI

Machine learning models provide powerful alternatives when analyzing large, unstructured datasets.

Key Techniques

- Natural Language Processing (NLP) – Analyzing news headlines, social media, or earnings transcripts.

- Neural networks – Detecting nonlinear patterns in price behavior.

- Random forests and gradient boosting – Handling large feature sets for predictive modeling.

Pros

- Excellent for unstructured data (e.g., text, images, sentiment).

- Scales well with massive datasets.

- Can uncover complex, hidden trading signals.

Cons

- Black-box nature reduces interpretability.

- Risk of overfitting to historical data.

- Requires high computing resources and expertise.

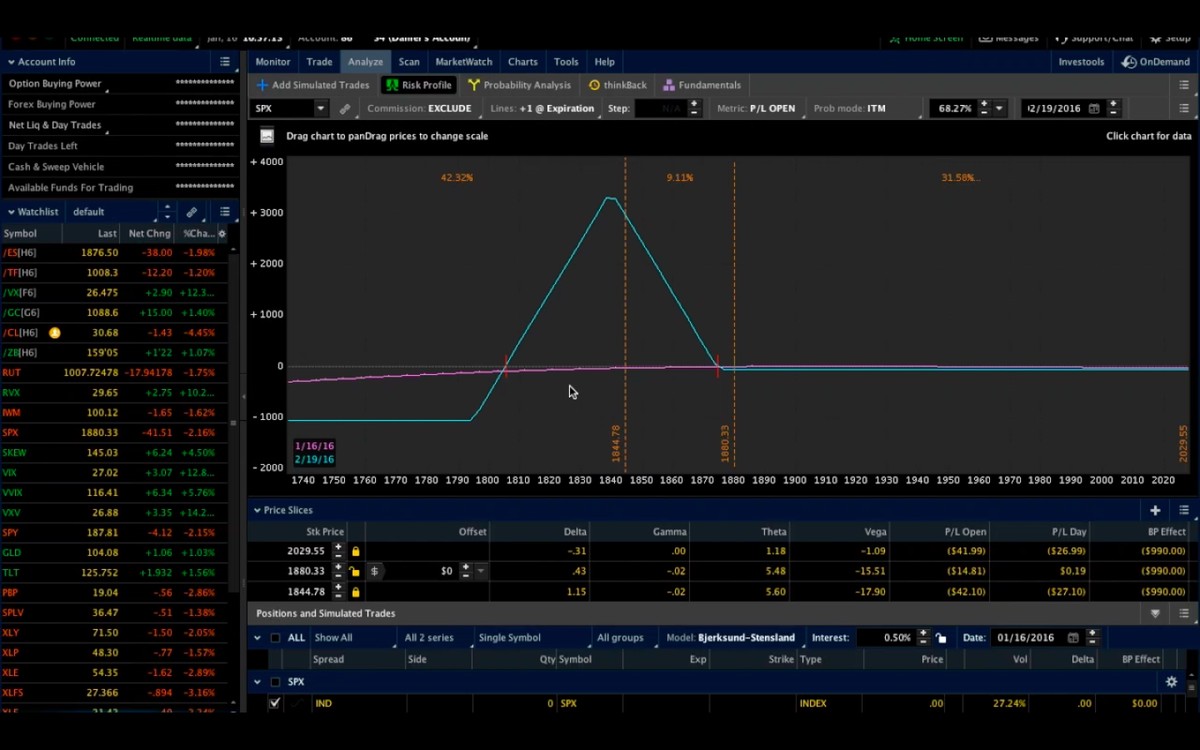

Machine learning workflow in trading

Comparing the Two Methods

| Criteria | Statistical Models | Machine Learning Models |

|---|---|---|

| Data type | Best for structured (numerical) data | Works with structured + unstructured data |

| Interpretability | High | Low (black box) |

| Adaptability | Slower | Rapid and flexible |

| Computational requirements | Low to medium | High (requires GPUs, cloud infrastructure) |

| Risk of overfitting | Moderate | High without proper regularization |

Recommendation: For traders just starting, begin with statistical models to build interpretability and discipline. Then, integrate machine learning gradually as you handle more complex datasets. Hybrid approaches—combining econometric rigor with machine learning power—are currently the most effective in the industry.

Practical Applications of Big Data in Trading

Enhancing Quantitative Trading Strategies

Traders often wonder how to use big data for quantitative trading effectively. The answer lies in integrating both structured market data (price, volume, volatility) with alternative datasets such as Twitter sentiment or Google search trends. For instance, sentiment analysis of central bank speeches has been shown to predict bond yield movements.

Risk Management and Stress Testing

Big data also supports advanced risk management by monitoring portfolio exposure in real time. Instead of quarterly backtests, traders can now stress-test positions instantly against millions of scenarios, making big data analytics in quantitative finance crucial for institutional survival.

Improving Market Forecasting

Predictive modeling with big data allows firms to anticipate not only price direction but also liquidity shifts. Retail traders now have access to platforms that previously only hedge funds could afford, narrowing the gap between institutions and individuals.

Applications of big data in financial markets

Challenges of Big Data Analysis in Trading

- Data quality issues: Incomplete or biased datasets can distort insights.

- Infrastructure costs: Requires high-performance computing and storage.

- Regulatory compliance: GDPR, SEC, and MiFID II compliance is mandatory.

- Skill gap: Traders must either learn coding and analytics or rely on specialized teams.

Best Practices for Analyzing Big Data

- Define clear trading objectives before data collection.

- Clean and normalize datasets to avoid biases.

- Backtest extensively but monitor for overfitting.

- Use hybrid approaches—combine interpretable statistical models with powerful machine learning.

- Adopt visualization tools for intuitive interpretation of complex outputs.

FAQ: Big Data in Trading

1. How do retail traders access big data for trading insights?

Retail traders can access big data through APIs, brokerage platforms, and open-source datasets. Tools like Quandl, Alpha Vantage, and Kaggle datasets allow traders to integrate large datasets into their strategies without building infrastructure from scratch.

2. What is the biggest risk when analyzing big data for trading?

The most significant risk is overfitting—when models perform well in backtests but fail in live markets. Traders must apply cross-validation, regularization, and out-of-sample testing to ensure models generalize.

3. Is machine learning always better than traditional statistical models?

Not necessarily. Machine learning excels at complex, nonlinear, and unstructured datasets but often lacks interpretability. Traditional models, while less flexible, provide transparency and are easier for regulators and stakeholders to understand. The best practice is to combine both.

Conclusion

Learning how to analyze big data for trading insights equips traders with a transformative edge. By comparing statistical models with machine learning, we see that each offers unique advantages. The future lies in hybrid strategies—leveraging the interpretability of econometrics with the predictive power of AI.

Big data is not only shaping institutional trading but also empowering retail traders with access to advanced analytics. As financial markets evolve, those who master big data analysis will be better prepared to capture alpha, manage risk, and stay ahead of the competition.

If you found this article useful, share it with fellow traders, leave a comment with your insights, and let’s build a community of data-driven investors.

Would you like me to also create a downloadable infographic (PDF or PNG) summarizing the best practices for big data trading analysis? That way, your readers could easily share it on LinkedIn or Twitter for higher engagement.

0 Comments

Leave a Comment