============================================

In modern financial markets, how to analyze big data for trading insights has become one of the most pressing questions for traders, portfolio managers, and quantitative analysts. The ability to process massive datasets, extract meaningful patterns, and translate them into actionable strategies often defines the difference between outperforming the market and falling behind.

This comprehensive guide explores the importance of big data in trading, practical strategies for analysis, and actionable steps to integrate these insights into your portfolio. By blending industry expertise, technology trends, and proven methods, we will equip you with the knowledge to make data-driven trading decisions.

Understanding Big Data in Trading

What Is Big Data in Finance?

Big data in trading refers to extremely large datasets collected from diverse sources such as stock exchanges, crypto platforms, social media, news feeds, alternative data providers, and macroeconomic indicators. Unlike traditional datasets, big data requires advanced analytics, artificial intelligence (AI), and cloud computing to process and extract insights.

Why It Matters

- Volume: Billions of trades and signals generated daily.

- Velocity: Real-time market data streams demand instant decision-making.

- Variety: Structured (prices, volumes) and unstructured (tweets, news sentiment) data.

- Veracity: Ensuring the accuracy and reliability of data is crucial for trading models.

The Role of Big Data in Trading Insights

Market Prediction

Big data enables predictive modeling to forecast asset price movements with higher accuracy.

Risk Management

Traders use big data to monitor correlations, volatility shifts, and systemic risks in real-time.

Sentiment Analysis

Natural language processing (NLP) applied to social media and financial news provides early signals of market sentiment.

Strategy Optimization

Backtesting and optimization using large datasets allow traders to refine strategies under diverse scenarios.

Big data sources for trading insights

Key Methods for Analyzing Big Data in Trading

Small and large-scale traders alike use multiple techniques. Below are two prominent strategies with their pros and cons.

1. Machine Learning Models

How It Works

Machine learning (ML) algorithms process massive datasets to detect non-obvious relationships and generate trading signals. Examples include random forests, gradient boosting, and neural networks.

Advantages

- Identifies complex, non-linear patterns.

- Adapts dynamically to new market conditions.

- Supports predictive analytics for asset pricing and volatility.

Drawbacks

- Requires large amounts of high-quality data.

- Models may overfit and lose effectiveness in live markets.

- Difficult to interpret “black-box” predictions.

2. Statistical and Econometric Analysis

How It Works

Statistical methods such as regression analysis, cointegration tests, and time-series modeling are applied to structured financial data.

Advantages

- Transparent and interpretable models.

- Well-suited for hypothesis testing and market efficiency studies.

- Strong regulatory acceptance in institutional environments.

Drawbacks

- Limited ability to process unstructured data.

- May oversimplify market dynamics.

- Less adaptive to sudden regime shifts compared to ML.

Which Strategy Is Best?

A hybrid approach is often recommended:

- Use statistical models to establish a strong foundation and ensure interpretability.

- Layer in machine learning to capture hidden patterns and improve predictive power.

This combination balances rigor with innovation, making it especially valuable for institutions seeking compliance while maintaining a competitive edge.

Practical Applications of Big Data in Trading

Algorithmic Trading

Automated systems analyze large datasets to generate trade orders in milliseconds.

Portfolio Management

Big data helps managers diversify holdings, optimize risk-return profiles, and monitor exposures in real-time.

Retail Investor Tools

Data visualization and simplified AI-driven insights are increasingly available to retail traders, bridging the gap with institutions.

Machine learning vs statistical analysis in trading

Integrating Big Data into Trading Workflows

Understanding how big data enhances trading strategies requires structured integration:

- Data Collection: Access real-time feeds, APIs, and alternative datasets.

- Data Cleaning: Remove outliers, normalize formats, and verify accuracy.

- Feature Engineering: Transform raw inputs into meaningful variables.

- Model Development: Choose between ML or statistical models.

- Backtesting: Validate performance across historical datasets.

- Deployment: Integrate into live trading systems.

- Monitoring & Updating: Continuously refine models with fresh data.

Latest Trends in Big Data for Trading

- Alternative Data Growth: Satellite imagery, credit card transactions, and shipping data enhance market predictions.

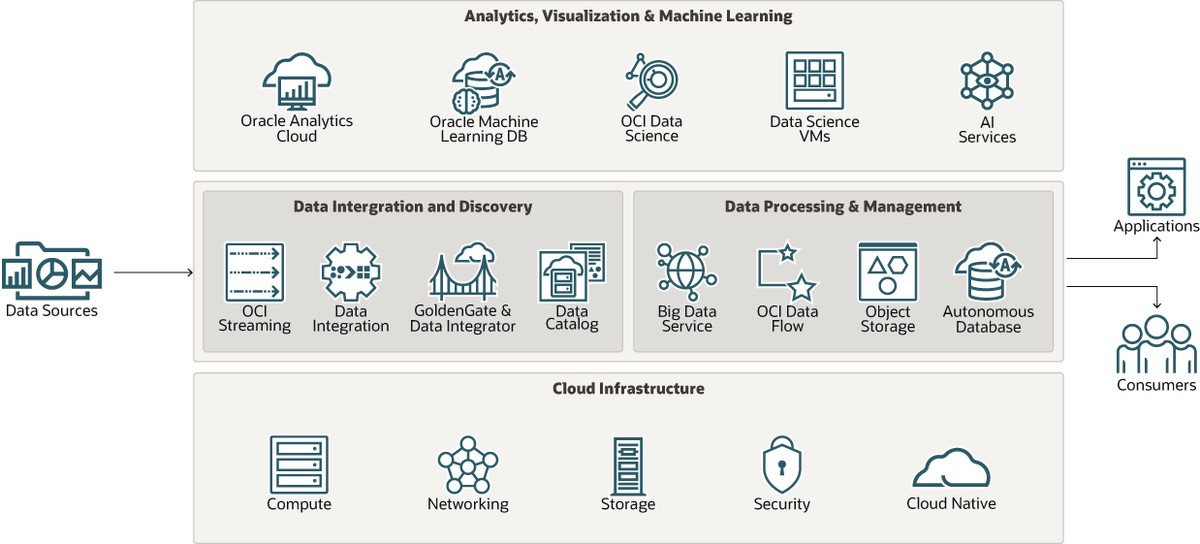

- Cloud-Based Platforms: Firms increasingly rely on AWS, Google Cloud, and Azure for scalable data processing.

- AI Integration: Deep learning models for natural language processing and real-time anomaly detection.

- Democratization: Retail traders now access big data insights once exclusive to hedge funds.

Best Practices for Traders

- Start Simple: Focus on structured data before integrating unstructured sources.

- Ensure Data Quality: Poor data leads to poor decisions, regardless of model complexity.

- Balance Interpretability and Performance: Avoid fully opaque models without risk controls.

- Invest in Visualization: Clear dashboards help decision-makers act faster.

- Stay Agile: Market regimes shift; update models regularly.

FAQs on Analyzing Big Data for Trading Insights

1. What tools are best for big data analysis in trading?

Python (Pandas, NumPy, scikit-learn), R, and specialized platforms like Kx Systems or Bloomberg Terminal are widely used. For visualization, Tableau and Power BI remain popular.

2. How can small traders benefit from big data without large budgets?

Retail traders can leverage open-source tools, cloud services with free tiers, and alternative data providers offering affordable subscriptions. Many broker platforms also provide built-in analytics powered by big data.

3. Is machine learning always better than traditional methods?

Not necessarily. While ML offers superior predictive capabilities in complex markets, traditional statistical methods remain more transparent, easier to validate, and often sufficient for certain strategies. A blended approach is best.

Final Thoughts

Big data is transforming the trading landscape, creating opportunities for both institutional investors and retail traders. By learning how to analyze big data for trading insights, professionals can unlock predictive power, optimize portfolios, and stay ahead of the competition.

The best approach combines statistical rigor with machine learning adaptability, supported by high-quality data and visualization tools.

💡 Did this article help you understand how to leverage big data in trading? Share it with colleagues, comment below with your favorite data tools, and spread the insights across your network!

0 Comments

Leave a Comment