================================

Introduction

Cryptocurrency markets are dynamic, fast-paced, and often unpredictable. For traders and investors, making sense of vast amounts of real-time data is essential to identify profitable opportunities. That’s where crypto quantitative (quant) analysis comes in. Learning how to analyze crypto quant data can help both beginners and professionals understand patterns, forecast price movements, and build systematic trading strategies.

This guide will provide a step-by-step framework for analyzing crypto quant data, introduce two widely used strategies, compare their pros and cons, and recommend best practices based on personal experience and industry trends. By the end, you’ll have a clear roadmap for incorporating quant data into your trading and investment decisions.

What is Crypto Quant Data?

Crypto quant data refers to structured numerical and statistical information derived from cryptocurrency markets. It includes metrics such as:

- Price data: open, high, low, close (OHLC)

- Volume data: traded volumes across exchanges

- Order book depth: bid-ask spreads, liquidity levels

- On-chain metrics: wallet activity, gas fees, hash rates

- Sentiment data: funding rates, market positioning, and investor mood

Analyzing these datasets requires mathematical, statistical, and computational tools to identify trading signals.

Why Analyze Crypto Quant Data?

For retail traders and institutional investors, analyzing crypto quant data has several benefits:

- Risk management: Spotting volatility spikes or liquidity gaps early

- Strategy development: Backtesting rules before risking real capital

- Execution efficiency: Using models to minimize slippage

- Competitive edge: Detecting opportunities invisible to discretionary traders

In short, learning how crypto quant trading works helps you turn raw market data into actionable insights.

Two Methods of Analyzing Crypto Quant Data

Method 1: Time-Series Statistical Analysis

Time-series analysis focuses on historical price and volume data to identify trends and forecast future movements.

Key Techniques

- Moving averages (SMA, EMA): Identify long-term trends

- Autoregressive models (ARIMA): Forecast future values based on past data

- Volatility clustering (GARCH models): Measure and predict risk levels

Advantages

- Easy to implement with tools like Python, R, or Excel

- Provides clear signals for trend-following strategies

- Useful for both short-term and long-term analysis

Disadvantages

- Relies heavily on past data, which may not capture sudden market shocks

- Performance can degrade in highly volatile environments

Method 2: Machine Learning and AI Models

Machine learning models use advanced algorithms to identify nonlinear patterns in large crypto datasets.

Key Techniques

- Random Forest and Gradient Boosting: Feature-based prediction

- Neural Networks (LSTMs, Transformers): Capture sequential and complex dependencies

- Reinforcement Learning: Optimize strategy performance through simulated environments

Advantages

- Handles vast and complex data better than traditional models

- Can adapt to nonlinear and dynamic relationships in crypto markets

- Suitable for developing predictive models and automated trading bots

Disadvantages

- Requires more computing power and technical expertise

- Overfitting risk if not validated properly

- Interpretability can be difficult for retail traders

Comparing the Two Approaches

| Feature | Time-Series Analysis | Machine Learning Models |

|---|---|---|

| Ease of Use | Simple, beginner-friendly | Complex, requires coding and ML skills |

| Data Requirements | Historical price/volume data | Large, diverse datasets (on-chain, sentiment, price) |

| Interpretability | High, easy to explain | Low, often black-box models |

| Adaptability to Market Shocks | Limited | Better with dynamic adjustments |

| Best For | Beginners and intermediate traders | Advanced traders and quant professionals |

Recommended Best Practice

Based on experience, the best approach for most retail traders is a hybrid model:

- Start with time-series analysis to learn market dynamics and test simple strategies.

- Gradually integrate machine learning models for more advanced predictive capabilities once you’re comfortable with data handling.

This hybrid approach balances interpretability with sophistication, ensuring you don’t rely entirely on black-box models while still benefiting from AI-driven insights.

Practical Workflow: How to Analyze Crypto Quant Data

Step 1: Data Collection

Use APIs from exchanges (Binance, Coinbase, Kraken) or platforms like Glassnode for on-chain metrics.

Step 2: Data Cleaning

Ensure timestamps align, remove outliers, and adjust for missing values.

Step 3: Exploratory Data Analysis (EDA)

Visualize OHLC charts, calculate rolling averages, and analyze distribution of returns.

Step 4: Model Building

- For beginners: Start with ARIMA or moving averages

- For advanced users: Train LSTM or transformer-based models

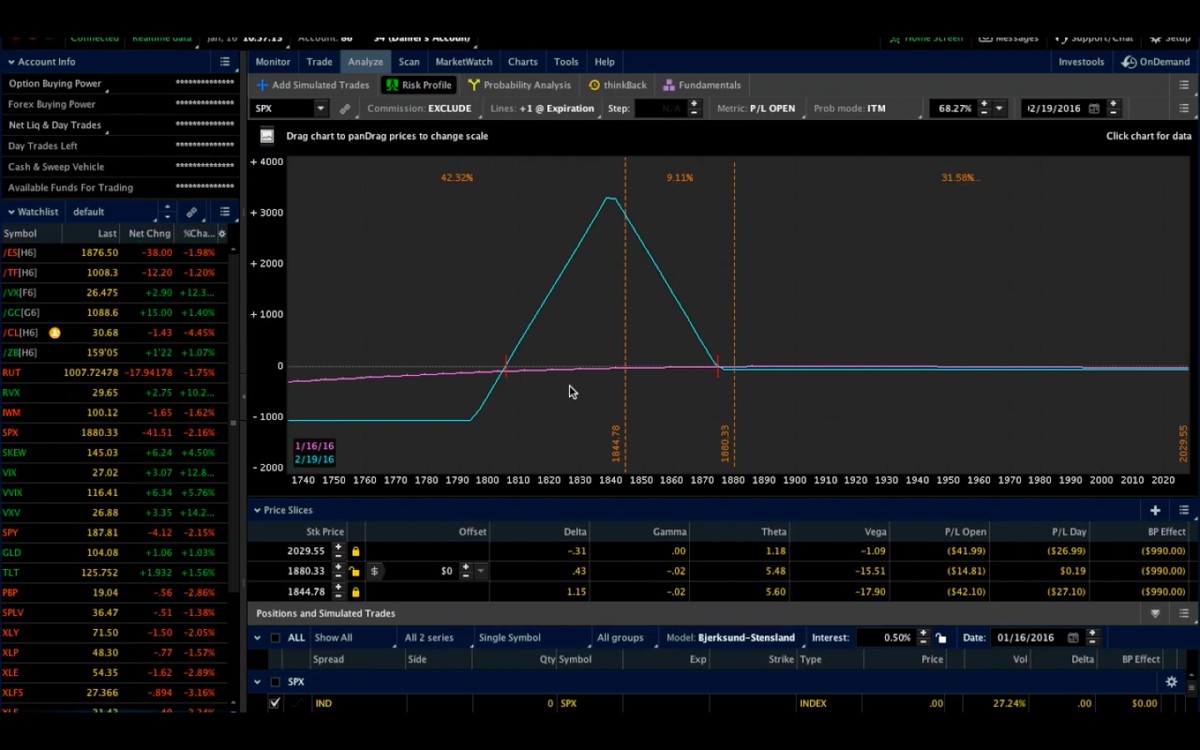

Step 5: Backtesting

Simulate your strategy on historical data to check profitability and risk.

Step 6: Implementation

Deploy your strategy using trading bots, connected via exchange APIs.

Crypto quant analysis workflow

Industry Trends in Crypto Quant Analysis

- On-chain analytics integration: Combining wallet-level data with trading signals

- DeFi quant strategies: Yield farming optimization and liquidity pool arbitrage

- AI-enhanced execution: Reinforcement learning bots improving order routing

- Cross-market quant systems: Applying models across crypto, FX, and equities

Internal Link Integration

Beginners often wonder: “How to start crypto quant trading?” The process begins with learning to collect and analyze market data before designing strategies.

For those looking to go further, it’s equally important to ask: “Where to learn crypto quant strategies?” Access to structured resources, tutorials, and professional guides can help accelerate your journey.

FAQ: How to Analyze Crypto Quant Data

1. What tools are best for analyzing crypto quant data?

Python (with libraries like Pandas, NumPy, and Scikit-learn), R, and specialized platforms like QuantConnect or CryptoQuant are excellent tools for beginners and professionals alike.

2. How do I avoid overfitting in machine learning models?

Use proper train-test splits, cross-validation, and regularization techniques. Always validate models on unseen data before deploying them in live markets.

3. Do I need programming skills to analyze crypto quant data?

Not necessarily. While programming enhances flexibility, many platforms offer no-code quant tools with drag-and-drop functionality, allowing non-technical traders to get started.

Conclusion

Understanding how to analyze crypto quant data is essential for building systematic strategies, managing risk, and achieving consistent returns in volatile crypto markets. Whether you choose time-series analysis or machine learning models, the key is to adopt a structured approach—collect, clean, analyze, backtest, and implement.

Retail investors who start small, experiment responsibly, and gradually adopt advanced tools will gain a sustainable edge in crypto markets.

If you found this guide helpful, share it with your network, leave a comment with your experience, and encourage more traders to embrace data-driven crypto strategies.

Quant data visualization in crypto trading

0 Comments

Leave a Comment