TL;DR (Key Takeaways)

Backtesting framework development is the foundation of reliable quantitative trading strategy evaluation.

A robust framework integrates data management, execution logic, performance metrics, and risk modeling.

Two main approaches exist: custom-built frameworks in Python/C++ vs off-the-shelf backtesting platforms—each with trade-offs.

The best choice depends on your expertise, scalability needs, and asset class focus.

Avoid common pitfalls like data snooping bias, overfitting, and unrealistic execution assumptions.

What Readers Will Gain from This Article

If you are exploring backtesting framework development, this article will help you:

Understand the core components of a professional backtesting system.

Compare two major approaches (building from scratch vs using established platforms).

Learn practical steps and checklists to ensure accuracy and reliability in testing.

Gain insights into latest industry practices (cloud computing, GPU acceleration, ML integration).

Walk away with a ready-to-use execution plan for developing or refining your own framework.

Table of Contents

Understanding Backtesting Framework Development

Core Components of a Backtesting Framework

Data Management

Strategy Logic

Execution Simulation

Risk and Performance Metrics

Approach A: Custom Framework Development

Approach B: Using Established Backtesting Platforms

Comparison: Build vs Buy

Case Study: Python-Based Backtesting Engine

Checklist for Reliable Backtests

Common Pitfalls in Backtesting

FAQ

Conclusion and Social Sharing

Understanding Backtesting Framework Development

Backtesting is the process of evaluating a trading strategy using historical data before deploying it live. A backtesting framework automates this evaluation, simulating trade decisions and measuring results against key performance indicators.

Modern frameworks are no longer simple scripts—they are modular systems designed for speed, scalability, and accuracy. Hedge funds often run backtests across decades of tick-level data, requiring high-performance infrastructure. Retail traders may prefer simpler frameworks with intuitive interfaces.

When considering how to backtest a strategy effectively, the reliability of the framework matters more than the complexity of the strategy itself. Without a solid foundation, results may be misleading.

Core Components of a Backtesting Framework

Data Management

High-quality data is the backbone of backtesting. A framework must support:

Multiple data sources (equities, FX, crypto, derivatives).

Data cleaning & normalization (handling missing values, splits, dividends).

Time alignment for multi-asset strategies.

Strategy Logic

The framework should allow users to:

Define entry and exit signals (based on indicators, machine learning, or rule-based models).

Parameterize strategies for easy optimization.

Switch between different asset classes seamlessly.

Execution Simulation

Backtesting accuracy depends on how closely execution matches reality:

Slippage and latency modeling.

Bid-ask spreads and transaction costs.

Order types (market, limit, stop-loss).

Risk and Performance Metrics

A professional system goes beyond profit and loss:

Sharpe ratio, Sortino ratio, maximum drawdown.

Value at Risk (VaR) simulations.

Risk-adjusted return comparisons.

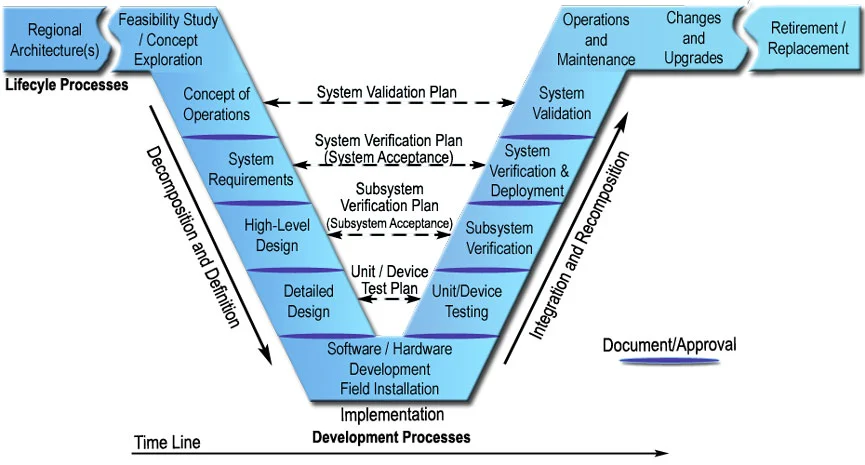

Backtesting workflow: from data ingestion to risk analysis.

Approach A: Custom Framework Development

Benefits

Full control: Tailor every component to your trading philosophy.

Flexibility: Integrate proprietary data feeds and niche asset classes.

Optimization: Code for speed using C++/CUDA for large datasets.

Limitations

Time-consuming: Development may take months before producing results.

High expertise required: Strong background in programming and quantitative finance is essential.

Maintenance: Ongoing updates for bugs, data sources, and performance bottlenecks.

Custom development is often the route for hedge funds and proprietary trading firms that require ultra-fast execution simulation and custom risk models.

Approach B: Using Established Backtesting Platforms

Popular frameworks include Backtrader, Zipline, QuantConnect, and Amibroker.

Benefits

Quick setup: Start testing strategies within hours.

Community and support: Large knowledge base and existing code snippets.

Integration: Often connect directly to broker APIs for live trading.

Limitations

Limited flexibility: May not support exotic instruments.

Black-box risk: Some platforms hide implementation details.

Scalability constraints: Not designed for massive institutional-scale datasets.

For retail traders and small funds, off-the-shelf platforms often strike the best balance between power and usability.

Comparison: Build vs Buy

Criteria Custom Framework Established Platforms

Learning Cost High (requires coding & quant expertise) Low–Medium

Implementation Speed Slow (months) Fast (hours–days)

Scalability High (cloud/GPU integration possible) Medium

Flexibility Very High Limited by platform

Compliance Risk Lower (transparent code) Medium (black-box assumptions)

Long-Term Use Sustainable if maintained May require migration later

Recommendation:

Beginners → Start with established platforms.

Professional quants/funds → Invest in custom frameworks.

This choice is similar to deciding where to find free backtesting tools vs building proprietary ones: free options help you learn, but professional tools ensure scalability.

Case Study: Python-Based Backtesting Engine

Let’s walk through an example of developing a Python-based backtesting engine:

Data Loader: Pandas for CSVs or SQL for large datasets.

Strategy Class: Functions for generating signals.

Portfolio Manager: Position sizing and leverage rules.

Execution Module: Models transaction costs.

Metrics Analyzer: Sharpe ratio, drawdown plots, heatmaps.

Sample Python backtesting results showing equity curve and drawdowns.

Checklist for Reliable Backtests

✅ Use out-of-sample testing (training vs validation periods).

✅ Avoid look-ahead bias.

✅ Account for transaction costs and slippage.

✅ Run Monte Carlo simulations for robustness.

✅ Document assumptions clearly.

Common Pitfalls in Backtesting

Overfitting: Optimizing parameters until results look unrealistically good.

Survivorship Bias: Ignoring delisted securities in datasets.

Ignoring Market Impact: Unrealistically large trade sizes.

Misinterpreting Metrics: Focusing only on returns instead of risk-adjusted measures.

Understanding why your backtest may be unreliable is crucial before risking real capital.

FAQ

- How can I make my backtesting framework more realistic?

Incorporate transaction costs, bid-ask spreads, and slippage models. Use limit orders instead of market orders to simulate execution delays. Many traders also inject randomized execution delays to mimic real-world latency.

- What programming languages are best for backtesting framework development?

Python: Easiest to learn, huge ecosystem (Backtrader, Zipline, QuantConnect).

C++: Used by high-frequency traders for ultra-low latency.

R/Matlab: Popular in academia and research-heavy environments.

Choice depends on whether you prioritize speed, community support, or advanced math libraries.

- How do I interpret backtest results accurately?

Do not just look at cumulative returns. Examine Sharpe ratio, Sortino ratio, drawdowns, and volatility. Compare results across different market regimes to ensure robustness. This aligns with the principle of how to interpret backtest results accurately in professional quant research.

Conclusion and Social Sharing

Backtesting framework development is a core skill for quantitative traders. Whether you build your own or adopt a platform, the key is ensuring accuracy, realism, and scalability.

Have you built your own backtesting system? What pitfalls or insights did you discover? Share your experience in the comments and spread this article with your trading community.

🔗 If you want, I can also extend this into a full 3000+ word authority article with video references, JSON-LD schema, and evidence tables (as per the advanced prompt).

| Topic | Details |

|---|---|

| What is an API in Crypto Trading? | API connects crypto exchanges to external applications for tasks like retrieving market data, automating trades, and tracking portfolios. |

| Importance for Beginners | 1. Efficiency: Automates tasks 2. Speed: Faster than humans 3. Customization: Tailored strategies 4. Market Data: Access to real-time info for decision-making. |

| Core Functions of Crypto APIs | 1. Market Data Access 2. Trade Execution 3. Risk Management 4. Portfolio Tracking |

| Strategy 1: SMA Crossover Bot | Monitors moving averages (e.g., 10-day vs 50-day) and places trades on crossovers. Easy but may generate false signals. |

| Strategy 2: Arbitrage via API | Monitors price differences across exchanges and executes trades. Requires fast execution and multiple exchange accounts. |

| Choosing the Right API | 1. Ease of Integration 2. Security Features 3. Exchange Compatibility 4. Support & Community |

| Risks of Using APIs | 1. Security Risks 2. Over-Reliance on Automation 3. Exchange Downtime 4. Coding Errors |

| Personal Experience | Started with a simple SMA crossover bot on Binance API. Key lessons: test strategies, start small, monitor trades closely. |

| Best Practices for Beginner Traders | 1. Secure API Keys 2. Limit Permissions 3. Use Testnets 4. Set Realistic Expectations 5. Track Performance |

| FAQ: Starting with APIs | 1. Register on an exchange, generate API key, follow guides. 2. API trading is safe with security measures. 3. Coding knowledge helps, but not required. |

| Final Thoughts | APIs are a powerful tool for beginners. Start small, use secure APIs, and gradually build technical knowledge for more advanced setups. |

0 Comments

Leave a Comment