=============================

The Sharpe Ratio is one of the most widely used metrics in finance for evaluating risk-adjusted returns. Whether you’re a retail investor, hedge fund manager, or quantitative analyst, learning how to calculate Sharpe Ratio is essential to determine whether your investments are delivering returns that justify the risk.

This in-depth guide covers step-by-step calculation methods, compares different approaches, provides case studies, and answers common questions. By the end, you’ll not only know how to calculate the Sharpe Ratio but also how to interpret it effectively for better investment decisions.

What is the Sharpe Ratio?

The Sharpe Ratio, introduced by Nobel laureate William F. Sharpe, measures the excess return of an investment over the risk-free rate, divided by its volatility (standard deviation of returns).

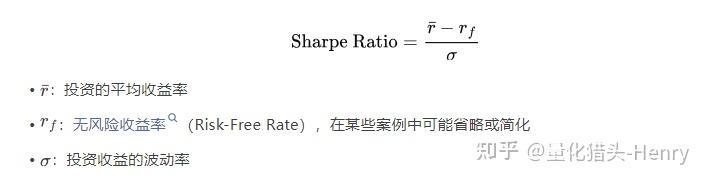

Formula:

Sharpe Ratio=Rp−RfσpSharpe\ Ratio = \frac{R_p - R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Portfolio (or asset) average return

- RfR_fRf = Risk-free rate (e.g., U.S. Treasury yield)

- σp\sigma_pσp = Standard deviation of portfolio returns

The higher the Sharpe Ratio, the more attractive the investment, since it indicates better returns per unit of risk.

Sharpe Ratio balances reward and risk, making it a core metric in modern portfolio theory.

Why is the Sharpe Ratio Important?

- It allows apples-to-apples comparison between investments with different risk profiles.

- It helps investors assess portfolio performance, showing if higher returns are justified by higher risks.

- It is widely used in hedge funds, mutual funds, and quant trading to evaluate strategies.

For example, if two funds both deliver 10% annual returns but one has half the volatility, its Sharpe Ratio will be higher, signaling better efficiency. This highlights why Sharpe Ratio is important for risk management.

Step-by-Step Guide: How to Calculate Sharpe Ratio

Step 1: Collect Data

You need historical returns of the asset or portfolio and the risk-free rate. Common data sources include Bloomberg, Yahoo Finance, or broker APIs.

Step 2: Calculate Excess Returns

Subtract the risk-free rate from the portfolio return for each period.

Excess Return=Rp−RfExcess\ Return = R_p - R_fExcess Return=Rp−Rf

Step 3: Find the Average Excess Return

Take the mean of excess returns over the chosen period.

Step 4: Compute Standard Deviation of Returns

Calculate the standard deviation of portfolio returns to measure risk.

Step 5: Apply the Sharpe Ratio Formula

Divide the average excess return by the standard deviation.

Example: Manual Calculation

- Portfolio average return (RpR_pRp): 12%

- Risk-free rate (RfR_fRf): 2%

- Standard deviation of returns (σp\sigma_pσp): 10%

Sharpe Ratio=12%−2%10%=1.0Sharpe\ Ratio = \frac{12\% - 2\%}{10\%} = 1.0Sharpe Ratio=10%12%−2%=1.0

This means the portfolio delivers 1 unit of excess return per unit of risk, which is considered decent but not exceptional.

Visualizing returns helps in understanding volatility, a key component of the Sharpe Ratio.

Methods to Calculate Sharpe Ratio

Method 1: Spreadsheet (Excel or Google Sheets)

- Import return data.

- Use built-in functions (

AVERAGE,STDEV.P) to compute mean and standard deviation.

- Apply formula to derive Sharpe Ratio.

Pros: Easy, visual, no coding needed.

Cons: Limited scalability for large datasets.

Method 2: Programming (Python, R, MATLAB)

Using Python and Pandas:

python

Copy code

import numpy as np

import pandas as pd

returns = pd.Series([0.05, 0.02, -0.01, 0.04, 0.03])

risk_free_rate = 0.01

excess_returns = returns - risk_free_rate

sharpe_ratio = excess_returns.mean() / excess_returns.std()

print(sharpe_ratio)

Pros: Scalable, automatable, great for quant strategies.

Cons: Requires coding skills.

Comparison: Spreadsheet vs Coding

| Method | Best For | Advantages | Limitations |

|---|---|---|---|

| Spreadsheet | Re |

0 Comments

Leave a Comment