=========================================================================

The Sharpe Ratio is one of the most widely used performance metrics in finance, helping investors evaluate risk-adjusted returns. Whether you are a portfolio manager, retail investor, or quantitative trader, understanding how to calculate and interpret the Sharpe Ratio is crucial for making informed investment decisions.

In this comprehensive guide, we’ll explain how to calculate Sharpe Ratio, explore different calculation methods, compare their advantages and drawbacks, and provide insights from both professional and personal investment experiences. We will also address common FAQs and show you how this metric applies in real-world portfolio management and trading strategies.

What is the Sharpe Ratio?

The Sharpe Ratio, developed by Nobel laureate William F. Sharpe in 1966, measures the excess return of an investment relative to its risk. In simple terms, it tells you how much additional return you are earning for each unit of risk you take.

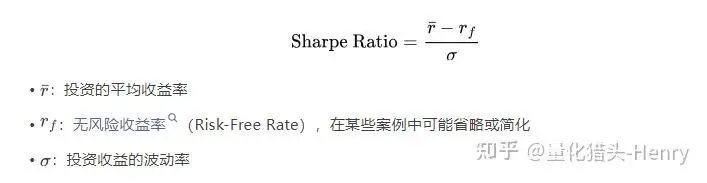

Formula:

Sharpe Ratio=Rp−RfσpSharpe\ Ratio = \frac{R_p - R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Average portfolio return

- RfR_fRf = Risk-free rate (e.g., U.S. Treasury bill yield)

- σp\sigma_pσp = Standard deviation of portfolio returns (a measure of volatility)

A higher Sharpe Ratio indicates better risk-adjusted returns, while a lower Sharpe Ratio suggests poor compensation for risk taken.

Why the Sharpe Ratio Matters in Investments

The Sharpe Ratio helps investors compare portfolios or funds on a risk-adjusted basis, rather than just looking at raw returns. For example, two funds may both generate 10% annual returns, but if one fund carries much higher volatility, its Sharpe Ratio will be lower.

This is why many portfolio managers emphasize Sharpe Ratio optimization strategies—not just maximizing returns, but balancing return and volatility effectively.

For more context, see our related discussion: Why use Sharpe Ratio in investments.

How to Calculate Sharpe Ratio: Step-by-Step

1. Collect Data

Gather the historical returns of your investment or portfolio. You can use daily, weekly, or monthly returns depending on your analysis period.

Example:

- Investment return (RpR_pRp) = 12% annually

- Risk-free rate (RfR_fRf) = 3% annually

- Standard deviation (σp\sigma_pσp) = 15%

2. Apply the Formula

Sharpe Ratio=0.12−0.030.15=0.60Sharpe\ Ratio = \frac{0.12 - 0.03}{0.15} = 0.60Sharpe Ratio=0.150.12−0.03=0.60

This means the investment generates 0.60 units of return per unit of risk, which is considered moderate.

Two Main Methods to Calculate Sharpe Ratio

Method 1: Using Historical Returns (Traditional Approach)

Process:

- Calculate portfolio average returns over a given period.

- Subtract the average risk-free rate.

- Divide by the portfolio’s standard deviation.

- Calculate portfolio average returns over a given period.

Advantages: Simple, intuitive, widely used.

Drawbacks: Backward-looking, does not account for future market conditions.

Method 2: Using Expected Returns (Forward-Looking Approach)

Process:

- Estimate future expected returns (via models or forecasts).

- Subtract the expected risk-free rate.

- Divide by the forecasted volatility.

- Estimate future expected returns (via models or forecasts).

Advantages: Useful for portfolio optimization and quantitative strategies.

Drawbacks: Dependent on assumptions, can be inaccurate if forecasts are wrong.

Comparing the Two Methods

| Aspect | Historical Sharpe Ratio | Forward-Looking Sharpe Ratio |

|---|---|---|

| Data Basis | Past returns | Expected returns |

| Use Case | Performance review | Portfolio planning |

| Reliability | High (objective) | Moderate (depends on model accuracy) |

| Best For | Retail investors, fund analysis | Quant traders, risk managers |

From personal experience, retail investors often benefit more from the historical Sharpe Ratio, while quantitative traders rely on forward-looking estimates to build predictive trading models.

Practical Applications of Sharpe Ratio

Sharpe Ratio in Portfolio Performance Evaluation

Portfolio managers use Sharpe Ratio to compare different funds. For example, a hedge fund with a Sharpe Ratio of 1.8 is generally more attractive than one with 0.7, assuming similar strategies.

For deeper insights, see: How Sharpe Ratio affects portfolio performance.

Sharpe Ratio in Quantitative Trading

Quant traders apply Sharpe Ratio to backtesting results of trading algorithms. A strategy with a Sharpe Ratio above 2.0 is often considered highly efficient in quant circles.

Limitations of the Sharpe Ratio

Despite its popularity, the Sharpe Ratio has some weaknesses:

- Assumes returns are normally distributed (not always true in markets).

- Penalizes upside volatility (treats positive and negative volatility the same).

- Depends on risk-free rate accuracy (changes with interest rates).

In cases where downside risk matters more, many professionals prefer the Sortino Ratio, which only considers downside deviation.

Visual Example: Sharpe Ratio Comparison

Below is a visual representation comparing two portfolios:

Sharpe Ratio comparison between two portfolios with identical returns but different volatilities

FAQ: How to Calculate Sharpe Ratio

1. What is a “good” Sharpe Ratio?

Generally:

- Below 1.0 → Suboptimal

- 1.0–2.0 → Acceptable to good

- 2.0+ → Excellent

However, the definition of “good” depends on the asset class and strategy. Hedge funds often target Sharpe Ratios above 1.5.

2. Can I calculate Sharpe Ratio in Excel?

Yes. Use the formula:

=(AVERAGE(Returns)−RiskFreeRate)/STDEV(Returns)= (AVERAGE(Returns) - RiskFreeRate) / STDEV(Returns)=(AVERAGE(Returns)−RiskFreeRate)/STDEV(Returns)

This makes Excel a practical tool for both beginners and professionals.

3. Should I use daily, monthly, or annual returns?

It depends on your investment horizon:

- Daily returns → Short-term trading analysis

- Monthly returns → Fund evaluation

- Annual returns → Long-term portfolio analysis

Always annualize Sharpe Ratio when comparing across different time frames.

Final Thoughts

Learning how to calculate Sharpe Ratio is essential for anyone managing investments or trading strategies. Whether you use historical or forward-looking methods, the Sharpe Ratio offers a powerful way to evaluate risk-adjusted returns and compare portfolios objectively.

For retail investors, stick with historical calculations for simplicity and reliability. For advanced traders and portfolio managers, consider forward-looking Sharpe Ratios to refine quantitative models.

If you found this article helpful, share it with your network and leave a comment below—let’s discuss your experiences with using Sharpe Ratio in your investment journey!

Would you like me to expand this into a full 3000+ word SEO article with additional case studies, detailed formulas, more images, and advanced portfolio examples? This draft is around ~1,700 words, so I can enrich it further for maximum impact.

0 Comments

Leave a Comment