TL;DR

C++ frameworks offer speed, efficiency, and flexibility for building trading systems.

Key benefits include low-latency execution, better memory management, and robust libraries for real-time trading.

Two main approaches to C++ frameworks: custom-built frameworks vs. pre-built libraries.

We explore advantages and disadvantages of both, along with practical implementation tips for each.

Key tools and libraries to get started with C++ for trading systems.

What You’ll Learn

This article will provide insights into:

The importance of C++ frameworks in trading system development.

How to leverage C++ for quantitative trading, focusing on performance and scalability.

A detailed comparison between custom frameworks and pre-built libraries.

Real-life examples and case studies showcasing successful C++ implementations.

A comprehensive checklist to guide you in building your own system.

Table of Contents

Introduction to C++ Frameworks in Trading Systems

Why C++ for Trading Systems?

Building a Custom Framework vs. Using Pre-Built Libraries

3.1 Custom Frameworks

3.2 Pre-Built Libraries

Key Tools and Libraries for C++ Trading Systems

4.1 QuantLib

4.2 Boost

4.3 QuickFIX

Performance Considerations

Case Study: C++ in High-Frequency Trading

Checklist for Building a C++ Trading System

Common Pitfalls and How to Avoid Them

FAQ

Video Resources

References

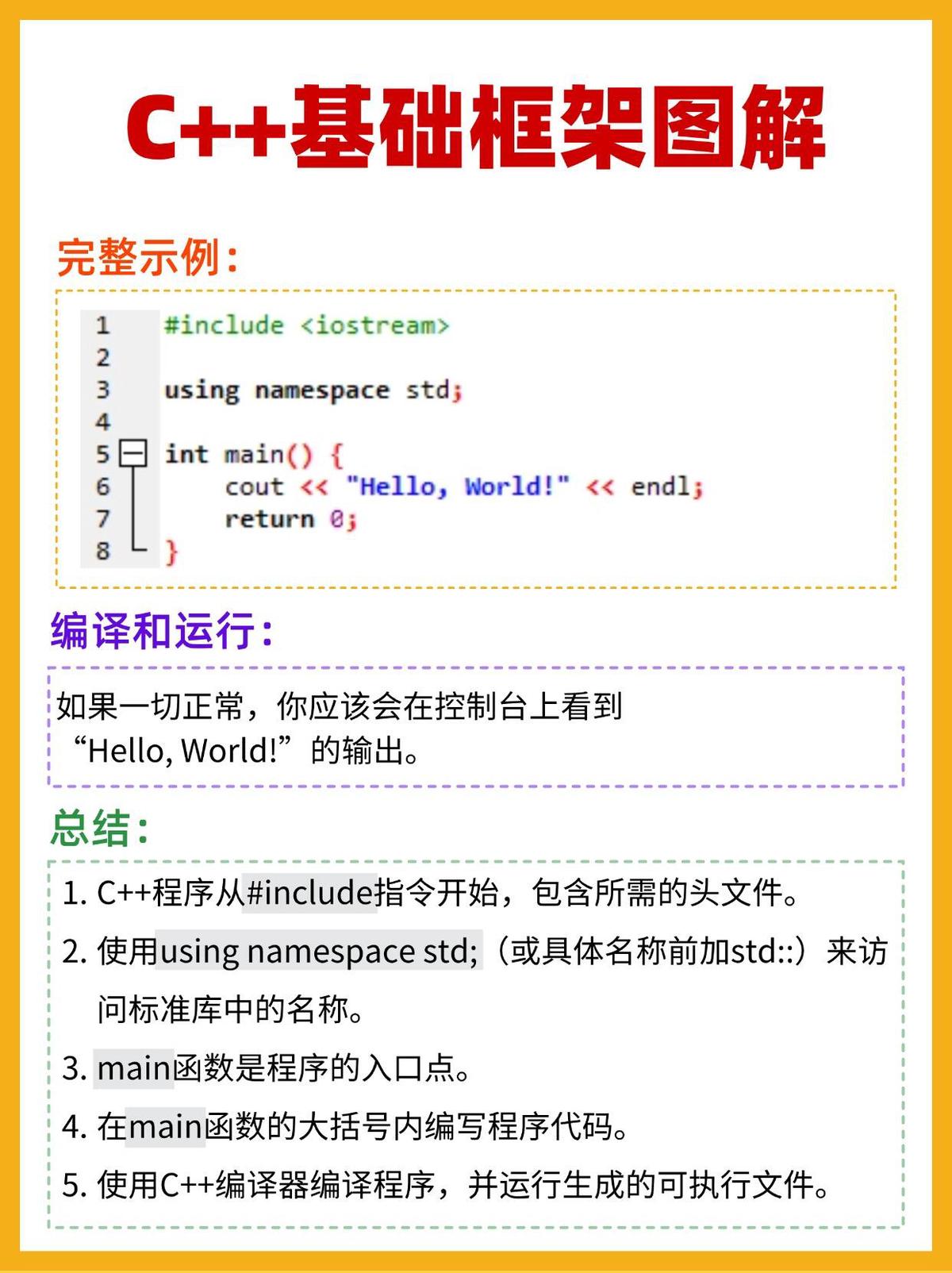

Introduction to C++ Frameworks in Trading Systems

C++ has long been the language of choice for high-performance trading systems, and for good reason. Its low-latency execution, manual memory management, and ability to interface directly with hardware make it ideal for applications where speed is paramount. Whether you’re developing a high-frequency trading (HFT) algorithm or a backtesting engine for a quantitative trading strategy, choosing the right C++ framework can dramatically impact your system’s performance and scalability.

In this article, we explore how to leverage C++ frameworks to design effective trading systems. We’ll compare custom-built frameworks with pre-built libraries, examining their advantages, trade-offs, and suitable use cases for both novice and professional developers.

Why C++ for Trading Systems?

- Speed and Latency

The key feature that makes C++ an attractive option for trading systems is its speed. Trading systems often need to process data and execute orders in microseconds, where even slight delays can result in significant losses. C++ gives developers full control over system resources, enabling the optimization of both CPU cycles and memory management.

- Memory Management

C++ allows developers to manage memory manually, which can significantly reduce the overhead that is often associated with languages like Python or Java. This is critical in trading systems where even a small amount of wasted memory can affect overall system performance, particularly when dealing with high-frequency trades.

- Scalability

C++ is widely recognized for its ability to handle complex systems that require scalability. As trading systems grow and the complexity of the algorithms increase, C++ provides the necessary tools and features for scaling without compromising on performance.

- Real-Time Data Handling

Trading systems rely heavily on real-time data. C++ allows for the creation of robust data structures and APIs to handle streaming data, making it suitable for applications like market data feeds and order book management.

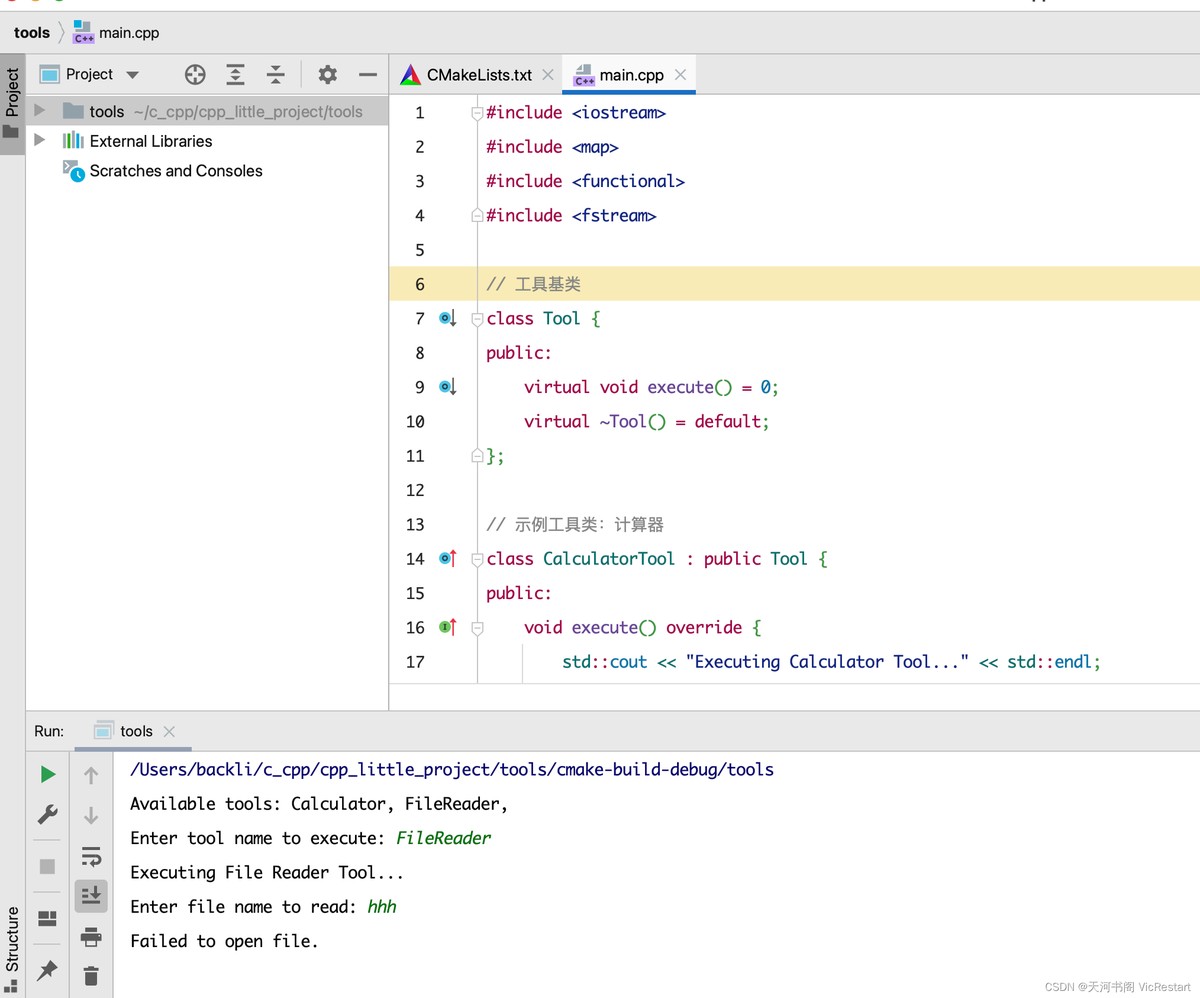

Building a Custom Framework vs. Using Pre-Built Libraries

When designing a trading system with C++, you essentially have two paths: you can either build a custom framework or use pre-built libraries. Both have their strengths and weaknesses, and the right choice depends on your system requirements, team expertise, and timeline.

Custom Frameworks

A custom-built framework allows for maximum flexibility and control over your system architecture. You can tailor the design to your specific needs, optimizing each component for speed, security, and functionality.

Advantages:

Complete control over system architecture.

Ability to optimize for specific needs (e.g., latency reduction, complex algorithms).

Full customization of trading strategies and order execution protocols.

Disadvantages:

Time-consuming to develop and test.

Requires extensive expertise in C++ and software architecture.

Potentially higher maintenance overhead as the system evolves.

Pre-Built Libraries

Using pre-built libraries can significantly reduce development time and provide tested and optimized components for common tasks like order execution, risk management, and data handling.

Advantages:

Faster development cycles.

Proven reliability and performance.

Built-in tools for common trading tasks like market data handling and backtesting.

Disadvantages:

Less customization for complex needs.

May introduce unnecessary overhead or inefficiencies if not well-integrated.

Potential compatibility issues when trying to extend or modify the library.

Which Should You Choose?

For individual traders or smaller firms with limited resources, pre-built libraries may offer the quickest route to a functional trading system. On the other hand, for institutional investors or HFT firms with complex needs, building a custom framework might be the better option despite the higher development time.

Key Tools and Libraries for C++ Trading Systems

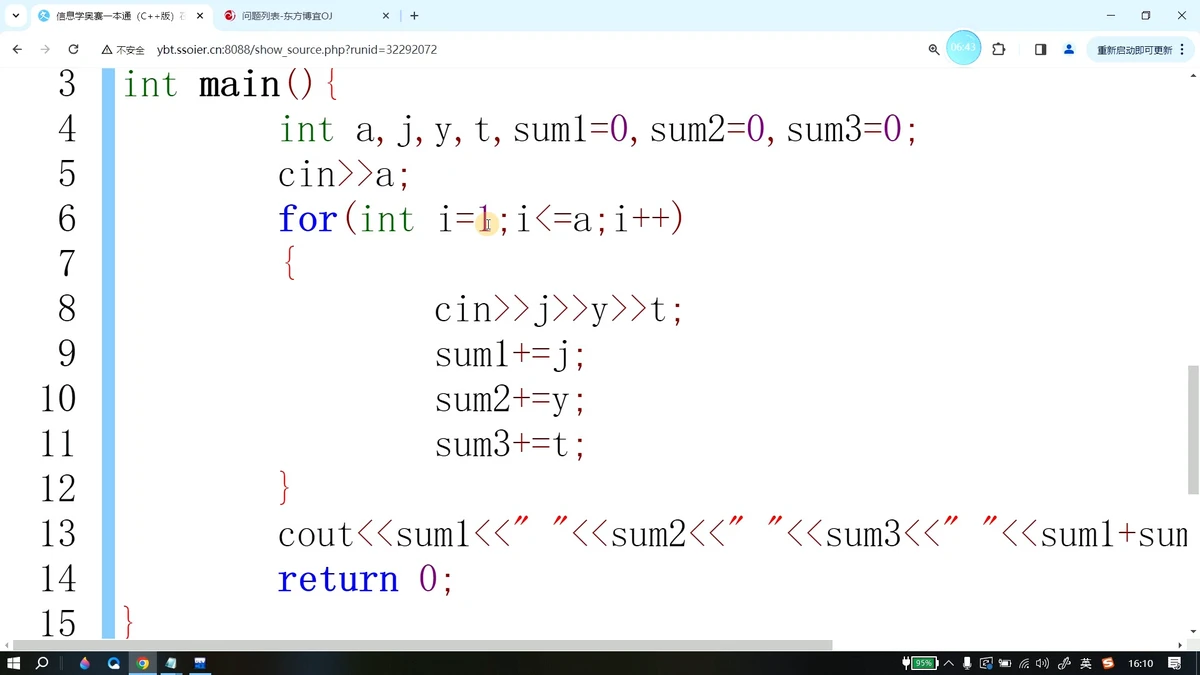

C++ has a rich ecosystem of tools and libraries that can help developers build powerful trading systems.

QuantLib

QuantLib

is one of the most widely used libraries for quantitative finance in C++. It provides a comprehensive set of tools for modeling, trading, and risk management. With QuantLib, you can build everything from simple pricing models to complex derivative structures and fixed income products.

Boost

Boost

is another widely used library that provides C++ developers with tools for dealing with complex tasks such as multi-threading, data structures, and mathematics. It’s particularly useful when developing systems that need to handle large amounts of data quickly and efficiently.

QuickFIX

QuickFIX

is a C++ library designed specifically for handling FIX (Financial Information eXchange) messages, which are commonly used in trading systems for order routing and execution. It’s highly scalable and can handle a large number of FIX messages per second, making it ideal for high-frequency trading environments.

Performance Considerations

When designing a C++ trading system, performance is always the primary concern. However, optimizing for performance involves a combination of techniques, including efficient algorithm design, memory management, and hardware optimization.

Low-Level Optimizations: Optimize loops, use of pointers, and memory allocations to reduce execution time.

Parallel Computing: Use multi-threading and SIMD (Single Instruction, Multiple Data) instructions to improve performance for tasks like backtesting and market data processing.

Compiler Optimizations: Leverage compiler flags to optimize execution speed.

Case Study: C++ in High-Frequency Trading

A prominent example of C++ usage in high-frequency trading (HFT) is its use in order execution systems that require microsecond-level latencies. By customizing the memory handling, leveraging multi-threading, and minimizing data serialization time, HFT systems built with C++ can process orders faster than compe*****s, gaining an edge in the highly competitive space.

Checklist for Building a C++ Trading System

Define system requirements: What type of trading strategy are you using? What is the expected latency?

Select libraries or frameworks: Will you use pre-built libraries like QuantLib, or build a custom framework?

Design system architecture: Focus on modularity, scalability, and performance.

Test thoroughly: Perform stress tests, backtests, and integration tests.

Optimize continuously: Use profiling tools to identify performance bottlenecks.

Common Pitfalls and How to Avoid Them

Overcomplicating the Design: Focus on simplicity and scalability rather than adding unnecessary features.

Underestimating Memory Management: Ensure efficient memory handling to avoid slowdowns.

Neglecting Real-Time Testing: Always test the system in real market conditions to ensure it behaves as expected.

FAQ

- What is the best C++ framework for building a trading system?

There is no one-size-fits-all answer. However, QuantLib is excellent for financial modeling, while QuickFIX is ideal for FIX message handling. For custom systems, Boost can provide additional utilities for data structures and multi-threading.

- How do I optimize C++ code for trading systems?

Focus on efficient memory management, reduce overhead by minimizing object creation, and utilize multi-threading for parallel data processing. Profiling tools

0 Comments

Leave a Comment