Finding a quant trading internship in the USA is one of the best ways to launch a career in quantitative finance, especially with top hedge funds, investment banks, or proprietary trading firms. This guide will walk you through the best strategies to secure these highly competitive positions, including networking, leveraging job platforms, and university recruiting. We will also explore the essential skills required for these roles and provide insight into common challenges aspiring quants face.

TL;DR

Top Strategies: Leverage networking, apply via specialized job boards, and tap into university recruiting programs.

Skills Needed: Strong programming skills (Python, C++, R), mathematical proficiency (probability, statistics), and financial knowledge.

Key Platforms: LinkedIn, Glassdoor, eFinancialCareers, university job portals.

Challenges: High competition, tough interview processes, and the need for strong technical backgrounds.

Recommended Resources: Utilize personal projects, online courses, and competitions to build a competitive portfolio.

What You Will Gain

This article will help you:

Find the Best Ways to secure a quant trading internship in the USA.

Understand Key Skills required for quantitative trading roles.

Identify Top Resources such as job platforms and networking events.

Overcome Common Challenges faced in the internship application process.

Table of Contents

Understanding Quant Trading Internships

Top Methods to Find Quant Trading Internships in the USA

Networking and Alumni Connections

Online Platforms and Job Boards

University Recruiting Programs

Applying Directly to Quant Firms

What Skills Are Needed for Quant Trading Internships

Challenges You Might Face and How to Overcome Them

FAQ

Conclusion

Understanding Quant Trading Internships

Quantitative trading internships provide invaluable exposure to the financial markets and trading algorithms used by top hedge funds, proprietary trading firms, and investment banks. During these internships, you’ll likely work with complex mathematical models, high-frequency trading systems, and large datasets to design and test trading strategies. The goal of these internships is to help you hone your technical skills while understanding how quants use algorithms to make trading decisions.

To successfully land a quant trading internship, you’ll need more than just theoretical knowledge in finance. A good mix of programming skills, advanced mathematics, and a deep understanding of financial concepts is crucial.

Top Methods to Find Quant Trading Internships in the USA

Networking and Alumni Connections

Networking is often one of the most effective methods for securing a quant internship. Many internships are filled via referrals and personal connections, especially in competitive fields like quantitative trading. Here’s how to leverage networking:

University Alumni: Many professionals in quantitative finance are alumni of prestigious universities. Reach out to alumni for advice, introductions, or referrals. You can usually find alumni through your school’s LinkedIn or alumni networks.

Professional Conferences & Events: Attending conferences or meetups related to finance and trading can expose you to professionals in the field. Networking at these events can lead to internships or job offers.

LinkedIn and Social Media: Optimize your LinkedIn profile to showcase relevant technical skills and coursework. Directly reach out to quants working at top firms, asking for informational interviews.

Social Platforms (Reddit, Twitter): Quants often share insights on subreddits like r/quantfinance and Twitter. Participate in discussions and share your knowledge to build your online presence.

Pros: Networking can give you direct access to internship opportunities, and referrals can significantly increase your chances.

Cons: It requires sustained effort and may take time to see results.

Online Platforms and Job Boards

Job boards dedicated to finance and trading positions often feature quant trading internships. Key platforms to use include:

LinkedIn: Regularly check LinkedIn’s job board and set up job alerts for quant trading positions. Many firms post internship opportunities on this platform.

Glassdoor: Glassdoor aggregates listings from various firms and provides reviews and insights from former interns, helping you make informed decisions.

Indeed: Another popular job board, Indeed often features a wide range of internships, including those in quantitative trading.

eFinancialCareers: Specializing in finance-related job postings, eFinancialCareers offers targeted listings for quant trading internships.

Pros: These platforms offer easy access to many internship listings, and you can apply directly on the site.

Cons: Due to the large volume of applicants, competition can be intense.

University Recruiting Programs

Top financial firms, including hedge funds and investment banks, often recruit directly from universities. This method is highly effective if you are currently attending a university with strong ties to the finance industry. Here’s how to get involved:

Career Fairs: Many universities host career fairs where leading trading firms participate in recruiting. Attend these events to meet recruiters in person.

On-Campus Interviews: Some firms schedule interviews directly on campus, providing a convenient way to interact with hiring managers.

University Job Portals: If your school has a job portal or career center, check regularly for internships posted by leading financial institutions and trading firms.

Pros: Direct access to recruiters from top firms with internships tailored for university students.

Cons: Limited to students at schools with established recruiting relationships with top firms.

Applying Directly to Quant Firms

Some of the largest and most prestigious quant trading firms, such as Jane Street, Two Sigma, and D.E. Shaw, offer internship opportunities that are available for direct application. Here’s how you can approach it:

Research: Identify leading firms in quantitative trading and regularly check their careers pages for internship postings.

Tailor Your Application: Customize your resume to highlight your relevant technical skills, such as proficiency in Python, C++, and R, as well as relevant coursework in mathematics and finance.

Follow Up: After submitting your application, follow up with a polite email to the recruiting team expressing your interest in the position.

Pros: Direct applications give you control over the process and may increase your chances of landing an internship if you demonstrate a strong fit.

Cons: The application process can be lengthy, and competition is fierce for top firms.

What Skills Are Needed for Quant Trading Internships

A successful candidate for a quant trading internship must have a strong technical and analytical skillset. Here are the essential skills:

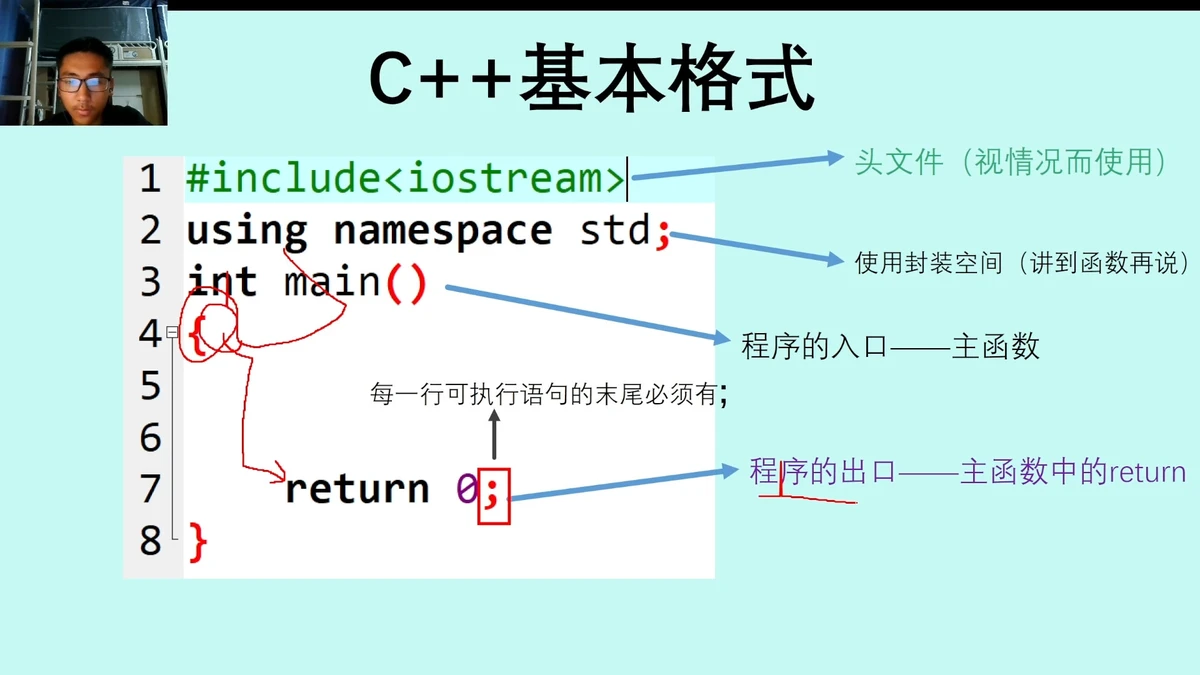

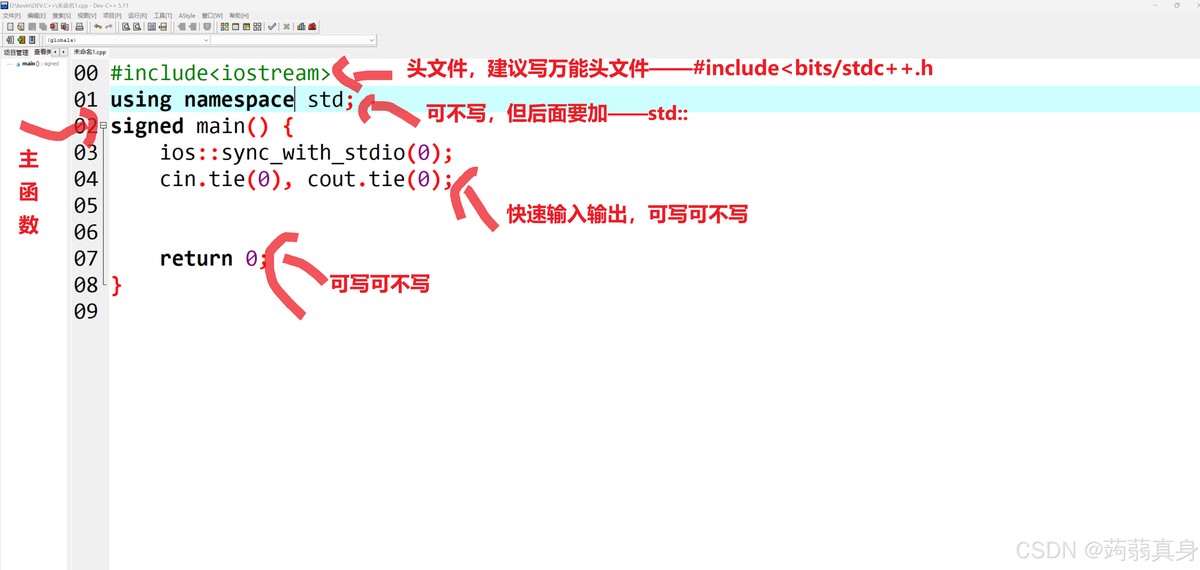

Programming: Knowledge of programming languages such as Python, C++, Java, or R is essential. Python is often the most commonly used language for data analysis and algorithmic development.

Mathematics and Statistics: A strong foundation in advanced mathematics, including linear algebra, calculus, probability, and stochastic processes, is critical in quantitative finance.

Data Analysis: Familiarity with tools like MATLAB, NumPy, or TensorFlow for analyzing large datasets will be beneficial.

Financial Knowledge: Understanding how financial markets work, how to model financial instruments, and the basics of trading strategies is essential.

Problem Solving: You must be able to approach complex financial problems with creative algorithmic solutions.

Pro Tip: If you don’t have a finance background, focus on building strong technical skills and gaining experience with data-driven problem solving.

Challenges You Might Face and How to Overcome Them

High Competition: Quantitative trading internships are highly competitive, particularly at top firms. To stand out, focus on building a portfolio of relevant projects and participate in coding competitions.

Tough Interview Process: Expect rigorous technical interviews that assess your programming and problem-solving abilities. Prepare by practicing coding challenges on platforms like LeetCode and HackerRank.

Lack of Experience: Many internships require prior experience in finance, but you can overcome this by working on independent projects, contributing to open-source finance algorithms, or participating in relevant online competitions.

FAQ

- What are the prerequisites for applying to a quant trading internship?

A strong understanding of programming, mathematics, and finance is essential. Most candidates will have proficiency in programming languages like Python, C++, or R, and a background in statistics, probability, and algorithms.

- How competitive are quant trading internships?

These internships are highly competitive. To secure a position, you need a robust technical skill set, relevant coursework, and a proactive approach to networking and job searching.

- How can I improve my chances of landing a quant trading internship?

Focus on building strong technical skills, such as programming and data analysis. Engage in networking opportunities, participate in relevant online competitions, and seek out personal projects that demonstrate your skills.

Conclusion

Securing a quant trading internship in the USA requires a mix of technical skills, persistence, and strategic approaches. Whether through networking, leveraging online job boards, or applying directly to top firms, it’s crucial to stay proactive in your job search. Additionally, acquiring the necessary skills—especially in programming, mathematics, and financial theory—will give you a significant edge in this highly competitive field.

Feel free to share your experience with us or ask any questions in the comments section! Have you found any strategies particularly helpful in landing an internship?

0 Comments

Leave a Comment