TL;DR

C++ is one of the most efficient programming languages for retail traders seeking to optimize their trading strategies.

Retail traders can leverage C++ to build fast, high-performance algorithmic trading systems.

The article will explore two major C++ strategies for retail traders: algorithmic trading and backtesting systems.

Key advantages of C++ include low latency, high speed, and control over system resources, making it ideal for high-frequency trading and complex quantitative models.

A comparison of the strategies will help retail traders choose the best approach based on their needs.

What Can You Achieve with This Article?

Learn how C++ can help optimize your trading system: Get an in-depth understanding of how the language boosts trading performance, reduces latency, and manages large data volumes.

Explore two key C++ strategies: You’ll discover algorithmic trading and backtesting systems to decide which method fits your trading style.

Understand the pros and cons of different C++ strategies for retail traders, guiding you to the best approach for your specific goals.

Get practical tips and best practices for implementing C++ strategies, especially for optimizing trading systems, improving performance, and reducing errors.

Table of Contents

Introduction

Why C++ for Retail Trading?

C++ Strategy A: Algorithmic Trading

Advantages

Challenges

C++ Strategy B: Backtesting Systems

Advantages

Challenges

Method Comparison: Algorithmic Trading vs. Backtesting

Practical Tips for Using C++ in Retail Trading

FAQ

Conclusion

Introduction

As retail traders venture into the world of algorithmic trading, the need for performance-driven programming languages becomes critical. C++ is widely regarded as one of the most efficient languages for building trading systems. Whether you’re building a high-frequency trading algorithm or backtesting a strategy, C++ offers several unique advantages that retail traders can capitalize on.

This article will explore how you can leverage C++ to enhance your retail trading strategies, covering two primary approaches: algorithmic trading and backtesting systems. By the end, you’ll be better equipped to decide which strategy works best for your trading goals.

Why C++ for Retail Trading?

Before diving into the strategies, let’s first understand why C++ is such a powerful tool for retail traders.

Performance and Speed: C++ is known for its ability to execute code extremely quickly. In trading, speed can make all the difference, especially in high-frequency trading where every millisecond matters.

Low Latency: When executing trades in a live market, latency is critical. C++ allows for low-latency communication between your trading algorithm and market exchanges, ensuring quicker decision-making.

Control Over Resources: Unlike high-level languages, C++ gives you more control over system resources, enabling you to fine-tune your code to maximize performance, memory, and CPU usage.

The performance advantages of C++ are particularly important for retail traders who are working on complex strategies and need fast, real-time data processing.

C++ Strategy A: Algorithmic Trading

What Is Algorithmic Trading?

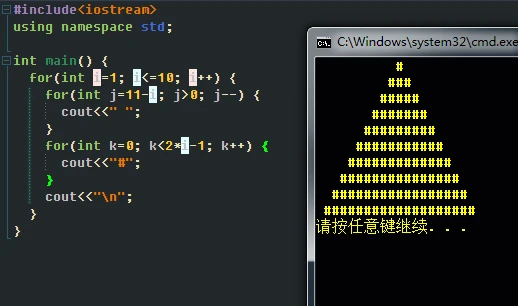

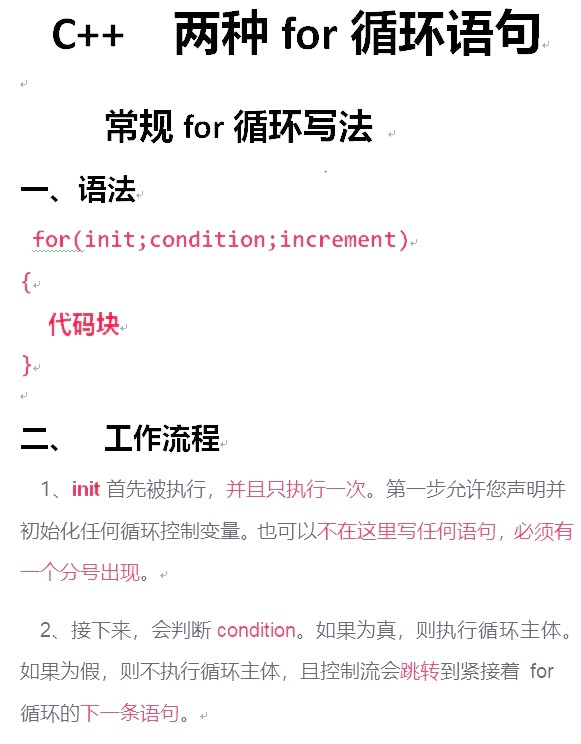

Algorithmic trading involves using computer algorithms to make automated trading decisions. These algorithms can range from simple rule-based strategies to complex machine learning models.

Retail traders typically use C++ in algorithmic trading for:

High-frequency trading (HFT): Using ultra-fast algorithms to execute numerous trades within a fraction of a second.

Market making: Providing liquidity to markets by placing both buy and sell orders.

Arbitrage: Identifying pricing inefficiencies in different markets and profiting from them.

Advantages

Speed: C++ allows for faster execution of trading algorithms, giving traders an edge in high-frequency environments where every millisecond counts.

Scalability: With C++, traders can easily scale their strategies to handle large amounts of data without sacrificing performance.

Real-Time Execution: C++ enables real-time decision-making and trade execution, which is crucial for algorithmic traders who rely on speed.

Challenges

Complexity: Building and maintaining C++ trading algorithms requires advanced programming skills and can be complex.

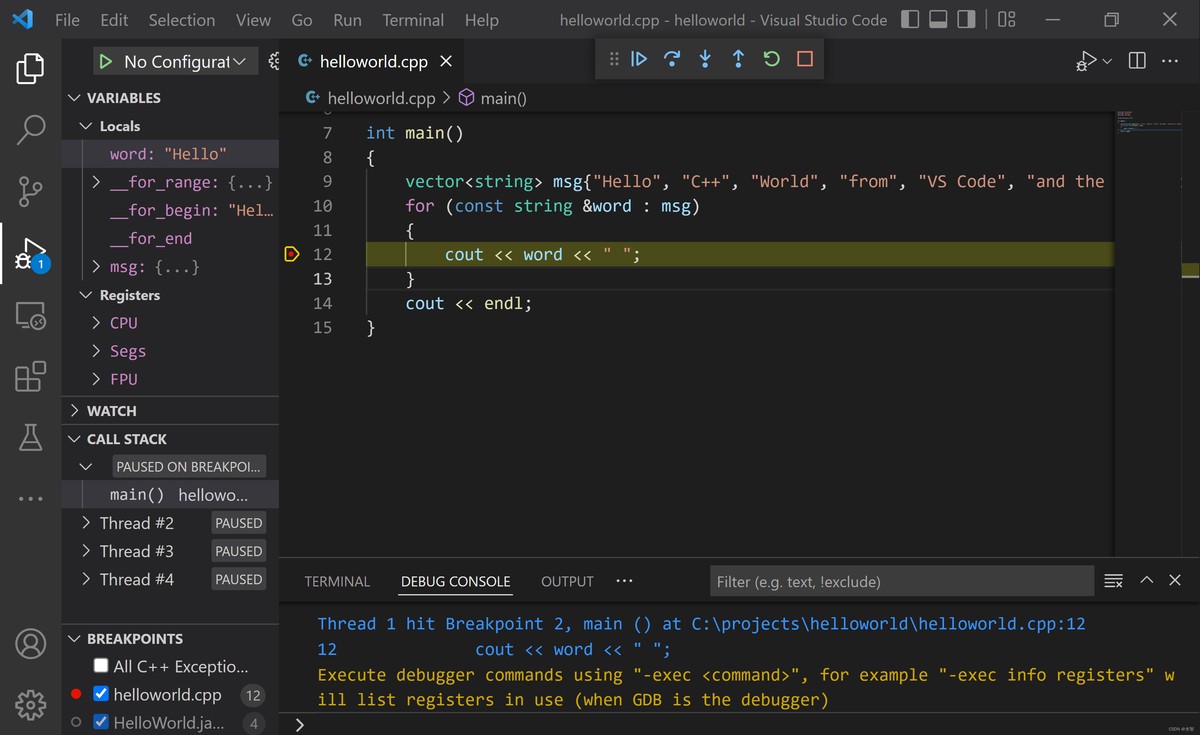

Debugging Difficulty: Identifying and fixing bugs in high-performance C++ code can be more challenging compared to higher-level languages like Python.

Resource Intensive: C++ algorithms are resource-heavy, requiring significant computational power, especially in high-frequency scenarios.

C++ Strategy B: Backtesting Systems

What Is Backtesting?

Backtesting is the process of testing a trading strategy using historical market data to determine its potential profitability. Retail traders can use C++ to build backtesting systems that simulate real market conditions and assess strategy performance.

Advantages

Historical Data Simulation: C++ can process large datasets quickly, allowing traders to backtest strategies over decades of market data.

Performance Optimization: With C++, traders can optimize their backtesting system to run faster, ensuring that strategies are tested efficiently.

Customizability: Traders can develop highly customizable backtesting engines that fit their exact needs, including incorporating specific risk parameters and trade rules.

Challenges

Initial Setup Complexity: Setting up a robust backtesting system in C++ can be time-consuming and requires extensive knowledge of both C++ and financial markets.

Overfitting Risk: Traders must be cautious of overfitting their strategies to historical data, which can lead to poor real-world performance.

Data Integrity: Inaccurate or incomplete historical data can skew backtest results, leading to incorrect conclusions about a strategy’s effectiveness.

Method Comparison: Algorithmic Trading vs. Backtesting

Criteria Algorithmic Trading Backtesting

Speed Extremely fast execution for real-time trading Slower, as it’s based on historical data simulation

Complexity Requires deep understanding of real-time systems and market behavior Requires comprehensive understanding of market dynamics and historical data

Risk Involves real money and market risks Lower risk, as it’s a simulation based on past data

Cost High cost due to infrastructure and real-time data feeds Lower cost, as it involves historical data and simulation

Customization Highly customizable, but can be complex to implement Highly customizable, with the possibility to test different conditions

Conclusion: If your focus is on real-time trading and executing fast decisions, algorithmic trading with C++ is likely the best approach. However, if you want to validate a strategy before putting real money on the line, a backtesting system built with C++ will give you an edge in identifying viable strategies.

Practical Tips for Using C++ in Retail Trading

Use Libraries: C++ has a wealth of libraries that can help retail traders develop sophisticated trading systems. Libraries such as QuantLib and Boost can save development time and provide pre-built solutions for financial computations.

Leverage Multithreading: For real-time trading, leveraging C++’s multithreading capabilities can significantly enhance performance and allow your algorithm to handle multiple tasks simultaneously.

Optimize Memory Usage: Efficient memory management in C++ is crucial for handling large datasets in trading, particularly when working with market data in high-frequency environments.

FAQ

- Why should I use C++ for algorithmic trading instead of Python?

While Python is widely used for its simplicity, C++ offers superior speed and low latency, making it more suited for high-frequency and real-time trading environments. C++ allows you to optimize memory usage and CPU performance, which is critical in competitive trading.

- Can I use C++ for backtesting my strategies?

Yes, C++ is excellent for building backtesting systems due to its ability to handle large datasets and perform complex computations quickly. By using C++, you can simulate trading strategies over years of historical data and test their profitability with minimal latency.

- How do I get started with C++ for retail trading?

To start with C++, you should focus on learning the basics of programming, memory management, and multithreading. From there, you can explore financial libraries and frameworks that will help you develop trading algorithms and backtesting systems. Many online courses and tutorials can guide you through the process.

Conclusion

C++ offers retail traders unparalleled performance, speed, and scalability, making it ideal for both algorithmic trading and backtesting. By understanding the pros and cons of each approach, retail traders can make more informed decisions about how to best use C++ in their trading strategies. Whether you’re focusing on high-frequency trading or validating strategies through backtesting, C++ will provide the tools necessary to optimize and refine your trading systems.

Feel free to share your thoughts on which C++ strategy works best for you. What challenges have you faced when implementing these strategies in your trading? Let’s discuss in the comments!

References

“C++ for Algorithmic Trading: What You Need to Know.” Financial Times, 2022-08-15. Accessed 2025-09-

0 Comments

Leave a Comment