Quantitative analysis in finance has evolved significantly over the years, with many advanced tools and programming languages being developed to handle complex tasks in financial modeling, risk management, and trading strategies. Among these tools, C++ remains one of the most widely used languages for quantitative finance, primarily due to its speed, efficiency, and powerful libraries that allow developers to create high-performance systems.

In this article, we will delve into how C++ templates can be effectively used for quantitative analysis solutions. We’ll explore the concept of C++ templates, their significance in the context of financial modeling, and how they can be leveraged to solve real-world problems in quantitative finance. We will also compare different strategies for implementing these templates and provide best practices for utilizing C++ in quantitative finance.

TL;DR:

C++ templates enable flexible, reusable code in financial modeling and quantitative analysis.

Using templates, developers can create generic algorithms and optimize performance for large datasets in quantitative trading.

C++ excels in high-frequency trading and algorithmic trading due to its speed and efficiency.

Two primary strategies for implementing C++ templates are data-driven modeling and algorithmic optimization.

This article compares these strategies and provides practical insights on how to leverage C++ templates for better trading systems.

What You Will Learn:

By reading this article, you will:

Understand the fundamentals of C++ templates and their role in quantitative finance.

Learn how to apply C++ templates to improve algorithmic trading, data analysis, and risk management.

Gain insights into best practices for optimizing C++ code in trading systems.

Discover two different strategies for using C++ templates to solve financial modeling problems.

Be introduced to real-world applications and case studies showcasing the effectiveness of C++ templates in trading systems.

Table of Contents

Introduction to C++ Templates

Why Use C++ in Quantitative Analysis?

C++ Templates for Quantitative Trading

Data-Driven Modeling in C++

Algorithmic Optimization in C++

Comparing Data-Driven vs Algorithmic Optimization Approaches

Case Studies of C++ in Quantitative Trading

Best Practices for Implementing C++ Templates

FAQ

Video References

References

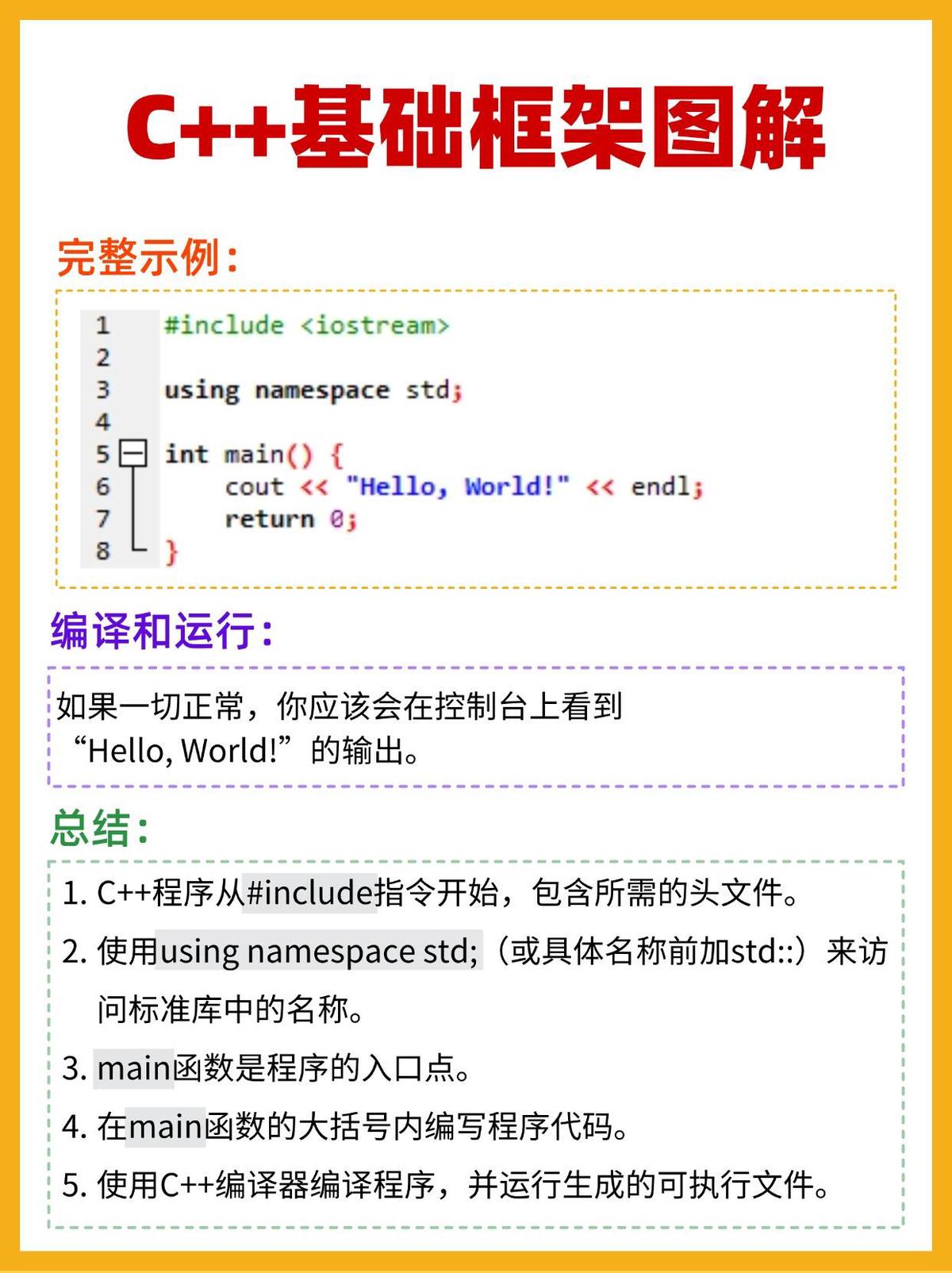

Introduction to C++ Templates

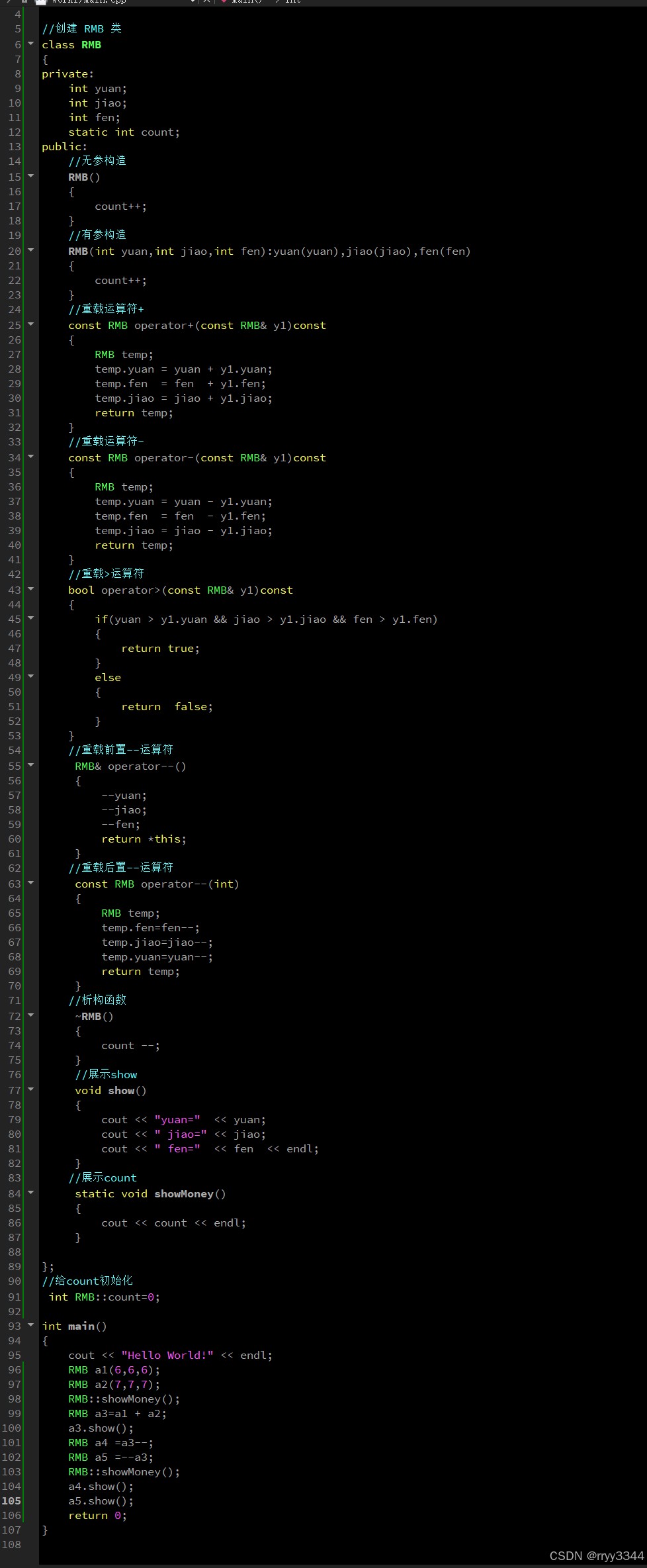

In the world of software development, C++ templates are a powerful feature that allows developers to write generic code. Templates in C++ enable code reusability by defining functions, classes, or data structures that can operate with any data type. This is particularly useful in quantitative finance, where models and algorithms often need to handle various types of data such as floating-point numbers, integers, or custom data structures.

C++ templates can be used to create generic algorithms for processing financial data, whether it’s for pricing models, risk analysis, or statistical computations. By using templates, developers can ensure that the code is more maintainable, extensible, and efficient, which is crucial for high-frequency trading and other performance-sensitive applications.

Why Use C++ in Quantitative Analysis?

C++ is a high-performance language that excels in applications that require real-time computations, such as high-frequency trading (HFT) and algorithmic trading. The key benefits of using C++ in quantitative finance include:

Speed: C++ compiles directly to machine code, making it one of the fastest programming languages available.

Memory Management: C++ offers direct memory control, which allows for fine-tuned performance optimizations.

Efficient Libraries: C++ has a vast ecosystem of libraries specifically designed for financial modeling, statistics, and data analysis.

High-Frequency Trading: C++ is widely used in HFT because of its ability to handle low-latency and high-throughput requirements.

By leveraging C++ for quantitative analysis, traders and analysts can implement more complex models and algorithms that would otherwise be impractical in slower languages.

C++ Templates for Quantitative Trading

When dealing with large datasets and complex models, C++ templates provide an efficient way to handle different data types and mathematical functions. These templates can be used for:

Custom Data Structures: Templates enable the creation of generic data structures like linked lists, trees, and matrices that can handle any type of data (e.g., real numbers, complex numbers).

Generic Algorithms: Traders can implement mathematical functions such as integration, differentiation, or optimization that work across different types of numerical data.

High-Performance Backtesting: Using C++ templates, quantitative analysts can develop backtesting frameworks that simulate trading strategies and optimize them based on historical data.

For example, a template-based approach could be used to implement a Monte Carlo simulation for options pricing, where the same function could be applied to different asset classes and option types.

Data-Driven Modeling in C++

Data-driven modeling is the process of creating models that can adapt based on incoming data. This is particularly important in financial markets where data can change rapidly. C++ templates can be employed in this type of modeling by creating generic functions that can process different data types, including:

Time-Series Data: C++ templates can handle time-series data used in trading strategies, including price history, moving averages, and volatility estimates.

Statistical Analysis: Analysts can use C++ templates to create statistical models like regression, correlation, and covariance, which are crucial for portfolio management and risk analysis.

For instance, a template function could be created to compute the correlation between two datasets, whether the data is stock prices, bond yields, or economic indicators. The same function can be used for different financial instruments without needing to write separate code for each.

Algorithmic Optimization in C++

Another way C++ templates are used in quantitative finance is for algorithmic optimization. Many quantitative trading strategies rely on optimization algorithms to find the best parameters for a given model or strategy. C++ templates can help by providing flexible and efficient implementations of these algorithms. Common optimization techniques in quantitative finance include:

Gradient Descent: A template-based implementation of gradient descent can be used to optimize machine learning models or trading algorithms.

Genetic Algorithms: Templates can be used to create generic functions for running genetic algorithms to search for optimal trading strategies.

The advantage of using C++ templates for optimization is that they allow developers to create algorithms that work with various data structures and model types, making the code extensible and scalable.

Comparing Data-Driven vs Algorithmic Optimization Approaches

In the context of quantitative finance, both data-driven modeling and algorithmic optimization have their advantages and drawbacks. Here’s a comparison:

Aspect Data-Driven Modeling Algorithmic Optimization

Complexity Moderate, requires handling large datasets High, involves sophisticated optimization algorithms

Performance High, especially with real-time data Very high, especially with C++ templates

Flexibility Highly flexible, adapts to different data types Requires domain knowledge and careful implementation

Use Case Time-series analysis, risk management Model parameter tuning, strategy optimization

Recommendation:

Data-driven modeling is best suited for real-time data analysis and applications requiring high flexibility.

Algorithmic optimization is ideal for complex model calibration and parameter optimization, particularly in backtesting environments.

Case Studies of C++ in Quantitative Trading

Case Study 1: High-Frequency Trading (HFT) Strategy Optimization

A quantitative hedge fund used C++ templates to optimize a market-making strategy in an HFT environment. By using templates for custom data structures and optimization algorithms, the fund was able to minimize latency and increase the number of trades executed per second.

Case Study 2: Risk Management with C++ Templates

A financial institution employed C++ templates to develop a real-time risk management system. By using generic templates, they were able to process large datasets (e.g., asset prices, volatility) and run multiple risk models simultaneously, resulting in better decision-making under volatile market conditions.

Best Practices for Implementing C++ Templates

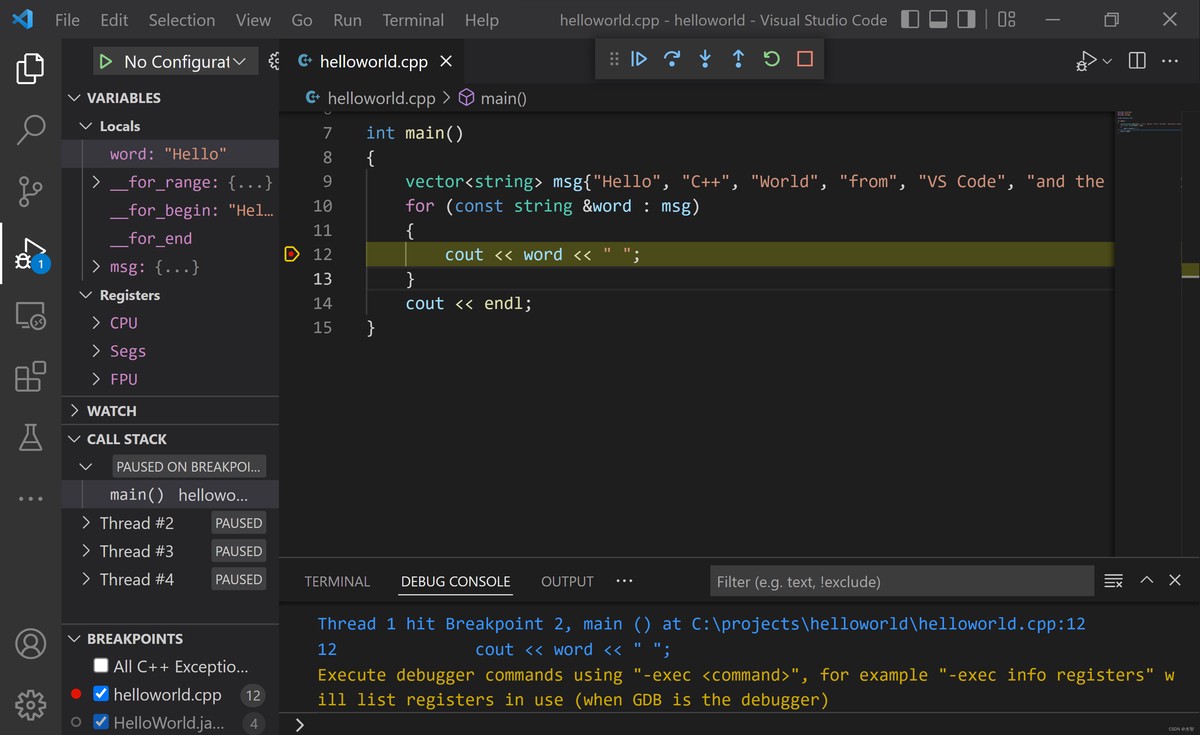

Use Templates for Generic Algorithms: Avoid writing redundant code by using templates to create reusable functions for common financial calculations.

Optimize Performance: Ensure that template-based algorithms are memory-efficient and optimized for speed to handle large datasets.

Test Extensively: Always perform thorough testing when using templates, especially when dealing with real-time trading data, to ensure accuracy and reliability.

FAQ

- What are the advantages of using C++ templates in quantitative analysis?

C++ templates allow for the creation of flexible, reusable code that can work with multiple data types,

0 Comments

Leave a Comment