=====================================

In today’s competitive trading landscape, custom tick data services for brokers have become indispensable. Brokers need access to accurate, high-frequency market data to support clients, build robust trading platforms, and remain compliant with regulatory standards. This article provides an in-depth exploration of how custom tick data solutions work, their applications, strategies for implementation, and why they matter more than ever in the age of algorithmic and high-frequency trading (HFT).

Introduction to Custom Tick Data Services

Tick data represents every price change in the market, recording bid, ask, and trade events in granular detail. Unlike minute or daily data, tick data captures the full story of price action, which is crucial for advanced backtesting, execution optimization, and risk modeling.

For brokers, custom tick data services ensure:

- Scalability: Handling millions of ticks per day.

- Accuracy: Eliminating errors and slippage risks.

- Flexibility: Delivering tailored datasets aligned with client needs.

This ability to deliver reliable tick data is what differentiates modern brokerage services in the eyes of institutional traders, hedge funds, and retail clients alike.

Why Brokers Need Custom Tick Data

Enhancing Trading Platforms

Brokers offering sophisticated tick data give traders access to high-precision analytics. This results in better user satisfaction and increased trading volume.

Regulatory Compliance

Financial regulators require detailed transaction records. Custom tick data archives help brokers stay compliant with MiFID II, SEC, and FCA standards.

Client Retention

Professional clients demand low-latency, high-quality data. A broker providing customizable tick feeds gains a competitive edge over those relying on standard, less-detailed data streams.

Types of Custom Tick Data Services

1. Historical Tick Data Services

Brokers can provide curated historical datasets to clients for backtesting and strategy development. These datasets are cleansed and formatted for integration with analytical tools.

Advantages:

- Supports algorithm validation.

- Helps detect anomalies and build predictive models.

Disadvantages:

- Requires heavy storage infrastructure.

- Costly to maintain across decades of data.

2. Real-Time Tick Data Feeds

Real-time feeds are vital for HFT and algorithmic trading. Brokers offering sub-millisecond latency gain loyalty from institutional traders.

Advantages:

- Enables precise execution strategies.

- Essential for scalping and high-frequency models.

Disadvantages:

- Expensive to maintain due to infrastructure costs.

- Vulnerable to market outages or technical errors.

Comparing Two Strategies for Tick Data Services

Strategy A: In-House Tick Data Infrastructure

Brokers build their own data pipelines, storage, and cleansing systems.

- Pros: Maximum control, customizable formats, enhanced security.

- Cons: High setup and maintenance costs, requires specialized staff.

Strategy B: Outsourcing to Professional Tick Data Providers

Brokers partner with external vendors offering custom APIs, data hosting, and analytics support.

- Pros: Cost-efficient, faster deployment, scalability.

- Cons: Less control over raw infrastructure, dependency on third parties.

Recommendation: A hybrid model works best. Brokers can outsource real-time feeds while maintaining their own historical tick databases for compliance and client-specific customization.

Industry Trends in Tick Data for Brokers

- AI-Driven Tick Data Cleansing: Machine learning is increasingly applied to detect anomalies and repair corrupted tick records.

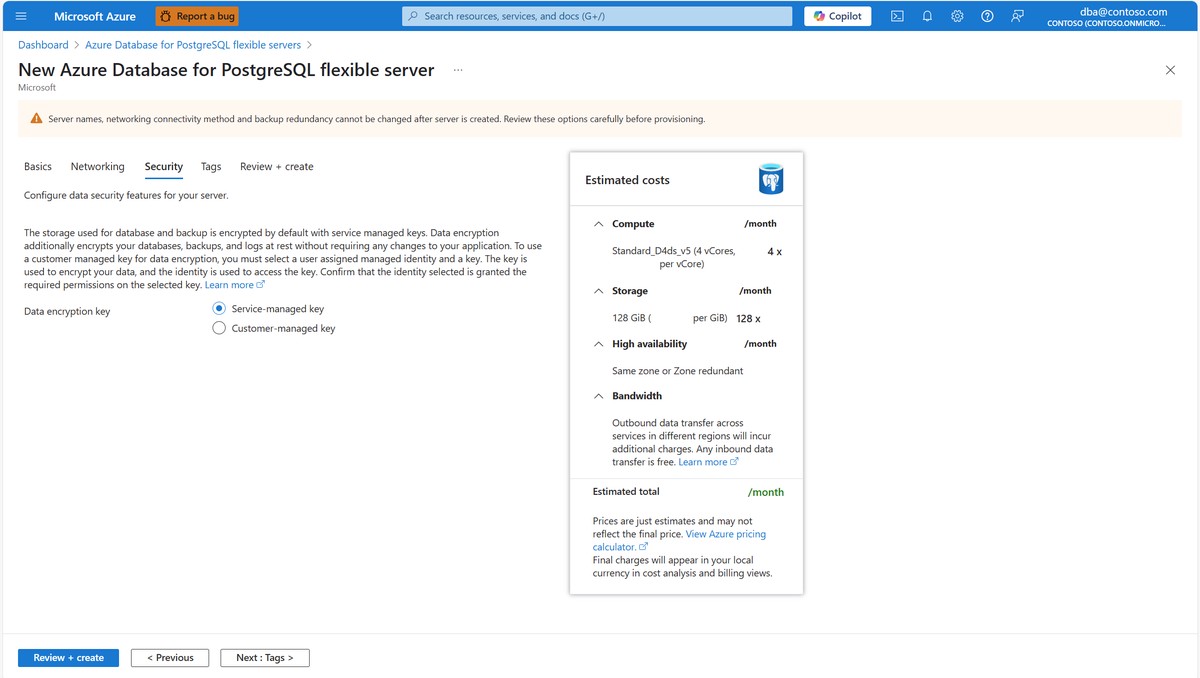

- Cloud-Based Tick Data Solutions: AWS, Azure, and Google Cloud are now hosting petabytes of tick data with real-time accessibility.

- APIs for Customization: Brokers integrate tick data API solutions to provide traders with tailored datasets, including asset-specific feeds or custom time ranges.

API-based tick data integration for brokers

Where Brokers Apply Custom Tick Data

Algorithmic Trading

Custom tick feeds enable brokers to serve clients using complex algorithmic strategies, improving execution speed and profitability.

Market Surveillance

Detailed tick archives help detect market manipulation, spoofing, and insider activity.

Risk Management

Brokers use real-time tick streams to monitor client exposures and enforce margin calls with precision.

Practical Insights: Cleaning and Processing Tick Data

Before using tick data, brokers must ensure accuracy through deduplication, time synchronization, and error filtering.

This relates directly to How to clean and process tick data, a key step for ensuring the integrity of both historical and real-time datasets. Without cleansing, anomalies like missing ticks or false trade prints can distort backtests and risk models.

Step-by-step tick data cleaning workflow

Best Practices for Brokers Offering Tick Data Services

- Transparency: Provide clients with clear documentation on tick sources, frequency, and timestamp accuracy.

- Scalability: Ensure data services can handle peak loads (e.g., during Federal Reserve announcements).

- Accessibility: Offer APIs, FTP servers, and cloud access for flexible client integration.

- Support: Provide technical support for traders integrating tick feeds into platforms like MetaTrader, QuantConnect, or custom-built engines.

Two Key Use Cases

Case Study 1: Hedge Fund Scalping Strategies

A hedge fund relies on a broker’s real-time custom tick feed to execute trades within microseconds. Any latency above 1ms leads to potential losses, making data precision a critical factor.

Case Study 2: Retail Broker Historical Archives

A retail broker provides downloadable tick data archives to retail clients, helping them backtest strategies in equities, forex, and crypto. This attracts algorithmic traders to the platform.

Visualizing tick data for backtesting and strategy analysis

FAQ: Custom Tick Data Services for Brokers

1. Why is custom tick data better than standard feeds?

Standard feeds only provide aggregated data (e.g., one-minute candles). Custom tick data captures every single price movement, giving traders granular insights for backtesting, high-frequency strategies, and risk modeling.

2. How can brokers manage the cost of custom tick data?

Brokers can adopt tiered subscription models where institutional clients pay for premium tick feeds, while retail clients access simplified datasets. Leveraging cloud storage also reduces infrastructure costs.

3. What are the risks of poor tick data quality?

Low-quality tick data can lead to inaccurate backtests, false trading signals, regulatory non-compliance, and client dissatisfaction. This is why cleansing and validation are non-negotiable.

Conclusion and Call to Action

Custom tick data services for brokers are no longer optional—they are a competitive necessity. Whether through historical datasets for backtesting or real-time feeds for high-frequency execution, brokers who invest in custom solutions empower traders with the tools they need to succeed.

By combining in-house management with outsourced provider support, brokers can achieve the perfect balance between control, scalability, and cost efficiency.

If you found this article insightful, share it with your colleagues, leave a comment about your experience with tick data, and join the discussion on how brokers can improve trading outcomes with customized tick services.

Would you like me to also create a visual comparison chart of in-house vs outsourced tick data solutions so this article becomes even more engaging and shareable?

0 Comments

Leave a Comment