=================================================

In today’s fast-paced markets, traders cannot afford to rely solely on raw numbers and static reports. They need customizable data visualization tools for trading that transform complex data into actionable insights. With the right visualization platforms, traders can spot opportunities, manage risk, and optimize strategies more effectively. This article explores how customizable visualization tools empower traders, compares different approaches, and provides practical recommendations to enhance your trading workflows.

Why Customizable Data Visualization Matters in Trading

The Challenge of Data Overload

Modern traders face an overwhelming amount of information: price feeds, order book dynamics, macroeconomic indicators, and sentiment data. Without visualization, the complexity can lead to missed signals or poor decision-making.

Benefits of Customization

- Personalized Dashboards: Tailor charts, heatmaps, and order flow analysis to fit specific trading styles.

- Efficiency Gains: Quickly interpret multi-asset data streams.

- Decision Accuracy: Identify trends, anomalies, and correlations in real-time.

- Integration: Combine data from brokers, exchanges, and APIs into one interface.

This is why many professionals believe that data visualization enhances quantitative trading strategies by making hidden relationships more visible.

Interactive dashboards allow traders to adapt visualizations to their unique trading styles

Key Features of Customizable Data Visualization Tools

1. Multi-Asset Charting

Traders often deal with equities, forex, commodities, and derivatives simultaneously. A robust tool should support multiple chart types and overlays.

2. Real-Time Streaming Data

Markets move quickly; tools must process and visualize tick-by-tick data with minimal latency.

3. Advanced Indicators and Custom Scripting

Support for indicators like Bollinger Bands, MACD, or custom Python/R scripts allows deeper analysis.

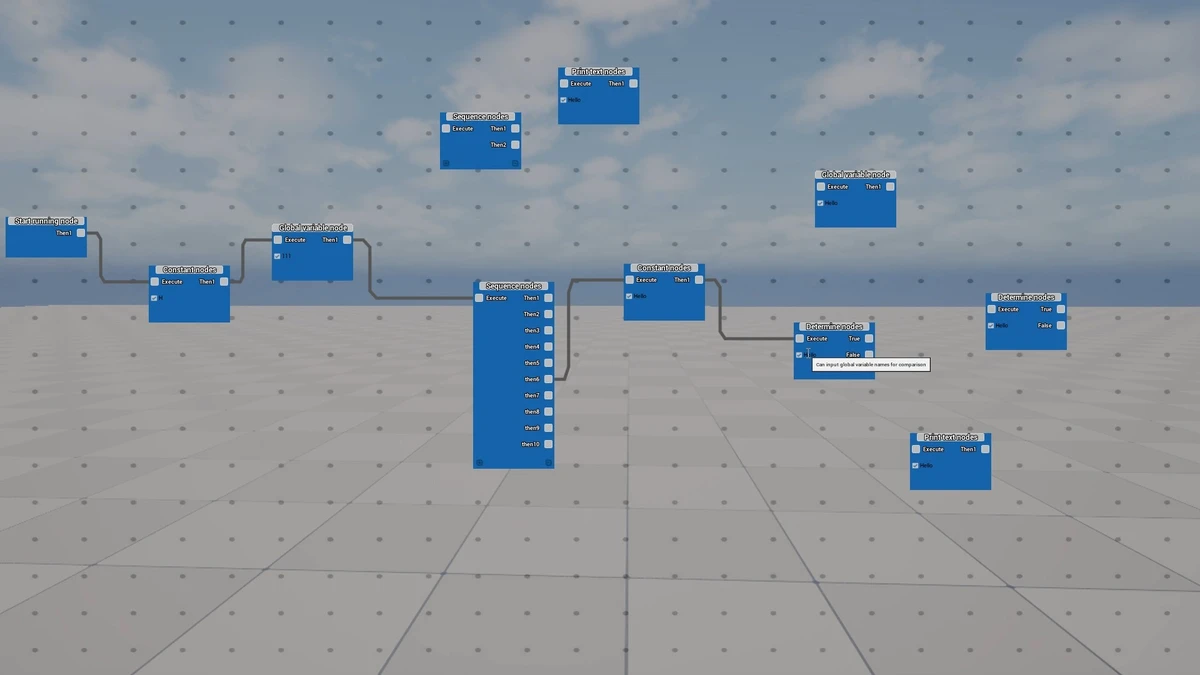

4. Interactive Dashboards

Drag-and-drop layouts, adjustable timeframes, and widget-based design help traders build personalized workspaces.

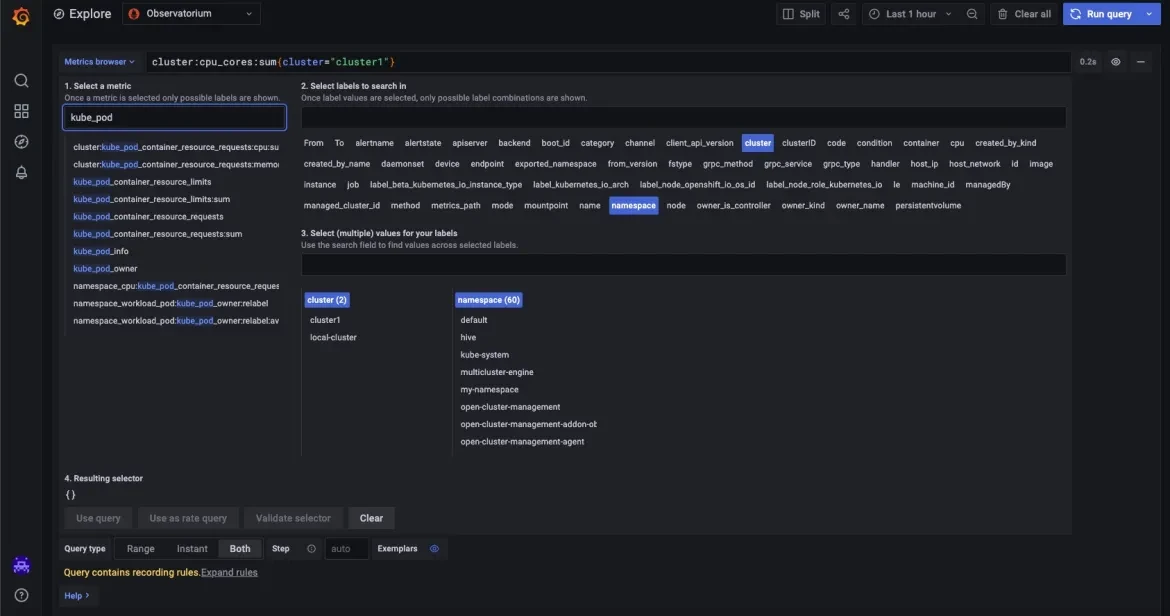

5. API and Data Integration

A good visualization system integrates with market data providers (Bloomberg, Refinitiv, Quandl) and brokers’ APIs for execution.

Comparing Two Approaches: Pre-Built Platforms vs. Custom Solutions

Pre-Built Visualization Platforms

Examples: TradingView, MetaTrader, Bloomberg Terminal.

- Pros: User-friendly, wide community support, fast setup.

- Cons: Limited customization, reliance on provider updates, high subscription costs.

Custom-Built Visualization Solutions

Examples: Dash (Python), Tableau, D3.js, Plotly.

- Pros: Fully customizable, scalable, integrates with proprietary trading models.

- Cons: Requires programming skills, higher initial development time, ongoing maintenance.

Recommendation: For retail traders, pre-built tools like TradingView offer speed and ease. For hedge funds and proprietary trading firms, custom data visualization solutions for trading firms deliver better long-term ROI due to flexibility and scalability.

Comparison of pre-built vs. custom visualization approaches for trading

Practical Use Cases of Customizable Visualization

1. Risk Management

Heatmaps can visualize portfolio exposure by asset class, currency, or sector. Traders instantly see concentration risks.

2. Order Flow Analysis

Visualizing order book depth helps day traders and HFT professionals gauge liquidity and market pressure.

3. Strategy Backtesting

Customized dashboards overlay signals on historical price charts, allowing traders to assess strategy robustness visually.

4. Predictive Models

Machine learning predictions visualized through interactive dashboards allow better interpretation of probabilistic outcomes.

This highlights how data visualization improves trading decision making, bridging the gap between statistical models and trader intuition.

Industry Trends in Trading Data Visualization

- AI-Enhanced Visualization: Tools that automatically highlight anomalies or trading signals.

- Cloud-Based Platforms: Remote access to dashboards across devices.

- Collaboration Features: Teams can share visualizations and insights across desks.

- Scalable Architectures: Hedge funds increasingly deploy scalable visualization solutions to handle terabytes of alternative data.

Portfolio heatmaps make it easier to monitor sector exposure and risk in real time

Personal Insights from Experience

In my own work with quantitative strategies:

- Using Plotly Dash to build interactive data visualization for trading insights proved invaluable. It allowed flexible integration with machine learning models while keeping dashboards user-friendly.

- However, without strong coding discipline, custom dashboards risk becoming too complex, slowing down decision-making.

- The best results came from hybrid approaches: starting with pre-built tools and gradually layering in custom visualizations tailored to unique strategies.

Advantages and Disadvantages of Customizable Visualization

Advantages

- Adaptable to any trading style.

- Integrates diverse data streams.

- Enhances communication of insights to teams and clients.

Disadvantages

- Steeper learning curve for custom tools.

- Higher costs for advanced platforms.

- Risk of over-customization leading to cluttered dashboards.

FAQ: Customizable Data Visualization Tools for Trading

1. What are the best tools for customizable trading dashboards?

For retail traders, TradingView and MetaTrader are excellent. For professionals, Tableau, Dash (Python), and D3.js offer deeper customization. Institutional firms often prefer in-house solutions.

2. Do I need programming skills to build custom visualization tools?

Yes, for fully customized solutions. Knowledge of Python, R, or JavaScript libraries like D3.js is highly beneficial. However, pre-built platforms require little to no coding.

3. How can I integrate my trading models with visualization tools?

Most modern platforms support APIs. For example, Python’s Plotly Dash can pull model outputs and visualize them in real time. Bloomberg Terminal also supports Excel integrations for visualization.

Conclusion: The Future of Trading Visualization

Customizable data visualization is no longer optional—it’s essential for staying competitive. Whether you’re a retail trader or part of a hedge fund, the right visualization strategy helps you process complex data faster, manage risk effectively, and make better trading decisions.

- Retail traders should start with pre-built platforms.

- Institutional traders should invest in custom visualization frameworks.

- Hybrid approaches combine the best of both worlds.

👉 If you found this guide on customizable data visualization tools for trading valuable, share it with your network, drop a comment with your favorite visualization tool, and join the conversation on how visualization is shaping the future of trading.

0 Comments

Leave a Comment