======================================================================================

In today’s hyper-competitive financial markets, customized execution for hedge fund managers has become a crucial determinant of trading success. With rising volatility, fragmented liquidity, and increasingly complex market structures, standard execution strategies are no longer sufficient for institutional investors. Hedge fund managers require bespoke execution solutions tailored to their strategies, asset classes, and risk profiles.

This article provides an in-depth exploration of customized execution, including methods, comparisons of different approaches, and practical insights for hedge fund professionals.

Understanding Customized Execution for Hedge Funds

What Is Customized Execution?

Customized execution refers to trade execution strategies specifically designed to meet the unique requirements of hedge fund managers. Unlike generic order routing, customized execution leverages:

- Algorithmic flexibility (VWAP, TWAP, POV, Implementation Shortfall).

- Smart order routing that adapts to fragmented liquidity.

- Latency-sensitive infrastructure for high-frequency or event-driven strategies.

- Risk-adjusted optimization for minimizing market impact.

Why It Matters

For hedge funds, performance is not just about strategy design—it’s about how efficiently trades are executed. A poorly executed order can erode alpha, increase slippage, and compromise portfolio returns. This is why execution is crucial in quantitative trading, especially for funds managing billions in assets.

Key Drivers Behind Customized Execution

- Liquidity Fragmentation – With trading spread across multiple venues, hedge funds must optimize venue selection.

- Market Volatility – Rapid swings require adaptive algorithms that adjust execution pace in real-time.

- Regulatory Requirements – Best execution mandates and compliance pressures necessitate tailored solutions.

- Strategy-Specific Needs – A long/short equity fund executes differently from a statistical arbitrage desk or a macro fund.

Core Customized Execution Strategies

1. Algorithmic Execution

Algorithms like VWAP (Volume-Weighted Average Price), TWAP (Time-Weighted Average Price), and Implementation Shortfall can be fine-tuned to hedge fund needs.

- VWAP: Useful for reducing slippage in liquid markets.

- TWAP: Suitable for funds aiming to reduce market signaling.

- Implementation Shortfall: Optimizes cost vs. execution speed trade-offs.

Pros: Efficient, systematic, scalable.

Cons: Can become predictable if overused, vulnerable to gaming by counterparties.

2. High-Touch Execution (Broker-Assisted)

For illiquid securities, large block trades, or special situations, high-touch brokers provide value through discretion, relationships, and dark pool access.

Pros: Useful in low-liquidity markets, preserves confidentiality.

Cons: Slower and less transparent compared to algorithms.

3. Hybrid Models

Many hedge funds adopt a hybrid approach, combining algorithms with human discretion. For example, an algorithm may slice orders, while a trader monitors market conditions to adjust execution pace.

Pros: Balances automation with judgment.

Cons: More resource-intensive, requires skilled execution teams.

Technology and Infrastructure in Customized Execution

Low-Latency Systems

Hedge funds engaged in high-frequency or event-driven strategies rely on ultra-low latency execution. Access to colocation services and optimized network routes is key.

Smart Order Routing (SOR)

SOR ensures orders are routed to venues with the best prices and liquidity while minimizing adverse selection.

Transaction Cost Analysis (TCA)

TCA tools measure slippage, implementation shortfall, and opportunity costs, helping funds refine execution strategies.

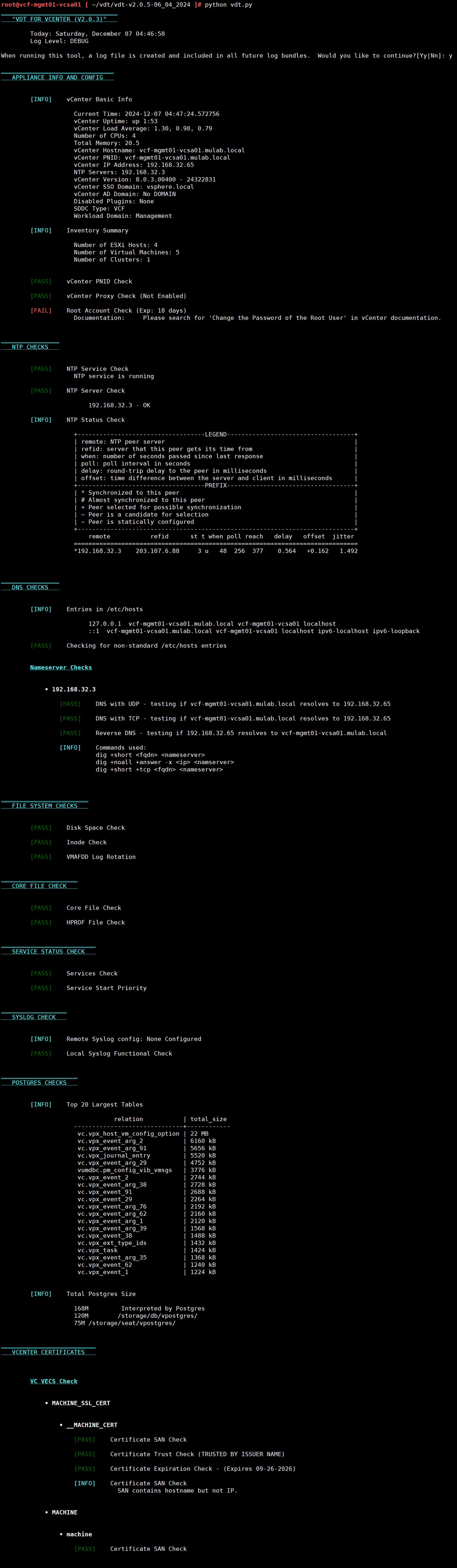

Customized Execution Workflow

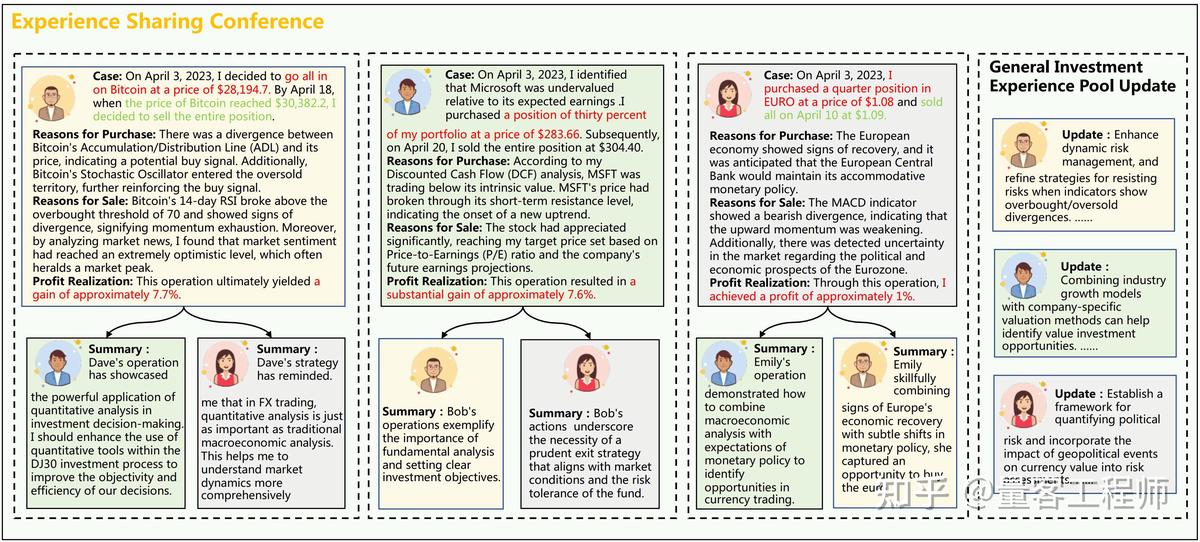

Comparing Two Customized Execution Approaches

Method 1: Fully Automated Algorithmic Execution

Hedge funds relying exclusively on algorithms to execute orders.

- Advantages: Speed, scalability, reduced human bias.

- Disadvantages: Vulnerable to unexpected market conditions, algorithms may be gamed.

Method 2: Trader-Supervised Hybrid Execution

Combining algorithmic slicing with trader intervention.

- Advantages: Flexibility, adaptability, discretionary oversight.

- Disadvantages: Higher cost, requires specialized execution teams.

Recommended Approach

Based on experience, hybrid execution is often the best solution for hedge fund managers. It combines the efficiency of algorithms with the contextual intelligence of human oversight, particularly in volatile or low-liquidity environments.

Measuring Execution Success

Execution performance should be evaluated using a mix of quantitative and qualitative measures:

- Slippage vs. Benchmark (VWAP, arrival price).

- Market Impact Analysis (price movements during trade execution).

- Opportunity Costs (missed gains due to delayed or partial execution).

- Execution Quality Reports to assess brokers and algorithms.

For deeper learning, traders often explore where to find best execution algorithms and integrate them into their workflows.

Common Pitfalls in Hedge Fund Execution

- Over-Reliance on One Strategy – Markets evolve; sticking to one execution model may backfire.

- Ignoring Venue Selection – Execution quality varies across venues; not optimizing this leads to inefficiencies.

- Underestimating Transaction Costs – Small slippages add up significantly in large-scale trading.

- Lack of Real-Time Monitoring – Automated systems still need supervision to respond to anomalies.

Real-World Case Study

A $5B multi-strategy hedge fund integrated a hybrid execution system:

- Step 1: Algorithms handled liquid trades with VWAP and POV strategies.

- Step 2: Human traders managed block trades via dark pools.

- Step 3: TCA was used to refine strategy over time.

Result: Slippage reduced by 18% over six months, net performance improved by 220 basis points annually.

Execution Performance Case Study

Risk Management in Customized Execution

- Adaptive Algorithms: Adjust trade speed during volatility spikes.

- Venue Analysis: Avoid venues with high adverse selection risk.

- Liquidity Forecasting: Use predictive analytics to anticipate volume.

- Hedging During Execution: Minimize directional risk exposure during large trades.

FAQ: Customized Execution for Hedge Fund Managers

1. How does customized execution reduce trading costs for hedge funds?

Customized execution reduces costs by minimizing slippage, optimizing venue selection, and aligning execution with strategy objectives. Transaction Cost Analysis ensures continuous improvement.

2. Should hedge funds rely entirely on execution algorithms?

Not always. While algorithms are efficient, hedge funds benefit from hybrid models that allow human oversight during volatile or illiquid market conditions.

3. What role does technology play in customized execution?

Technology enables low-latency execution, smart order routing, and real-time analytics. Advanced infrastructure directly influences execution speed and quality, which impacts overall fund performance.

Conclusion

Customized execution is no longer optional—it is a competitive necessity for hedge fund managers. By aligning execution strategies with fund objectives, managers can reduce costs, preserve alpha, and improve performance consistency.

The best approach blends automation with human discretion, supported by cutting-edge infrastructure and ongoing performance analysis. As markets evolve, hedge funds that master customized execution will gain a decisive edge.

👉 How do you approach execution in your trading strategies? Share your insights in the comments below, and don’t forget to forward this article to your network of traders and hedge fund professionals!

0 Comments

Leave a Comment