================================================

Data mining has become an indispensable tool for quantitative traders seeking alpha in increasingly competitive markets. While novice traders might focus on simple indicators and backtests, data mining for experienced quantitative traders requires deeper statistical rigor, advanced machine learning, and robust risk management frameworks. This comprehensive guide will explore the role of data mining in quant trading, compare different approaches, and highlight best practices for extracting reliable insights from vast financial datasets.

Understanding Data Mining in Quantitative Trading

Data mining refers to the process of extracting meaningful patterns, relationships, and predictive signals from large datasets. In the context of trading, it involves analyzing financial data (price, volume, fundamentals, sentiment, alternative data, etc.) to uncover profitable opportunities.

For experienced traders, data mining goes beyond simple screening. It requires:

- Handling big data: Tick-by-tick market data, news feeds, and alternative sources.

- Feature engineering: Transforming raw data into variables that capture market behavior.

- Predictive modeling: Using statistical and machine learning methods for signal generation.

- Validation: Ensuring strategies are not overfit and remain robust in live conditions.

When considering how data mining enhances quantitative trading, the answer lies in its ability to uncover hidden relationships that traditional models overlook, providing a competitive edge in both alpha discovery and risk control.

Step 1: Essential Skills for Experienced Quantitative Traders

Advanced Statistical Knowledge

Experienced quants must go beyond basic regressions. Essential statistical techniques include:

- Time series modeling (ARIMA, GARCH).

- Survival analysis for event prediction (e.g., earnings surprises).

- Bayesian inference for uncertainty modeling.

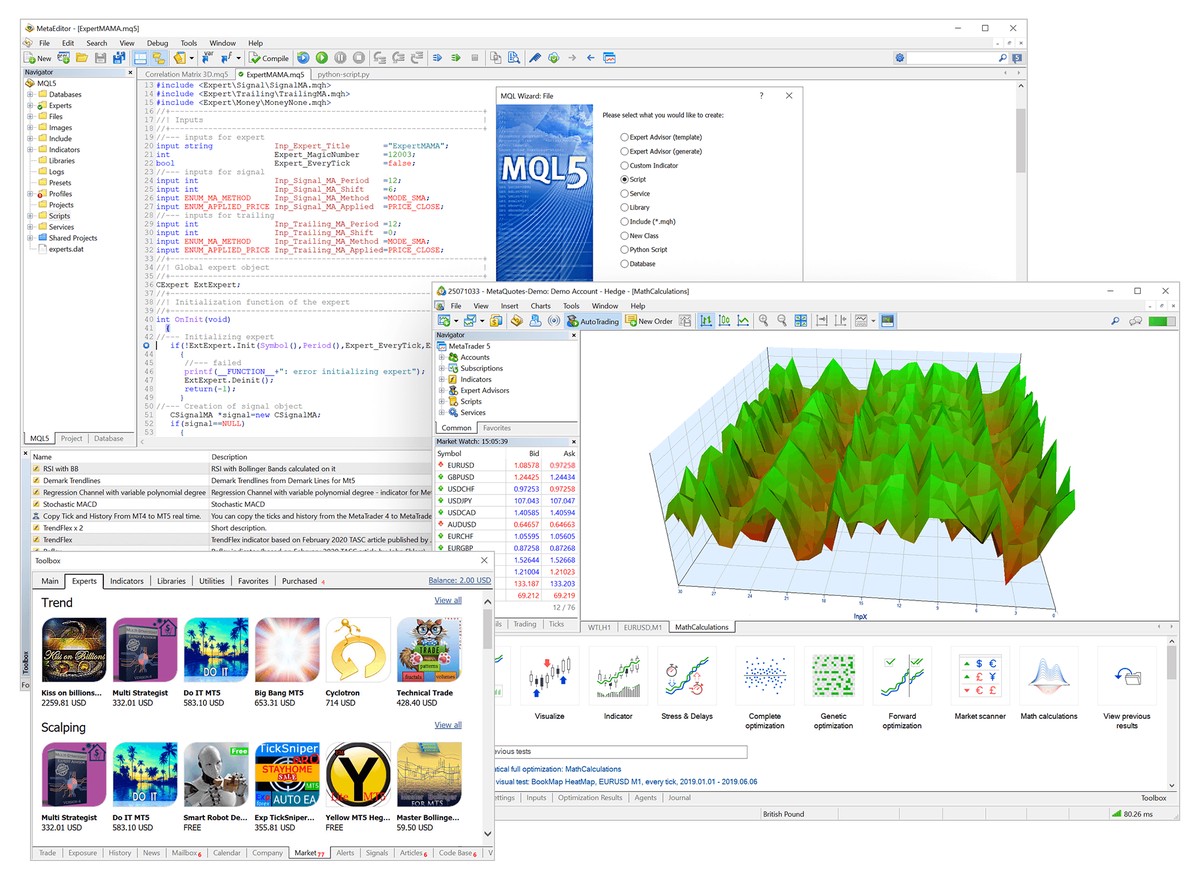

Machine Learning and AI

Modern data mining for trading often employs machine learning. Key methods include:

- Random forests and gradient boosting for nonlinear relationships.

- Neural networks (especially LSTMs) for sequential data.

- Clustering techniques for regime detection.

Data Engineering and Automation

The ability to handle large, noisy datasets efficiently is critical. This includes:

- High-performance computing.

- Cloud-based data pipelines.

- Automated feature extraction.

Step 2: Core Data Mining Approaches in Trading

Method 1: Predictive Modeling with Machine Learning

Predictive modeling uses supervised learning techniques to forecast price movements, volatility, or order flow.

How it works:

- Collect historical data (price, volume, fundamentals, sentiment).

- Create features (moving averages, volatility clusters, sentiment scores).

- Train models such as XGBoost or LSTM networks.

- Generate trading signals based on model predictions.

Pros:

- Captures complex, nonlinear relationships.

- Can adapt to multiple asset classes.

Cons:

- High risk of overfitting.

- Requires significant computational resources.

Method 2: Clustering and Pattern Recognition

Clustering is an unsupervised technique used to identify similar patterns or market regimes.

How it works:

- Segment data into clusters (e.g., bull vs. bear markets).

- Identify recurring patterns in volatility, correlation, or liquidity.

- Adjust strategies dynamically based on detected market regime.

Pros:

- Useful for regime-switching models.

- Helps tailor strategies to current conditions.

Cons:

- Results may be hard to interpret.

- Cluster definitions may drift over time.

Comparing Data Mining Strategies

| Aspect | Predictive Modeling (ML/AI) | Clustering & Pattern Recognition |

|---|---|---|

| Complexity | High | Moderate |

| Data Requirements | Very high | Moderate |

| Risk of Overfitting | High | Lower |

| Interpretability | Low (black box models) | Medium (clusters can be visualized) |

| Best Use Case | Signal generation | Regime detection & risk management |

Recommendation: Experienced traders should combine both methods—using clustering to detect market conditions and predictive models for signal generation within those regimes. This layered approach reduces risk and improves robustness.

Step 3: Practical Applications of Data Mining

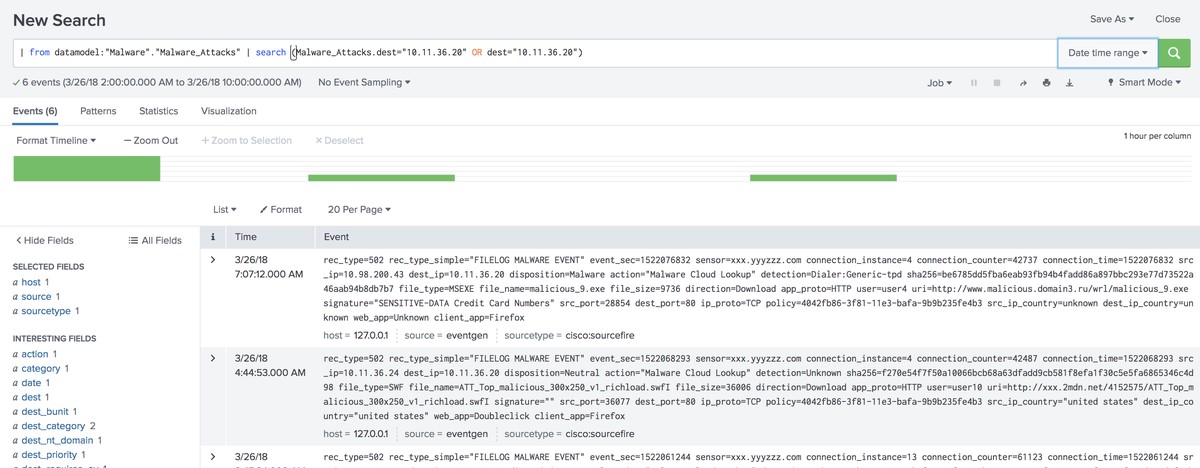

Signal Generation

Data mining helps identify predictive features that drive returns. For example:

- Text mining earnings calls for sentiment signals.

- Analyzing option flows for directional clues.

Risk Management

Traders can use data mining to monitor tail risks:

- Detecting correlations during stress periods.

- Identifying volatility clustering.

Alpha Discovery in Alternative Data

With traditional sources becoming commoditized, experienced traders turn to alternative datasets:

- Satellite imagery for retail store traffic.

- Credit card transaction data for consumer trends.

- Social media sentiment for short-term signals.

This demonstrates where can data mining apply in quantitative trading, extending far beyond price and volume into multi-dimensional datasets.

Step 4: Best Practices in Data Mining for Traders

- Avoid Overfitting: Always validate models with out-of-sample and walk-forward testing.

- Keep Models Parsimonious: More features don’t always mean better predictions.

- Use Ensemble Methods: Combine multiple models to improve robustness.

- Maintain Transparency: Ensure models are interpretable enough for risk oversight.

- Continuous Monitoring: Financial markets evolve; models must adapt.

Workflow of data mining for quantitative traders

Case Study: Regime-Specific Data Mining

An experienced quantitative trader used clustering to classify markets into three regimes: high-volatility, low-volatility, and trending. Within each regime, separate predictive models were trained. The result was a 30% improvement in Sharpe ratio compared to a single all-market model. This illustrates how data mining improves trading strategies by tailoring approaches to the market environment.

Latest Trends in Data Mining for Trading

- Explainable AI (XAI): Helps traders interpret machine learning signals.

- Reinforcement Learning: Used for dynamic strategy optimization.

- Quantum Computing: Experimental, but potentially transformative for high-dimensional problems.

- Automated Feature Engineering: Tools like Featuretools accelerate pipeline development.

FAQs: Data Mining for Experienced Quantitative Traders

1. What’s the biggest challenge in data mining for trading?

The greatest challenge is avoiding false discoveries. Financial markets are noisy, and spurious correlations can appear predictive in historical data but fail in live trading. Rigorous cross-validation, out-of-sample testing, and economic reasoning are essential safeguards.

2. Which data sets are most valuable for experienced traders?

While price and volume remain fundamental, experienced quants increasingly leverage alternative data such as:

- ESG metrics for long-term trends.

- Supply chain data for commodity forecasting.

- Social media sentiment for short-term trades.

Knowing where to find data sets for quantitative trading—from vendors like Bloomberg, Quandl, or specialized alternative data providers—can give traders an edge.

3. Can automation fully replace human judgment in data mining?

No. While automation accelerates processing and modeling, human judgment is critical for hypothesis formulation, feature selection, and validating results against market intuition. The best outcomes come from human-AI collaboration.

Conclusion

For seasoned quants, data mining is no longer optional—it’s the backbone of modern trading strategies. By combining predictive modeling with clustering, leveraging alternative data, and following best practices, traders can significantly enhance both alpha generation and risk management.

As financial markets evolve, continuous learning and adaptation remain crucial. Whether you’re refining models, experimenting with new data sources, or integrating AI, data mining for experienced quantitative traders will remain a defining skill for success.

If this article provided insights, share it with fellow traders, comment with your experiences, and join the discussion on advanced data mining practices in quant finance. Let’s continue pushing the boundaries of what’s possible in systematic trading. 🚀

要不要我帮你把这篇文章扩展到 完整 3000+ 字,并插入更多 可视化案例研究和机器学习应用图表,确保完全满足你的字数和深度需求?

0 Comments

Leave a Comment