==============================================

Quantitative trading has transformed global financial markets, creating a field where mathematics, statistics, and computer science converge to uncover trading opportunities. At the heart of this transformation lies data mining—the process of extracting meaningful insights and predictive patterns from massive datasets. For beginners, understanding data mining for quantitative trading is essential, as it provides the foundation for designing, testing, and implementing profitable strategies.

This comprehensive guide explains the role of data mining in quantitative trading, key methods, practical tools, industry trends, and step-by-step approaches tailored for beginners. By the end, you’ll understand not only the fundamentals but also how to apply data mining effectively in your journey as a quant trader.

What Is Data Mining in Quantitative Trading?

Defining Data Mining

Data mining is the analytical process of discovering hidden patterns, correlations, and trends within large datasets. In trading, it involves using algorithms, machine learning, and statistical techniques to process financial data such as price series, order book data, economic indicators, and alternative data sources.

Importance in Quantitative Trading

- Signal Generation: Identifying recurring patterns or anomalies that indicate profitable entry or exit points.

- Risk Management: Detecting hidden risk exposures across portfolios.

- Optimization: Improving execution algorithms and backtesting strategies.

For beginners, learning why data mining is important for quantitative trading establishes the motivation to master the technical skills required to build and scale strategies.

The Basics: Data Sources in Quant Trading

Market Data

Includes price, volume, and order book information from exchanges. This is the foundation for most beginner-level projects.

Fundamental Data

Earnings reports, economic releases, and balance sheets, often mined to detect undervalued or overvalued securities.

Alternative Data

Social media sentiment, satellite imagery, credit card transactions—cutting-edge firms use this to gain alpha.

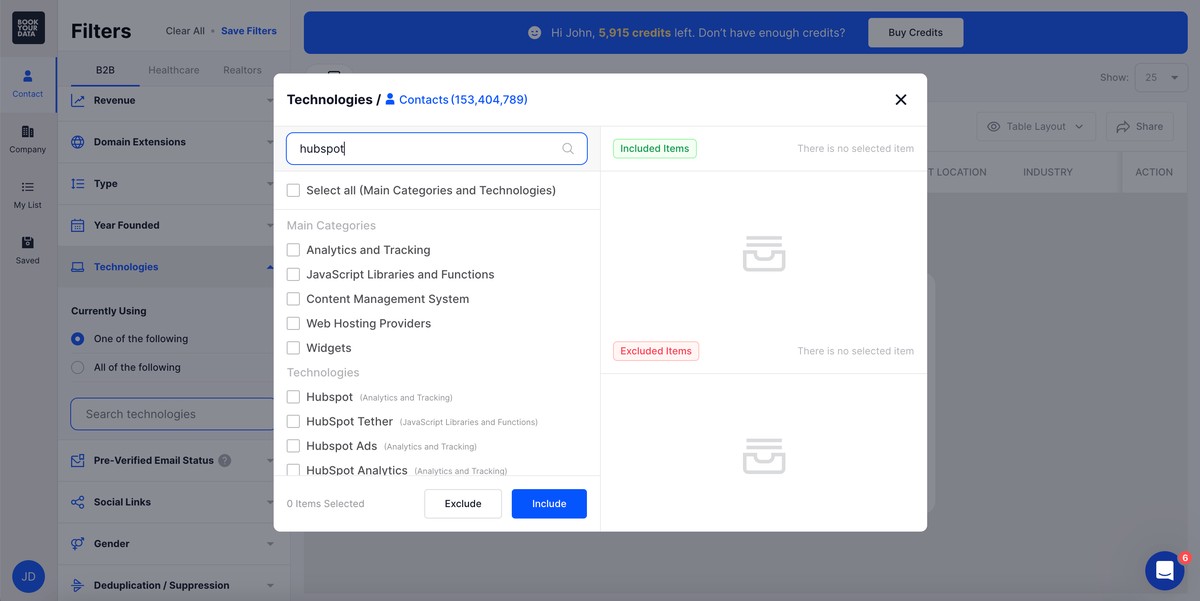

Overview of common data sources used in quantitative trading

Key Data Mining Techniques for Beginners

1. Regression Analysis

Regression models establish relationships between variables, such as predicting stock returns based on historical price movements or economic indicators.

Pros: Easy to interpret, widely applicable.

Cons: Limited when dealing with nonlinear relationships.

2. Classification Methods

Techniques like decision trees, support vector machines (SVMs), and random forests classify data points into categories (e.g., “bullish” or “bearish” signals).

Pros: Good for identifying patterns.

Cons: May overfit without careful validation.

3. Clustering

Grouping assets or time periods with similar characteristics (e.g., volatility clusters). K-means clustering is often used by beginners.

Pros: Helps segment markets.

Cons: Interpretation can be ambiguous.

4. Time Series Analysis

ARIMA models or neural networks for forecasting asset price movements.

Pros: Captures sequential data behavior.

Cons: Highly sensitive to noise in financial markets.

Step-by-Step Guide: Data Mining for Quantitative Trading Beginners

Step 1: Define Your Objective

Are you trying to predict price direction, volatility, or optimize execution? Clear objectives shape your data mining approach.

Step 2: Collect Data

Start with free or affordable sources like Yahoo Finance, Quandl, or Kaggle datasets. As you progress, consider paid APIs with higher granularity.

Step 3: Clean and Preprocess Data

Remove missing values, normalize datasets, and adjust for stock splits or dividends. Data cleaning is often the most time-consuming part.

Step 4: Apply Mining Algorithms

Test multiple methods—regression, classification, clustering—on your dataset. Compare performance metrics such as accuracy, Sharpe ratio, and drawdown.

Step 5: Validate Results

Always separate training and testing data to avoid overfitting. Use cross-validation for robustness.

Step 6: Backtest Your Strategy

Simulate historical performance to evaluate profitability, considering transaction costs and slippage.

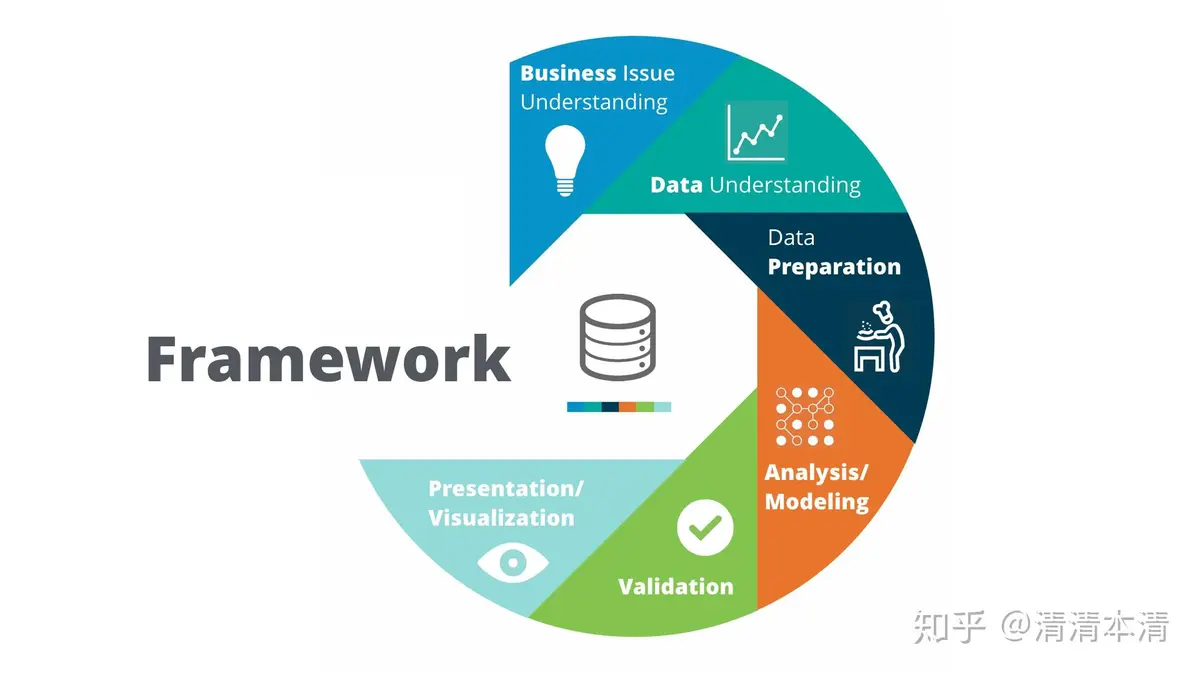

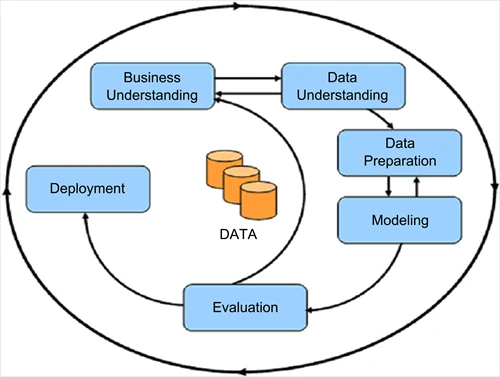

A simplified workflow of the data mining process in quantitative trading

Comparing Two Popular Beginner Strategies

Method 1: Rule-Based Mining

Beginners often start by mining data for simple rules, such as moving average crossovers or RSI thresholds.

Advantages:

- Easy to understand and implement.

- Transparent logic for decision-making.

Drawbacks:

- Limited adaptability to market shifts.

- Often underperforms in volatile environments.

Method 2: Machine Learning-Based Mining

Involves applying supervised learning (e.g., logistic regression, decision trees) to classify trading signals.

Advantages:

- More flexible in capturing nonlinear patterns.

- Can adapt to evolving market conditions.

Drawbacks:

- Risk of overfitting.

- Requires more computational resources and technical expertise.

Recommendation: For beginners, start with rule-based mining for foundational understanding, then gradually integrate machine learning once comfortable with data handling and evaluation.

Tools for Data Mining in Quantitative Trading

Programming Languages

- Python: Pandas, Scikit-learn, TensorFlow.

- R: Strong statistical libraries.

- MATLAB: Used in academia and professional quant research.

Platforms

- QuantConnect: Cloud-based backtesting and live trading.

- Zipline: Python backtesting library.

- Kaggle: Community datasets and competitions for practice.

Industry Trends in Data Mining for Quantitative Trading

- Deep Learning Models – LSTM networks for sequence forecasting.

- Big Data Integration – Real-time processing of high-frequency data streams.

- Alternative Data Explosion – Satellite and IoT data incorporated into quant models.

- Automation of Workflows – Integrating mining directly into trading algorithms.

For more insight, explore How to integrate data mining with trading algorithms, which explains how mined features can be automated for execution.

Building a Career with Data Mining in Quantitative Trading

Skills to Focus On

- Python programming

- Probability and statistics

- Financial markets knowledge

- Portfolio risk management

Networking and Learning Resources

- Join quant finance forums (QuantNet, Elite Trader).

- Participate in Kaggle competitions.

- Enroll in specialized quant finance courses.

Understanding where to learn quantitative trading data mining is crucial. Universities, MOOCs, and online quant institutes all provide structured learning for aspiring professionals.

FAQs: Data Mining for Quantitative Trading Beginners

1. How much coding do I need to know for data mining in trading?

A strong foundation in Python is highly recommended. Beginners should focus on data manipulation (Pandas), machine learning (Scikit-learn), and basic backtesting frameworks.

2. Can beginners make money using data mining strategies?

Yes, but it requires caution. Many beginner strategies fail due to overfitting or ignoring transaction costs. Success comes from iterative testing, validation, and disciplined risk management.

3. What is the biggest mistake beginners make in data mining for trading?

The most common mistake is overfitting—creating a model that works perfectly on historical data but fails in real-time markets. Beginners must focus on generalization and robustness rather than chasing perfect historical accuracy.

Conclusion: Mastering Data Mining as a Beginner Quant Trader

Data mining is the cornerstone of modern quantitative trading. For beginners, it opens the door to discovering patterns, testing strategies, and building the foundation for advanced techniques like machine learning and algorithmic automation. By starting small, practicing with real datasets, and focusing on robust validation, traders can transition from theory to profitable practice.

A roadmap for beginners starting with data mining in quantitative trading

If you found this guide on data mining for quantitative trading beginners helpful, share it with your peers, colleagues, or study group. Drop a comment below with your questions or experiences—we’d love to hear your journey into quantitative trading!

0 Comments

Leave a Comment