=================================================

Introduction

In today’s data-driven financial industry, data visualization courses for financial analysts have become a critical learning path for professionals who want to transform raw datasets into actionable insights. Financial analysts increasingly rely on interactive dashboards, charts, and advanced visualization techniques to interpret market signals, assess portfolio risks, and communicate findings to stakeholders.

With the rise of quantitative trading, fintech innovation, and AI-driven analytics, mastering visualization is no longer optional—it is a competitive necessity. This article explores the best courses, strategies, and tools financial analysts can leverage to enhance their analytical capabilities. We’ll also compare different approaches, evaluate their advantages and disadvantages, and provide recommendations based on industry trends and personal experience.

Why Financial Analysts Need Data Visualization

Turning Complexity into Clarity

Financial markets generate enormous volumes of data, from stock prices to derivative contracts. Visualization transforms these complex numbers into clear insights, helping analysts detect patterns, anomalies, and risks.

Communication with Stakeholders

Charts and interactive dashboards make it easier to present findings to non-technical decision-makers, ensuring that investment committees, executives, and clients understand key financial trends.

Enhancing Quantitative Workflows

Visualization plays a crucial role in trading systems. For example, knowing how to use data visualization in quantitative trading allows analysts to monitor strategy performance, backtesting results, and live executions in real-time.

An interactive financial dashboard enables analysts to track portfolio performance, volatility, and risk exposure in real time.

Core Components of Data Visualization Training

1. Foundations of Visualization

Courses typically start with basics: chart types (line, bar, candlestick, scatter), design principles, and avoiding misleading visuals.

2. Financial Data-Specific Training

Specialized programs focus on price movements, portfolio analysis, Monte Carlo simulations, and risk-return visualization.

3. Software and Tools

Financial analysts need to learn industry-standard tools like:

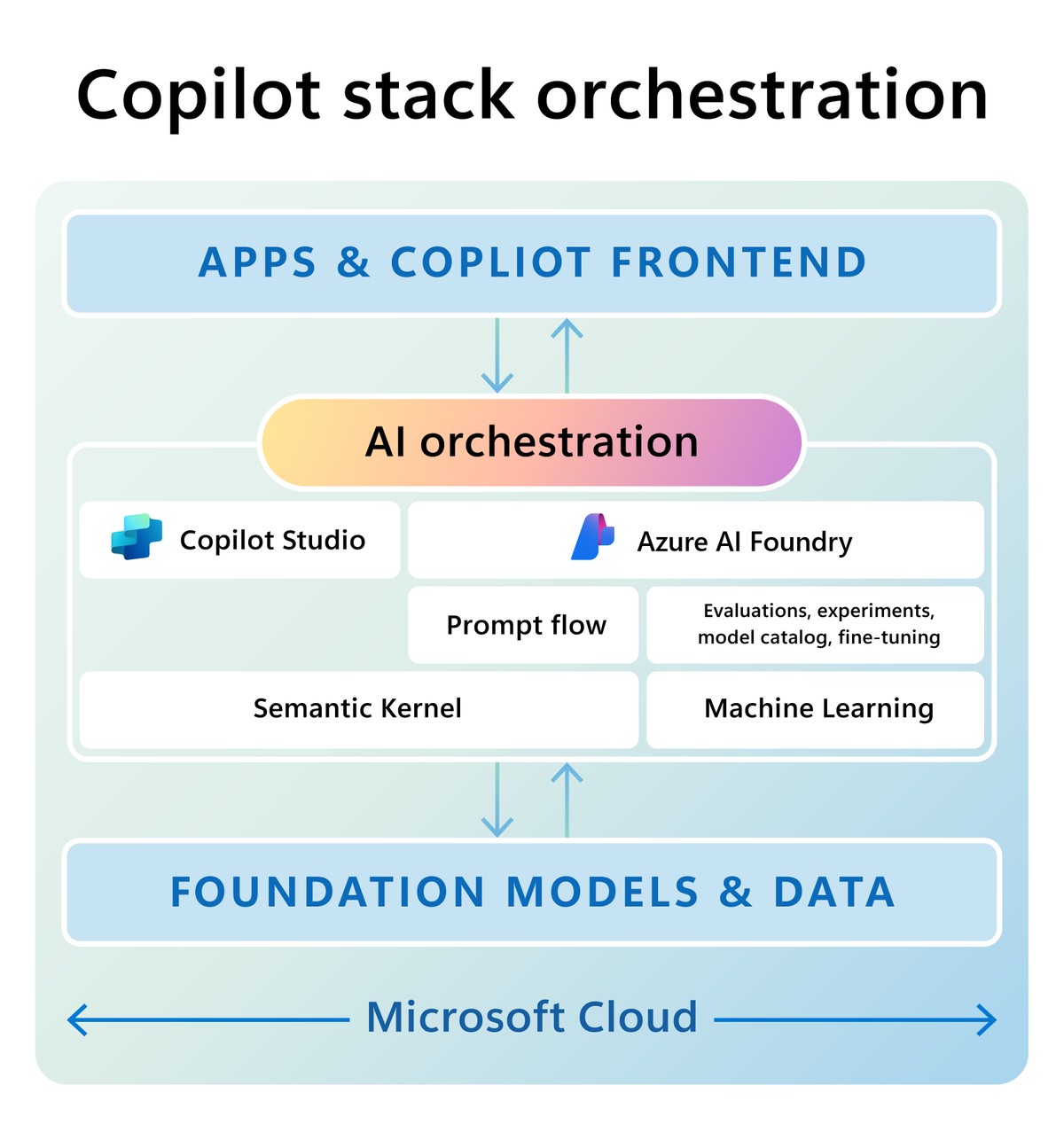

- Tableau: Widely used for dashboard reporting.

- Power BI: Strong integration with Excel and Microsoft ecosystem.

- Python Libraries: Matplotlib, Plotly, and Seaborn for customizable coding solutions.

- R Packages: ggplot2 for statistical visualization.

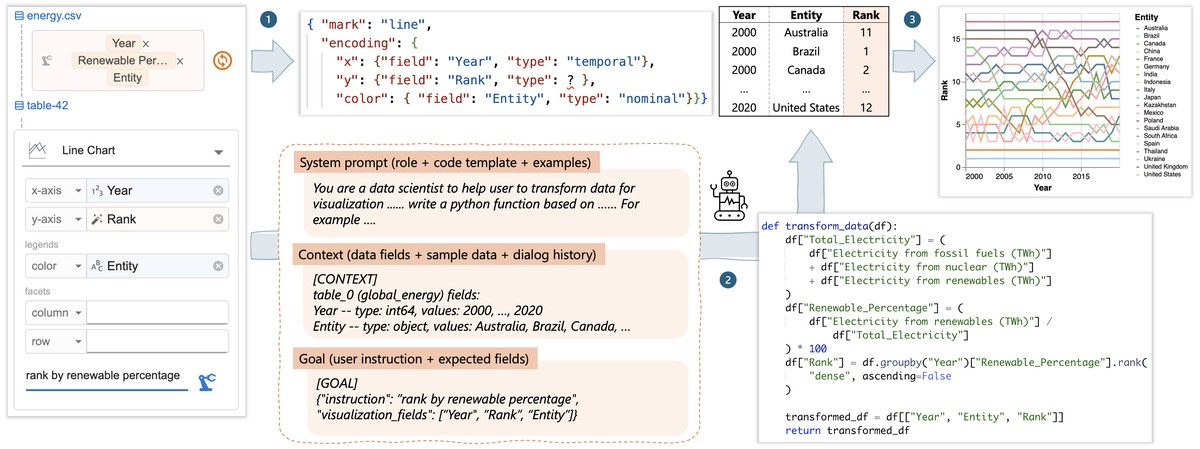

4. Quantitative Integration

Courses also cover how visualization interacts with algorithms, risk models, and automated reporting pipelines, which connects with where to find best tools for data visualization in trading.

Strategies for Using Data Visualization in Finance

Strategy 1: Dashboard-Centric Approach

This strategy focuses on pre-built dashboards using software like Tableau or Power BI.

Advantages:

- User-friendly, minimal coding required.

- Rapid deployment in corporate environments.

- Easy to integrate with financial databases.

Disadvantages:

- Limited customization compared to coding.

- Expensive licensing fees for large teams.

Strategy 2: Coding and Customization

Using Python or R for full control over visualization pipelines.

Advantages:

- High flexibility with customized charts.

- Easy integration into automated trading and risk systems.

- Supports advanced machine learning and big data integration.

Disadvantages:

- Requires programming knowledge.

- Longer learning curve for beginners.

Recommendation: For beginner analysts, dashboard tools provide quick wins, while advanced professionals should transition into coding-based visualization for scalability.

Choosing between dashboard tools and coding depends on financial analysts’ experience, goals, and the complexity of required analysis.

Top Data Visualization Courses for Financial Analysts

1. Coursera – Data Visualization with Tableau Specialization

- Focus: Interactive dashboards and visualization best practices.

- Ideal for: Beginners and mid-level analysts.

- Pros: Industry-recognized, hands-on projects.

- Cons: Limited coding exposure.

2. Udemy – Python for Data Visualization: Finance Edition

- Focus: Python libraries for financial datasets.

- Ideal for: Analysts interested in coding.

- Pros: Practical, finance-specific examples.

- Cons: Requires Python fundamentals.

3. CFA Institute – Data Science and Visualization Modules

- Focus: Applying visualization in portfolio analysis and investment research.

- Ideal for: Professionals pursuing CFA designation.

- Pros: Tailored to financial markets.

- Cons: Less interactive coding practice.

4. EdX – Data Visualization for Finance Professionals (University of Michigan)

- Focus: Advanced techniques for financial modeling and risk analysis.

- Ideal for: Mid-career analysts.

- Pros: Academic rigor, structured learning.

- Cons: More theoretical than applied.

How Data Visualization Enhances Decision-Making

Risk Management

Heatmaps and volatility charts reveal risk concentrations across portfolios.

Performance Monitoring

Dashboards enable analysts to benchmark portfolios against indices and visualize alpha/beta exposure.

Trading Strategy Evaluation

Visualization provides a quick way to test strategy efficiency. For instance, knowing how data visualization enhances quantitative trading strategies helps quants refine models using real-time execution metrics.

Backtesting results can be visualized through performance charts to evaluate drawdowns, Sharpe ratios, and alpha.

Personal Experience and Industry Trends

From personal consulting experience with hedge funds, I’ve observed two key trends:

- Shift Toward Interactive Dashboards: Institutions want scalable, real-time reporting for compliance and investor relations.

- Rise of AI-Powered Visualization: Machine learning models generate predictive visualizations, helping analysts forecast volatility and returns.

The future of financial analysis belongs to hybrid professionals who can combine coding, quantitative methods, and visual storytelling.

FAQ: Data Visualization for Financial Analysts

1. What is the best tool for financial analysts to learn first?

Tableau or Power BI is best for beginners since they are intuitive and widely used in the industry. Once comfortable, analysts should progress to Python or R for more flexibility.

2. How does data visualization improve trading decision-making?

It reduces cognitive overload by turning complex data into patterns and signals, allowing traders and analysts to react quickly to market changes. This directly links to how does data visualization improve trading decision making.

3. Are coding skills necessary for financial analysts?

Not strictly, but they are increasingly essential. Analysts without coding experience may be limited to basic reporting, while those with coding expertise can integrate visualization directly into trading algorithms and risk systems.

4. How do data visualization courses differ for finance compared to general analytics?

Finance-focused courses emphasize time-series data, portfolio metrics, risk-return visualization, and trading signals, making them more relevant for financial analysts than general-purpose courses.

Conclusion

Data visualization is no longer a secondary skill—it is an essential capability for every financial analyst. Whether through intuitive dashboards or advanced coding-based visualization, analysts must master these tools to remain competitive in the financial sector.

By taking data visualization courses for financial analysts, professionals can improve risk analysis, optimize portfolio reporting, and enhance quantitative decision-making. As industry trends shift toward real-time dashboards and AI-powered analytics, the demand for these skills will only increase.

If you’ve already taken a visualization course or integrated visualization into your financial workflows, share your experience in the comments below—and don’t forget to share this article with peers who want to upgrade their skills.

Would you like me to also prepare a course comparison chart (beginner, intermediate, advanced) so readers can quickly see which data visualization training best matches their career stage?

0 Comments

Leave a Comment