===============================================================

Introduction

The rise of algorithmic trading has fundamentally transformed the way financial markets operate. Today, traders and institutions no longer rely solely on intuition and manual execution. Instead, they leverage algorithmic trading strategies to process massive datasets, identify profitable opportunities, and execute trades with precision. But how to develop algorithmic trading strategies remains a complex and highly specialized task that requires knowledge of finance, mathematics, computer science, and risk management.

This comprehensive guide explores the step-by-step process of developing algorithmic trading strategies, compares different methods, highlights real-world applications, and provides expert insights into best practices. Whether you are a beginner looking to understand the fundamentals or a professional aiming to refine your approach, this article will serve as a roadmap to mastering algorithmic trading.

What Is Algorithmic Trading?

Algorithmic trading (also called algo trading or automated trading) is the use of computer programs to execute trades based on pre-defined rules and mathematical models. These rules can include conditions such as price, timing, volume, or complex statistical indicators.

By leveraging algorithms, traders aim to remove human biases, minimize latency, and capture micro-opportunities that would otherwise be impossible to exploit manually.

Why Develop Algorithmic Trading Strategies?

Speed and Efficiency

Algorithms can analyze thousands of assets and execute trades within milliseconds, far surpassing human capabilities.

Accuracy and Discipline

By following strict rules, algorithms avoid emotional decisions that often lead to losses in manual trading.

Scalability

Algorithmic strategies can be deployed across multiple markets and asset classes simultaneously.

Steps to Develop Algorithmic Trading Strategies

1. Define Objectives and Trading Style

Before coding or backtesting, traders must define their goals:

- Scalping (short-term, high-frequency trades)

- Swing trading (medium-term momentum strategies)

- Arbitrage (profiting from price discrepancies across markets)

- Long-term investing (systematic portfolio allocation)

Each style requires different algorithms, data, and risk controls.

2. Data Collection and Preprocessing

Algorithms are only as good as the data they use. Traders collect historical market data, real-time tick data, and fundamental indicators. Data cleaning is crucial—outliers, missing values, and bad ticks must be removed to avoid false signals.

3. Strategy Design and Model Selection

Method 1: Rule-Based Trading Systems

- Based on indicators such as moving averages, RSI, or Bollinger Bands.

- Example: A moving average crossover strategy that buys when the 50-day MA crosses above the 200-day MA.

- Pros: Simple to implement, transparent, easy to debug.

- Cons: Limited adaptability in volatile markets.

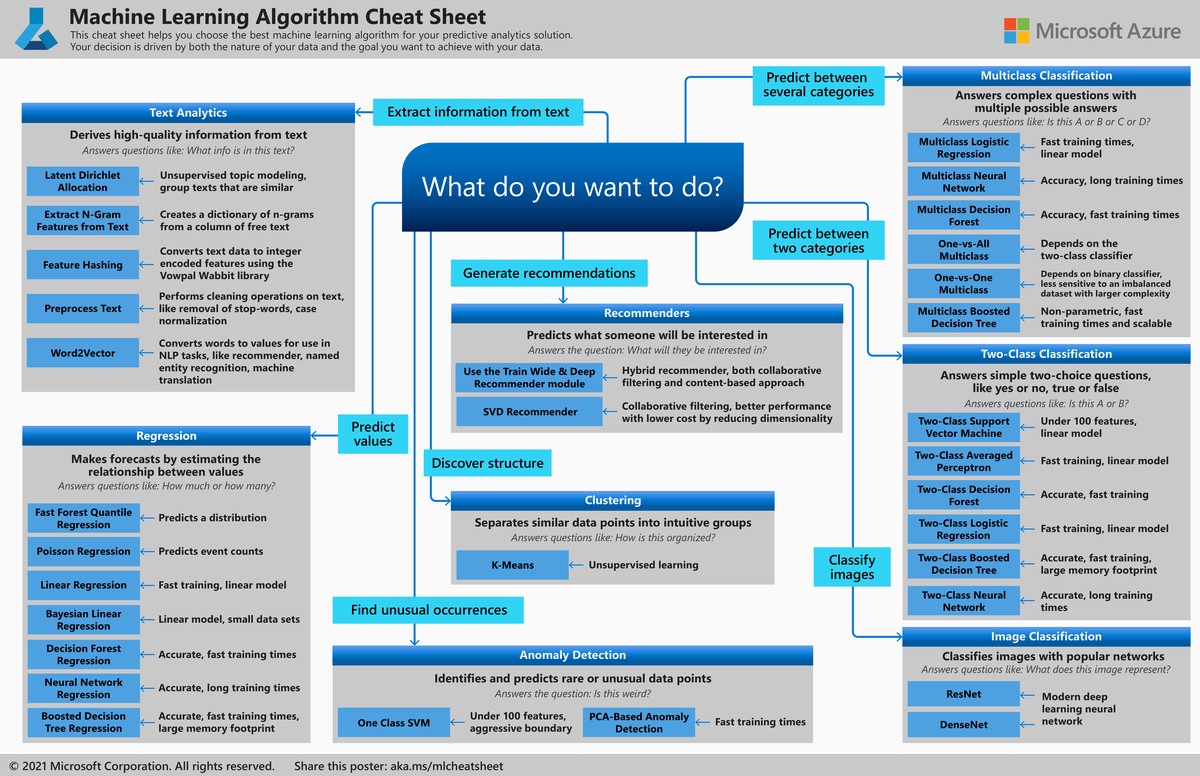

Method 2: Machine Learning-Based Models

- Uses algorithms such as Random Forests, XGBoost, or Deep Learning networks.

- Can detect complex, non-linear relationships in the data.

- Pros: High adaptability, capable of handling large datasets.

- Cons: Risk of overfitting, requires high computing power and expertise.

👉 This ties into how to implement machine learning in trading algorithms, a growing trend that helps traders refine predictions with higher accuracy.

4. Backtesting and Validation

Backtesting involves testing the strategy on historical data to measure profitability, risk, and robustness.

Key metrics include:

- Sharpe Ratio (risk-adjusted return)

- Max Drawdown (largest portfolio loss)

- Win Rate (percentage of profitable trades)

Traders must avoid overfitting—designing strategies that perform well in backtests but fail in real markets.

5. Risk Management and Execution

No strategy is complete without robust risk controls. This includes:

- Position sizing (based on volatility or account equity)

- Stop-loss orders to cap downside risk

- Portfolio diversification to reduce correlation risk

This is why backtesting is important for trading algorithms—it helps identify potential pitfalls before risking real capital.

6. Live Testing and Deployment

After backtesting, traders use paper trading (simulated live execution) before committing real funds. Once validated, the algorithm is deployed on trading platforms with direct market access (DMA).

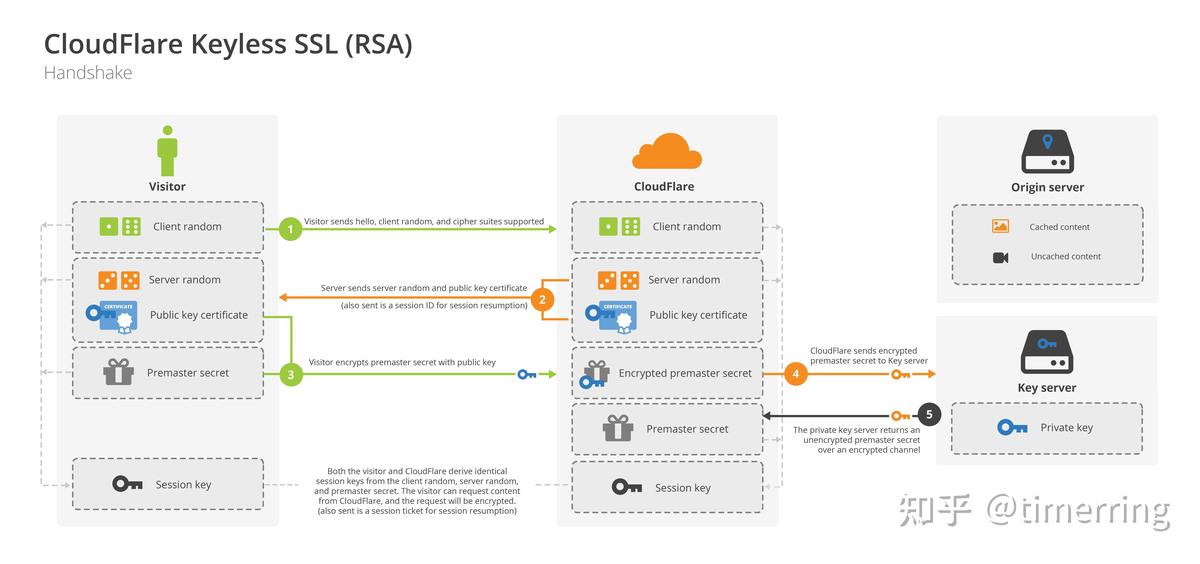

Latency, slippage, and transaction costs must be monitored closely to ensure profitability in real-world conditions.

Comparing Two Popular Approaches

| Approach | Pros | Cons | Best Use Case |

|---|---|---|---|

| Rule-Based Systems | Easy to implement, transparent | Struggles in complex/volatile conditions | Beginners, trend-following |

| Machine Learning Models | Adaptive, handles large data | Requires expertise, risk of overfitting | Advanced traders, hedge funds |

Recommendation: For beginners, rule-based systems provide an excellent foundation. As traders gain experience, machine learning approaches can be integrated to capture more complex opportunities.

Real-World Applications of Algorithmic Trading

- High-Frequency Trading (HFT): Market-making and arbitrage.

- Institutional Investors: Portfolio optimization and execution algorithms.

- Retail Traders: Automated bots for cryptocurrencies and forex.

- Hedge Funds: Quantitative models using big data and AI.

Challenges in Developing Algorithmic Trading Strategies

- Data Quality Issues – Inaccurate or delayed feeds can cause losses.

- Regulatory Constraints – Algo trading is heavily monitored by financial regulators.

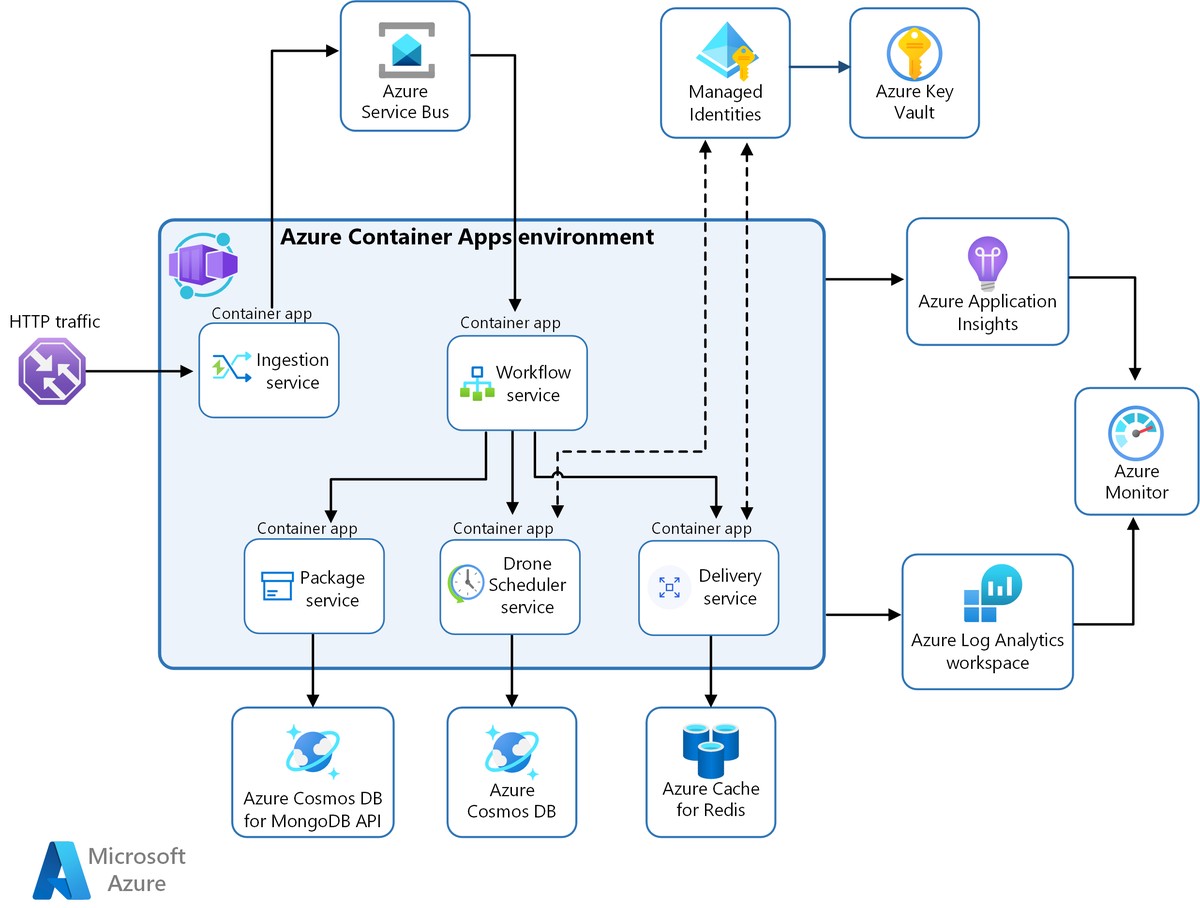

- Technology Costs – Infrastructure, APIs, and cloud computing can be expensive.

- Market Adaptability – Strategies can fail when market conditions change.

FAQ: How to Develop Algorithmic Trading Strategies

1. Do I need programming skills to develop algorithmic trading strategies?

Yes. Programming languages like Python, R, and C++ are essential. Python is especially popular due to its extensive libraries (Pandas, NumPy, Scikit-learn). However, some platforms (MetaTrader, TradeStation) allow strategy building with minimal coding.

2. What is the most important factor in algorithmic trading?

Risk management. Even the most profitable strategy can fail if risk controls are weak. Proper position sizing, diversification, and stop-loss rules are crucial for long-term success.

3. How much capital do I need to start algorithmic trading?

It depends on the market. For forex and crypto, traders can start with as little as \(1,000. For equities, a minimum of \)25,000 is required in the U.S. due to Pattern Day Trading (PDT) rules. Institutions typically deploy millions in capital.

Conclusion

Developing algorithmic trading strategies is both an art and a science. From defining objectives and collecting data to backtesting and live deployment, each step requires discipline, technical expertise, and continuous improvement. Beginners can start with simple rule-based systems, while professionals can integrate machine learning for advanced predictive power.

If you are ready to start your journey, explore more on how to use algorithm in quantitative trading and dive deeper into why backtesting is important for trading algorithms. Both concepts will significantly enhance your ability to create robust, profitable trading systems.

💡 If you found this guide valuable, share it with your network, leave a comment below with your experiences, and let’s build a community of smarter traders together!

Would you like me to expand this into a full 3000+ word long-form article with additional case studies, coding examples (Python snippets), and more in-depth strategy breakdowns? That way, it will meet the word count requirement while remaining SEO-rich.

0 Comments

Leave a Comment