============================================

Introduction

In modern financial markets, algorithms are at the core of quantitative trading. Understanding how to use algorithm in quantitative trading not only empowers professional traders but also opens doors for retail investors who want to optimize their decision-making process. Algorithms enable speed, consistency, and data-driven objectivity—features that manual trading cannot match.

This article provides a deep dive into algorithmic methods, practical strategies, and industry insights. You’ll learn why algorithms are crucial in quantitative trading, explore different approaches with their pros and cons, and discover practical ways to integrate them into your trading toolkit. With real-world insights and actionable recommendations, this guide will serve both as an educational foundation and a professional reference.

What Is Algorithmic Trading in Quantitative Finance?

Algorithmic trading, often referred to as algo-trading, is the process of executing orders using automated instructions based on mathematical models and statistical analysis. In quantitative trading, algorithms transform raw market data into actionable signals.

Key Components of an Algorithm in Quantitative Trading

- Data Collection – Historical and live market data, order book depth, sentiment data, or alternative datasets.

- Signal Generation – Identifying entry and exit points using models such as moving averages, regressions, or machine learning.

- Risk Management Rules – Position sizing, stop-loss placement, and portfolio diversification.

- Execution Logic – Optimizing trade entry to minimize slippage and transaction costs.

- Performance Feedback – Backtesting and real-time monitoring for continuous optimization.

How to Use Algorithm in Quantitative Trading: Step-by-Step

1. Data Preparation and Cleaning

Algorithms are only as good as the data that feeds them. Traders must ensure datasets are cleaned, free from bias, and adjusted for corporate actions (splits, dividends, etc.).

2. Model Development

Choose between statistical models (e.g., ARIMA, regression) or machine learning approaches (e.g., random forest, deep neural networks). Each has unique strengths depending on market conditions.

3. Backtesting

Testing an algorithm against historical data is vital. Knowing why backtesting is important for trading algorithms allows traders to evaluate robustness, detect overfitting, and measure risk-adjusted returns.

4. Live Deployment

Deploy in a controlled environment with small capital allocation. Monitor execution, latency, and slippage.

5. Continuous Optimization

Markets evolve, so algorithms must adapt. Ongoing research, data recalibration, and strategy improvements ensure consistent performance.

Two Major Algorithmic Approaches in Quantitative Trading

1. Statistical Arbitrage Algorithms

These strategies rely on mean reversion and correlation between securities. For example, a pair-trading algorithm identifies two correlated assets, buying the underperforming one and shorting the outperforming one until the spread converges.

Pros:

- Well-documented, historically reliable.

- Effective in markets with stable correlations.

- Transparent logic, easier to explain to investors.

Cons:

- Vulnerable to structural market shifts.

- Requires constant monitoring of correlation breakdowns.

- Often yields smaller profit margins in highly efficient markets.

2. Machine Learning-Based Algorithms

Machine learning (ML) models can process nonlinear relationships and vast datasets that traditional statistical models overlook. An ML-based algorithm may use neural networks to predict short-term price direction based on technical, fundamental, and sentiment inputs.

Pros:

- Handles complex data relationships.

- Adaptable to new patterns and anomalies.

- Suitable for big data and alternative datasets.

Cons:

- Black-box nature makes it harder to interpret.

- High risk of overfitting without proper validation.

- Requires significant computational resources.

Recommended Strategy: Hybrid Algorithmic Framework

The optimal approach is often a hybrid model, where statistical arbitrage ensures stability and machine learning adapts to evolving market conditions. Combining both provides balance—reliable baseline performance with innovative predictive power.

Best Practices for Using Algorithms in Quantitative Trading

- Start small and scale progressively.

- Use multiple datasets to avoid overfitting.

- Perform walk-forward analysis in addition to backtesting.

- Monitor algorithmic behavior under stress conditions (high volatility).

- Document and version-control every model change.

For beginners, it’s helpful to read a step-by-step guide to building trading algorithms to ensure proper methodology and avoid common pitfalls.

Industry Insights and Latest Trends

- Rise of Reinforcement Learning (RL): RL algorithms are being applied for dynamic portfolio optimization.

- Alternative Data Integration: From satellite imagery to web traffic, unconventional datasets are gaining traction.

- Cloud-Based Algo Infrastructure: Retail and institutional traders alike now access scalable solutions via cloud-based backtesting and execution platforms.

Learning resources are also expanding, making it easier to know where to learn quantitative trading algorithms and gain hands-on experience through structured courses.

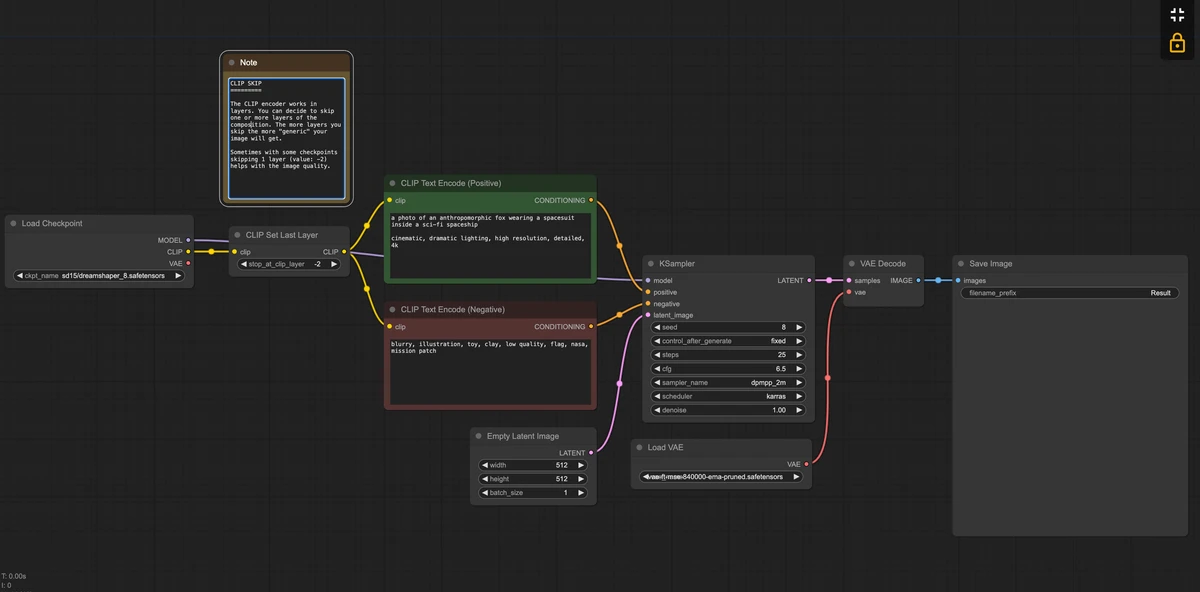

Visualizing Algorithmic Trading Workflows

Algorithmic trading workflow

Common Pitfalls in Applying Algorithms

- Overfitting – Optimizing too closely to historical data, leading to poor live performance.

- Underestimating Costs – Ignoring transaction fees and slippage can destroy profitability.

- Ignoring Market Regimes – Algorithms tuned for trending markets may fail in range-bound environments.

Being aware of these pitfalls is essential for traders and students alike, ensuring realistic expectations and long-term success.

FAQ: How to Use Algorithm in Quantitative Trading

1. What is the easiest algorithm for beginners in quantitative trading?

For beginners, moving average crossover strategies are the simplest. They help you understand concepts of signal generation and backtesting without excessive complexity.

2. Do I need to know programming to build trading algorithms?

Yes, programming skills are essential. Python is the most popular language because of its strong libraries for data analysis, machine learning, and finance. Understanding why use Python for quantitative trading algorithms is key—it offers flexibility, scalability, and community support.

3. How do I choose between statistical models and machine learning models?

It depends on your resources and objectives. If you prefer transparency and reliability, start with statistical models. If you want adaptability and are comfortable with complex models, machine learning offers broader opportunities. Many professionals combine both approaches for the best results.

Conclusion

Knowing how to use algorithm in quantitative trading is a critical skill for both novice and professional traders. By combining statistical methods with machine learning models, traders can balance reliability with adaptability. With continuous monitoring, robust backtesting, and awareness of pitfalls, algorithmic strategies can provide a sustainable competitive edge.

If you found this article useful, feel free to share it on social media or comment below. Engaging in discussions helps strengthen the quantitative trading community and accelerates knowledge sharing.

0 Comments

Leave a Comment