==========================================================================

Tick data analysis plays a critical role in quantitative trading, providing granular insights that can make the difference between profitable and unprofitable strategies. Whether you’re analyzing historical data or working with real-time market ticks, having the right tools and scripts can significantly enhance your trading strategies. In this article, we’ll explore the best downloadable tick data analysis scripts, the importance of tick data in quantitative trading, and practical methods for leveraging tick data to improve your performance.

What is Tick Data and Why is It Important in Quantitative Trading?

Before we dive into the specifics of downloadable tick data analysis scripts, it’s essential to understand what tick data is and why it’s crucial for quantitative trading.

Definition of Tick Data

Tick data consists of the rawest form of market data, capturing every individual price change and transaction that occurs in the market. Unlike minute data or hourly data, tick data provides a time-stamped record of every trade, including price, volume, and other relevant information. This fine-grained level of detail is highly valuable for high-frequency traders and those developing sophisticated quantitative trading strategies.

The Role of Tick Data in Quantitative Trading

- Granularity: Tick data offers the most detailed level of data available, allowing for deep analysis of price movements, spread behavior, and market microstructure.

- High-Frequency Strategies: For high-frequency and algorithmic trading strategies, tick data is essential as it allows for minute-by-minute analysis of the market.

- Improved Strategy Accuracy: When testing strategies, using tick data can provide more accurate backtest results, leading to more reliable predictions of future performance.

How to Analyze Tick Data for Quantitative Trading

To extract meaningful insights from tick data, it’s essential to have a structured approach. Below are two primary methods for analyzing tick data effectively:

Method 1: Time-Based Analysis

Time-based analysis involves examining tick data over a specified period. This method allows traders to identify trends and price movements that occur at specific intervals, such as during certain hours of the day or after major economic events.

Steps to Implement Time-Based Analysis:

- Collect Historical Tick Data: Download historical tick data from reliable sources (more on that later).

- Aggregate Data: Use downloadable tick data analysis scripts to aggregate the data into smaller time frames (e.g., 1-minute or 5-minute intervals).

- Statistical Analysis: Run statistical tests to identify trends, patterns, or anomalies in price movements during specific time frames.

Advantages of Time-Based Analysis:

- Easy to implement for both beginner and advanced traders.

- Helps identify patterns based on time of day, market open/close, etc.

- Can be integrated with other forms of data, such as fundamental analysis.

Disadvantages of Time-Based Analysis:

- May not capture the full market dynamics, especially during high-frequency movements.

- Aggregating tick data into time intervals may obscure important price movements.

Method 2: Event-Based Analysis

Event-based analysis focuses on how specific events, such as news releases, earnings reports, or macroeconomic data releases, impact the market. Tick data allows traders to examine price movements immediately before, during, and after these events.

Steps to Implement Event-Based Analysis:

- Identify Key Events: Define which events you want to analyze (e.g., economic indicators, earnings reports, geopolitical events).

- Download Relevant Tick Data: Use scripts to download tick data for the period surrounding each event.

- Analyze Market Reaction: Examine how market prices react in response to the event by analyzing tick data spikes, volatility, and order flow.

Advantages of Event-Based Analysis:

- Provides insight into how the market reacts to specific events.

- Useful for developing strategies that capitalize on market volatility.

- Can be used to fine-tune risk management strategies.

Disadvantages of Event-Based Analysis:

- Requires understanding of event-driven market dynamics.

- May not be as reliable if the market reacts unpredictably.

Downloadable Tick Data Analysis Scripts: Tools You Need

For any serious quantitative trader, having access to downloadable tick data analysis scripts is essential. Below are some of the best options available:

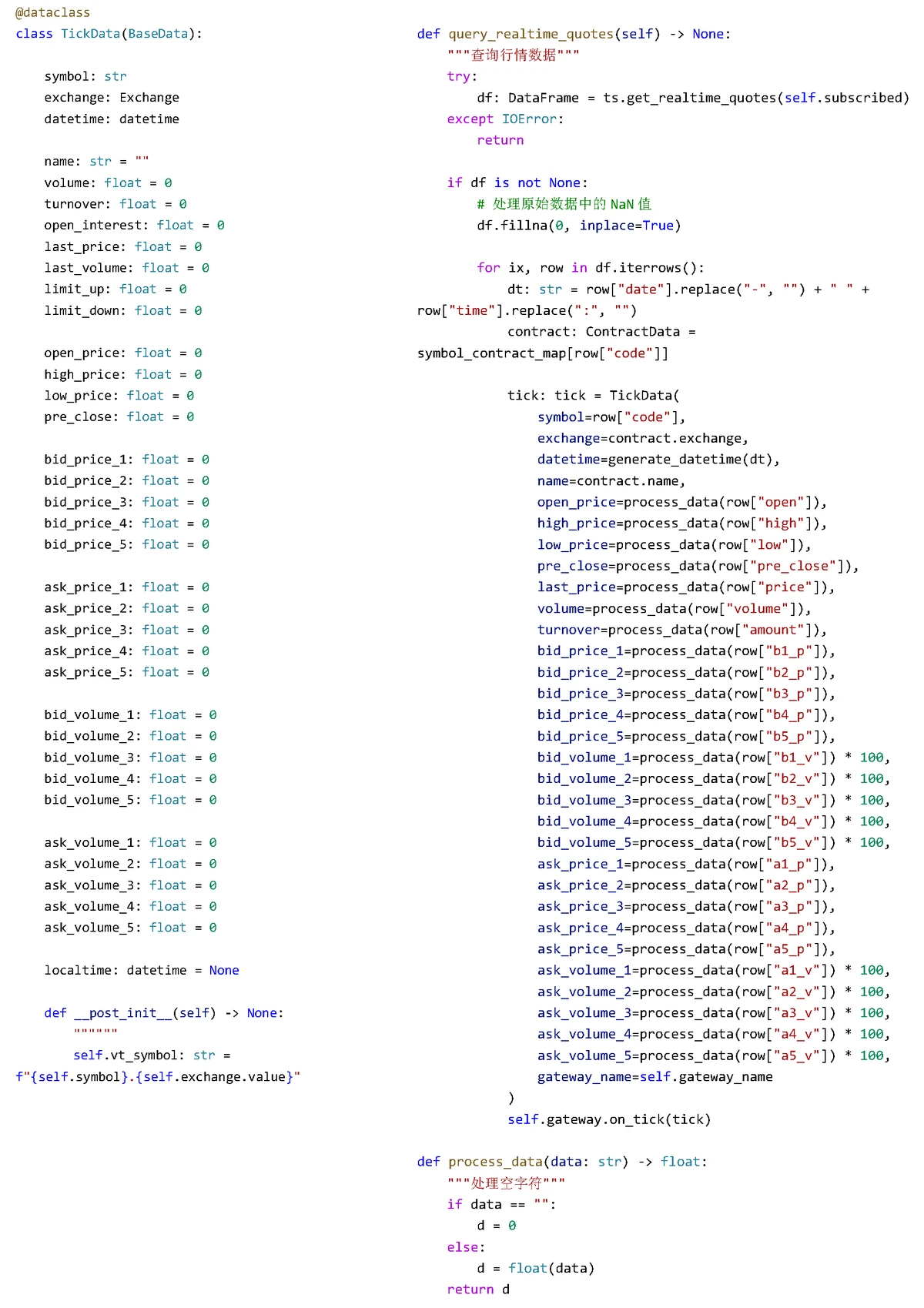

1. Python-Based Scripts

Python is a popular programming language among quant traders due to its versatility and the abundance of libraries available for data analysis. There are several open-source Python libraries and scripts that allow traders to download and analyze tick data.

Popular Python Libraries for Tick Data Analysis:

- Pandas: Great for data manipulation and analysis. It can be used to aggregate tick data and calculate various statistical measures.

- NumPy: Provides support for large, multi-dimensional arrays and matrices, along with a wide collection of mathematical functions.

- Matplotlib and Seaborn: Useful for visualizing tick data trends and identifying patterns.

- TA-Lib: A library for technical analysis, including indicators such as moving averages, Bollinger bands, and more.

Example Python Script for Analyzing Tick Data:

python

Copy code

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

# Load the tick data (CSV format)

tick_data = pd.read_csv('tick_data.csv')

# Resample data to 5-minute intervals

tick_data['Timestamp'] = pd.to_datetime(tick_data['Timestamp'])

tick_data.set_index('Timestamp', inplace=True)

resampled_data = tick_data['Price'].resample('5T').ohlc()

# Plot the 5-minute data

plt.plot(resampled_data.index, resampled_data['close'], label='Price')

plt.title('5-Minute Interval Tick Data')

plt.xlabel('Time')

plt.ylabel('Price')

plt.show()

2. R-Based Scripts

R is another powerful language for statistical analysis and is widely used in financial modeling. R has excellent libraries for time series analysis, making it a great option for tick data analysis.

Popular R Libraries for Tick Data Analysis:

- quantmod: This library is designed specifically for modeling and analyzing financial data, including tick data.

- xts: Provides functionality for working with

0 Comments

Leave a Comment