====================================================================================

Introduction

In the world of institutional investing, drawdown analysis plays a critical role in evaluating portfolio performance, managing risk, and ensuring capital preservation. Unlike retail investors, institutions such as pension funds, hedge funds, endowments, and sovereign wealth funds must prioritize long-term stability over short-term gains. This makes drawdown analysis for institutional investors not only a performance measure but also a cornerstone of fiduciary responsibility.

This article provides a comprehensive deep dive into the concept of drawdown analysis, why it matters for institutional investors, and the most effective strategies to assess and manage drawdowns. We’ll explore different analytical methods, compare their strengths and weaknesses, provide practical examples and industry insights, and finish with a detailed FAQ section to address common challenges faced by institutional investors.

Understanding Drawdown in Institutional Portfolios

Definition and Core Concept

In finance, drawdown refers to the peak-to-trough decline in the value of a portfolio before a new peak is achieved. For institutional investors, drawdown is not just about temporary portfolio losses, but about how these declines affect funding ratios, liabilities, and long-term objectives.

Types of Drawdowns

- Absolute Drawdown – The difference between the initial investment and the lowest point reached.

- Maximum Drawdown (MDD) – The largest observed decline from peak to trough during a specific period.

- Relative Drawdown – The percentage loss relative to the most recent peak.

Understanding these distinctions is essential for building robust risk management systems.

Why Drawdown Analysis is Crucial for Institutional Investors

Risk Management Perspective

Institutional investors must answer to stakeholders, trustees, and regulators. A deep drawdown can trigger:

- Funding shortfalls for pensions.

- Liquidity crises for hedge funds.

- Reputational damage for asset managers.

This is why industry professionals often emphasize why drawdown matters in quantitative analysis: it directly impacts the long-term viability of investment strategies.

Investor Psychology and Fiduciary Duty

Severe drawdowns can cause stakeholder panic, leading to premature liquidation of positions and missed recovery opportunities. Trustees and board members rely on clear drawdown analysis to maintain confidence in investment policies.

Methods of Drawdown Analysis

Method 1: Historical Simulation

This involves examining historical data to assess how a portfolio would have behaved under past market conditions.

- Pros: Simple, intuitive, based on real-world events.

- Cons: Past performance does not always predict future risks.

Method 2: Monte Carlo Simulation

Monte Carlo simulations use random sampling to project thousands of possible outcomes for a portfolio.

- Pros: Captures a wide range of scenarios, including extreme tail risks.

- Cons: Computationally intensive, dependent on model assumptions.

Comparison: Historical simulation works best for portfolios with stable strategies, while Monte Carlo is more effective for stress-testing highly complex, multi-asset portfolios. A hybrid approach often yields the most accurate risk assessment.

Drawdown Analysis in Practice

Example: Pension Fund Portfolio

A pension fund may face a 20% maximum drawdown during a financial crisis. While the portfolio might eventually recover, liabilities such as retirement payouts continue, forcing the fund to sell assets at depressed prices.

Example: Hedge Fund Strategy

For a hedge fund using leverage, even a 10% drawdown can be catastrophic if it triggers margin calls. Hence, hedge funds often implement strict drawdown limits in their risk control policies.

Tools and Techniques for Institutional Drawdown Analysis

Data-Driven Methods

Institutional investors increasingly rely on data-driven drawdown evaluation methods to monitor and predict portfolio risks. These techniques use:

- Machine learning models to forecast risk-adjusted drawdowns.

- Real-time monitoring software to provide live portfolio stress tests.

Key Performance Indicators (KPIs)

- Calmar Ratio (Return/Max Drawdown).

- Ulcer Index (Depth & Duration of Drawdowns).

- Conditional Value-at-Risk (CVaR).

These metrics help investors balance return expectations with acceptable risk thresholds.

Strategies to Reduce and Manage Drawdowns

Strategy 1: Diversification Across Asset Classes

By holding equities, bonds, commodities, and alternatives, institutions can reduce the likelihood of simultaneous drawdowns across the entire portfolio.

- Pros: Proven long-term risk reducer.

- Cons: Correlations can rise during crises, limiting effectiveness.

Strategy 2: Dynamic Hedging

Using options, futures, or volatility-based instruments, investors can hedge against market downturns.

- Pros: Provides downside protection.

- Cons: Costly in low-volatility environments.

Best Practice: Combining diversification with cost-effective hedging strategies is the most sustainable approach for institutional investors. For deeper insights, see how to reduce drawdown risk, which explores specific tactics for minimizing downside exposure.

Institutional Case Studies

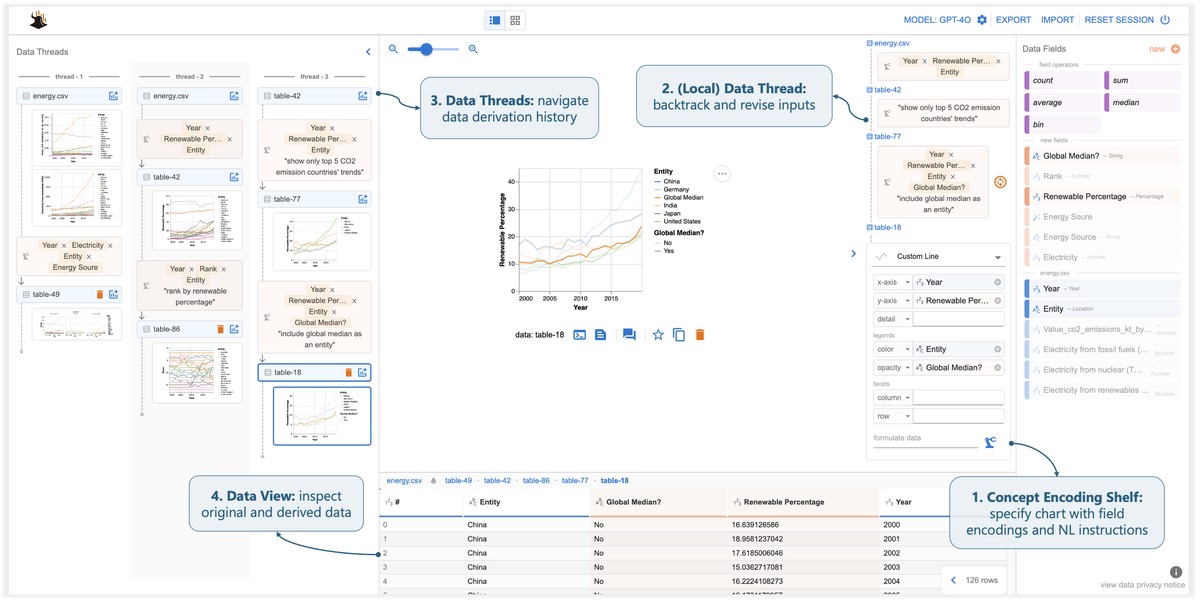

Drawdown analysis in institutional portfolios over different market cycles

Case Study 1: Sovereign Wealth Fund

A sovereign wealth fund that heavily relied on oil revenues faced steep drawdowns when oil prices collapsed in 2014. By diversifying into technology equities and infrastructure, the fund stabilized future returns.

Case Study 2: University Endowment

A leading university endowment minimized drawdowns during 2020’s COVID crash by using derivative overlays to hedge equity exposures, allowing them to recover faster than peers.

Emerging Trends in Drawdown Management

1. AI-Powered Risk Forecasting

Machine learning algorithms now predict potential drawdowns before they occur, allowing proactive rebalancing.

2. ESG and Sustainable Portfolios

Portfolios incorporating ESG factors show lower drawdown volatility during crises, according to recent studies.

3. Real-Time Transparency

Regulators are increasingly requiring real-time drawdown reporting, pushing institutions to adopt advanced monitoring systems.

FAQ: Drawdown Analysis for Institutional Investors

1. How often should institutional investors conduct drawdown analysis?

At minimum, quarterly. However, best practice involves real-time monitoring systems that alert managers whenever portfolio drawdowns exceed predefined thresholds.

2. Is maximum drawdown the best measure of portfolio risk?

Not always. While maximum drawdown is useful, it only reflects the worst-case scenario. Institutions should also track drawdown duration, recovery time, and conditional VaR for a more comprehensive view.

3. What is the biggest mistake institutions make when managing drawdowns?

Relying solely on historical performance. Markets evolve, correlations shift, and new risks emerge. The failure to incorporate forward-looking simulations and stress tests often leads to underestimating potential losses.

Conclusion

Drawdown analysis for institutional investors is more than a technical exercise—it is a vital element of risk management, fiduciary duty, and long-term capital preservation. By adopting advanced techniques like Monte Carlo simulations, leveraging real-time monitoring tools, and combining diversification with dynamic hedging, institutions can protect portfolios from severe capital erosion.

As financial markets grow increasingly complex, successful institutions will be those that continuously refine their drawdown management strategies.

If you found this article insightful, feel free to share it with peers, colleagues, or investment professionals. Let’s spark a discussion on how institutions can better protect capital and ensure sustainable returns.

要不要我帮你制作一个 高质量的信息图(Infographic),把 不同的 drawdown 分析方法、优缺点和适用场景总结成一张图?这样读者在阅读长文后可以一目了然。

0 Comments

Leave a Comment