=============================================================================

Drawdown is one of the most critical risk metrics every professional risk manager must master. A poorly managed drawdown can erode investor confidence, damage trading strategies, and in severe cases, lead to catastrophic financial losses. For those overseeing portfolios, funds, or corporate risk frameworks, developing a structured approach to drawdown is essential. This article provides drawdown advice for risk managers, combining professional experience, quantitative methods, and the latest industry insights to deliver actionable strategies.

We will examine multiple methods to manage drawdown, evaluate their strengths and weaknesses, and highlight best practices for sustainable portfolio performance.

Understanding Drawdown in Risk Management

What Is Drawdown?

Drawdown represents the decline from a portfolio’s peak value to its lowest point before recovering. It is usually expressed as a percentage and acts as a measure of downside risk.

For example, if a portfolio grows from \(1,000,000 to \)1,200,000, then falls to $960,000 before recovering, the drawdown is:

Drawdown=1,200,000−960,0001,200,000×100=20%\text{Drawdown} = \frac{1,200,000 - 960,000}{1,200,000} \times 100 = 20\%Drawdown=1,200,0001,200,000−960,000×100=20%

This percentage highlights the capital at risk during downturns, which risk managers must monitor closely.

Why Drawdown Matters

- Investor confidence: Large drawdowns scare investors and increase redemption risks.

- Strategy resilience: High drawdowns expose fragile or poorly optimized trading models.

- Capital preservation: Managing drawdown ensures survival during volatile markets.

As emphasized in why is drawdown important in trading, minimizing drawdown is not just about performance—it’s about trust and sustainability.

Key Causes of Drawdowns in Markets

Before implementing strategies, risk managers must understand what causes drawdowns:

- Market volatility: Sudden price swings can erode gains rapidly.

- Over-leverage: Excessive leverage amplifies both profits and losses.

- Poor diversification: Concentrated positions expose portfolios to systemic risk.

- Ineffective stop-loss strategies: Delayed exits deepen losses.

- External shocks: Black swan events (pandemics, geopolitical crises) can trigger sharp downturns.

Identifying these causes is the first step toward implementing drawdown prevention strategies effectively.

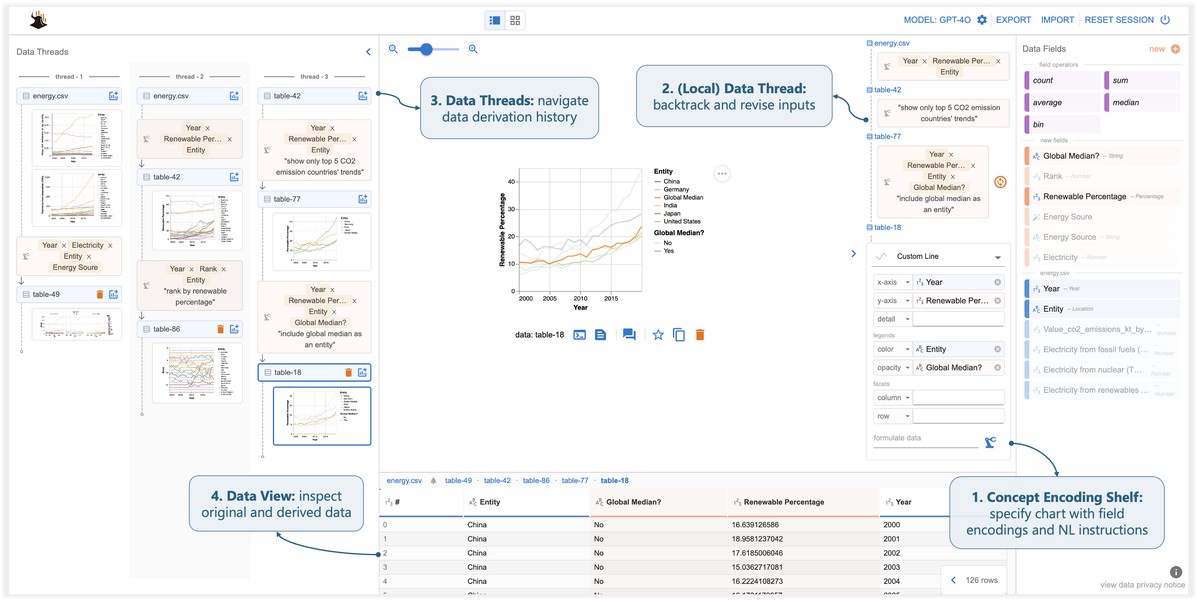

Example of a drawdown cycle showing peak, trough, and recovery

Two Core Approaches to Drawdown Management

Risk managers can rely on a variety of methods, but two stand out as particularly effective: stop-loss based control systems and statistical risk allocation models.

1. Stop-Loss and Position Sizing Control

This approach uses predefined risk limits to reduce exposure when losses mount. Stop-loss orders and dynamic position sizing are its core tools.

Advantages

- Simple to implement across asset classes.

- Provides immediate protection during market downturns.

- Reduces emotional decision-making.

Disadvantages

- Can trigger exits prematurely during temporary volatility.

- May limit upside if thresholds are too conservative.

Example in Practice

A portfolio manager might cap losses at 2% per trade and dynamically reduce position sizes when volatility increases, ensuring controlled exposure.

2. Statistical Risk Allocation Models

This method involves advanced quantitative techniques, such as Value at Risk (VaR), Conditional VaR, and Monte Carlo simulations, to forecast potential drawdowns and adjust allocations accordingly.

Advantages

- Provides probabilistic insights into potential losses.

- Incorporates correlations and diversification benefits.

- Adaptable for institutional portfolios.

Disadvantages

- Requires deep statistical expertise.

- Dependent on quality of input data.

- May underestimate extreme events (tail risks).

Example in Practice

An institutional fund manager may use Monte Carlo simulations to estimate drawdowns under multiple scenarios and reallocate capital toward less correlated assets.

Comparing the Two Approaches

| Criteria | Stop-Loss & Position Sizing | Statistical Risk Models |

|---|---|---|

| Complexity | Low | High |

| Accessibility | Retail & Institutional | Primarily Institutional |

| Speed of Action | Immediate | Forecast-based |

| Suitability | Short-term trading | Long-term portfolio risk |

Recommendation: For balanced risk management, combining both methods delivers optimal results. Stop-loss systems handle immediate threats, while statistical models provide forward-looking resilience.

Industry Trends in Drawdown Risk Management

- AI-driven monitoring: Machine learning models detect drawdown risks earlier.

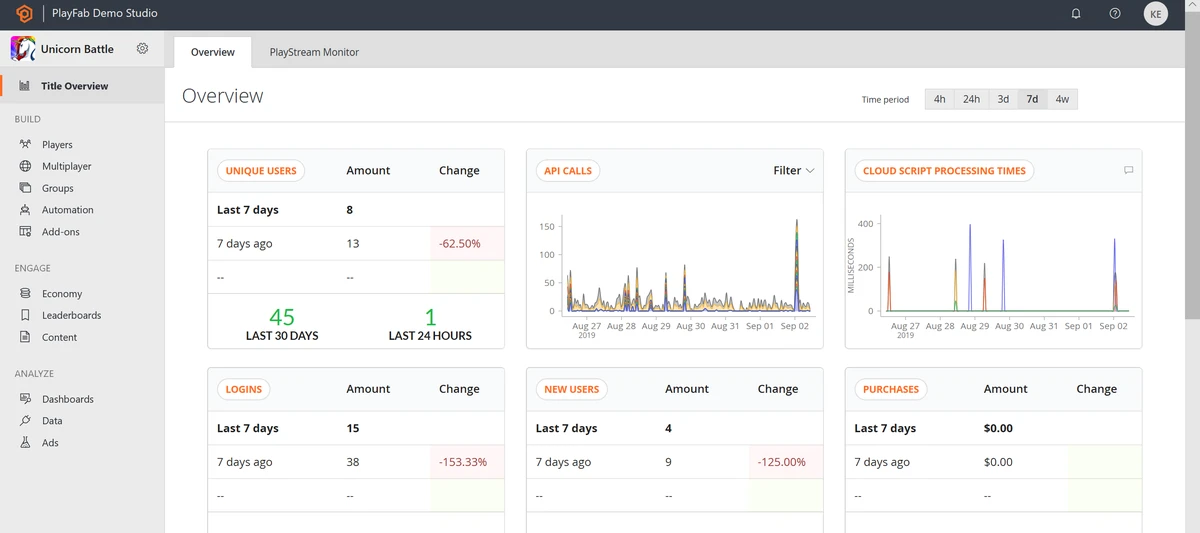

- Real-time dashboards: Software now provides live drawdown tracking for institutional managers.

- Stress testing: Regulators increasingly require stress simulations for extreme scenarios.

- Crypto integration: Risk managers now factor in digital assets, which carry extreme drawdowns.

Practical Drawdown Advice for Risk Managers

Implement Multi-Layered Risk Controls

Do not rely on a single metric. Combine volatility analysis, leverage caps, and position sizing to create robust controls.

Use Data-Driven Evaluation Methods

As highlighted in data-driven drawdown evaluation methods, relying on statistical simulations ensures that risk managers are not caught off guard by rare but damaging scenarios.

Communicate with Stakeholders

Transparency about drawdown tolerance and recovery plans fosters trust with investors and senior management.

Balance Risk and Reward

Avoid over-conservatism. Completely eliminating drawdown risk is impossible; the goal is to maintain acceptable levels while still achieving growth.

Common Mistakes in Drawdown Management

- Focusing only on short-term drawdowns while ignoring long-term capital erosion.

- Underestimating correlations between assets that increase systemic risks.

- Overreacting to temporary volatility, causing unnecessary exits.

- Ignoring behavioral biases, such as holding onto losing positions out of hope.

FAQ: Drawdown Advice for Risk Managers

1. How much drawdown is acceptable in professional portfolio management?

It depends on strategy and investor profile. For conservative portfolios, a maximum drawdown of 5–10% is common, while hedge funds may tolerate 20–30% if returns justify the risk.

2. What tools can risk managers use for real-time drawdown monitoring?

Institutional managers often use Bloomberg, RiskMetrics, or specialized real-time drawdown monitoring software. Retail traders can use trading platforms like MetaTrader or TradingView with drawdown plugins.

3. Can drawdowns be completely avoided?

No. Drawdowns are a natural part of investing. The goal is not to eliminate them but to minimize severity and shorten recovery periods. Effective diversification, risk controls, and discipline are the keys.

Conclusion: Building a Sustainable Drawdown Strategy

Effective drawdown advice for risk managers centers on balancing immediate protective measures with long-term risk modeling. By combining stop-loss systems, statistical allocation, and real-time monitoring, risk managers can safeguard portfolios, preserve investor trust, and navigate market uncertainty with confidence.

If you found this article useful, share it with your network of risk professionals, leave a comment with your insights, and contribute to a stronger culture of disciplined risk management.

要不要我也帮你写一个 SEO meta description(150–160 字符) 和 URL slug,这样这篇文章就能直接上线使用?

0 Comments

Leave a Comment