=======================================

In trading and investment risk management, understanding drawdowns is as important as maximizing returns. A drawdown measures the decline from a peak to a trough in portfolio value, highlighting the downside risks inherent in any strategy. With markets becoming increasingly data-centric, data-driven drawdown evaluation methods are now essential for both institutional investors and retail traders. This comprehensive guide explores advanced techniques, compares different strategies, and provides actionable insights into how data analytics can revolutionize drawdown evaluation.

Introduction: Why Data-Driven Approaches to Drawdown Matter

Drawdowns directly impact investor psychology, capital allocation, and long-term performance. Traditional approaches—such as calculating the maximum drawdown—offer only partial insights. In contrast, data-driven methods integrate statistical modeling, machine learning, and real-time monitoring, enabling more precise evaluations.

As markets grow more volatile and algorithm-driven, risk managers, quant traders, and portfolio managers must adopt advanced drawdown risk assessment techniques to stay competitive.

Fundamentals of Drawdown

What Is a Drawdown?

A drawdown represents the peak-to-trough decline in the value of a trading account, portfolio, or asset. It is expressed as a percentage of the peak value.

For example:

- If a portfolio peaks at \(100,000 and drops to \)80,000, the drawdown is 20%.

Why Is Drawdown Important in Trading?

Drawdowns reveal risk exposure, helping traders understand potential losses before they happen. They also influence leverage usage, position sizing, and overall portfolio resilience. Knowing why drawdown matters in quantitative analysis ensures that strategies are not only profitable but also sustainable.

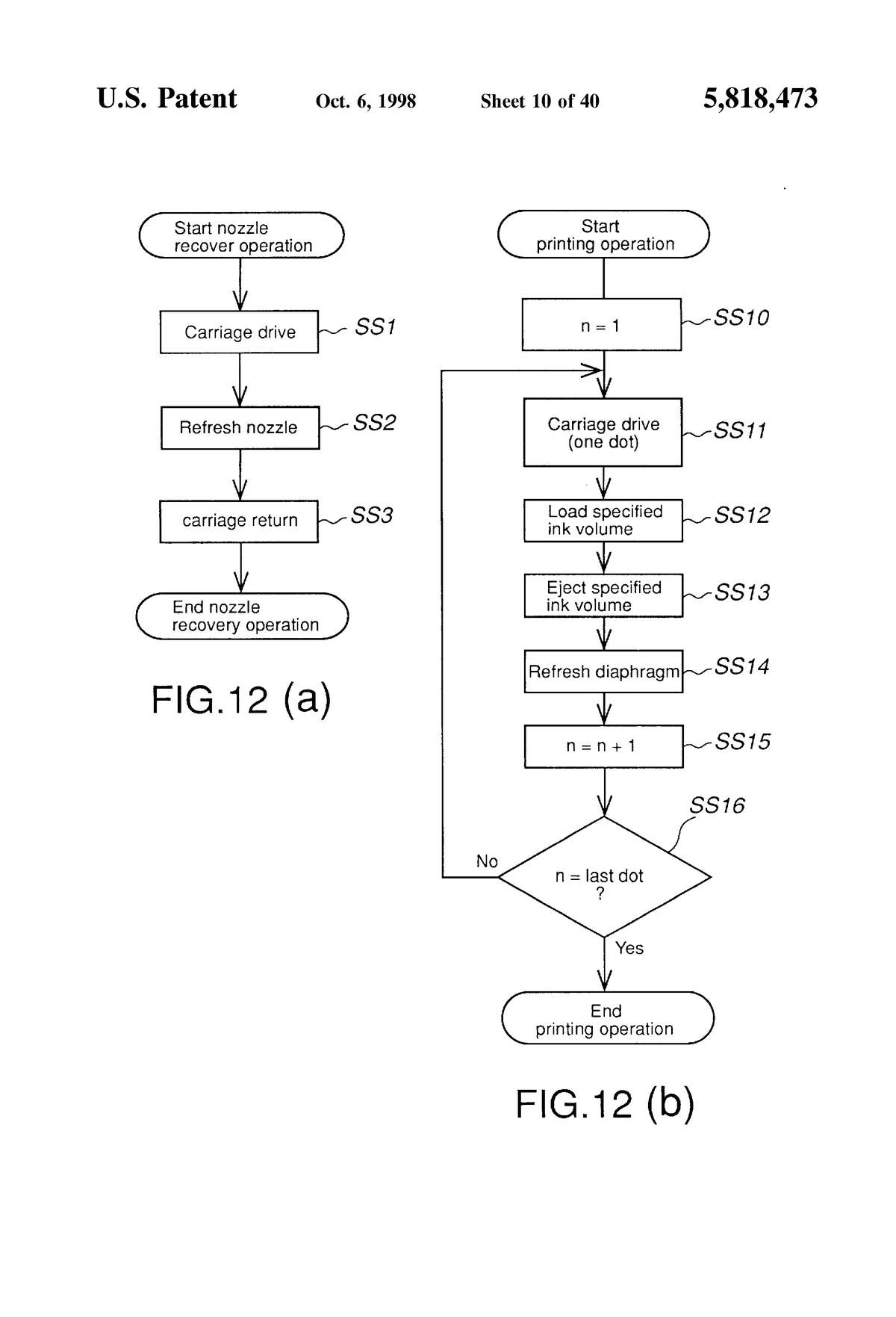

Example of a portfolio equity curve showing drawdown phases

Traditional vs. Data-Driven Drawdown Evaluation

Traditional Methods

- Maximum Drawdown (MDD): Simple but static; only shows the worst historical drop.

- Calmar Ratio / MAR Ratio: Relates returns to drawdown but lacks granularity.

These methods provide a baseline but fail to capture dynamic risks in real time.

Data-Driven Methods

Data-driven approaches use large datasets, real-time analytics, and predictive models. They go beyond static metrics to forecast potential drawdowns, identify causal factors, and provide actionable insights.

Examples include:

- Monte Carlo Simulations

- Machine Learning Models

- Factor-Based Stress Testing

- Real-Time Monitoring Software

Data-Driven Drawdown Evaluation Methods

1. Monte Carlo Simulation

Monte Carlo simulations model thousands of possible market scenarios to evaluate potential drawdowns under different conditions.

- Advantages: Provides probabilistic insights, accounts for uncertainty.

- Disadvantages: Computationally heavy, dependent on assumptions.

2. Machine Learning Forecasting

Using supervised and unsupervised learning, ML models can predict drawdown likelihoods based on historical price movements, volatility spikes, and macroeconomic indicators.

- Advantages: Adaptive, scalable, and increasingly accurate with big data.

- Disadvantages: Risk of overfitting, requires strong feature engineering.

3. Factor-Based Stress Testing

This method isolates market factors (interest rates, volatility, sector exposure) and evaluates their contribution to drawdown risks.

- Advantages: Identifies hidden vulnerabilities.

- Disadvantages: Relies on accurate factor models.

4. Real-Time Monitoring Systems

Real-time drawdown monitoring software integrates trading platforms with dashboards to continuously track performance dips and trigger alerts when thresholds are breached.

- Advantages: Immediate feedback, supports automated risk controls.

- Disadvantages: Requires robust infrastructure and data integration.

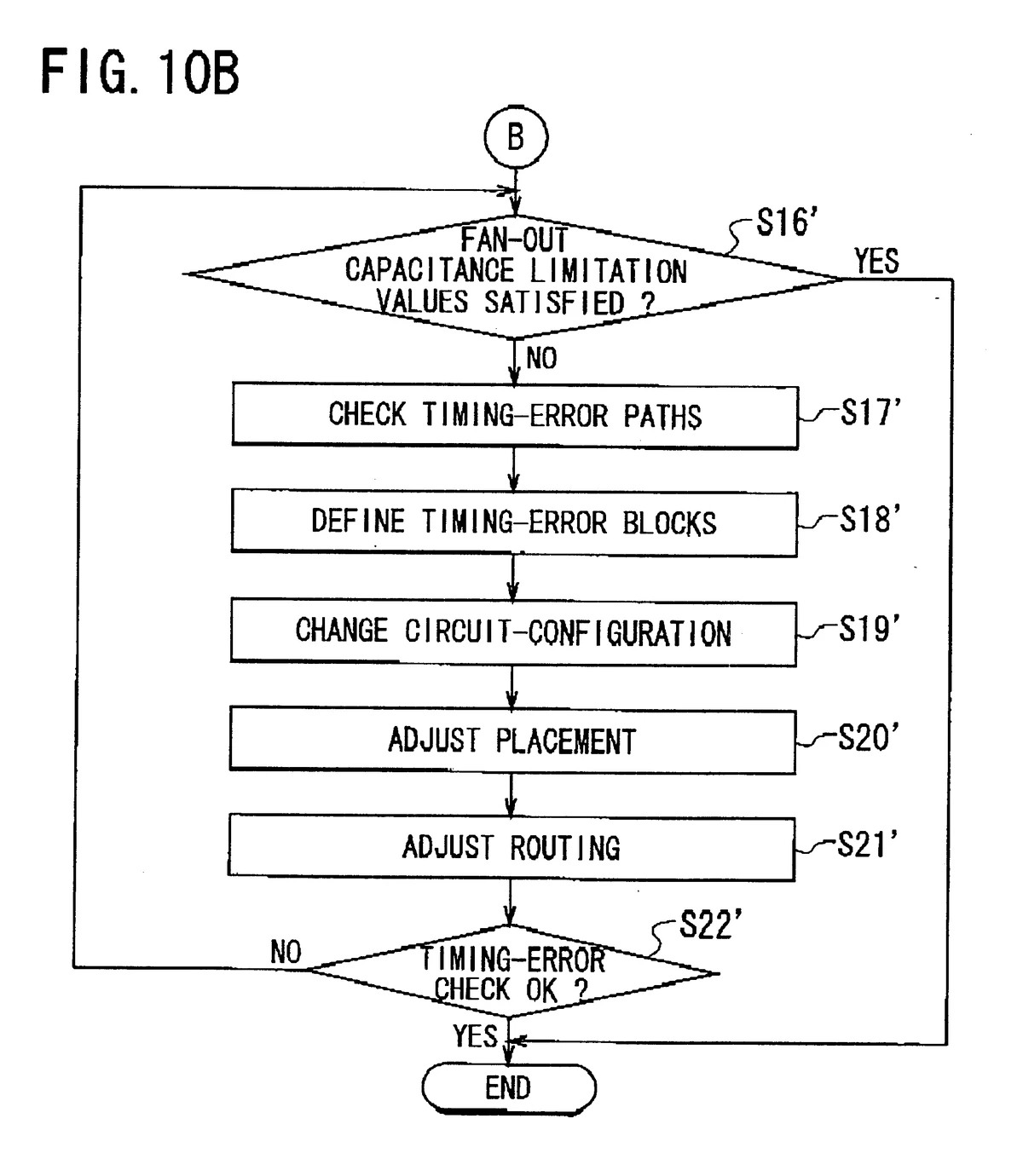

Monte Carlo simulation used for drawdown risk assessment

Comparing Different Approaches

| Method | Strengths | Weaknesses | Best For |

|---|---|---|---|

| Maximum Drawdown | Easy to calculate, widely understood | Static, not predictive | Beginner traders, quick analysis |

| Monte Carlo Simulation | Probabilistic, stress-tests future scenarios | Assumption-heavy, computationally costly | Risk managers, hedge funds |

| Machine Learning Forecast | Adaptive, predictive, data-rich | Complexity, risk of overfitting | Quant traders, data-driven firms |

| Factor-Based Stress Testing | Identifies causal risks, granular insights | Requires accurate models and factors | Institutional investors |

| Real-Time Monitoring | Instant alerts, dynamic controls | Needs integration and automation | Active traders, portfolio managers |

Best Practices in Data-Driven Drawdown Evaluation

Integrating Multiple Methods

No single method suffices. Combining simulations, ML models, and real-time monitoring yields a holistic picture of drawdown risks.

Tracking Key Metrics

Investors should know how to calculate drawdown in quantitative trading and supplement it with rolling drawdown curves, average recovery times, and volatility-adjusted drawdowns.

Regular Updates

Markets evolve, so drawdown models must be recalibrated regularly with new data.

Industry Use Cases

Hedge Funds

Use drawdown solutions for hedge fund managers, integrating machine learning forecasts with factor models for robust risk frameworks.

Retail Traders

Adopt simplified dashboards or mobile apps to evaluate drawdowns in real time. Many fintech brokers now provide built-in drawdown strategies for retail traders.

Institutional Investors

Deploy enterprise-level drawdown analysis tools and techniques that combine predictive analytics with compliance monitoring.

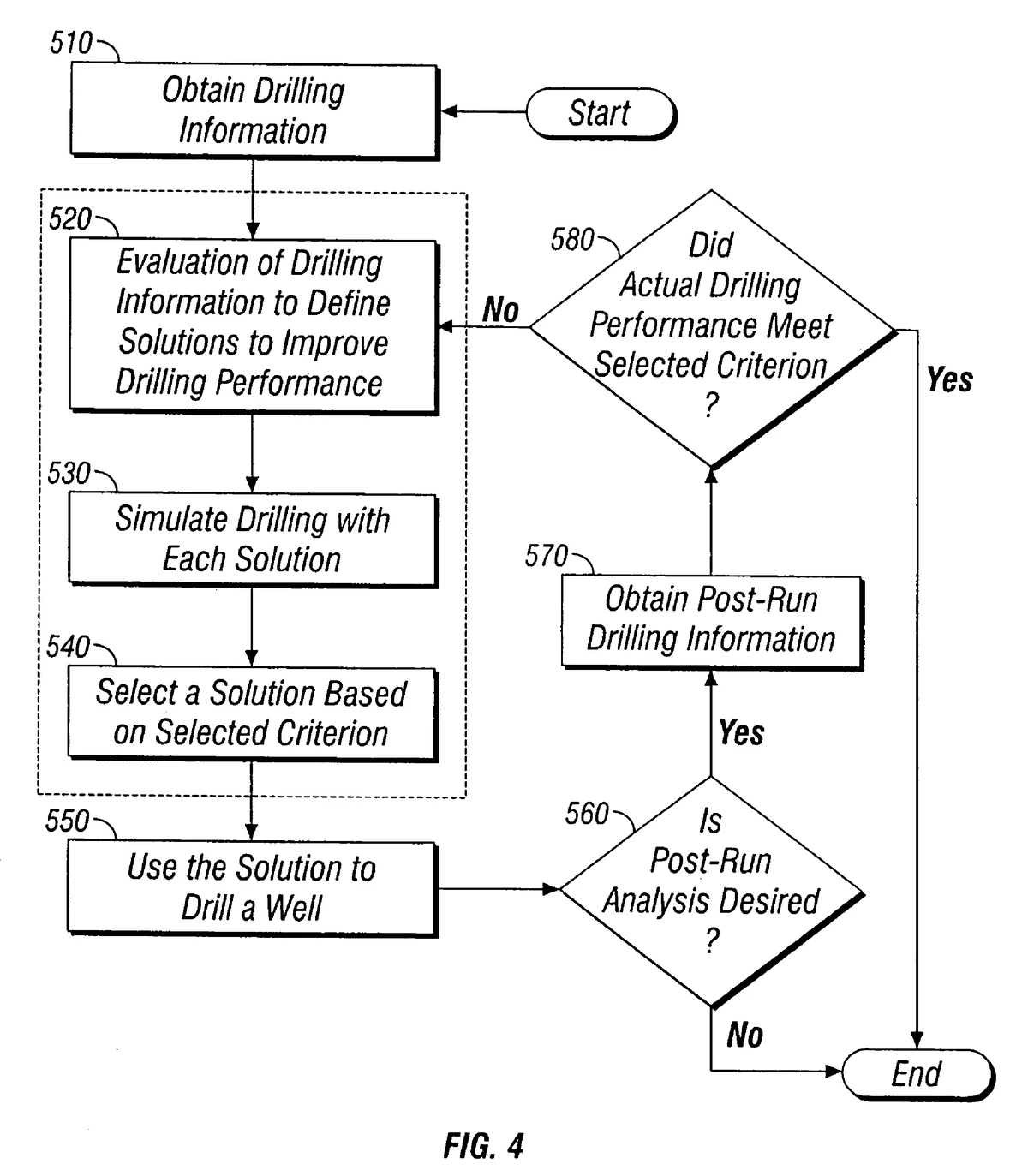

Real-time drawdown monitoring dashboard for portfolio managers

Recommendations

After analyzing the different methods, the best strategy is a hybrid approach:

- Use Monte Carlo simulations for scenario analysis.

- Apply machine learning models for predictive drawdown alerts.

- Implement real-time monitoring systems for execution-level controls.

This layered framework balances foresight, accuracy, and responsiveness.

FAQ: Data-Driven Drawdown Evaluation Methods

1. How do data-driven methods improve drawdown analysis compared to traditional ones?

Traditional methods like maximum drawdown are static and historical. Data-driven methods are dynamic, predictive, and can identify risks before they materialize. They incorporate machine learning, simulations, and real-time monitoring, making them far superior for modern markets.

2. What causes drawdowns in markets, and how can data-driven tools help?

Drawdowns are caused by volatility, macroeconomic shocks, liquidity issues, and poor risk management. Data-driven tools can detect early warning signals—such as rising volatility indices or abnormal correlations—that indicate elevated drawdown risk.

3. How can traders reduce drawdown risk using data-driven strategies?

Traders can apply drawdown prevention strategies like real-time stop-loss automation, machine learning-based portfolio rebalancing, and factor diversification. By tracking risks continuously, traders can minimize both the frequency and severity of drawdowns.

Conclusion

The shift from static analysis to data-driven drawdown evaluation methods is transforming how traders and investors manage risk. By leveraging simulations, machine learning, and real-time monitoring, professionals can not only measure but also predict and control drawdowns more effectively.

Whether you’re a hedge fund manager or a retail trader, embracing these methods ensures resilience in today’s volatile markets. The future of trading risk management is undeniably data-driven.

👉 What about you? Do you rely on traditional or data-driven methods for evaluating drawdowns? Share your thoughts below, and don’t forget to share this article with fellow traders and analysts to spark discussion on next-gen risk management.

要不要我帮你绘制一份 “Data-Driven Drawdown Evaluation Flowchart” 信息图,直观展示不同方法如何结合形成一体化风险管理体系?

0 Comments

Leave a Comment