==================================================================================

Effective drawdown management is one of the most critical aspects of long-term trading and investment success. Regardless of whether you are a hedge fund manager, quantitative trader, or retail investor, the ability to handle portfolio losses systematically can determine survival in volatile markets. This comprehensive drawdown management solution guide provides professional insights, strategies, and tools to minimize losses, enhance risk-adjusted returns, and maintain investor confidence.

Understanding Drawdown in Trading

What Is Drawdown?

In trading, drawdown refers to the peak-to-trough decline in equity before a new peak is reached. It measures risk exposure and capital erosion, offering insight into the sustainability of a trading strategy.

- Maximum Drawdown (MDD): The largest historical loss from a peak.

- Relative Drawdown: Expressed as a percentage of account equity.

- Recovery Factor: How efficiently a strategy recovers after a drawdown.

Understanding these measures is critical before exploring how to manage drawdown effectively in live markets.

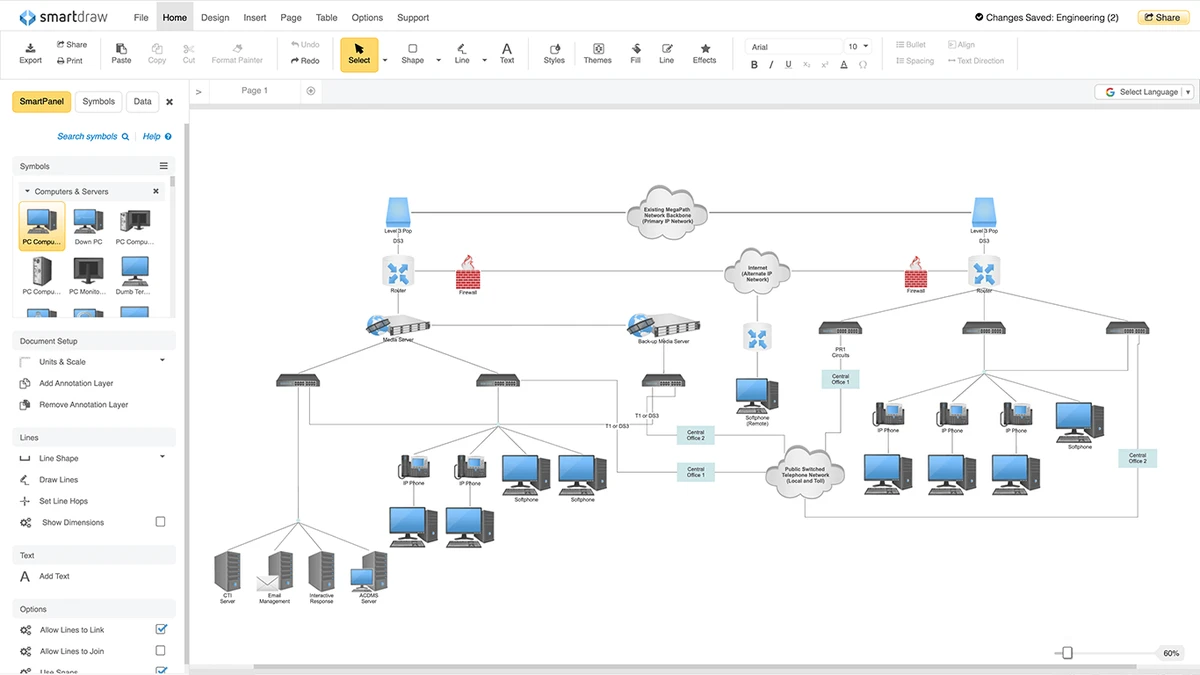

A visual representation of drawdown from equity peak to trough

Why Drawdown Management Matters

- Capital Preservation: Large drawdowns may lead to account blow-ups.

- Investor Confidence: Institutions and clients demand stability.

- Strategy Sustainability: Reducing drawdowns helps strategies withstand adverse market cycles.

- Psychological Resilience: Traders perform better when losses are contained.

For more detail on this perspective, see related insights such as why is drawdown important in trading and drawdown insights for financial analysts.

Common Causes of Drawdown

- Market Volatility: Unexpected macro events or black swan scenarios.

- Over-leverage: Excessive position sizing magnifies losses.

- Strategy Weakness: Backtest overfitting or poor diversification.

- Execution Errors: Slippage, latency, or human mistakes.

Understanding what causes drawdown in markets allows traders to create robust defense mechanisms.

Drawdown Management Strategies

1. Position Sizing and Risk Control

Method: Use fixed fractional position sizing, limiting exposure per trade (e.g., 1–2% of equity).

Pros:

- Straightforward to implement.

- Scales naturally with account size.

Cons:

- May limit upside potential in strong markets.

2. Stop-Loss and Trailing Stops

Method: Predetermine maximum acceptable loss per trade and use dynamic trailing stops.

Pros:

- Provides hard protection against catastrophic losses.

- Automates discipline.

Cons:

- May trigger premature exits in volatile conditions.

3. Diversification and Correlation Analysis

Method: Spread capital across uncorrelated assets, markets, and strategies.

Pros:

- Reduces risk concentration.

- Smooths equity curve.

Cons:

- Requires deep statistical analysis of correlations.

- Diversification may dilute performance.

4. Volatility-Based Adjustments

Method: Adjust leverage and position sizing based on implied or realized volatility.

Pros:

- Aligns risk-taking with market environment.

- Effective for systematic trading models.

Cons:

- Complex implementation.

- May reduce profits in calm markets.

5. Hedging with Options or Futures

Method: Use derivatives to protect downside exposure.

Pros:

- Limits downside while allowing upside.

- Widely used in institutional settings.

Cons:

- Costs may erode returns.

- Requires advanced knowledge of derivatives pricing.

Comparison of common drawdown management strategies and their trade-offs

Two Effective Approaches Compared

Conservative Approach: Stop-Loss + Position Sizing

- Best for: Retail traders and beginners.

- Advantages: Simplicity, discipline enforcement.

- Limitations: May reduce profit potential.

Advanced Approach: Diversification + Volatility Adjustment + Hedging

- Best for: Hedge funds and quantitative professionals.

- Advantages: Risk-adjusted returns, robustness across regimes.

- Limitations: Requires sophisticated infrastructure.

Recommended Solution: A hybrid approach combining conservative risk management with advanced hedging and diversification. This provides balanced protection without overly sacrificing growth potential.

Modern Tools for Drawdown Monitoring

- Real-time drawdown monitoring software: Automated alerts when losses cross thresholds.

- Data-driven drawdown evaluation methods: Quantitative metrics and simulations.

- Scenario stress testing: Evaluating performance under extreme market shocks.

- Drawdown analysis tools and techniques: Backtesting with Monte Carlo simulations.

These tools are critical for institutional investors who rely on precision and accountability in reporting.

Case Studies: Successful Drawdown Reduction

Hedge Fund Example

A global macro hedge fund reduced its MDD from 25% to 12% by implementing dynamic volatility targeting combined with options hedging.

Retail Trader Example

A retail trader reduced account blow-ups by switching from 10% per trade exposure to 2% risk per trade, achieving long-term capital growth.

These cases highlight that successful drawdown reduction tactics are adaptable across scales.

Frequently Asked Questions (FAQ)

1. What is an acceptable level of drawdown for professional traders?

For hedge funds, an MDD of 10–15% is generally acceptable. Retail traders often tolerate slightly higher drawdowns, but anything above 25% is risky for long-term survival.

2. How can I track my drawdown performance in real-time?

Use broker platforms or third-party real-time drawdown monitoring software. Many offer equity curve tracking, alert systems, and integration with trading bots.

3. Can drawdown be completely eliminated?

No. Drawdowns are inherent to trading. The goal is not elimination but minimization and controlled recovery, ensuring risk-adjusted growth.

Conclusion

This drawdown management solution guide highlights the importance of proactive planning, disciplined execution, and the use of advanced tools to limit portfolio losses. Traders and investors who prioritize capital preservation and drawdown minimization gain not only stronger performance metrics but also improved confidence and sustainability.

Which drawdown management strategies have you found most effective? Share your thoughts in the comments, and don’t forget to pass this guide along to colleagues who want to optimize their trading risk management.

0 Comments

Leave a Comment