======================================

Mean reversion is one of the most widely used concepts in finance, particularly in quantitative and systematic trading. At its core, mean reversion assumes that asset prices and returns eventually revert to their historical averages. Creating effective mean reversion trading plans is therefore about designing structured, rules-based strategies that exploit temporary mispricings and inefficiencies in the market.

This article provides a comprehensive guide to building, implementing, and optimizing mean reversion strategies. Drawing on both academic research and real-world experience, it explores multiple approaches, compares their strengths and weaknesses, and offers practical insights for traders at all levels.

What Is Mean Reversion in Trading?

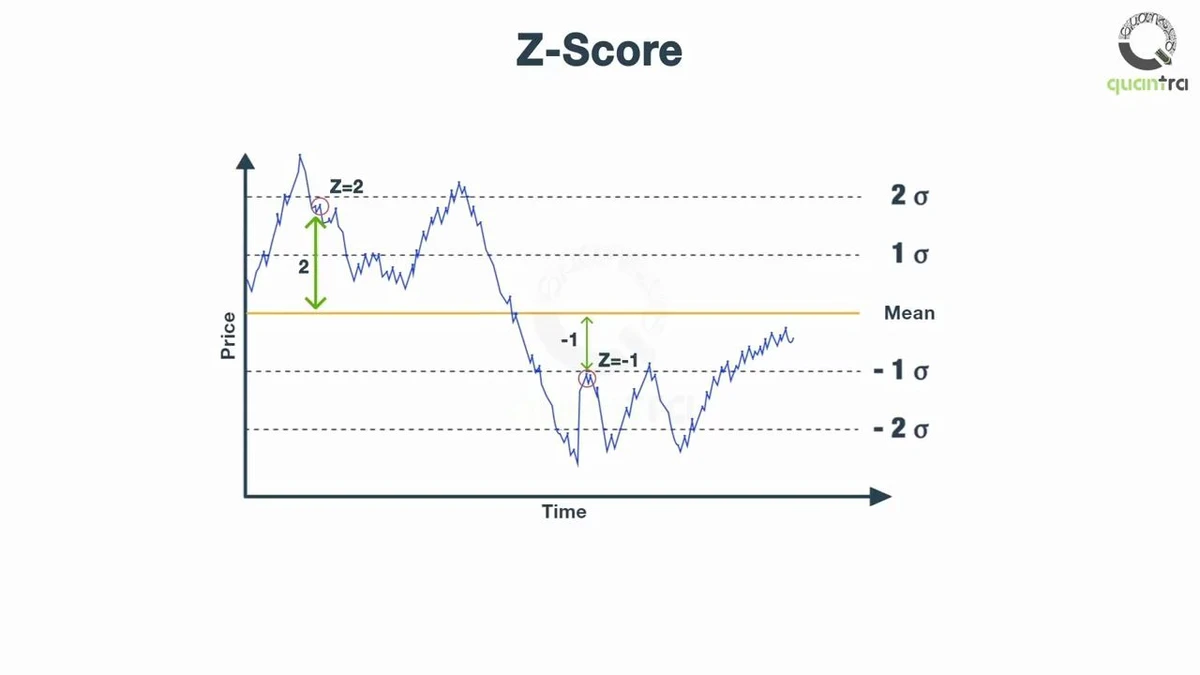

Mean reversion is the statistical tendency of an asset’s price to move back toward its historical mean or equilibrium level after deviating significantly.

- Key Assumption: Prices oscillate around a fair value, and large deviations often present profitable opportunities.

- Applications: Equities, forex, futures, commodities, and even crypto markets.

- Core Goal: Identify overbought or oversold conditions and profit from the correction back to the mean.

Understanding how does mean reversion work in quantitative trading is crucial: it is based on probability distributions, statistical indicators (like standard deviation, Bollinger Bands, or Z-scores), and market behavior.

A visual example of prices reverting toward their mean over time.

Key Elements of Effective Mean Reversion Trading Plans

1. Defining the Mean

The “mean” can be defined in different ways:

- Simple moving averages (SMA)

- Exponential moving averages (EMA)

- Statistical averages over specific timeframes

- Fundamental equilibrium values (e.g., P/E ratios)

2. Entry and Exit Rules

A robust trading plan defines exactly when to enter and exit trades. For instance:

- Buy when price is two standard deviations below its mean.

- Sell when price reverts back to the mean or moves above by one standard deviation.

3. Risk Management

Mean reversion can fail in strong trending markets. Stop-losses, position sizing, and portfolio diversification protect against extended drawdowns.

4. Time Horizon

Short-term mean reversion (intraday or swing trading) differs significantly from long-term reversion strategies (e.g., valuation-based mean reversion in equities).

Two Common Mean Reversion Strategies

Strategy 1: Bollinger Bands Reversion

Bollinger Bands measure volatility around a moving average.

How it works:

- Buy when price touches or breaches the lower band.

- Sell when it reverts to the moving average or crosses above the upper band.

- Buy when price touches or breaches the lower band.

Advantages:

- Easy to implement.

- Works across asset classes.

- Well-documented in both academic and professional research.

- Easy to implement.

Disadvantages:

- False signals in trending markets.

- Requires parameter optimization.

- False signals in trending markets.

Strategy 2: Pairs Trading (Statistical Arbitrage)

Pairs trading involves identifying two historically correlated assets and trading divergences in their relative value.

How it works:

- Go long the undervalued asset and short the overvalued one when the spread diverges from the mean.

- Close the position when the spread converges.

- Go long the undervalued asset and short the overvalued one when the spread diverges from the mean.

Advantages:

- Market-neutral (reduces exposure to broad market risk).

- Strong academic backing and institutional adoption.

- Market-neutral (reduces exposure to broad market risk).

Disadvantages:

- Requires rigorous statistical testing.

- Profitability depends on stable correlations.

- Vulnerable to regime shifts.

- Requires rigorous statistical testing.

Pairs trading example showing divergence and convergence around the mean.

Comparing the Two Strategies

| Feature | Bollinger Bands Reversion | Pairs Trading (Stat Arb) |

|---|---|---|

| Complexity | Low | High |

| Market Neutrality | No | Yes |

| Suitability for Retail | High | Moderate to Low (requires coding) |

| Sensitivity to Trends | High | Moderate |

| Scalability | Medium | High (institutional strategies) |

Recommendation:

- For beginners, Bollinger Bands strategies offer a practical entry point.

- For advanced or institutional traders, pairs trading provides more robust risk-adjusted returns.

Why Mean Reversion Works

Understanding why mean reversion is effective is essential for building conviction:

- Behavioral Finance: Investors overreact to news, pushing prices away from fair value.

- Market Microstructure: Liquidity imbalances create temporary inefficiencies.

- Statistical Tendencies: Reversion to the mean is observed in many natural and financial processes.

Common Pitfalls in Mean Reversion Trading

- Ignoring Transaction Costs: High turnover strategies can lose profitability once fees and slippage are accounted for.

- Overfitting Models: Over-optimizing parameters to historical data leads to poor live performance.

- Trending Market Risks: In strong bull or bear markets, assets may stay “overbought” or “oversold” far longer than expected.

- Correlation Breakdown: In pairs trading, relationships can diverge permanently.

This highlights why mean reversion fails sometimes and why robust risk controls are essential.

Best Practices for Effective Mean Reversion Trading Plans

- Use robust statistical validation such as cointegration tests in pairs trading.

- Always backtest with out-of-sample data to avoid overfitting.

- Incorporate transaction costs and slippage into all backtests.

- Diversify across multiple strategies and assets.

- Monitor continuously—markets evolve, and strategies must adapt.

Practical Example: A Simple Equity Mean Reversion Plan

Setup:

- Asset: S&P 500 stock.

- Indicator: 20-day SMA with Bollinger Bands (2 standard deviations).

- Asset: S&P 500 stock.

Entry: Buy when stock closes below the lower band.

Exit: Sell when stock returns to the SMA.

Stop-loss: 5% below entry price.

Risk per trade: 2% of account balance.

This plan is simple, structured, and easy to automate.

Example of mean reversion trading using Bollinger Bands.

Frequently Asked Questions (FAQ)

1. Is mean reversion still profitable in modern markets?

Yes, but profitability has declined in some areas due to algorithmic competition. However, opportunities remain in less liquid assets, cross-asset pairs, and emerging markets.

2. How do I backtest mean reversion strategies effectively?

Use high-quality historical data, account for transaction costs, and test on both in-sample and out-of-sample data. A mean reversion backtesting toolkit like Backtrader or QuantConnect can help.

3. Which markets are best suited for mean reversion?

Equities and forex are most commonly used. Understanding how mean reversion affects stock prices shows that large-cap equities tend to revert to fundamentals, while forex often oscillates within ranges.

4. Should beginners use mean reversion?

Yes, mean reversion for beginners can be simpler than momentum trading, provided strict risk management is followed.

Conclusion

Building effective mean reversion trading plans requires a mix of statistical rigor, practical risk management, and adaptability. While Bollinger Bands strategies provide a straightforward entry point, pairs trading and advanced statistical arbitrage offer scalable opportunities for professionals.

Ultimately, success depends on aligning strategy complexity with trader expertise, testing rigorously, and constantly refining based on evolving market conditions.

Have you ever tried a mean reversion strategy in your trading? Share your experiences in the comments below, and don’t forget to forward this article to fellow traders who might benefit from structured approaches to mean reversion!