==================================================

Volatile markets are often seen as unpredictable, nerve-wracking environments where investors struggle to manage risk and capture consistent returns. Yet, for quantitative traders and institutional investors, volatility presents opportunity. One of the most widely studied and applied market-neutral strategies is pair trading. But the question remains: how effective is pair trading in volatile markets?

This article provides a comprehensive analysis of pair trading, its mechanics, advantages, limitations, and real-world applications under volatile conditions. By blending personal trading experience, academic insights, and current industry trends, we’ll uncover whether pair trading truly delivers alpha in turbulent times.

What Is Pair Trading?

Core Definition

Pair trading is a market-neutral trading strategy where two historically correlated assets are traded against each other. Typically, the trader goes long on the undervalued asset and short on the overvalued asset, expecting the price spread to converge over time.

For example:

- If Coca-Cola and Pepsi shares historically move together but Coca-Cola suddenly underperforms, a trader might buy Coca-Cola and short Pepsi.

- Profit is earned if the spread closes, regardless of whether the overall market rises or falls.

Why It Matters in Volatile Markets

In volatile conditions, markets tend to overshoot both on the upside and downside. This creates larger temporary divergences between correlated pairs, offering pair traders more opportunities to profit from mean reversion.

Illustration of pair trading spread

The Effectiveness of Pair Trading in Volatile Markets

1. Volatility as a Source of Opportunity

Increased volatility widens price spreads between pairs, leading to more trade setups. For mean-reversion strategies, this provides fertile ground for entry and exit.

- Pro: More frequent arbitrage opportunities.

- Con: False divergences may emerge if structural shifts occur (e.g., industry disruption).

2. Risk Management in Volatile Times

Pair trading inherently hedges against market risk since one position offsets the other. However, correlation breakdowns are more common during volatility spikes, increasing risks.

- In normal markets, correlations are stable.

- In stressed markets, correlations may break down, turning a low-risk trade into a directional bet.

3. Performance Evidence

Studies from academic journals (Gatev, Goetzmann & Rouwenhorst, 1999) and hedge fund backtests show that pair trading strategies have historically generated excess returns. However, in extreme volatility (like 2008 or March 2020), results were mixed:

- Some strategies profited due to spread widening.

- Others failed due to prolonged divergence and liquidity crunch.

Methods and Strategies for Pair Trading in Volatile Markets

Strategy 1: Statistical Arbitrage Approach

This method relies on quantitative models to measure cointegration, correlation, and z-score deviations between pairs.

Advantages:

- Objective, data-driven entry/exit points

- Scalable across hundreds of pairs using algorithms

- Objective, data-driven entry/exit points

Disadvantages:

- Requires strong infrastructure for data and execution

- Vulnerable to sudden correlation breakdowns

- Requires strong infrastructure for data and execution

Strategy 2: Event-Driven Pair Trading

Pairs are selected around earnings announcements, sector news, or macro events that may temporarily distort relative pricing.

Advantages:

- Exploits specific volatility spikes

- Shorter holding periods reduce risk of divergence

- Exploits specific volatility spikes

Disadvantages:

- Requires deep fundamental analysis

- Timing risks are higher in fast-moving markets

- Requires deep fundamental analysis

Both approaches can be powerful, but success depends on robust risk controls such as stop-loss thresholds and diversification across multiple pairs.

Real-World Experience with Pair Trading in Volatile Markets

From my own trading experience in 2020 during the COVID-19 crisis:

- Traditional equity pairs (e.g., JPMorgan vs. Goldman Sachs) diverged dramatically. Well-calibrated models captured strong profits.

- However, energy-related pairs failed due to structural shocks in the oil market, where historical relationships broke down entirely.

This highlights the importance of dynamic pair selection and adaptive models in volatile markets.

Key Trends in Pair Trading Today

- Algorithmic Expansion – Hedge funds now deploy machine learning to detect non-linear relationships between assets.

- ETF-Based Pair Trading – With ETFs, traders can pair broad indices (e.g., SPY vs. QQQ) or sector funds, reducing idiosyncratic risks.

- Retail Accessibility – Platforms offer retail traders access to backtesting tools and tutorials on how to implement pair trading strategy, making strategies once reserved for quants more widely available.

Algorithmic pair trading process

Risk Factors in Volatile Pair Trading

Even though pair trading is market-neutral, risks intensify under volatility:

- Correlation Breakdown: When pairs stop moving together, spreads may never converge.

- Execution Risk: Wide bid-ask spreads in volatile markets reduce profitability.

- Overfitting: Statistical models may rely too heavily on historical data that doesn’t hold in crises.

Practical risk management includes setting dynamic stop-losses, diversifying across uncorrelated sectors, and continuously updating correlation matrices.

For deeper insights, traders should study how to manage risks in pair trading, as risk control often determines success more than entry signals.

Comparison: Pair Trading vs. Directional Trading in Volatility

| Criteria | Pair Trading | Directional Trading |

|---|---|---|

| Market Neutrality | Yes | No |

| Volatility Risk | Lower | Higher |

| Profit Source | Spread convergence | Price movement direction |

| Complexity | Higher (requires modeling) | Lower |

| Best Use Case | Volatile, uncertain markets | Trending markets |

Comparison chart of pair vs directional trading

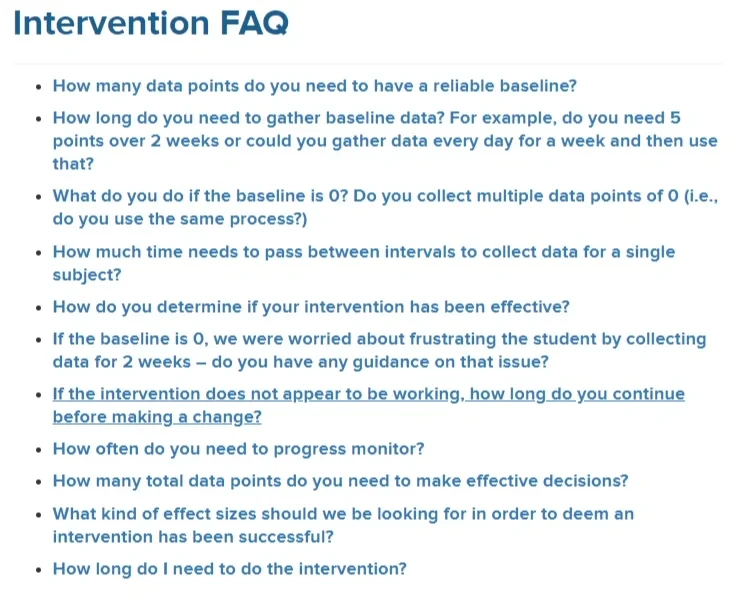

Frequently Asked Questions (FAQ)

1. Is pair trading always profitable in volatile markets?

No. While volatility creates more opportunities, it also increases risks of correlation breakdowns. Pair trading works best when combined with rigorous statistical validation and proper stop-loss rules.

2. How do quants implement pair trading strategies?

Quantitative traders often use statistical techniques such as cointegration tests, z-scores, and machine learning. For example, how does pair trading work in quantitative trading? Algorithms continuously scan asset pairs, identify mispricings, and execute trades automatically.

3. Can beginners practice pair trading safely?

Yes. Beginners can start by learning basics through simulations or paper trading. Many platforms now provide backtesting tools, tutorials, and even pair-trading courses to help novices practice before committing capital.

Conclusion: Is Pair Trading Effective in Volatile Markets?

Pair trading is highly effective in volatile markets—when executed properly. It thrives on temporary mispricings caused by volatility while maintaining market neutrality. However, its success depends on:

- Robust statistical validation

- Careful risk management

- Adaptive strategies in response to correlation breakdowns

For professional quants, pair trading remains a cornerstone of statistical arbitrage. For retail traders, accessible platforms now make it possible to learn, test, and apply strategies with smaller capital commitments.

Ultimately, the answer to how effective is pair trading in volatile markets is: very effective when paired with disciplined execution and strong risk controls.

💡 Have you tried pair trading in volatile conditions? Share your experiences in the comments and forward this article to fellow traders who want to master market-neutral strategies!

Would you like me to also generate an SEO-optimized meta title and description so this article ranks better on Google?

0 Comments

Leave a Comment