=================================

In financial markets, predicting asset returns and managing risk are two of the most complex challenges faced by investors. One of the most widely adopted solutions is the use of factor models. By breaking down returns into systematic components and isolating drivers of performance, factor models provide a framework to anticipate trends, optimize portfolios, and control exposure. For traders and investors wondering how factor models predict markets, this article offers a deep dive into the mechanics, applications, advantages, and pitfalls of these models.

What Are Factor Models?

Factor models explain the returns of securities or portfolios by relating them to a set of risk factors or return drivers. Instead of attributing performance to randomness, they break it into predictable components.

Types of Factors

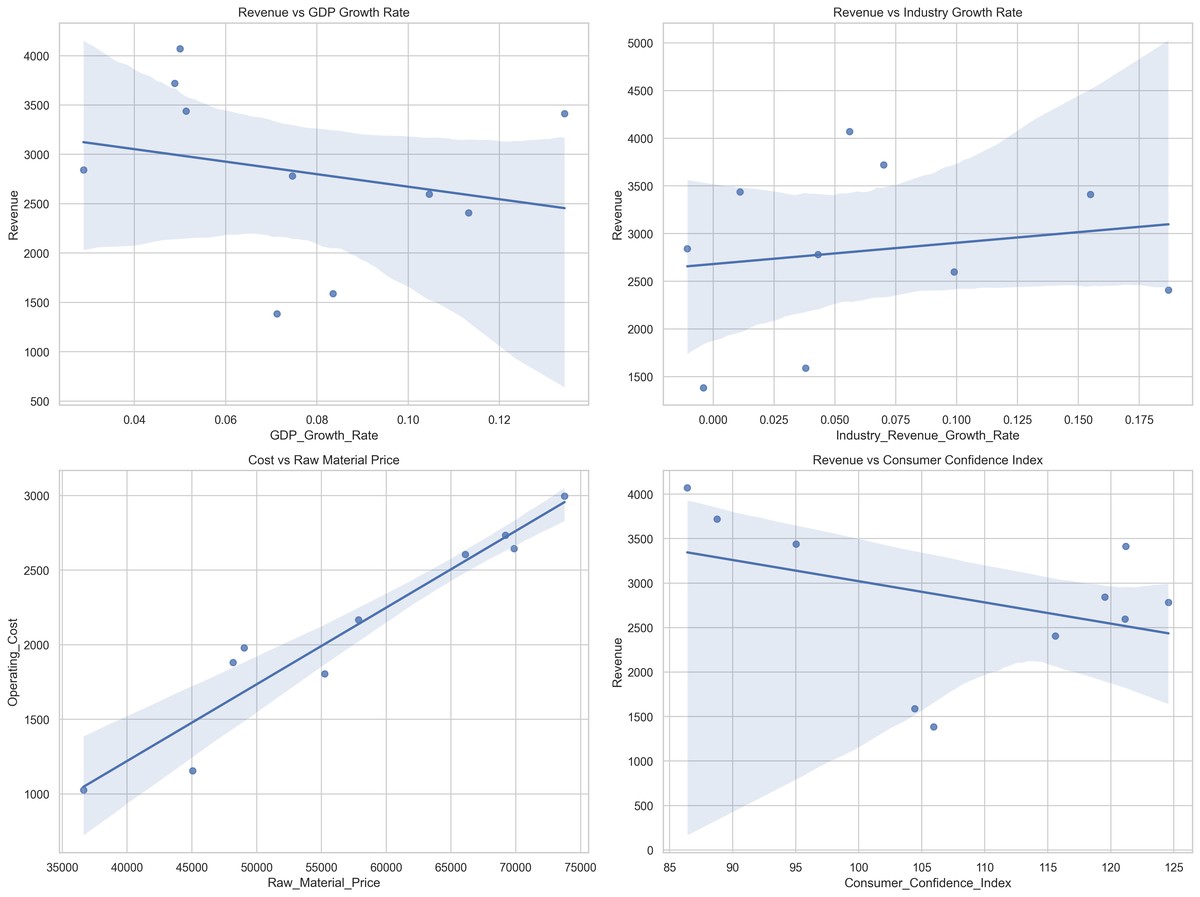

- Macroeconomic factors: GDP growth, inflation, interest rates.

- Style factors: Value, momentum, size, quality, low volatility.

- Statistical factors: Extracted through principal component analysis or other data-driven techniques.

Why Factor Models Matter

- They provide structure for analyzing markets.

- They allow portfolio managers to separate alpha (skill) from beta (systematic exposure).

- They help traders evaluate risk and opportunities across asset classes.

How Factor Models Predict Markets

1. The Single-Factor Model

One of the earliest approaches, such as the Capital Asset Pricing Model (CAPM), assumes that returns are primarily driven by the market factor.

Mechanism:

Ri=α+βiRm+ϵiR_i = \alpha + \beta_i R_m + \epsilon_iRi=α+βiRm+ϵi

Where:- RiR_iRi = return of asset i

- RmR_mRm = return of the market portfolio

- βi\beta_iβi = sensitivity of asset i to the market

- ϵi\epsilon_iϵi = idiosyncratic error

- RiR_iRi = return of asset i

Prediction Capability: It forecasts how securities will react to changes in market returns.

Limitation: Oversimplified, ignores style and sector drivers.

2. The Multi-Factor Model

Modern finance relies heavily on multi-factor models (e.g., Fama-French three-factor or five-factor models).

Mechanism:

Ri=α+β1F1+β2F2+…+βnFn+ϵiR_i = \alpha + \beta_1 F_1 + \beta_2 F_2 + … + \beta_n F_n + \epsilon_iRi=α+β1F1+β2F2+…+βnFn+ϵi

Here, F1,F2…FnF_1, F_2 … F_nF1,F2…Fn represent multiple drivers like value, momentum, or interest rates.

Prediction Capability:

- More granular insights into return drivers.

- Can forecast how portfolios react to style shifts, sector rotations, or macroeconomic events.

- More granular insights into return drivers.

Limitation: Complex calibration, prone to overfitting.

Factor models decompose returns into systematic and idiosyncratic drivers.

Comparing Two Factor Model Approaches

Fundamental Factor Models

These rely on economic or accounting data (e.g., book-to-market ratios, earnings yield, GDP growth).

- Pros: Grounded in real-world data, interpretable.

- Cons: Slow to adapt to fast-changing markets, backward-looking.

Statistical Factor Models

These extract patterns using tools like PCA (Principal Component Analysis).

- Pros: Adaptive, can uncover hidden factors.

- Cons: Harder to interpret, sensitive to noisy data.

Best Recommendation:

Use hybrid models that combine fundamental insights with statistical methods, balancing interpretability and adaptability.

Practical Applications of Factor Models in Market Prediction

1. Equity Portfolio Management

Portfolio managers use factor exposures (value, size, momentum) to predict expected returns and rebalance portfolios.

2. Risk Management

Risk managers monitor factor sensitivities to hedge against macro shocks (e.g., interest rate hikes).

3. Quantitative Trading

Quantitative analysts integrate factor models into algorithms to forecast short-term and long-term market movements. This explains how factor models work in quantitative trading, where signals are embedded directly into execution logic.

Case Study: Factor Models in Action

A hedge fund integrates a multi-factor model with exposures to momentum, quality, and interest rates. During an economic downturn:

- The momentum factor predicted short-term sell-offs.

- The quality factor signaled defensive positioning.

- Interest rate exposure warned of bond-equity correlation shifts.

Result: The portfolio outperformed benchmarks by 4% over 12 months by rebalancing ahead of market shifts.

Analyzing factor exposures reveals which drivers contribute most to portfolio performance.

Challenges in Using Factor Models

1. Factor Instability

Relationships between factors and returns may change over time (e.g., momentum underperforms in sideways markets).

2. Overfitting Risk

Too many factors may fit historical data well but fail in live trading.

3. Data Quality

Poor or lagging data undermines prediction accuracy.

Best Practices for Factor Model Implementation

- Limit the number of factors to avoid noise.

- Regularly update models to reflect regime shifts.

- Perform out-of-sample testing to ensure predictive reliability.

- Use where to find factor model data sources that provide clean, timely datasets.

The Future of Factor Models

Integration with Machine Learning

Machine learning can dynamically adjust factor weights, improving adaptability.

Alternative Data

Social sentiment, ESG signals, and big data inputs are enhancing predictive power.

Personalized Factor Models

Retail platforms are beginning to offer simplified versions of factor models for individual investors.

FAQ: How Factor Models Predict Markets

1. Do factor models guarantee accurate market predictions?

No model guarantees certainty. Factor models improve probabilistic forecasts, but traders must combine them with risk management and diversification.

2. Which factor model is best for beginners?

The Fama-French three-factor model is a great starting point because it balances simplicity and explanatory power. Beginners can then expand to more advanced frameworks.

3. How often should factor models be recalibrated?

Regularly—typically quarterly or semi-annually. However, high-frequency trading strategies may require daily or even intraday recalibration.

Final Thoughts

Understanding how factor models predict markets provides traders and investors with powerful insights into the drivers of asset returns. By decomposing performance into systematic and idiosyncratic elements, these models enable better forecasting, smarter risk management, and more consistent investment strategies.

For professionals, blending fundamental and statistical models offers the most robust predictive power. For beginners, starting with simpler models before layering complexity ensures a solid foundation.

💡 What about you? Have you used factor models in your trading or investing strategies? Share your experiences in the comments and forward this article to peers interested in predictive analytics in finance!

0 Comments

Leave a Comment