===============================================================================

Introduction

Factor models have become one of the most reliable frameworks in modern portfolio management, risk analysis, and quantitative trading. By breaking down asset returns into explanatory components, traders and investors can identify systematic sources of risk and alpha. In this article, we will dive deep into factor model strategy examples, comparing different approaches, analyzing their pros and cons, and exploring how they are applied in real-world investment scenarios. This guide is designed to provide not only theory but also actionable insights backed by research and practical experience.

What Is a Factor Model in Finance?

A factor model is a statistical approach used to explain the returns of assets by identifying common drivers or “factors.” These can be macro factors (such as interest rates, inflation, or GDP growth) or style factors (such as value, momentum, size, or volatility).

- Single-factor models: Explain asset returns using one primary factor, e.g., the Capital Asset Pricing Model (CAPM), which uses market beta as the single driver.

- Multi-factor models: Incorporate multiple variables, such as the Fama-French 3-Factor Model, later extended to 5 factors, including profitability and investment.

By using factor models, portfolio managers can identify which exposures drive performance and where risks lie.

Why Use Factor Models in Trading and Investment?

Factor models are widely adopted because they:

- Improve risk management: They highlight hidden exposures to economic shocks.

- Support alpha generation: Factor tilts (e.g., momentum or value) can systematically outperform markets.

- Enhance portfolio diversification: Instead of focusing on sectors, factor models diversify across risk drivers.

As discussed in why use factor models in trading, they not only provide transparency but also allow traders to implement disciplined, repeatable strategies that reduce reliance on speculation.

Core Factor Model Strategy Examples

1. Value Factor Strategy

The value factor is one of the oldest and most studied factors. It is based on the principle that undervalued companies (low price-to-earnings or price-to-book ratios) outperform overvalued ones in the long run.

How it works:

- Rank stocks by valuation metrics.

- Construct a portfolio with the cheapest decile and short the most expensive decile.

- Rank stocks by valuation metrics.

Advantages:

- Strong academic and empirical support.

- Works well in long-term investment horizons.

- Strong academic and empirical support.

Limitations:

- Can underperform in growth-driven markets.

- Value traps (cheap for a reason) can hurt performance.

- Can underperform in growth-driven markets.

2. Momentum Factor Strategy

Momentum strategies capitalize on the tendency of assets with recent high returns to continue performing well in the near future.

How it works:

- Rank assets by 6–12 months past performance.

- Buy top performers, sell laggards.

- Rank assets by 6–12 months past performance.

Advantages:

- Consistent across asset classes and geographies.

- Robust empirical evidence.

- Consistent across asset classes and geographies.

Limitations:

- Vulnerable to sharp reversals (“momentum crashes”).

- Requires strict risk management.

- Vulnerable to sharp reversals (“momentum crashes”).

3. Quality Factor Strategy

Quality strategies favor firms with strong profitability, stable earnings, and low debt.

How it works:

- Screen for high return on equity (ROE), low debt-to-equity, and stable cash flows.

- Build portfolios with top-ranked companies.

- Screen for high return on equity (ROE), low debt-to-equity, and stable cash flows.

Advantages:

- Resilient during downturns.

- Appeals to conservative investors.

- Resilient during downturns.

Limitations:

- Can lag in speculative, high-growth markets.

- Quality metrics may be manipulated by accounting choices.

- Can lag in speculative, high-growth markets.

4. Multi-Factor Strategy Example

Instead of relying on a single factor, many funds combine factors such as value, momentum, quality, and size.

How it works:

- Create a composite scoring system across multiple factors.

- Diversify across factors to reduce drawdowns.

- Create a composite scoring system across multiple factors.

Advantages:

- Balanced risk-adjusted returns.

- Reduces concentration in a single factor.

- Balanced risk-adjusted returns.

Limitations:

- Complexity in construction.

- Risk of factor correlation during crises.

- Complexity in construction.

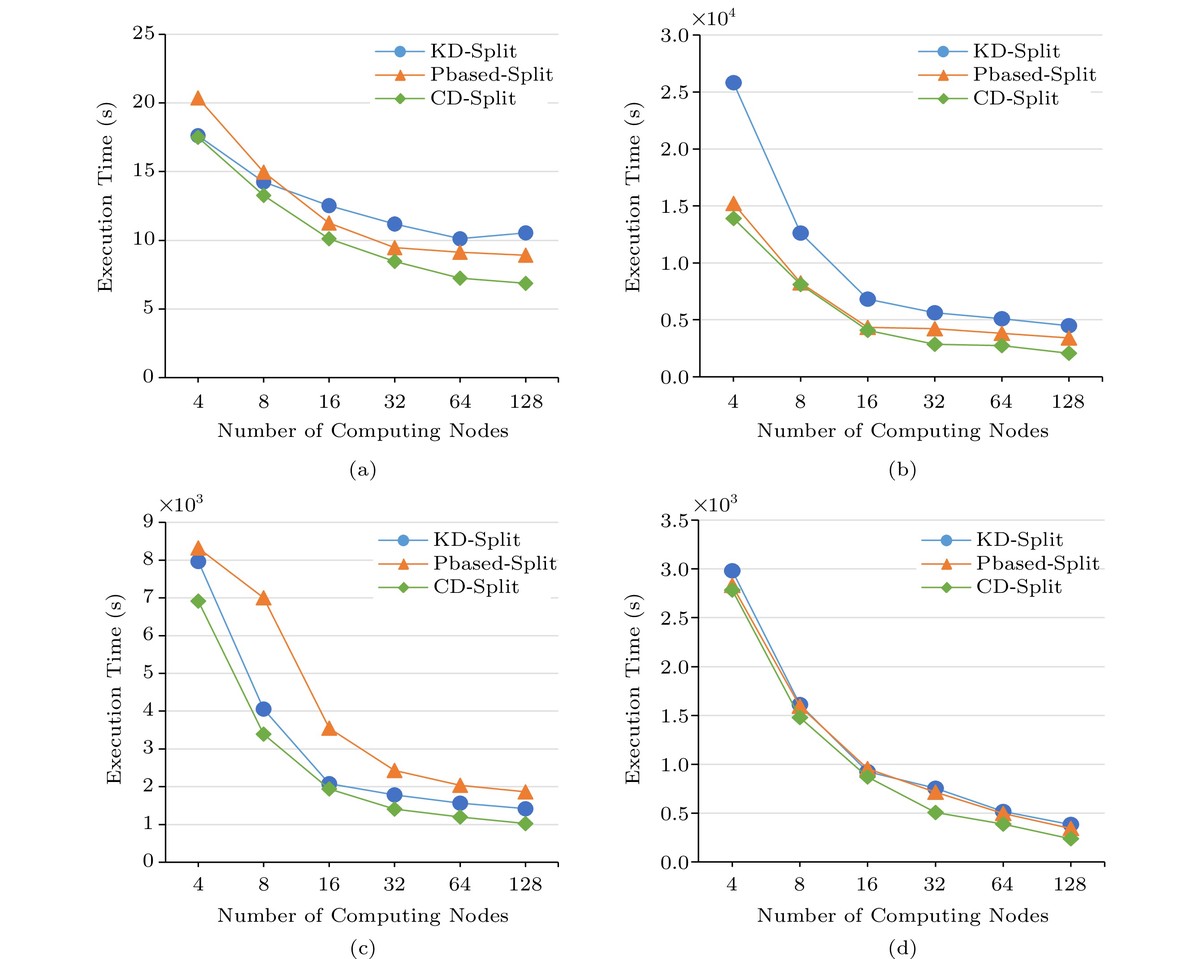

Factor exposures comparison across Value, Momentum, Quality, and Size

Comparing Factor Model Strategies: Strengths and Weaknesses

| Strategy | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| Value Factor | Long-term outperformance, easy to implement | Weak in growth markets, value traps | Long-term investors |

| Momentum Factor | High short-term gains, works across markets | Momentum crashes, high turnover | Active traders |

| Quality Factor | Defensive, resilient in downturns | Underperforms in speculative markets | Conservative portfolios |

| Multi-Factor | Balanced returns, diversification | Complex, factor correlations | Institutional investors |

Practical Applications of Factor Models

Portfolio Construction

Factor models are widely used in portfolio optimization. For instance, a portfolio manager might balance exposure to value and momentum while controlling for volatility.

Risk Management

By using factor models, risk managers can identify hidden exposures. For example, a portfolio may appear diversified across industries but still be heavily tilted toward the growth factor.

Quantitative Trading

Factor models are also used in algorithmic trading. As highlighted in how factor models work in quantitative trading, algorithms rely on predictive signals from factor exposures to build systematic, rules-based strategies.

Visualization of factor model integration in portfolio construction

Best Practices When Using Factor Models

- Backtesting rigorously: Always test strategies over different regimes.

- Avoid overfitting: Too many factors may weaken predictive power.

- Monitor factor decay: Market dynamics change; factors may lose effectiveness.

- Dynamic weighting: Adjust factor weights based on market conditions.

Emerging Trends in Factor Model Strategies

- Machine Learning Integration: Advanced models incorporate AI techniques for better factor selection.

- Alternative Data: Sentiment, ESG scores, and satellite imagery are being used as new factors.

- Dynamic Factor Allocation: Adaptive models shift weights as macro conditions evolve.

These innovations signal that factor models are moving beyond traditional finance, combining quantitative rigor with big data insights.

FAQ: Factor Model Strategies

1. Are factor models only useful for institutional investors?

No. While hedge funds and large asset managers pioneered factor models, retail traders now have access to factor ETFs and online tools, making these strategies accessible for beginners and professionals alike.

2. What is the difference between factor investing and stock picking?

Factor investing focuses on systematic, rules-based exposure to factors such as value or momentum. Stock picking relies on discretionary analysis of individual companies. Factor strategies reduce behavioral bias and emphasize consistency.

3. How do I know if my factor strategy is working?

You can evaluate a factor model through backtesting, performance attribution, and risk-adjusted metrics like Sharpe ratio and information ratio. As explained in how to evaluate factor model performance, consistent results across market cycles are a strong indicator of robustness.

Conclusion

Factor models represent a powerful framework for both risk management and alpha generation. From simple value strategies to advanced multi-factor approaches, these models help traders and investors navigate markets with clarity and discipline. While no single factor works in all conditions, a thoughtful combination tailored to specific objectives often yields the best results.

If you found these factor model strategy examples insightful, share this article with colleagues, leave a comment with your favorite strategy, and join the discussion on how factor models are reshaping modern investing.

Would you like me to also create a downloadable PDF version of this article so you can share it with your colleagues or team?

0 Comments

Leave a Comment