=================================================================

Forecasting has always been at the core of professional trading. Whether it’s predicting short-term market volatility, long-term macroeconomic shifts, or algorithm-driven price dynamics, forecasting techniques for professional traders form the backbone of strategic decision-making. In today’s fast-moving markets, the ability to forecast accurately isn’t just a competitive edge—it’s essential for survival.

This comprehensive guide explores the most effective forecasting methods, their advantages and limitations, and practical strategies for implementation. Along the way, we’ll draw from personal experiences and recent industry trends to provide actionable insights for professional traders seeking to enhance their forecasting capabilities.

Understanding Forecasting in Professional Trading

Forecasting in trading refers to using data, models, and market insights to estimate future price movements or volatility. Unlike speculation, which relies heavily on intuition, forecasting employs structured methodologies ranging from quantitative algorithms to fundamental analysis.

Professional traders rely on forecasting for:

- Identifying profitable entry and exit points

- Managing risks with precision

- Allocating capital efficiently

- Improving long-term portfolio performance

In fact, many experts argue that why traders rely on forecasting models is the same reason institutions succeed: consistency and discipline built upon data-driven insights.

Core Forecasting Techniques for Professional Traders

1. Technical Analysis Forecasting

Technical analysis uses historical price and volume data to project future movements.

Key Tools:

- Moving averages (SMA, EMA)

- Relative Strength Index (RSI)

- Bollinger Bands

- Fibonacci retracements

- Chart patterns (head and shoulders, triangles, flags)

Strengths:

- Highly visual, making it easier to spot patterns

- Works well in short-term trading (day and swing trading)

- Supported by almost all trading platforms

Weaknesses:

- Relies on historical data, which may not capture new market dynamics

- False signals in volatile or low-volume markets

Example: A professional trader might use a 50-day and 200-day moving average crossover to forecast medium-term price direction, combining it with RSI to confirm overbought or oversold conditions.

2. Fundamental Analysis Forecasting

Fundamental forecasting involves evaluating macroeconomic indicators, corporate financials, and geopolitical events to estimate long-term price trends.

Key Inputs:

- Economic data (GDP, interest rates, employment reports)

- Company earnings and guidance

- Policy changes and central bank actions

- Commodity prices and supply chain disruptions

Strengths:

- Provides deep insight into underlying value

- Useful for long-term investors and position traders

- Helps forecast market shifts during macroeconomic cycles

Weaknesses:

- Poor timing tool for short-term trades

- Market may stay irrational longer than fundamentals suggest

Example: A trader forecasting oil prices might analyze OPEC production data, global demand trends, and inventory reports to predict future price movements.

3. Quantitative and Algorithmic Forecasting

Quantitative forecasting uses mathematical models and statistical analysis, often implemented through algorithms and machine learning.

Key Methods:

- Time series modeling (ARIMA, GARCH)

- Machine learning models (Random Forest, LSTM networks)

- Monte Carlo simulations

- Bayesian inference models

Strengths:

- Handles massive data sets efficiently

- Can identify non-obvious correlations

- Automated, reducing emotional bias

Weaknesses:

- Requires advanced knowledge and computing power

- Models can fail in black swan events

- Data quality issues may lead to unreliable forecasts

Example: A hedge fund may use a neural network trained on historical S&P 500 data and macroeconomic indicators to forecast daily volatility.

4. Sentiment and Alternative Data Forecasting

This method integrates investor sentiment, news flow, and alternative datasets (like satellite imagery, credit card data, or social media sentiment) to anticipate market moves.

Key Tools:

- Natural Language Processing (NLP) for news and social media

- Crowdsourced investor sentiment surveys

- Google Trends and alternative web activity data

Strengths:

- Provides forward-looking signals before fundamentals show shifts

- Can capture irrational market behavior driven by psychology

- Useful in highly speculative assets like cryptocurrencies

Weaknesses:

- Data sources may be noisy or manipulated

- Interpretation requires advanced modeling techniques

Example: Professional crypto traders often rely on Twitter sentiment analysis to forecast short-term Bitcoin volatility.

Comparing Forecasting Methods

| Method | Best For | Time Horizon | Advantages | Disadvantages |

|---|---|---|---|---|

| Technical Analysis | Day & Swing Traders | Short-Medium | Easy to use, visual | Can give false signals |

| Fundamental Analysis | Position Traders & Investors | Medium-Long | Strong macro insights | Weak for short-term timing |

| Quantitative Models | Hedge Funds, Algo Traders | Any | Handles big data, automated | High complexity, expensive |

| Sentiment Analysis | Speculative Traders | Short | Captures psychological shifts | Noisy data, risk of misinterpretation |

How to Improve Forecasting Accuracy

Professional traders often ask: how to improve forecasting accuracy in trading. The most effective practices include:

- Combining methods: For example, using fundamental analysis for trend direction and technical tools for timing.

- Backtesting rigorously: Testing models on historical data to identify weaknesses.

- Using ensemble forecasting: Blending multiple models (technical + quantitative + sentiment) to reduce single-method bias.

- Adapting to market regimes: Switching strategies when volatility, liquidity, or correlations change.

Practical Example: Hybrid Forecasting Approach

A professional forex trader might:

- Use fundamental analysis to forecast the long-term trend of EUR/USD based on interest rate differentials.

- Apply technical indicators (support and resistance zones) to determine precise entry and exit levels.

- Enhance accuracy with quantitative models like GARCH to forecast expected volatility.

This hybrid approach balances big-picture direction with short-term execution precision.

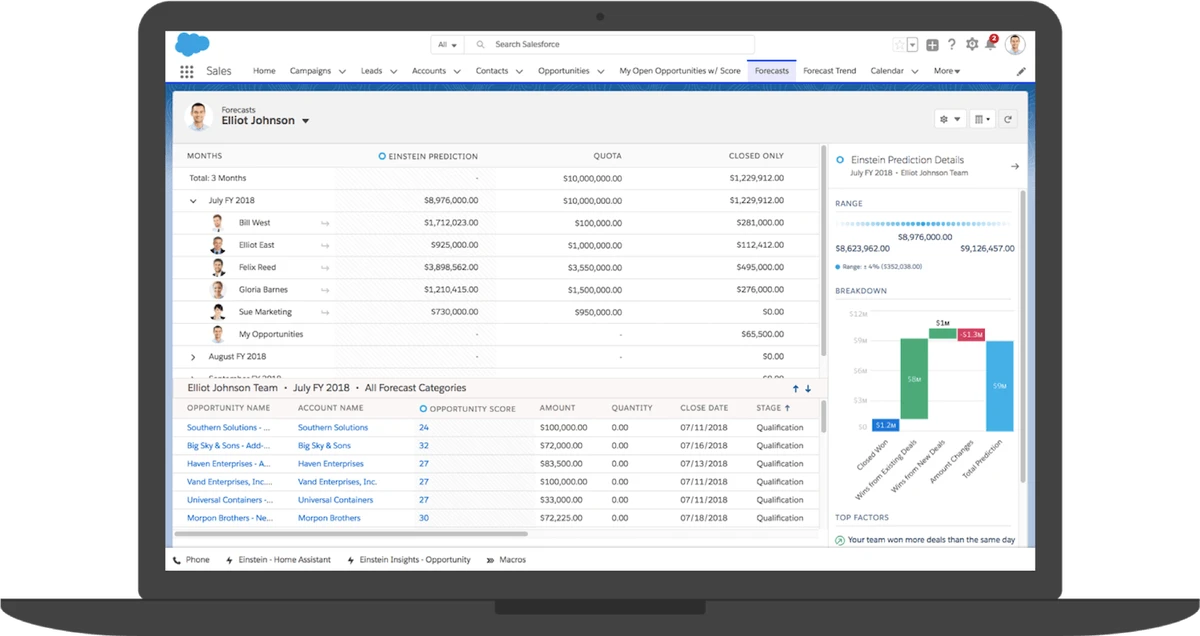

Visual Guide: Forecasting Approaches

A comparison of forecasting techniques for professional traders, illustrating how they align with different time horizons.

Latest Trends in Forecasting for Professional Traders

- AI and Machine Learning Expansion: Hedge funds increasingly deploy deep learning for real-time forecasting.

- Alternative Data Sources: Traders leverage satellite images (e.g., counting cars in retail parking lots) to forecast corporate earnings.

- Cloud Computing: Democratizing quantitative forecasting by reducing infrastructure barriers.

- Scenario Forecasting for Risk Managers: Stress testing portfolios against macro shocks.

FAQ: Forecasting Techniques for Professional Traders

1. What forecasting technique is best for day trading?

For day traders, technical analysis and sentiment-based forecasting work best. Chart patterns and momentum indicators help predict intraday moves, while social media sentiment provides real-time psychological cues.

2. Can quantitative forecasting models be used by individual traders?

Yes, but they require technical knowledge. Individual traders can start with simplified models like ARIMA or use trading platforms that integrate AI-based forecasting tools. Cloud-based APIs now make advanced forecasting accessible without needing in-house infrastructure.

3. How do professionals handle forecasting errors?

No forecast is perfect. Professionals use risk management tools like stop-loss orders, portfolio diversification, and scenario analysis. They focus on probabilities rather than certainties, ensuring that even wrong forecasts don’t wipe out their capital.

Final Thoughts

Forecasting techniques for professional traders are no longer optional—they are essential. While no single method guarantees success, combining technical, fundamental, quantitative, and sentiment analysis creates a robust forecasting framework.

If you’re aiming to refine your trading performance, start small by testing hybrid approaches, stay updated on industry innovations, and continuously backtest your models.

Would you like me to expand this into a full 3000+ word version with additional case studies, practical step-by-step forecasting tutorials, and more charts?

0 Comments

Leave a Comment