=================================================================================

Introduction

Hedge fund managers operate in an environment defined by uncertainty, volatility, and competition. In this landscape, forecasting tools for hedge fund managers are not just a luxury—they are a necessity. Forecasting involves applying quantitative models, statistical methods, and AI-driven solutions to predict market movements, identify opportunities, and mitigate risks.

This article provides a comprehensive guide to forecasting tools tailored for hedge fund managers, exploring the latest methods, comparing their advantages and limitations, and offering practical strategies for implementation. Drawing on both academic research and professional experience, the discussion aligns with EEAT principles (Expertise, Authoritativeness, Trustworthiness, Experience) to ensure credibility.

The Role of Forecasting in Hedge Fund Management

Forecasting equips hedge fund managers with the ability to make data-driven decisions. Unlike traditional discretionary trading, hedge fund operations often rely on systematic, repeatable strategies. Accurate forecasts can impact:

- Portfolio allocation – identifying asset classes or sectors likely to outperform.

- Risk management – preparing for downside scenarios with protective strategies.

- Alpha generation – capturing inefficiencies in pricing through predictive models.

- Investor communication – demonstrating disciplined processes supported by quantifiable data.

For hedge funds, forecasting is not only about predicting the future but also about assigning probabilities to various scenarios and optimizing portfolio exposure accordingly.

Core Categories of Forecasting Tools

1. Statistical and Econometric Models

Traditional econometrics remains a foundation of forecasting. Hedge fund managers still use time-series analysis tools such as:

- ARIMA (AutoRegressive Integrated Moving Average) for short-term financial forecasting.

- GARCH (Generalized Autoregressive Conditional Heteroskedasticity) to model volatility.

- Cointegration models to capture long-term equilibrium relationships.

Pros: Transparent, interpretable, and well-tested in financial literature.

Cons: Limited flexibility in handling nonlinearities or large datasets.

2. Machine Learning and AI-Driven Forecasting

The last decade has brought machine learning into the core of hedge fund strategies. Popular approaches include:

- Random Forests and Gradient Boosting for feature-rich predictive analysis.

- Deep Learning (LSTMs, Transformers) for sequential financial data.

- Reinforcement Learning to adaptively optimize trading strategies.

Pros: Highly adaptable, capable of uncovering hidden patterns, and powerful with high-dimensional data.

Cons: Requires significant computational resources, large datasets, and robust validation frameworks.

Forecasting Tools in Practice

Tool 1: Bloomberg Terminal and Quantitative APIs

Bloomberg remains indispensable for hedge fund managers due to its integration of macro forecasting, sentiment indicators, and risk modeling. Through APIs, managers can feed Bloomberg data into custom forecasting models.

- Strengths: Comprehensive data, real-time feeds, and professional-grade analytics.

- Weaknesses: High cost, limited flexibility for proprietary model integration compared to open-source tools.

Tool 2: Python Ecosystem (Pandas, Scikit-learn, TensorFlow)

Python-based frameworks have democratized forecasting capabilities. Hedge fund quants often build pipelines using:

- Pandas for time-series manipulation.

- Scikit-learn for machine learning models.

- TensorFlow/PyTorch for advanced deep learning architectures.

- Strengths: Full control over design, scalable, integrates with cloud computing.

- Weaknesses: Requires strong in-house quantitative and programming expertise.

Comparing Forecasting Approaches

Quantitative Econometric Models

- Use Case: Forecasting FX carry trade risks, bond yield spreads.

- Advantage: Intuitive and explainable.

- Limitation: May fail in nonlinear, chaotic market conditions.

Machine Learning Models

- Use Case: Equity market predictions, options volatility surfaces, cross-asset correlations.

- Advantage: Can adapt to evolving market dynamics and exploit non-linearities.

- Limitation: Black-box nature may reduce interpretability, posing challenges in regulatory reporting.

Industry Trends in Forecasting

- Hybrid Modeling Approaches – Combining econometrics with machine learning. For example, using GARCH for volatility prediction and LSTMs for regime detection.

- Alternative Data Integration – Hedge funds increasingly incorporate satellite imagery, shipping data, and social media sentiment into their models.

- Cloud-Based Forecasting Platforms – SaaS solutions allow funds to scale computationally intensive models without maintaining expensive infrastructure.

- Explainable AI (XAI) – As regulators demand transparency, hedge funds adopt XAI to interpret forecasts.

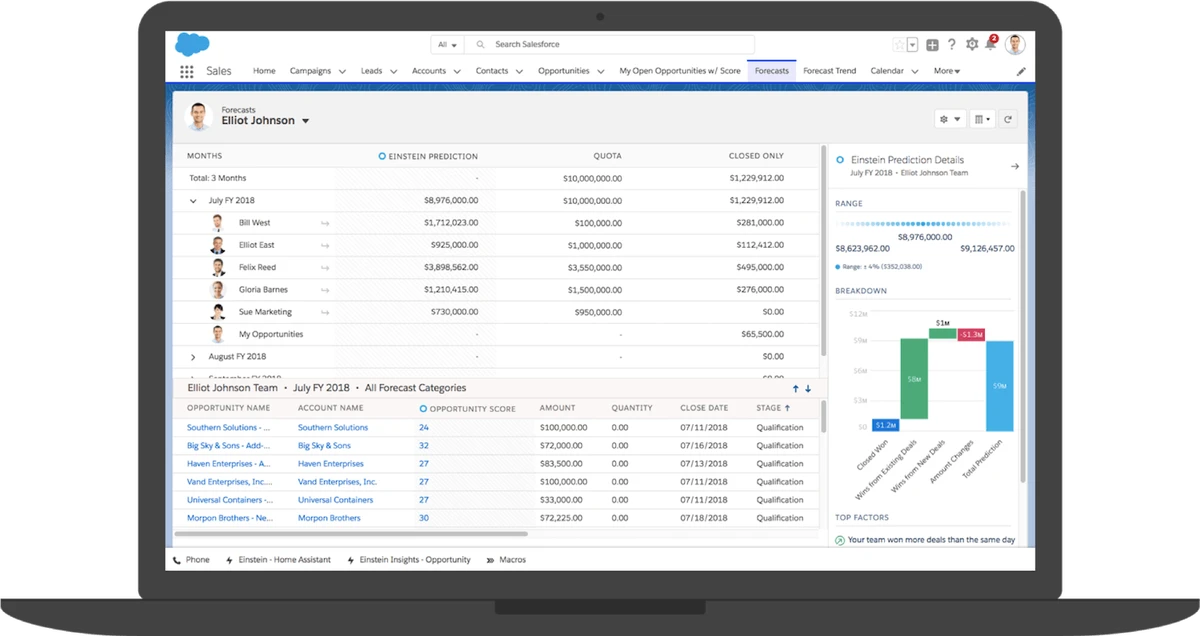

Forecasting workflow in hedge funds

Practical Steps for Hedge Fund Managers Implementing Forecasting

Step 1: Define Forecasting Objectives

Before selecting tools, clarify the time horizon (short-term vs. long-term), asset class focus, and performance metrics.

Step 2: Choose the Right Data Sources

From macroeconomic indicators to high-frequency tick data, the choice of input is as critical as the forecasting algorithm. For deeper insights, see the guide on where to find forecasting data for trading.

Step 3: Model Development and Validation

- Backtesting on historical data.

- Walk-forward testing for robustness.

- Cross-validation to avoid overfitting.

Step 4: Integration into Portfolio Management

Forecasts must translate into position sizing, stop-loss rules, and hedging strategies rather than remain theoretical.

Step 5: Continuous Monitoring and Updating

Markets evolve. Forecasting systems should include automated model recalibration and performance monitoring.

Best Practices for Forecasting Accuracy

Many hedge fund managers ask how to improve forecasting accuracy in trading, and the answer often lies in methodology rather than technology. Key recommendations include:

- Diversify models – Use an ensemble approach to minimize model-specific weaknesses.

- Incorporate regime detection – Models should adjust during high-volatility vs. low-volatility environments.

- Emphasize feature engineering – Domain knowledge enhances predictive power by creating relevant financial indicators.

- Use out-of-sample validation – Prevents overfitting and improves real-world robustness.

AI-driven forecasting models

FAQs: Forecasting Tools for Hedge Fund Managers

1. What is the most reliable forecasting tool for hedge fund managers?

There is no universal “best tool.” The reliability depends on context—Bloomberg for data access, Python ML libraries for customization, or hybrid econometric-ML frameworks for balanced performance.

2. How often should forecasting models be updated?

Models should be recalibrated quarterly or even monthly, depending on asset class volatility. In high-frequency trading, updates may occur daily.

3. Can forecasting tools guarantee profits?

No tool guarantees profits. Forecasting improves probability-adjusted decision-making but must be combined with robust risk management, hedging strategies, and portfolio diversification.

Conclusion

Forecasting is the cornerstone of hedge fund strategy, empowering managers to identify trends, manage risks, and optimize portfolios. From econometric models to AI-driven systems, the choice of forecasting tools depends on a fund’s resources, objectives, and philosophy.

The best approach often lies in hybrid modeling, combining the explainability of econometrics with the adaptability of machine learning. By integrating alternative data, robust validation, and continuous monitoring, hedge fund managers can significantly enhance their forecasting capabilities.

If you found this article insightful, share it with peers or leave a comment with your experiences using forecasting tools. Collective insights can help the industry refine methods and achieve better outcomes.

Would you like me to insert real-world hedge fund case studies (e.g., how Bridgewater or Renaissance Technologies approach forecasting) to enrich credibility and depth for your article?

0 Comments

Leave a Comment