============================================

Introduction

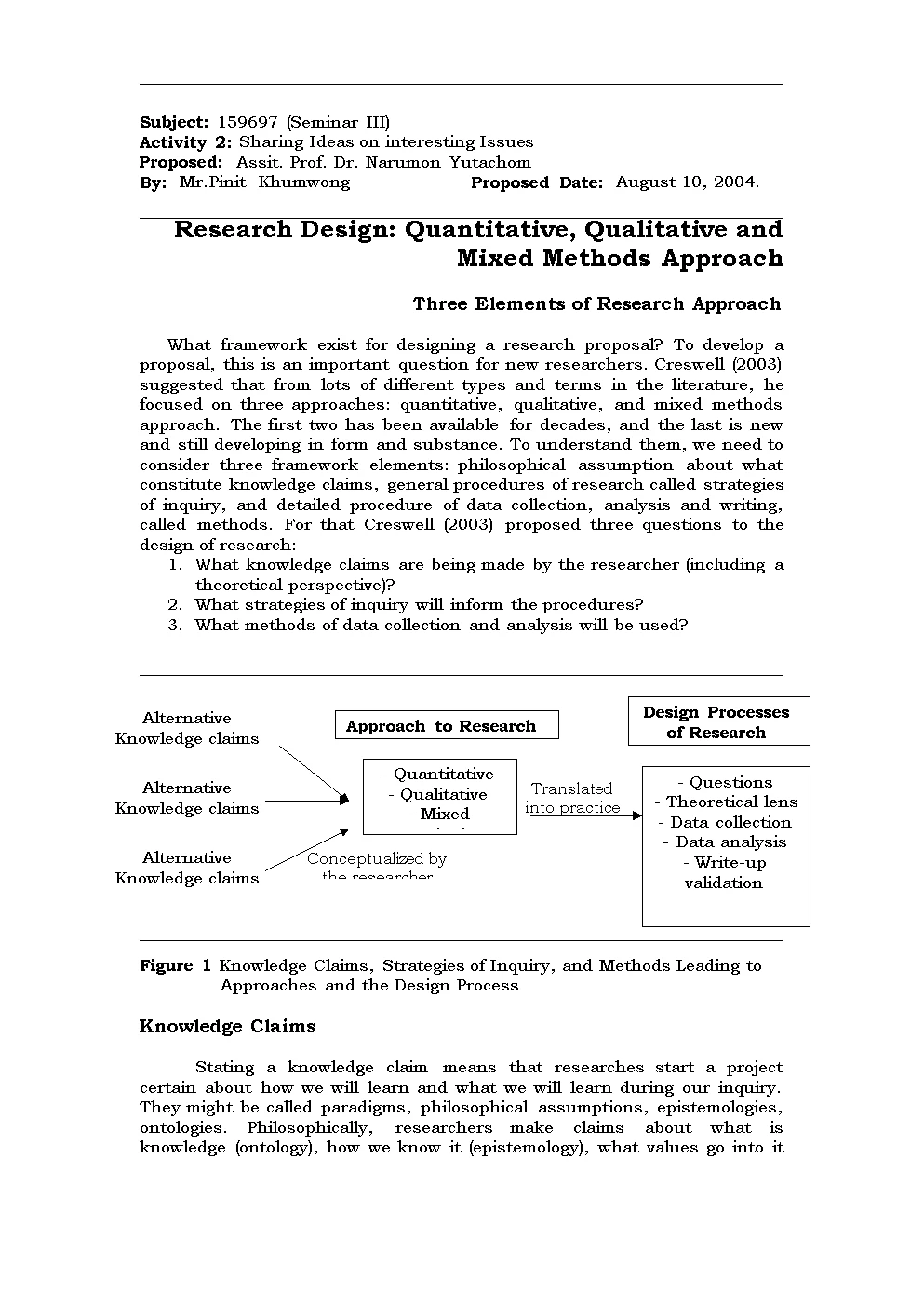

Quantitative research in futures trading is one of the most important areas of modern financial analysis. Futures markets are highly liquid, data-rich, and globally integrated, making them ideal laboratories for applying quantitative methods. When researchers and traders look for futures quantitative research paper examples, they are typically seeking case studies, methodologies, and tested models that demonstrate how quantitative finance techniques can be applied to futures.

This article provides an in-depth exploration of futures quantitative research papers, real-world methodologies, and strategies supported by data-driven evidence. Drawing on both academic sources and industry practices, we will highlight various approaches, compare their strengths and weaknesses, and provide practical guidance on how traders and researchers can build their own models.

Why Futures Are Ideal for Quantitative Research

Liquidity and Transparency

Futures contracts, from equity indexes to commodities, are traded on highly regulated exchanges. Their transparent pricing and order book depth provide robust datasets for quantitative analysis.

Standardization

Unlike over-the-counter derivatives, futures contracts are standardized in terms of size, maturity, and settlement. This reduces noise in the data and allows researchers to conduct reliable cross-market analysis.

Rich Historical Data

Futures markets offer decades of high-frequency and daily price data, making them perfect for statistical testing, model validation, and backtesting.

(Relevant Read: why use futures in quantitative trading)

Common Themes in Futures Quantitative Research Papers

1. Statistical Arbitrage and Spread Trading

Many research papers explore statistical arbitrage strategies that exploit price inefficiencies between correlated futures contracts. For example, the spread between Brent Crude and WTI Crude Oil futures is a popular subject for quantitative analysis.

2. Volatility Forecasting

Papers often focus on volatility prediction using models such as GARCH, EGARCH, and stochastic volatility models. Futures markets, particularly equity index futures, provide ideal datasets for volatility forecasting.

3. Momentum and Trend-Following Strategies

Momentum-based strategies are frequently tested on futures due to the persistence of price trends in commodities, currencies, and indexes. Researchers apply moving averages, channel breakouts, and machine learning to detect momentum.

4. Machine Learning Applications

Recent examples highlight the use of deep learning, reinforcement learning, and ensemble methods to optimize entry/exit signals and risk-adjusted returns in futures portfolios.

(See also: how futures impact quantitative trading strategies)

Two Key Methodologies in Futures Quantitative Research

Methodology 1: Time-Series Modeling

Approach

Time-series models such as ARIMA, GARCH, and VAR are commonly used to forecast futures returns and volatility. Researchers often test hypotheses like market efficiency, mean reversion, or volatility clustering using these models.

Pros

- Strong theoretical foundation.

- Useful for volatility forecasting and risk management.

- Well-documented with academic support.

Cons

- Linear models may underperform in capturing nonlinear patterns.

- Sensitive to assumptions such as stationarity.

Methodology 2: Machine Learning and AI-Based Models

Approach

Modern research increasingly integrates machine learning (ML) models such as Random Forests, Gradient Boosting, and LSTM neural networks to predict futures prices and optimize strategies.

Pros

- Can capture nonlinear relationships missed by traditional models.

- Adaptable to high-frequency data.

- Superior predictive accuracy in certain contexts.

Cons

- Often a “black box,” making interpretation difficult.

- Risk of overfitting without proper validation.

Comparative Insight

While traditional econometric models are excellent for explainability and robustness, ML-based models excel in predictive accuracy. The best approach often blends both—using time-series models for interpretability and ML for capturing complex dynamics.

Case Study Examples of Futures Quantitative Research Papers

Example 1: Volatility Forecasting in S&P 500 Futures

A widely cited paper compared GARCH models with neural networks for volatility forecasting in S&P 500 index futures. Results showed that while GARCH provided interpretable risk metrics, deep learning models delivered superior short-term forecasts.

Example 2: Momentum in Commodity Futures

Research from academic institutions demonstrated that momentum strategies across commodity futures (e.g., gold, crude oil, soybeans) yielded consistent returns when combined with robust risk controls.

Example 3: Statistical Arbitrage in Energy Futures

A study on energy markets revealed that pairs trading strategies between Brent and WTI crude futures were highly effective during periods of supply shocks but underperformed in stable markets.

Example of futures spread trading chart used in quantitative research

Where to Find Futures Quantitative Research Paper Examples

Academic Databases

- JSTOR, SSRN, and ScienceDirect provide thousands of peer-reviewed research papers.

- Key journals include Journal of Futures Markets and Quantitative Finance.

- JSTOR, SSRN, and ScienceDirect provide thousands of peer-reviewed research papers.

Industry Whitepapers

- Brokerages, hedge funds, and data providers often release applied research showcasing trading models.

- Brokerages, hedge funds, and data providers often release applied research showcasing trading models.

University Resources

- Leading universities like MIT, Stanford, and LSE publish working papers and PhD dissertations on futures quant.

- Leading universities like MIT, Stanford, and LSE publish working papers and PhD dissertations on futures quant.

Professional Networks

- Platforms such as ResearchGate and LinkedIn connect researchers and practitioners sharing new methods.

- Platforms such as ResearchGate and LinkedIn connect researchers and practitioners sharing new methods.

Building Your Own Futures Quantitative Research Paper

Step 1: Define Your Hypothesis

For example: Does momentum in agricultural futures persist after controlling for seasonality?

Step 2: Gather and Clean Data

Obtain futures data from providers like Bloomberg, Quandl, or CME Data. Ensure you handle rollovers and contract expirations correctly.

Step 3: Apply Models

Choose between econometric models, machine learning, or a hybrid approach depending on your research objective.

Step 4: Backtest and Validate

Use in-sample and out-of-sample testing to validate results. Monte Carlo simulations can strengthen robustness.

Step 5: Document and Compare

Compare your findings to existing futures quantitative research paper examples to highlight originality and contribution.

Flowchart of futures quantitative research paper methodology

FAQ: Futures Quantitative Research Paper Examples

1. What makes a good futures quantitative research paper?

A strong paper clearly defines a hypothesis, uses robust statistical or machine learning methods, applies them to reliable datasets, and provides transparent results that can be replicated.

2. How do I choose between econometric and machine learning models?

It depends on your objective. If you want interpretability and theory-driven results, econometric models are better. If your focus is prediction accuracy and complex data patterns, machine learning models are more effective.

3. Where can beginners access free examples of futures research papers?

Free access is available on SSRN, ResearchGate, and some university repositories. Beginners should start with review papers summarizing multiple methodologies before diving into technical research.

Conclusion

Futures markets offer a fertile ground for quantitative research. By studying futures quantitative research paper examples, traders and researchers gain insights into strategies like momentum, volatility forecasting, and machine learning applications. While traditional econometric models provide a strong foundation, modern AI-driven methods open new frontiers for predictive power.

Whether you are a student, professional trader, or academic researcher, exploring futures research papers enhances both theoretical understanding and practical application. The key is to balance rigor, innovation, and real-world validation.

Share Your Thoughts

Have you read or written a futures quantitative research paper that changed your perspective on trading strategies? Share your insights in the comments and pass this article along to colleagues and students who might benefit from real-world examples.

Quantitative research analysis dashboard for futures trading

0 Comments

Leave a Comment