==================================================

Quantitative trading has evolved rapidly in the past two decades, blending mathematics, statistical modeling, and computing power to identify profitable opportunities in financial markets. Among the various instruments available, futures contracts play a crucial role in shaping quantitative trading strategies. This article explores in depth how futures impact quantitative trading strategies, examining practical methods, advantages and limitations, industry trends, and real-world applications.

We will break down how futures markets influence algorithm design, risk management, and execution, while also highlighting case comparisons between different strategies. By the end, you will have a complete understanding of how futures integrate into the world of quantitative finance.

Understanding the Role of Futures in Quantitative Trading

Futures contracts are standardized agreements to buy or sell an asset at a future date for a predetermined price. Their popularity among quantitative traders comes from three key features: leverage, liquidity, and hedging potential. These features directly shape the design and success of quantitative strategies.

- Leverage allows traders to control large notional values with smaller amounts of capital, amplifying returns (and risks).

- Liquidity in major futures markets (e.g., S&P 500 futures, crude oil futures, Bitcoin futures) ensures that quantitative models can execute high-frequency or large-scale trades efficiently.

- Hedging potential makes futures ideal for portfolio risk management, a cornerstone of quantitative finance.

In practice, futures are not just speculative tools—they are integrated into systematic trading strategies that rely on statistical relationships, machine learning, and predictive modeling.

Key Ways Futures Impact Quantitative Trading Strategies

1. Price Discovery and Market Signals

Quantitative models often treat futures markets as leading indicators of underlying asset prices. For example:

- Equity index futures frequently move before stock markets open, providing signals about intraday trends.

- Commodity futures (like crude oil or gold) capture macroeconomic shifts, influencing cross-asset strategies.

Because of their forward-looking nature, futures prices can provide more predictive information compared to spot markets. This makes them essential for quantitative trading systems that rely on early signals.

2. Risk Management and Hedging

One of the strongest impacts of futures on quantitative trading is risk control. Hedge funds and professional traders often design strategies around futures because they can:

- Hedge directional exposure: For instance, a long equity portfolio can be protected using S&P 500 futures shorts.

- Manage volatility: Volatility futures allow quants to balance risk during unstable market conditions.

- Optimize capital efficiency: Futures require lower margin compared to holding the underlying, freeing up capital for other strategies.

This flexibility explains why futures risk management for quantitative experts has become a specialized area of research.

3. Strategy Design in Quantitative Models

Futures impact how strategies are structured. For instance:

- Trend-following models in futures markets rely on momentum indicators, moving averages, and breakout levels.

- Mean-reversion strategies exploit short-term mispricing between futures contracts and spot markets.

- Arbitrage strategies look for inefficiencies, such as between index futures and ETFs or calendar spreads between different contract months.

These approaches require sophisticated execution algorithms to ensure slippage and transaction costs don’t erode profitability.

Comparing Two Major Futures-Based Quantitative Strategies

To illustrate how futures impact trading, let’s compare two commonly applied methods: statistical arbitrage and trend-following in futures.

Statistical Arbitrage with Futures

Statistical arbitrage involves identifying price discrepancies between related assets or contract maturities.

- Example: If crude oil spot prices and futures prices diverge beyond a historical range, models can exploit the spread.

- Advantages: Lower directional risk, high scalability, and reliance on statistical laws rather than market prediction.

- Limitations: Requires constant monitoring, profits are small per trade, and execution speed is critical.

Trend-Following in Futures

Trend-following uses momentum indicators to ride sustained market movements. Futures are ideal because of leverage and liquidity.

- Example: A model detects upward momentum in Nasdaq futures and enters long positions, holding until the trend weakens.

- Advantages: Potentially large gains in strong trending markets, simple to scale across multiple contracts.

- Limitations: Vulnerable to choppy sideways markets, requires strong risk management to avoid drawdowns.

Best Application: Many professional traders combine the two—using trend-following for core positions and statistical arbitrage for hedging and diversification. This dual approach balances profitability with stability.

Industry Trends: Futures and Quantitative Trading Today

The landscape of futures-based quantitative trading is rapidly evolving:

- AI and Machine Learning: Advanced models are now being trained on tick-level futures data to forecast price movements with greater accuracy.

- Crypto Futures Expansion: With exchanges offering Bitcoin and Ethereum futures, quantitative firms are integrating digital assets into multi-asset futures strategies.

- Institutionalization of Futures Trading: Hedge funds and pension funds increasingly rely on futures for portfolio hedging and tactical positioning, making strategies more complex but also more robust.

For traders exploring deeper applications, topics such as how to analyze futures market trends quantitatively or where futures fit into quantitative investment strategies provide valuable learning pathways.

Practical Example: Futures in Portfolio Hedging

Imagine a quant fund with $500M in global equities exposure. By shorting S&P 500 futures, the fund can neutralize systemic risk during high volatility events while still preserving alpha from stock selection strategies.

This demonstrates how futures serve as risk management tools that allow quant models to stay consistent and perform even in turbulent environments.

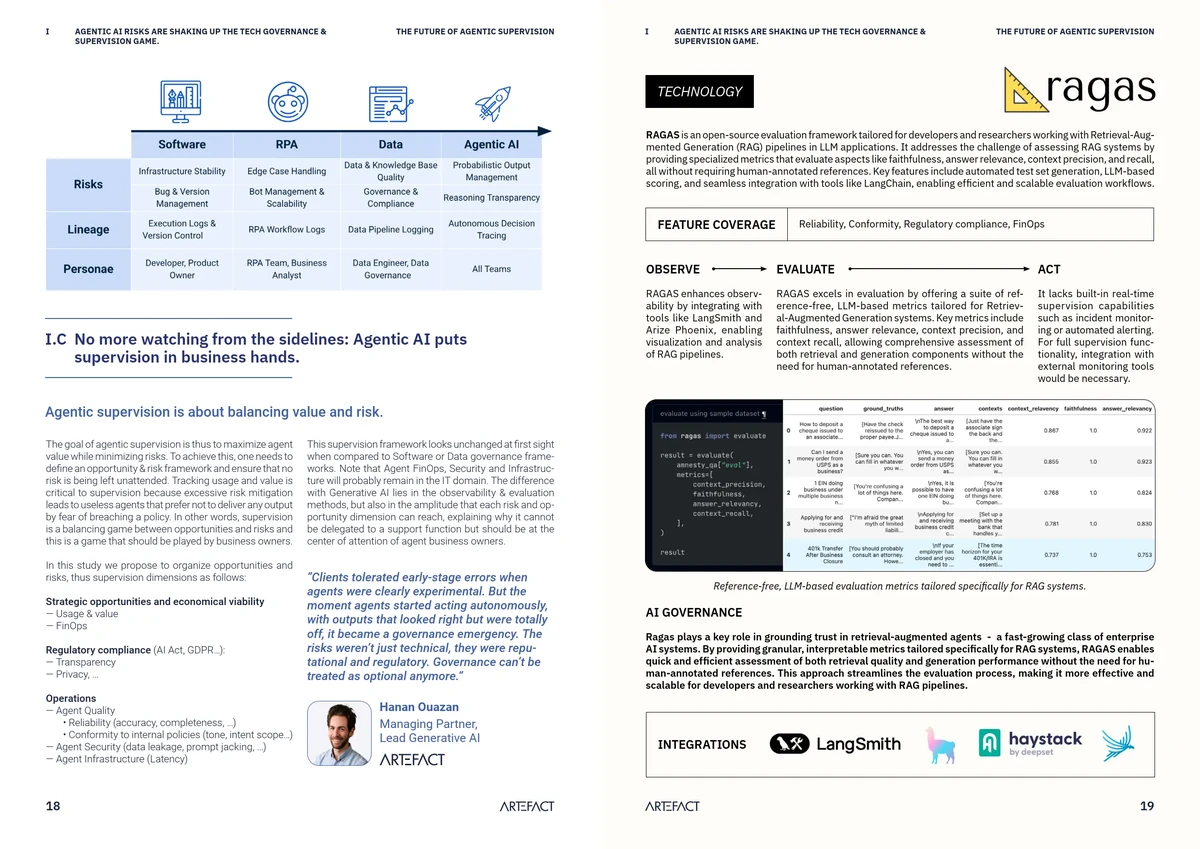

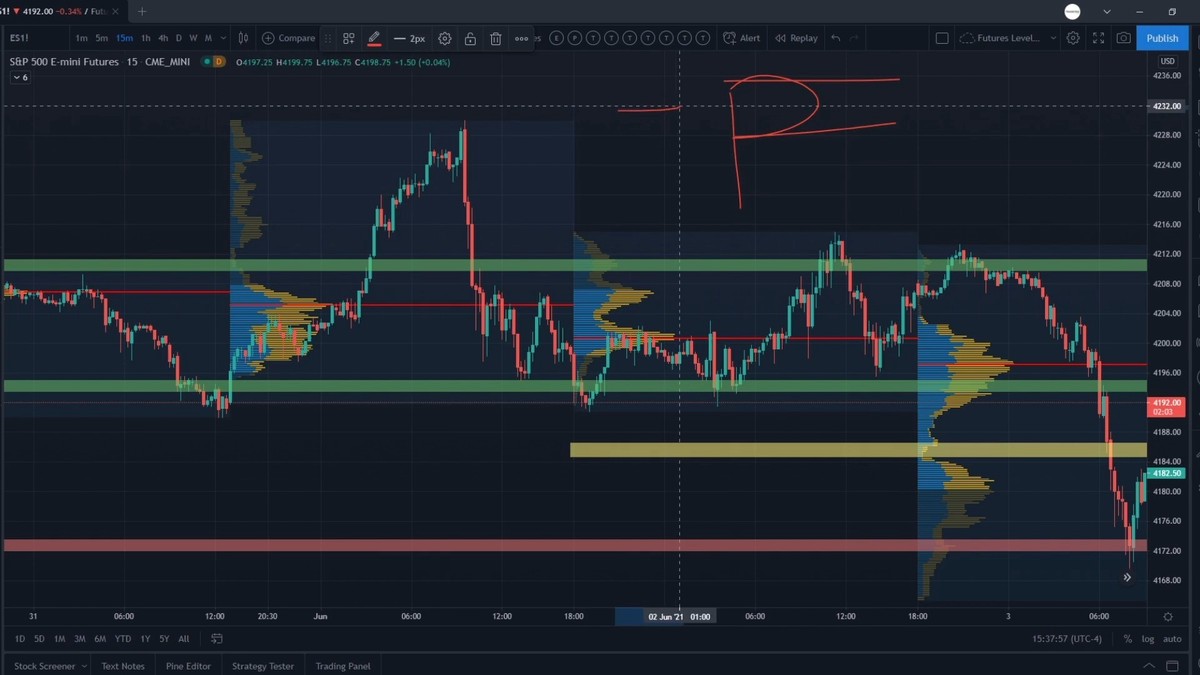

Visual Insights

Below are some visual representations that illustrate the role of futures in quantitative trading.

Futures contracts often trade at a premium (contango) or discount (backwardation) compared to spot prices, creating opportunities for statistical arbitrage.

High liquidity in futures markets ensures smoother execution for quantitative strategies.

FAQ: How Futures Impact Quantitative Trading Strategies

1. Why are futures more suitable for quantitative trading than spot markets?

Futures offer standardized contracts, high liquidity, and leverage, making them ideal for systematic strategies. Unlike spot markets, futures also facilitate hedging and capital efficiency, both critical for quants running multiple models simultaneously.

2. How do futures improve risk management in quant funds?

Futures allow quant funds to hedge portfolio risk without selling underlying assets. For instance, using index futures, a fund can temporarily reduce exposure to market downturns while keeping long-term investments intact.

3. What are the biggest challenges of using futures in quantitative strategies?

Challenges include contract expiration (requiring rollovers), slippage in high-frequency strategies, and exposure to leverage-induced risks. Additionally, models must account for seasonality and basis risk between futures and spot prices.

Conclusion: The Strategic Value of Futures in Quantitative Trading

Futures are not just auxiliary tools—they are at the core of modern quantitative trading strategies. From providing early signals to enabling capital-efficient hedging, their impact is profound.

For traders and funds, combining futures with predictive modeling, algorithmic execution, and risk-adjusted strategies offers the most sustainable edge. Whether through trend-following, statistical arbitrage, or portfolio hedging, futures continue to shape the competitive landscape of quantitative finance.

If you’re looking to expand your expertise, explore resources on how to do quantitative trading with futures and where to learn futures quantitative analysis, which provide step-by-step frameworks for applying futures in professional trading.

✅ If you found this article useful, feel free to share it on social media, comment with your insights, or forward it to your trading peers. Engaging in discussion helps refine strategies and builds a stronger quantitative trading community.

0 Comments

Leave a Comment