==========================================================================================

Investing in the financial markets can be an exhilarating yet risky experience. For cautious investors who prefer a more conservative approach, hedging options can be a powerful tool to manage risk and protect their portfolios from unpredictable market movements. Whether you’re dealing with stocks, bonds, or commodities, using effective hedge strategies can significantly reduce your exposure to market volatility and safeguard your returns.

This article will explore the best hedge options for cautious investors, detailing strategies, methodologies, and practical advice. We will compare several hedging techniques, discuss their pros and cons, and highlight the best approach based on individual risk tolerance.

- What is Hedging in Investing?

————————————

1.1 Understanding the Concept of Hedging

Hedging involves taking a position in a financial asset that will offset the potential losses from another investment. Essentially, it’s a form of insurance—while it doesn’t eliminate risk entirely, it reduces exposure to it.

Hedging is commonly used to manage risks associated with market fluctuations, interest rates, currency movements, and commodity prices. For cautious investors, hedging can provide peace of mind, knowing that their portfolio is shielded from extreme volatility.

1.2 Why is Hedging Important for Cautious Investors?

Cautious investors tend to have a low-risk tolerance and aim to preserve their capital while achieving moderate returns. Hedging allows them to:

- Minimize losses during periods of market downturns.

- Protect against unpredictable market movements (e.g., economic crises, geopolitical instability).

- Ensure more stable returns over time by reducing the likelihood of major losses.

- Popular Hedge Options for Cautious Investors

—————————————————

2.1 1. Options Contracts: A Flexible Hedging Tool

Options contracts are one of the most popular hedging instruments used by cautious investors. These financial derivatives give investors the right, but not the obligation, to buy or sell an asset at a predetermined price before a specified expiration date.

How It Works:

- Put options: If you own stocks and are concerned about their potential decline in value, you can purchase put options as a hedge. A put option gives you the right to sell a stock at a certain price, thereby limiting your potential losses if the stock price drops.

- Call options: While more commonly used for speculative purposes, call options can also be used to hedge against potential upward price movements of an asset you’re shorting.

Pros:

- Flexibility: You can choose the strike price and expiration date, tailoring your hedge to your needs.

- Limited risk: The maximum loss is the premium paid for the option, providing a well-defined risk.

- Profit potential: If the market moves in your favor, you could see significant profits.

Cons:

- Cost: Options come with premiums, which can be expensive, especially for longer-term contracts.

- Time-sensitive: If the market doesn’t move as anticipated before the option expires, you may lose the entire premium.

Best For:

- Investors seeking protection against short-term price swings without committing to long-term contracts.

2.2 2. Futures Contracts: Locking in Prices

Futures contracts are agreements to buy or sell an asset at a specific price at a future date. Although they are often used for speculation, cautious investors can also use futures to hedge against price fluctuations in the underlying asset.

How It Works:

- For example, if you own oil stocks, you could enter into a short futures contract on oil to protect your position in the event of falling prices. The profits from the futures position will offset any losses incurred from the drop in oil prices.

Pros:

- No upfront cost: Unlike options, futures do not require a premium, and the contracts are traded on margin.

- Flexibility: Futures can be used for a wide range of assets, including commodities, stocks, and currencies.

- Hedge against long-term price movements: Futures allow for protection against price volatility over a longer horizon.

Cons:

- Potential for large losses: If the market moves unfavorably, your losses could exceed your initial investment, especially if you’re using leverage.

- Obligation to execute: Unlike options, futures contracts obligate you to either buy or sell the asset at the expiration date, which could limit flexibility.

Best For:

- Institutional investors or those with higher risk tolerance who seek protection against large, sustained price movements.

2.3 3. Exchange-Traded Funds (ETFs) and Index Funds

Exchange-traded funds (ETFs) and index funds can be used to hedge risk by providing broad exposure to an entire market or sector. By holding a basket of assets, ETFs reduce the risk of individual securities while offering an efficient way to hedge.

How It Works:

- If you’re concerned about a downturn in the stock market, you can invest in a bear ETF that profits when the market declines.

- Alternatively, sector-specific ETFs can help hedge against specific risks related to certain industries (e.g., energy, technology, etc.).

Pros:

- Diversification: By owning a broad selection of stocks or assets, you reduce the risk of individual assets significantly affecting your overall portfolio.

- Lower cost: ETFs generally have lower expense ratios compared to actively managed funds.

- Liquidity: ETFs are traded on the stock exchange, making them easy to buy and sell.

Cons:

- Limited hedging power: ETFs are generally less effective as a hedge compared to more direct instruments like options or futures.

- Market exposure: If the market moves against you, your ETF position may not provide sufficient protection.

Best For:

- Conservative investors seeking an easier and more cost-effective way to hedge against market downturns or sector-specific risks.

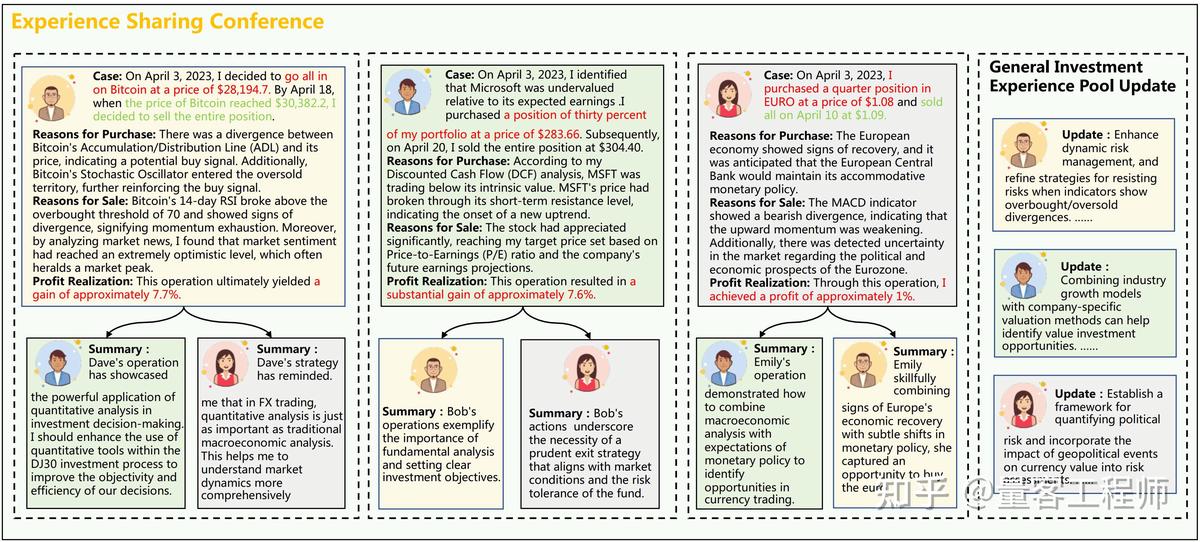

2.4 4. Currency Hedging: Protecting Against Forex Risk

For investors with international exposure or those who hold foreign assets, currency hedging can be an effective way to protect against unfavorable currency fluctuations. Currency risks arise when assets are denominated in a foreign currency, and changes in exchange rates can impact their value.

How It Works:

- Currency forward contracts or currency ETFs can be used to lock in exchange rates and mitigate the risk of currency volatility.

Pros:

- Protection against forex fluctuations: Currency hedging ensures that exchange rate movements don’t erode the value of foreign assets.

- Customizable: Hedging can be tailored based on the specific currency risk exposure of your portfolio.

Cons:

- Complexity: Currency markets can be highly volatile and difficult to predict.

- Costs: Currency hedging can incur significant fees, particularly for complex instruments like forwards and swaps.

Best For:

- Investors holding international assets or those with exposure to foreign currencies.

- Hedge Strategies for Cautious Investors: A Comparison

————————————————————

3.1 Using Options vs. Futures

Options are generally more suitable for cautious investors because they provide limited risk with a fixed premium. Futures, while effective for hedging, can carry more risk due to leverage and the obligation to fulfill the contract. Options are a better choice for investors who want to cap their losses while maintaining flexibility.

3.2 ETFs vs. Direct Hedging Instruments

ETFs are a passive form of hedging, suitable for those who want to diversify their exposure or reduce risk across an entire market. However, they may not provide sufficient protection during extreme market movements. Direct hedging instruments like options and futures offer more precise and targeted protection but require more active management and expertise.

- FAQ: Common Questions About Hedging Options for Cautious Investors

————————————————————————-

4.1 What is the best hedging option for a conservative investor?

For conservative investors, put options are often the best choice for hedging because they offer limited risk while providing protection against downside risk. ETFs that track the market or specific sectors can also be a good, low-cost alternative.

4.2 How do I know if my hedge strategy is effective?

To assess the effectiveness of your hedge strategy, monitor its performance relative to the market. Tools such as hedge ratios and performance metrics can help you determine whether your hedge is providing adequate protection.

4.3 Can I hedge my portfolio without using derivatives?

Yes, it is possible to hedge your portfolio without using derivatives. Diversification across asset classes, sectors, and geographic regions can provide natural hedging, reducing the impact of specific market risks.

- Conclusion: Choosing the Right Hedge for Your Portfolio

————————————————————–

For cautious investors, hedging options provide an essential way to manage risk, protect capital, and achieve more consistent returns. While there are several hedging strategies available, choosing the right one depends on your investment goals, risk tolerance, and market outlook. Whether you opt for options, futures, ETFs, or currency hedging, it’s crucial to assess your portfolio’s needs and select the most suitable hedging instrument. By doing so, you can safeguard your investments and navigate market volatility with confidence.

0 Comments

Leave a Comment