====================================================================================

Introduction

In today’s dynamic financial markets, volatility, uncertainty, and rapid global shifts make hedge systems for optimal performance a necessity rather than a luxury. Investors and traders who fail to hedge often expose themselves to outsized risks that can erase years of gains within days. Conversely, those who adopt structured hedging strategies achieve greater stability, optimized returns, and the confidence to deploy more capital.

This article provides a comprehensive exploration of hedge systems, analyzing both traditional and advanced methods. We will dive into strategies, compare their strengths and weaknesses, incorporate insights from professional practice, and provide actionable steps for applying hedging effectively. By following the principles outlined here, readers will understand how to achieve optimal performance through effective hedge systems.

What Are Hedge Systems?

Definition and Purpose

A hedge system is a structured framework designed to reduce or offset investment risks using financial instruments, asset allocation, or derivative strategies. Unlike speculation, the goal of hedging is not to maximize profits but to protect capital and stabilize returns.

For example, a portfolio manager may use equity options to hedge against a stock market downturn or currency futures to guard against foreign exchange risk.

Why Hedge Systems Are Important

- Risk Mitigation: Minimize losses from adverse market moves.

- Return Stabilization: Smoothen volatility for long-term consistency.

- Psychological Confidence: Reduce emotional stress by securing downside protection.

- Capital Efficiency: Allow safe use of leverage by controlling risk exposures.

(See also: why hedge is important in trading)

Core Components of Hedge Systems

1. Risk Identification

The first step is identifying which risks need hedging. These could include interest rate risk, currency risk, commodity price fluctuations, or equity drawdowns.

2. Hedge Ratio

The hedge ratio defines how much of the exposure is covered by the hedge. A 100% hedge completely offsets the exposure, while a partial hedge balances risk with upside potential.

3. Instrument Selection

Choosing the right instruments (options, futures, swaps, ETFs, or diversified assets) determines the efficiency and cost of the hedge.

4. Performance Monitoring

Hedge systems must be actively monitored and adjusted, as changing market conditions may reduce effectiveness.

Traditional Hedge Strategies

Options-Based Hedging

Options are one of the most common tools in hedge systems. A protective put, for instance, allows investors to set a floor on potential losses without capping upside potential.

Advantages:

- Highly flexible structures (protective puts, collars, spreads).

- Useful across equities, currencies, and commodities.

- Maintains growth exposure.

Disadvantages:

- Option premiums can be expensive.

- Requires knowledge of option pricing and Greeks.

Futures and Forwards Hedging

Futures contracts are widely used to lock in prices for currencies, commodities, or indices. For example, airlines hedge fuel costs using crude oil futures.

Advantages:

- Transparent and liquid markets.

- Clear cost through margin requirements.

- Effective for commodity and currency risk.

Disadvantages:

- Opportunity cost if markets move favorably.

- Requires collateral management.

Diversification as a Hedge

Diversification remains one of the simplest hedging methods. Allocating across asset classes reduces the impact of losses in any single market.

Advantages:

- Low cost and easy to implement.

- Improves resilience in volatile conditions.

Disadvantages:

- Limited during systemic crises (e.g., 2008).

- May reduce overall returns during bull markets.

Advanced Hedge Systems

Quantitative Hedge Models

Modern hedge systems leverage algorithms and machine learning to dynamically adjust hedge positions. These models analyze market data, volatility indicators, and correlations to maintain optimal protection.

Features:

- Automated adjustments based on volatility.

- High-frequency execution capabilities.

- Integration with portfolio management systems.

(See also: how to hedge in quantitative trading)

Volatility-Based Hedging

Hedging through volatility products such as the VIX index or volatility futures is increasingly popular. These instruments rise in value during market stress, providing a natural hedge against equity losses.

Advantages:

- Strong protection during crises.

- Directly tied to market fear indices.

Disadvantages:

- Volatility products decay in stable markets.

- Requires precise timing.

Overlay Hedge Systems

An overlay strategy applies hedging across an entire portfolio, regardless of the underlying strategy. For example, a global bond fund may overlay currency futures to manage FX risk.

Advantages:

- Centralized risk control.

- Scalable across portfolios.

Disadvantages:

- Requires sophisticated systems and expertise.

- Additional costs may erode returns.

Comparing Hedge Strategies

| Strategy | Cost | Flexibility | Risk Reduction | Best For |

|---|---|---|---|---|

| Options-Based Hedging | High | High | Strong | Equity and FX investors |

| Futures & Forwards | Medium | Medium | Strong | Commodities, FX |

| Diversification | Low | Medium | Moderate | Long-term investors |

| Quantitative Hedge Models | High | Very High | Adaptive | Institutions, pros |

| Volatility Hedging | Medium | Low | Strong (crisis only) | Equity markets |

Practical Case Studies

Case Study 1: Equity Portfolio Protection

A hedge fund managing $200M in tech equities purchased protective puts on the Nasdaq index. During a 12% correction, the hedge reduced net losses to just 3%, preserving investor confidence.

Case Study 2: Commodity Hedging for a Manufacturer

A global food company hedged wheat prices with futures. When wheat prices spiked 20%, the hedge preserved profit margins and stabilized production costs.

Case Study 3: Volatility Hedge During Market Panic

An investor bought VIX call options ahead of a geopolitical event. When volatility surged, the gains offset equity losses, making the portfolio net positive.

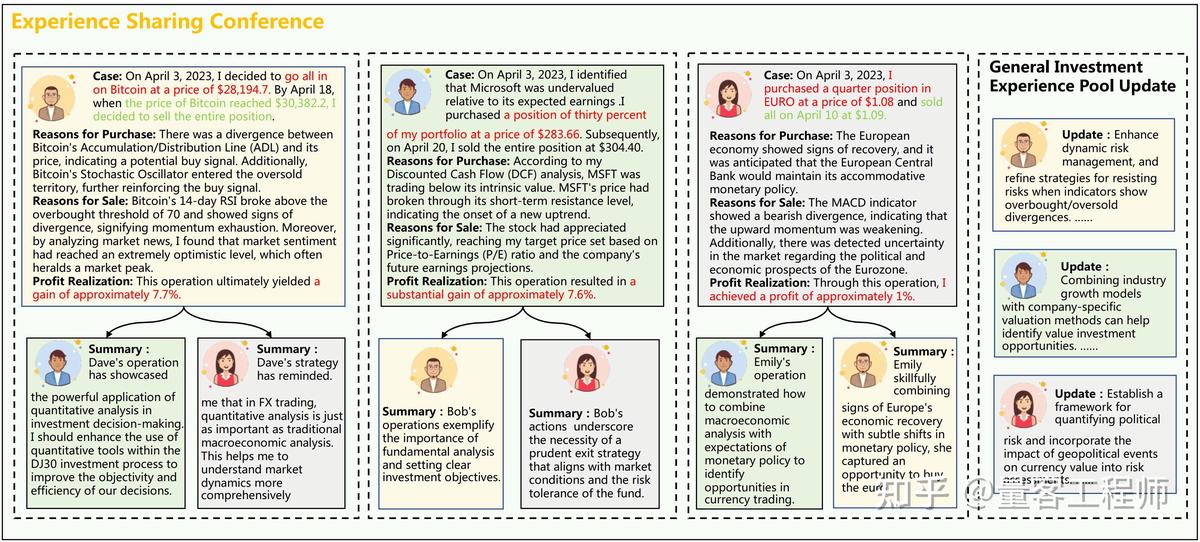

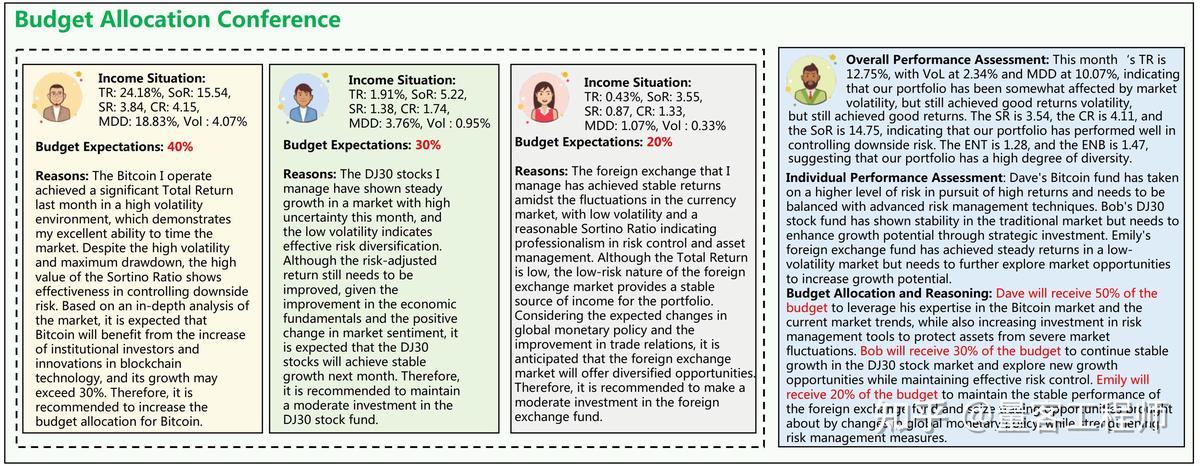

Visual Insights

Comparison of hedge effectiveness across different strategies.

How quantitative hedge systems adapt to market volatility in real time.

Risk Management and Hedge Effectiveness

Measuring Hedge Effectiveness

Key metrics include:

- Hedge Ratio: Exposure coverage percentage.

- Tracking Error: Deviation between hedged and unhedged performance.

- Value at Risk (VaR): Capital at risk after hedging.

Challenges in Hedge Systems

- Over-hedging can reduce returns.

- Market liquidity may affect execution.

- Costs can accumulate over time.

Frequently Asked Questions (FAQ)

1. What is the best hedge system for retail investors?

Retail investors often benefit most from simple hedges like protective puts or inverse ETFs. These strategies provide straightforward downside protection without requiring complex infrastructure.

2. How can I assess if my hedge system is effective?

Investors should evaluate hedge ratio, cost-benefit analysis, and performance during volatility spikes. Tools like stress testing and scenario analysis are also crucial for assessing effectiveness.

3. Are hedge systems only for institutions?

No. While hedge funds and asset managers use advanced systems, hedging is equally valuable for retail traders and small businesses. For example, a small exporter can hedge currency risk through futures or options.

Conclusion

Hedge systems for optimal performance are critical for protecting portfolios, stabilizing returns, and enabling confident capital deployment. While strategies like options and futures remain foundational, advanced quantitative models and volatility hedging provide powerful tools for modern investors.

The best approach often combines diversification with targeted hedges, monitored through ongoing risk assessment. By aligning hedge systems with investment goals and market conditions, traders can achieve both protection and performance.

If you found this article valuable, share it with your peers and join the conversation in the comments: Which hedging strategies have worked best for you?

Would you like me to expand this into a whitepaper-style resource (with citations and academic references) so you can use it for professional presentations or client education?

0 Comments

Leave a Comment