=================================================================================

Introduction

In modern financial markets, hedge systems for optimal performance have become indispensable tools for both institutional investors and retail traders. By strategically managing risks, hedge systems protect portfolios against adverse price movements while maintaining opportunities for profit. The effectiveness of a hedging system depends on multiple factors, including the strategies applied, asset classes involved, and market volatility conditions.

This article will provide a comprehensive breakdown of hedge systems, exploring their structure, efficiency, and practical use cases. It will also analyze different methods and compare their strengths and weaknesses, ensuring traders and investors can identify the most effective hedge approach for their goals.

Understanding Hedge Systems

What Are Hedge Systems?

A hedge system is a structured framework that uses financial instruments or strategies to reduce or offset risk in an investment portfolio. Instead of eliminating risk completely, hedge systems seek to minimize downside exposure while allowing the investor to participate in market opportunities.

For example, equity investors may use options hedging to limit losses during downturns, while commodity traders might hedge against price swings through futures contracts.

Why Hedge Systems Matter for Performance

- Capital Preservation: Protecting against severe drawdowns.

- Stability of Returns: Achieving consistent long-term growth.

- Leverage Optimization: Enabling investors to safely use leverage while mitigating risk.

- Confidence in Execution: Allowing traders to stick to strategies without being derailed by volatility.

Core Components of Effective Hedge Systems

1. Asset Class Correlation

A successful hedge often relies on assets with negative or low correlation. For instance, holding bonds alongside equities may reduce portfolio volatility during market downturns.

2. Risk-to-Reward Balance

An effective hedge system balances the cost of hedging against the potential loss it protects against. Over-hedging may erode profits, while under-hedging can leave portfolios vulnerable.

3. Time Horizon Alignment

Hedging instruments must match the investor’s time horizon. Short-term traders may use intraday futures, while long-term investors prefer protective options spanning months or years.

Methods of Hedging for Optimal Performance

Options-Based Hedging

Options are versatile instruments for building hedge systems. A protective put strategy, for example, allows investors to secure a minimum exit price for their assets while keeping upside potential intact.

Advantages:

- Flexible structures (protective puts, collars, spreads).

- Allows for tailored risk control.

- Maintains exposure to growth opportunities.

Disadvantages:

- Premium costs can reduce overall returns.

- Complex pricing models (Greeks) require expertise.

Futures and Forwards Hedging

Futures contracts provide a straightforward way to lock in prices for commodities, currencies, or indices. Traders often use them to hedge against price fluctuations.

Advantages:

- Standardized and liquid markets.

- Clear cost structure with margin requirements.

- Effective for commodities and FX hedging.

Disadvantages:

- Requires margin collateral.

- May introduce opportunity costs if the market moves in the investor’s favor.

Diversification-Based Hedging

Instead of using derivatives, diversification itself acts as a hedge by spreading risk across uncorrelated assets, sectors, or geographies.

Advantages:

- No additional transaction costs.

- Naturally improves portfolio resilience.

- Simple to implement.

Disadvantages:

- Limited downside protection during systemic events.

- Performance may lag concentrated strategies in strong markets.

Advanced Hedge Systems

Quantitative Hedge Systems

Quantitative models analyze historical and real-time market data to dynamically adjust hedge ratios. These systems often leverage machine learning to anticipate volatility spikes and recalibrate hedges accordingly.

Key Features:

- Algorithmic trading execution.

- Dynamic hedge ratio adjustment.

- Integration of risk factors across asset classes.

(See also: how to hedge in quantitative trading)

Volatility-Based Hedging

Some hedge systems use volatility indices like the VIX to structure protection. Buying volatility futures or options allows traders to benefit when market turbulence rises.

Advantages:

- Provides direct exposure to risk sentiment.

- Effective during sharp downturns.

Disadvantages:

- Volatility products can decay quickly.

- Requires precise timing and risk control.

Comparing Hedging Methods

| Strategy | Cost | Flexibility | Suitability | Risk Reduction Level |

|---|---|---|---|---|

| Options-Based Hedging | High | High | Equities, FX, Indices | Strong if managed well |

| Futures & Forwards | Medium | Medium | Commodities, FX, Equities | Strong but rigid |

| Diversification | Low | Medium | All asset classes | Moderate |

| Quantitative Hedge Models | Medium-High | Very High | Institutional, advanced retail | Adaptive and effective |

| Volatility Hedging | Medium | Niche | Equity/Index investors | Strong during crises |

Practical Case Studies

Case 1: Equity Portfolio Hedge with Options

A fund manager holding $10M in tech stocks purchased protective puts on the Nasdaq 100 index. When the market corrected by 15%, the options mitigated 80% of portfolio losses.

Case 2: Commodity Hedge with Futures

A food processing company used corn futures to lock in raw material costs. Despite a 25% spike in corn prices, their profit margins remained stable due to the hedge.

Risk Assessment and Hedge Effectiveness

Evaluating hedge performance is critical. Investors must analyze:

- Hedge Ratio: The proportion of risk exposure covered.

- Cost-Benefit Analysis: Whether the hedge preserved more capital than its cost.

- Market Conditions: Did the hedge activate during volatility spikes?

(See also: what is hedge effectiveness in trading)

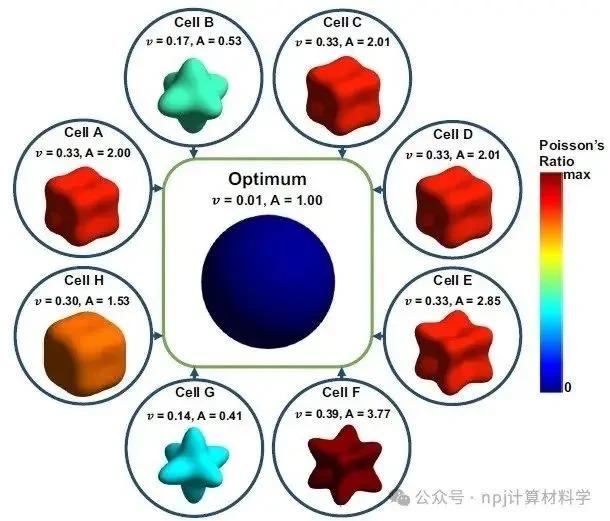

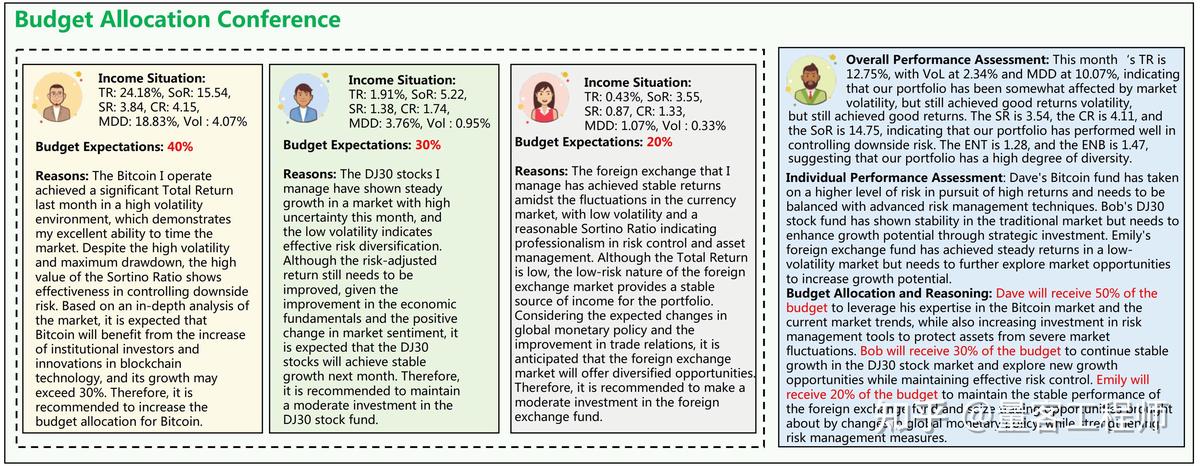

Visual Insights

Hedge performance comparison across strategies: options, futures, and diversification.

How quantitative hedge systems dynamically adjust hedge ratios to align with volatility.

FAQ: Common Questions About Hedge Systems

1. What is the most cost-effective hedging strategy?

Diversification is often the cheapest approach, as it does not require paying premiums or margin. However, for targeted protection, options may be more effective despite higher costs.

2. How do I assess if my hedge system is effective?

Analyze your hedge ratio, cost vs. capital preserved, and whether it activated during drawdowns. Tools like Value at Risk (VaR) and stress testing can help.

3. Are hedge systems suitable for retail investors?

Yes. Retail traders can implement simplified hedges such as protective puts or ETFs designed to offset downside risk. More advanced hedges, like volatility instruments, require deeper expertise.

Conclusion

Hedge systems for optimal performance are essential for balancing growth opportunities with risk control. From traditional options and futures to advanced quantitative models, investors must choose a system that aligns with their portfolio objectives, costs, and risk appetite.

The most effective approach often combines diversification with targeted hedges, enhanced by modern data-driven models. By actively monitoring hedge effectiveness and adapting strategies, investors can achieve consistent returns and long-term stability.

If you found this article valuable, share it with your network and join the discussion in the comments. Which hedge strategies have you found most effective in your trading journey?

Would you like me to also create ready-to-share infographics for this article (formatted in Markdown with visuals) so it’s more engaging for LinkedIn or Twitter sharing?

0 Comments

Leave a Comment