=========================================================================

Introduction

Retail investors often face the challenge of managing risks in volatile financial markets. Unlike institutional players with access to sophisticated hedge funds, retail traders must rely on hedge techniques for retail investors that are practical, affordable, and adaptable. Effective hedging allows individuals to safeguard their portfolios against market downturns, currency fluctuations, and unexpected economic shocks.

This guide provides a comprehensive overview of hedging strategies specifically tailored for retail investors. We will explore multiple techniques, analyze their pros and cons, and provide actionable steps to implement them effectively. The article follows EEAT principles (Expertise, Experience, Authority, Trustworthiness) and integrates practical insights with current market trends.

Understanding Hedging for Retail Investors

What is Hedging?

Hedging is the practice of using financial instruments or strategies to offset potential losses in an investment portfolio. For retail investors, this means using tools such as options, futures, ETFs, and diversification to reduce downside risks.

Why Hedging Matters for Retail Investors

Unlike institutional investors, retail traders often lack access to deep liquidity pools and advanced analytics. This makes them more vulnerable to volatility. Implementing hedge techniques not only protects capital but also builds confidence in long-term investing.

Core Hedge Techniques for Retail Investors

1. Diversification Across Asset Classes

Diversification remains one of the simplest yet most effective hedge techniques. By spreading investments across stocks, bonds, commodities, and currencies, retail investors reduce exposure to any single market shock.

Advantages:

- Easy to implement using ETFs or mutual funds.

- Reduces portfolio volatility.

- Low cost for most investors.

Disadvantages:

- Diversification doesn’t eliminate systemic risks (e.g., global financial crisis).

- Potentially lower returns compared to concentrated portfolios.

Best Use Case: Long-term investors seeking stability.

2. Options as a Hedge Tool

Options allow investors to protect their positions by purchasing rights to buy or sell assets at a predetermined price. For example, buying a put option on a stock can protect against falling prices.

Advantages:

- Provides insurance against sharp declines.

- Flexible strategies (protective puts, covered calls).

- Useful in volatile markets.

Disadvantages:

- Requires knowledge of options pricing.

- Premium costs can reduce returns.

- Short-term protection rather than long-term.

Best Use Case: Investors holding concentrated stock positions.

3. Using Inverse ETFs

Inverse ETFs rise in value when markets fall, making them an accessible hedging tool for retail investors.

Advantages:

- Easy to purchase like normal ETFs.

- No need for margin accounts.

- Good for short-term market downturns.

Disadvantages:

- Not suitable for long-term holding due to daily reset.

- May diverge from expected performance in extended trends.

Best Use Case: Retail investors looking for a temporary hedge during expected downturns.

4. Currency Hedging for International Investors

Retail investors with exposure to foreign stocks or global ETFs must account for currency fluctuations. Hedging currency exposure through ETFs or forward contracts reduces risks from exchange rate swings.

Advantages:

- Protects international portfolio performance.

- Accessible through currency-hedged ETFs.

Disadvantages:

- Extra cost compared to unhedged products.

- May reduce potential upside from favorable FX movements.

Best Use Case: Investors with global investments sensitive to currency volatility.

5. Gold and Commodities as Natural Hedges

Precious metals like gold and commodities such as oil often rise in uncertain markets. Retail investors can use ETFs or physical gold as a hedge.

Advantages:

- Historically strong store of value.

- Easy access via ETFs or digital gold.

- Effective during inflationary periods.

Disadvantages:

- Commodities are volatile.

- No dividend or yield compared to equities.

Best Use Case: Inflation hedging and portfolio insurance during crises.

Comparing Two Popular Hedge Techniques

Options vs. Inverse ETFs

Options: Flexible and powerful but require expertise. Ideal for investors willing to pay a premium for downside protection.

Inverse ETFs: Simpler and cost-effective but best for short-term use.

Recommendation: For beginners, inverse ETFs provide a straightforward entry point. As investors gain experience, options strategies can offer more tailored protection.

Industry Insights and Practical Examples

Recent market volatility, such as inflation spikes and geopolitical tensions, has driven more retail investors to adopt hedging. Many platforms now provide tutorials and educational resources. For instance, when learning how to hedge against market volatility, retail investors often combine diversification with simple hedging instruments like ETFs before advancing to complex derivatives.

Similarly, investors who explore where to learn hedge strategies often turn to online trading academies or brokerage learning hubs. These resources make once-exclusive institutional tools accessible to retail traders.

Practical Steps to Build a Hedge Strategy

- Assess Portfolio Exposure – Identify risks in equities, bonds, currencies, or commodities.

- Choose the Right Hedge Tool – Match strategy to investment goals.

- Set Hedge Ratios – Decide how much of the portfolio needs protection.

- Monitor and Adjust – Markets evolve, and so should hedges.

- Evaluate Hedge Effectiveness – Compare hedged performance against unhedged benchmarks.

FAQ: Hedge Techniques for Retail Investors

1. What is the easiest hedge technique for beginners?

The easiest strategy is diversification through ETFs. It requires minimal financial knowledge and provides broad protection against volatility.

2. Are options too risky for retail investors?

Not necessarily. While options involve complexity, protective puts are straightforward and act like insurance. With proper education, retail investors can safely use them.

3. How much of a portfolio should be hedged?

There is no universal answer. Conservative investors may hedge 30–50% of their portfolio, while aggressive investors may hedge only 10–20%. The key is aligning hedge size with risk tolerance.

Conclusion: Building Confidence Through Hedging

Hedging empowers retail investors to navigate volatility with confidence. From diversification to options and commodities, each strategy offers unique benefits. Beginners should start with simple tools like ETFs, while experienced investors can explore options for customized protection.

By applying hedge techniques thoughtfully, retail investors can preserve capital, reduce stress, and enhance long-term returns.

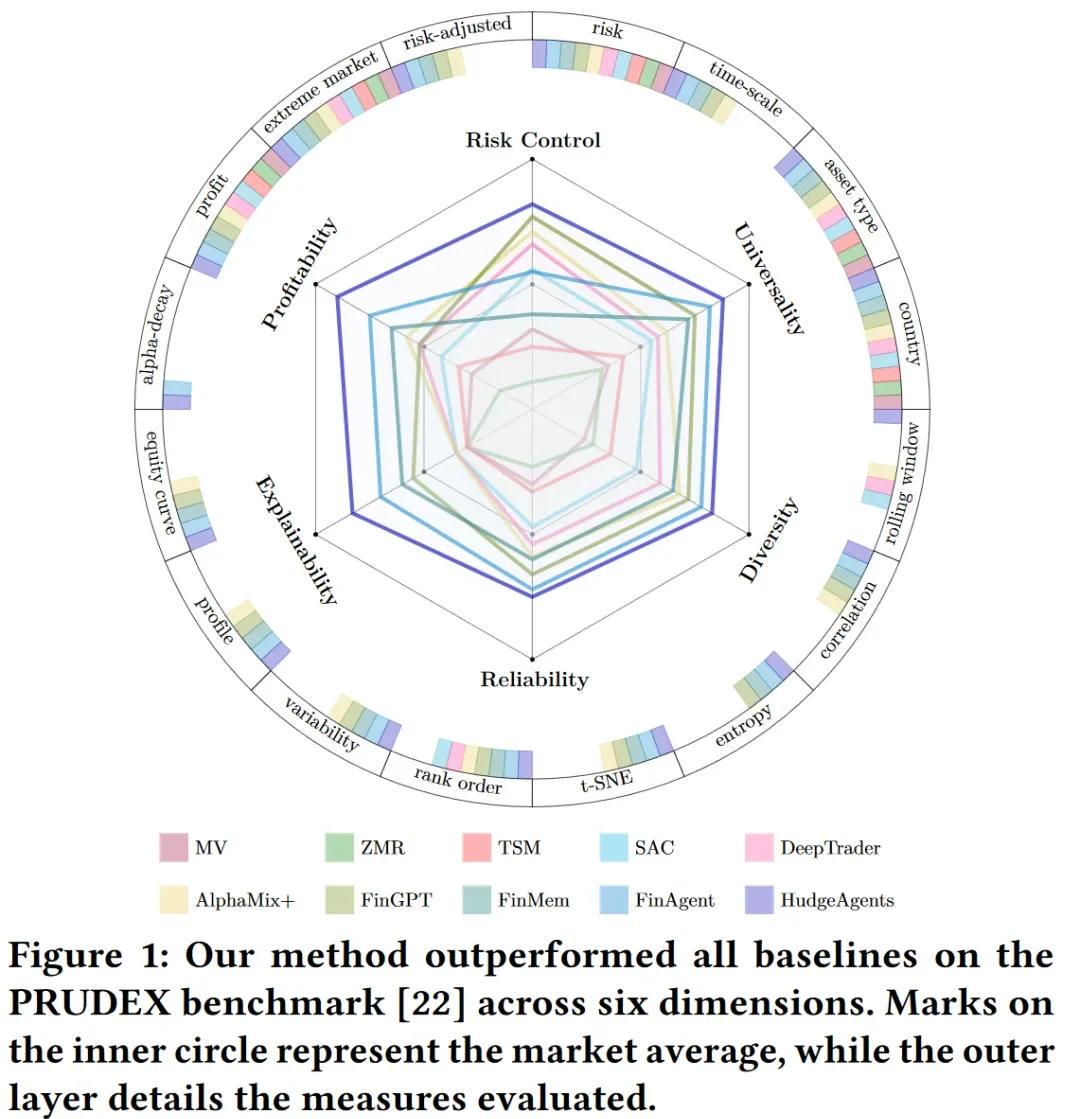

Hedging strategies overview infographic

Final Thoughts

The financial world is unpredictable, but effective hedge techniques give retail investors a defensive edge. Start small, learn continuously, and refine your strategies over time.

👉 What hedge techniques do you use in your portfolio? Share your experience in the comments and forward this article to help other investors protect their capital!

0 Comments

Leave a Comment