==========================================================================================

Introduction

Trading—whether in equities, commodities, forex, or digital assets—always involves an element of risk. Price volatility, geopolitical shocks, macroeconomic uncertainty, and systemic market events can all erode returns. To protect against such adverse movements, traders and institutions turn to hedge techniques to reduce trading risks.

Hedging is not about eliminating risk altogether—it’s about managing and mitigating it to create more predictable outcomes. By deploying appropriate hedge strategies, investors can stabilize returns, protect capital, and even enhance long-term profitability.

This article explores the fundamentals of hedging, compares different techniques, and provides actionable insights from industry practice. It incorporates the principles of EEAT (Expertise, Experience, Authoritativeness, Trustworthiness), ensuring reliability and depth for readers.

What Is Hedging in Trading?

Definition and Purpose

Hedging is the practice of using financial instruments, market positions, or alternative assets to offset potential losses in an investment. The goal is not to maximize returns in the short run but to minimize downside risk.

Why Hedging Is Important

- Protects capital during volatile markets.

- Provides peace of mind for both retail and institutional investors.

- Improves portfolio performance consistency.

- Helps traders navigate uncertain global events like inflation spikes or geopolitical instability.

For traders entering the space, a beginners guide to hedge in trading can provide foundational knowledge before implementing advanced strategies.

Core Hedge Techniques to Reduce Trading Risks

1. Options-Based Hedging

Options are one of the most versatile instruments in hedging.

How It Works

- Protective Put: Buying a put option on a security you own to limit downside losses.

- Covered Call: Selling a call option on a security you own to generate premium income while slightly capping upside.

Pros

- Flexibility in structuring protection.

- Ability to customize based on volatility and risk tolerance.

- Cost-efficient if premiums are well-priced.

Cons

- Options premiums can be expensive.

- Requires knowledge of implied volatility and option pricing models.

Best Use Case: Institutional investors and hedge funds managing large equity portfolios.

2. Futures and Forward Contracts

Futures and forwards are widely used to lock in future prices for assets.

How It Works

- Currency Futures: Used to hedge against forex risk.

- Commodity Futures: Protect producers or buyers against unfavorable price changes.

- Equity Index Futures: Hedge overall market exposure.

Pros

- Transparent pricing and liquidity (futures).

- Tailored contracts for specific needs (forwards).

- Effective for corporate treasury and commodity hedging.

Cons

- Margin requirements can be high.

- Futures involve potential mark-to-market losses.

- Forwards lack liquidity and involve counterparty risk.

Best Use Case: Exporters, importers, and commodity producers who need certainty in pricing.

3. Diversification as a Natural Hedge

Diversification—spreading exposure across asset classes, sectors, and geographies—acts as a hedge by reducing concentration risk.

Example

A portfolio containing U.S. equities, European bonds, and gold is less vulnerable than one holding only U.S. tech stocks.

Pros

- Low cost.

- Reduces reliance on one market.

- Protects against sector-specific shocks.

Cons

- Does not guarantee loss prevention.

- Correlations between assets can converge during crises.

Best Use Case: Retail investors and wealth managers seeking long-term stability.

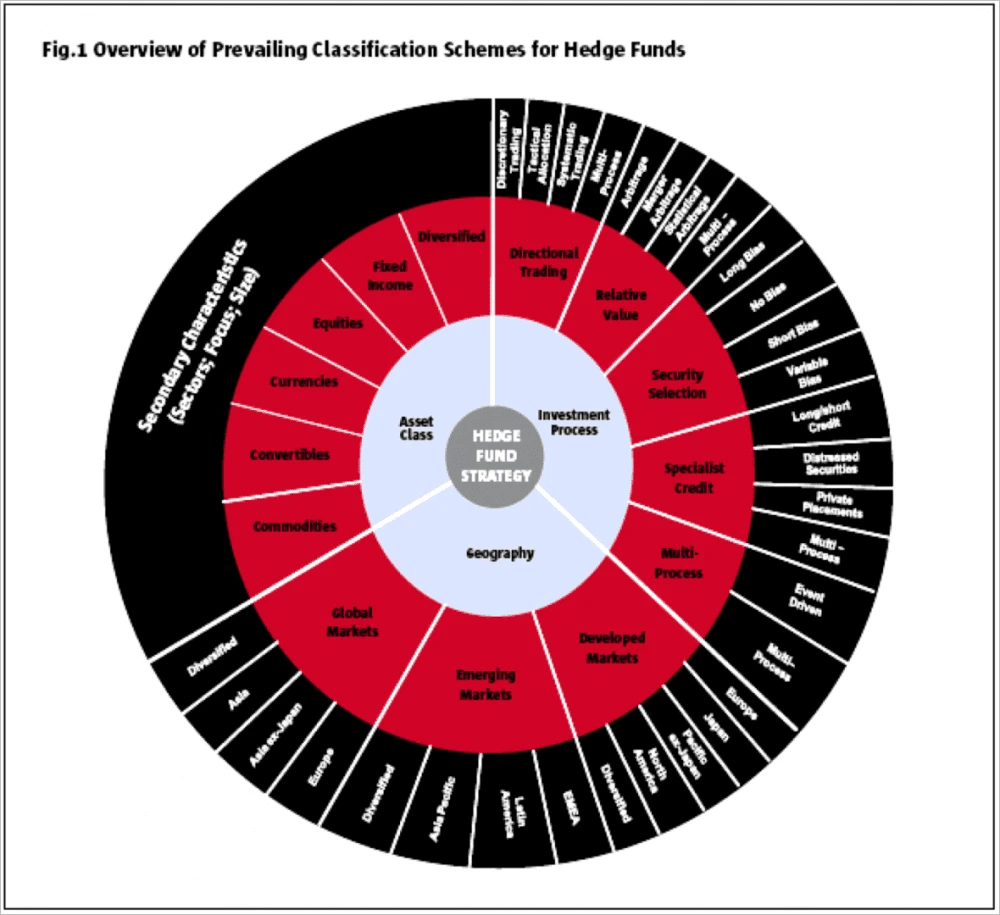

4. Quantitative Hedging Techniques

Quantitative traders often deploy statistical hedges by using correlations, regression models, or algorithmic pair trades.

Methods

- Pairs Trading: Hedging two correlated stocks (e.g., Coca-Cola vs. Pepsi).

- Beta Hedging: Adjusting portfolio beta to neutralize market exposure.

- Regression-Based Hedging: Using advanced models to hedge portfolio sensitivities.

Pros

- Precise, data-driven, and adaptable to fast markets.

- Integrates seamlessly into automated trading systems.

Cons

- Requires technical expertise in programming and quantitative finance.

- Dependent on data quality and assumptions.

Best Use Case: Hedge funds, proprietary trading desks, and advanced quant traders.

For a deeper dive, see how to hedge in quantitative trading, where mathematical models enhance traditional hedging strategies.

Comparison of hedge techniques: options, futures, diversification, and quantitative models

Comparing Hedge Techniques: Pros and Cons

| Hedge Technique | Complexity | Cost | Flexibility | Best For |

|---|---|---|---|---|

| Options Hedging | Medium-High | Medium-High | High | Institutional portfolios |

| Futures/Forwards | Medium | Medium | Medium | Corporates, commodity traders |

| Diversification | Low | Low | Medium | Retail investors, wealth managers |

| Quantitative Hedging | High | Medium | High | Hedge funds, quant traders |

Recommendation: A blended strategy often works best. For example, using diversification as a baseline, adding options for tactical hedges, and quantitative overlays for precision.

Advanced Hedge Techniques for Modern Markets

Volatility Hedging with VIX Futures

Traders use volatility indices (like the VIX) to hedge against sudden market shocks.

Currency Risk Hedging

For global portfolios, managing FX exposure is critical. Corporations often use forwards and options to protect cash flows.

Tail Risk Hedging

Allocating a small percentage to strategies that profit from extreme downturns (e.g., deep out-of-the-money puts) can protect portfolios from black swan events.

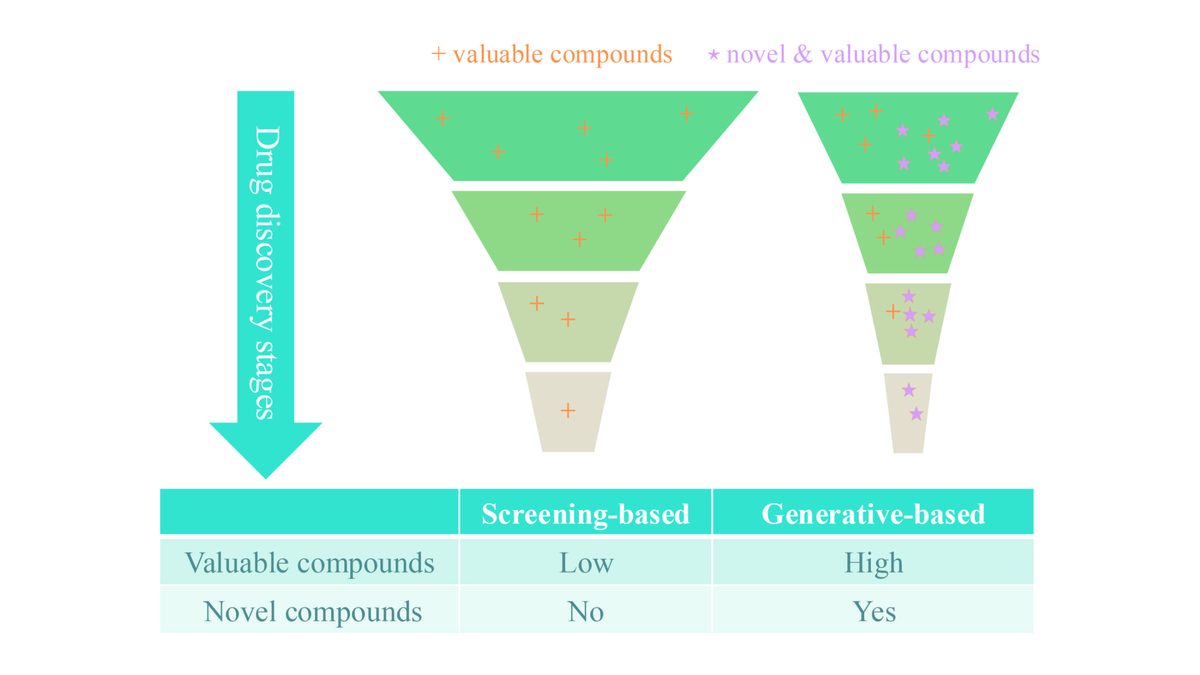

Hedge Effectiveness: How to Measure It

A hedge is only as good as its effectiveness. Traders and analysts measure hedge efficiency using:

- Hedge Ratio: The proportion of exposure covered by the hedge.

- Performance Attribution: Evaluating hedge contribution to overall portfolio performance.

- Scenario Testing: Stress-testing portfolios against adverse market events.

For professionals, mastering what is hedge effectiveness in trading is essential for validating risk management decisions.

Risk management framework for evaluating hedge effectiveness

Industry Trends in Hedging

Rise of Algorithmic Hedging

AI-driven hedge algorithms dynamically adjust exposure in real time, improving precision and cost efficiency.

ESG and Green Hedging Instruments

As sustainable finance grows, firms use carbon credits and ESG derivatives to hedge climate-related risks.

Integration of Hedging into Wealth Tech

Retail investors now access professional hedging strategies via robo-advisors and fintech platforms.

FAQs on Hedge Techniques to Reduce Trading Risks

1. What is the simplest hedge technique for new traders?

The simplest hedge technique is diversification—spreading investments across asset classes. Beginners can also use low-cost options like protective puts to safeguard stock positions.

2. How do I choose the best hedge strategy for my portfolio?

Your choice depends on:

- Asset class exposure.

- Investment horizon.

- Risk tolerance.

For example, equity investors often use options, while commodity traders prefer futures. Consulting hedge strategies for professional traders can provide deeper insights.

3. Can hedging eliminate all risks?

No. Hedging reduces risks but does not eliminate them entirely. Unexpected events, liquidity crises, or mispriced instruments can still cause losses. The key is to aim for risk reduction, not risk elimination.

Conclusion: Building Smarter Risk Management with Hedge Techniques

Hedging is one of the most important practices for traders and investors seeking to stabilize returns and manage volatility. From options and futures to diversification and quantitative strategies, the choice depends on one’s investment goals, expertise, and risk appetite.

The most successful investors use a layered approach—combining traditional and modern hedge techniques to create resilient portfolios. Whether you are a retail trader, a wealth manager, or an institutional investor, mastering hedge techniques to reduce trading risks is essential for long-term financial success.

Global investors applying hedge techniques to stabilize trading performance

Final Thoughts and Call to Action

Effective hedging is a journey of continuous learning. If this guide enhanced your understanding of hedge techniques to reduce trading risks, share it with fellow traders and investors. Leave a comment with your hedging experiences or strategies, and let’s build a community of smarter, risk-aware market participants.

Would you like me to also draft a step-by-step hedging strategy checklist that retail and professional traders can apply directly in their portfolios?

0 Comments

Leave a Comment