==============================================

The integration of artificial intelligence in financial markets is revolutionizing how traders make decisions. Among the most effective AI techniques, neural networks stand out for their ability to recognize complex patterns in market data and forecast price movements. This article provides a comprehensive guide on how to build neural network models for trading, blending theory, strategies, real-world applications, and expert insights.

Understanding Neural Networks in Trading

What Are Neural Networks?

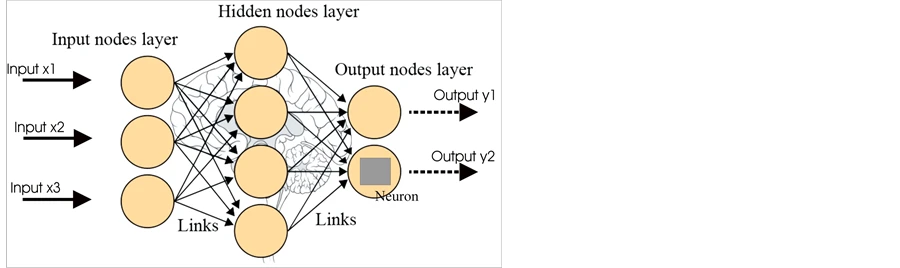

Neural networks are computational models inspired by the human brain. They consist of layers of interconnected nodes (“neurons”) that process input data, learn hidden patterns, and generate predictive outputs.

In trading, they analyze price history, volume, technical indicators, and sentiment data to predict future price actions.

Why Neural Networks Are Used in Quantitative Trading

Unlike traditional statistical methods, neural networks excel at handling non-linear relationships in financial data. This is why neural networks enhance trading accuracy, especially in volatile markets where human intuition often falls short.

A typical neural network used in trading consists of input, hidden, and output layers that process financial data.

Steps to Build Neural Network Models for Trading

Step 1: Data Collection and Preparation

- Sources: Price data, trading volume, economic indicators, and even news sentiment.

- Preprocessing: Normalize data, handle missing values, and create lag features (e.g., past 10-day returns).

Step 2: Feature Engineering

Features should capture trading signals, such as:

- Moving averages (SMA, EMA).

- Momentum indicators (RSI, MACD).

- Volatility measures.

- Order book depth in high-frequency trading.

Step 3: Choosing Neural Network Architectures

Different neural networks serve different purposes:

- Feedforward Neural Networks (FNNs) – Good for simple price prediction tasks.

- Recurrent Neural Networks (RNNs) – Capture sequential dependencies, useful for time-series forecasting.

- Long Short-Term Memory (LSTM) networks – Handle long-term dependencies in market data.

- Convolutional Neural Networks (CNNs) – Analyze candlestick chart patterns like images.

Step 4: Training the Model

- Split data into training, validation, and testing sets.

- Use backpropagation and gradient descent optimization.

- Regularize with dropout to prevent overfitting.

Step 5: Backtesting and Evaluation

- Test the neural network on unseen data.

- Use metrics like Sharpe ratio, drawdown, and accuracy of directional predictions.

Step 6: Deployment in Live Trading

- Connect the model to an execution system via APIs.

- Implement risk management rules.

- Monitor latency and performance.

Two Neural Network Approaches for Trading

Approach 1: Predictive Price Modeling with LSTM

LSTMs are particularly effective in time-series forecasting, making them suitable for predicting cryptocurrency or stock prices.

- Pros: Excellent at capturing long-term patterns; widely researched.

- Cons: Computationally heavy; requires large datasets.

Approach 2: Pattern Recognition with CNNs

CNNs can treat candlestick charts or technical indicators as images and classify bullish vs. bearish setups.

- Pros: Ideal for technical traders who rely on chart formations.

- Cons: Less interpretable; prone to overfitting if data is scarce.

Candlestick chart patterns can be identified and classified using convolutional neural networks (CNNs).

Comparing the Two Approaches

| Approach | Best Use Case | Strengths | Weaknesses |

|---|---|---|---|

| LSTM (Time-Series) | Forecasting crypto, forex, and stocks | Captures long-term dependencies | Requires large datasets, slower |

| CNN (Pattern-Based) | Detecting technical setups | Effective for visual recognition | Less transparent, overfits easily |

Recommendation: Advanced traders should combine LSTMs for forecasting with CNNs for technical pattern recognition, creating a hybrid model that leverages both data-driven and chart-driven signals.

The Role of Neural Networks in Quantitative Trading

Understanding how neural networks improve quantitative trading is essential. They automate repetitive decision-making, uncover hidden relationships, and adapt quickly to new market conditions. Many hedge funds and algorithmic trading firms already rely on neural networks for signal generation and portfolio optimization.

Best Practices in Building Neural Networks for Trading

- Avoid Overfitting – Always validate models on out-of-sample data.

- Incorporate Risk Management – Predictions should be combined with stop-loss and position-sizing rules.

- Update Models Frequently – Financial markets evolve; retrain models with fresh data.

- Combine Neural Networks with Other Models – Use ensemble methods (e.g., neural networks + random forests) for more robust predictions.

A neural network-powered trading system must be integrated with execution platforms for real-time performance.

Common Challenges and Solutions

- Data Quality Issues – Use high-quality, cleaned data to prevent bias.

- Interpretability – Neural networks are black boxes; consider techniques like SHAP values for explanation.

- Execution Latency – Optimize hardware and software for low-latency trading environments.

FAQs

1. Can beginners build neural network models for trading?

Yes, but it requires a solid foundation in Python, machine learning libraries (TensorFlow, PyTorch), and financial market knowledge. Beginners should start with simpler feedforward networks before moving to LSTMs or CNNs.

2. How much data do I need to train a neural network for trading?

The more, the better. At least 5–10 years of historical data is recommended for equities, while crypto traders can start with a few years of minute-level or tick-level data.

3. Are neural networks better than traditional technical analysis?

Not necessarily. Neural networks enhance prediction accuracy but should complement, not replace, traditional analysis. A hybrid approach that blends human expertise with AI models is often the most effective.

Conclusion

Building effective trading systems requires a deep understanding of how to build neural network models for trading. Whether you use LSTMs for price forecasting or CNNs for pattern recognition, the key lies in combining robust models with strong risk management.

👉 Have you experimented with neural networks in your trading strategies? Share your insights in the comments below, and don’t forget to share this guide with your trading community!

Neural networks are shaping the future of trading by enhancing decision-making and predictive accuracy.

0 Comments

Leave a Comment