================================================

Building predictive models with data mining is one of the most impactful ways businesses, researchers, and traders extract actionable insights from large datasets. From forecasting stock prices to predicting customer churn, predictive modeling allows decision-makers to anticipate outcomes and optimize strategies. In this comprehensive guide, we’ll explore step-by-step methods, compare modeling strategies, and share expert insights on how to build predictive models with data mining effectively.

Understanding Predictive Modeling in Data Mining

Predictive modeling is the process of using historical data to train algorithms that forecast future events. Data mining provides the foundation by extracting meaningful patterns and relationships hidden in large datasets.

Why Predictive Modeling Matters

- Business applications: Customer segmentation, fraud detection, marketing optimization.

- Financial applications: Credit risk scoring, portfolio optimization, algorithmic trading.

- Healthcare applications: Disease progression modeling, patient outcome predictions.

Predictive models rely on both statistical techniques and machine learning algorithms to transform raw data into actionable forecasts.

Key Steps to Build Predictive Models with Data Mining

1. Define the Objective Clearly

Before modeling, you must establish a precise business or research question. For instance:

- “Which customers are most likely to churn?”

- “What is the probability of stock X increasing by 5% next week?”

2. Data Collection and Preparation

High-quality data is the backbone of predictive modeling. Data preparation includes:

- Cleaning: Handling missing values, duplicates, or outliers.

- Transformation: Normalizing, encoding categorical data, and feature scaling.

- Integration: Combining structured (e.g., databases) and unstructured (e.g., social media text) sources.

3. Feature Engineering

Feature engineering enhances predictive power by:

- Creating new variables (ratios, lags, interaction terms).

- Selecting the most important features via statistical tests or algorithms like Random Forest importance ranking.

4. Choosing the Right Algorithm

The choice of algorithm depends on the type of prediction:

- Regression models: Forecasting continuous values (e.g., sales, prices).

- Classification models: Predicting categorical outcomes (e.g., fraud vs. not fraud).

- Time-series models: Forecasting sequential data (e.g., demand, financial markets).

5. Model Training and Validation

- Training: Fit the model on historical data.

- Validation: Use cross-validation or hold-out sets to avoid overfitting.

- Metrics: Evaluate using accuracy, precision, recall, F1-score, or RMSE depending on the problem.

6. Deployment and Monitoring

Predictive models must be integrated into real-time systems and continuously monitored to ensure accuracy as data patterns shift.

Comparing Two Popular Predictive Modeling Strategies

Strategy 1: Decision Trees and Random Forests

Decision trees are intuitive, easy-to-interpret models. Random Forests, an ensemble of decision trees, enhance predictive accuracy.

Advantages:

- Handles categorical and numerical data.

- Resistant to overfitting (especially Random Forest).

- Provides feature importance ranking.

Disadvantages:

- Single decision trees may overfit.

- Random Forests are harder to interpret than individual trees.

Strategy 2: Neural Networks for Deep Learning

Neural networks mimic human brain structures, making them powerful for capturing non-linear relationships.

Advantages:

- Excellent for large, complex datasets (e.g., images, text, high-frequency trading data).

- Can model highly non-linear patterns.

- Widely used in modern applications like fraud detection and financial forecasting.

Disadvantages:

- Requires large amounts of data.

- Computationally expensive.

- Less interpretable (“black box” models).

Which Strategy is Best?

- For structured data with clear relationships, Random Forests are more practical.

- For large-scale unstructured data or highly complex tasks, Neural Networks deliver superior performance.

A hybrid approach often works best, combining interpretable models with deep learning for maximum efficiency.

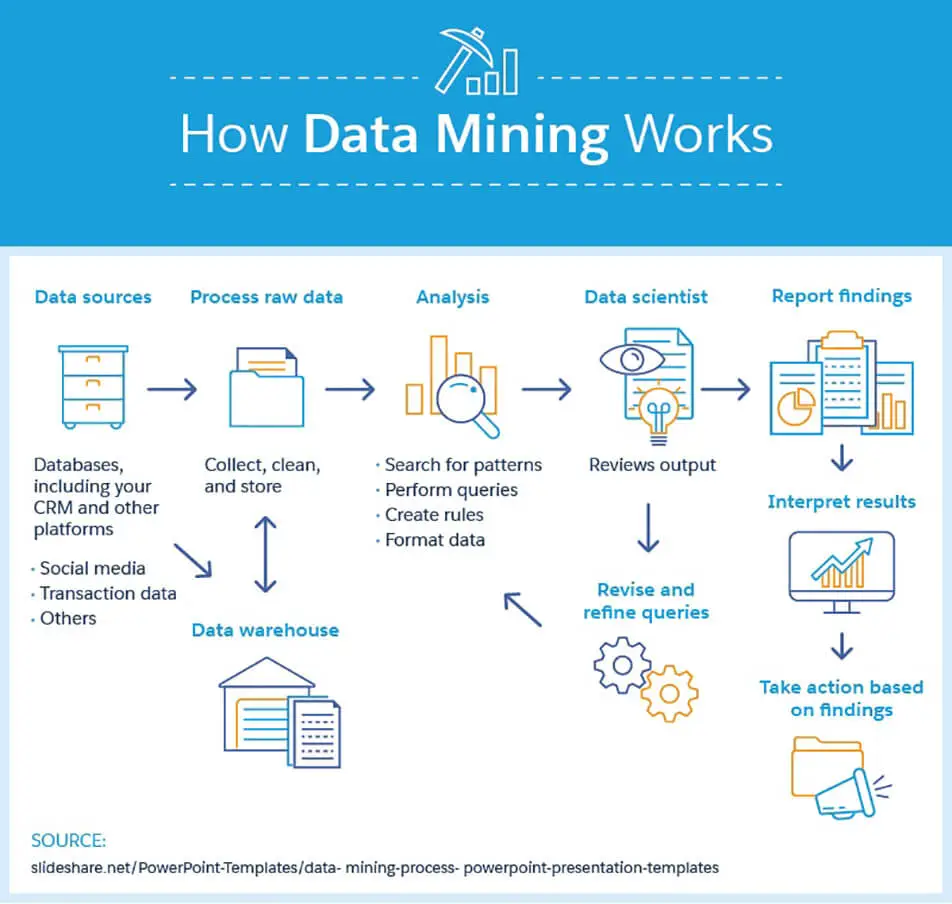

Visual Workflow of Predictive Model Development

Predictive model development involves iterative cycles of data preparation, feature engineering, model training, validation, and deployment.

Advanced Techniques to Enhance Predictive Models

1. Ensemble Learning

Combines multiple algorithms (e.g., Gradient Boosting, XGBoost, LightGBM) to improve robustness and accuracy.

2. Automated Machine Learning (AutoML)

AutoML platforms (H2O.ai, Google AutoML) automate algorithm selection and hyperparameter tuning, making predictive modeling more accessible.

3. Data Mining in Finance

Predictive modeling is especially impactful in finance. For instance, how data mining enhances quantitative trading is seen in backtesting strategies, identifying market anomalies, and improving execution timing.

4. Risk Management Applications

Predictive models can forecast portfolio risks, allowing hedge funds to rebalance before volatility spikes. This aligns closely with data mining strategies for risk management, a core concern for institutional investors.

Real-World Applications of Predictive Modeling with Data Mining

- Retail: Predicting customer purchase intent.

- Healthcare: Early disease detection using patient history.

- Banking: Credit scoring and fraud detection.

- Trading: Predicting asset price movements, volatility clustering, and liquidity risks.

Data mining models are widely used in algorithmic trading to anticipate market behavior.

Common Challenges in Building Predictive Models

- Data Quality Issues – Garbage in, garbage out.

- Overfitting – Model fits historical data but fails in live environments.

- Interpretability – Complex models like neural networks lack transparency.

- Changing Patterns – Market dynamics or customer behavior shifts can reduce accuracy.

Solutions include continuous retraining, interpretable AI techniques, and robust validation processes.

FAQ: Building Predictive Models with Data Mining

1. What is the most important step in building predictive models?

The most important step is data preparation. Even the best algorithms cannot compensate for poor-quality data. Proper cleaning, transformation, and feature engineering determine up to 80% of model success.

2. Which algorithm is best for beginners?

For beginners, decision trees and logistic regression are ideal starting points. They are easy to understand, require less computation, and provide interpretable results. As expertise grows, practitioners can transition to Random Forests, Gradient Boosting, and Neural Networks.

3. How do I keep predictive models accurate over time?

Predictive models must be regularly retrained with new data. Monitoring performance metrics like accuracy or RMSE helps identify when a model is drifting. In industries like finance, where data patterns shift quickly, retraining can occur weekly or even daily.

Conclusion: Turning Data into Predictive Power

Learning how to build predictive models with data mining is not just about mastering algorithms—it’s about understanding business objectives, preparing high-quality data, and applying the right techniques for each context. By leveraging strategies like Random Forests and Neural Networks, organizations can unlock powerful insights and stay ahead of compe*****s.

Predictive modeling is an evolving field, and its integration with AI and automation promises even greater advancements. Whether you’re a data scientist, financial analyst, or business leader, mastering these methods is key to transforming data into future-ready decisions.

💡 Join the conversation: How have you applied predictive modeling in your field? Share your thoughts in the comments, and don’t forget to share this article with colleagues who want to master predictive analytics!

0 Comments

Leave a Comment