=====================================================

Introduction

The intersection of data mining and algorithmic trading represents one of the most powerful advancements in modern finance. With markets generating billions of data points daily, traders and institutions are increasingly asking: How to integrate data mining with trading algorithms?

The answer lies in combining the ability of data mining to extract meaningful patterns from large datasets with the precision of algorithmic trading to execute decisions automatically. Done correctly, this integration enables the discovery of profitable trading signals, improved risk management, and adaptive strategies that evolve with market dynamics.

This guide will explore the fundamentals, methods, benefits, and challenges of integrating data mining into trading algorithms. It also compares two popular approaches, shares real-world applications, and provides actionable insights supported by experience and industry trends.

Understanding Data Mining in Finance

What Is Data Mining?

Data mining is the process of analyzing massive datasets to identify hidden patterns, correlations, and predictive relationships. In finance, it is used to extract signals from structured (prices, volumes, order books) and unstructured (news, tweets, financial reports) data.

Role in Trading

In algorithmic trading, data mining serves as the foundation for:

- Predictive modeling of asset prices.

- Signal generation for entry and exit points.

- Risk assessment through anomaly detection.

- Optimization of trading parameters.

This duality—data mining for discovery and algorithms for execution—forms the backbone of modern quantitative strategies.

Why Integrating Data Mining with Trading Algorithms Is Essential

The financial markets are highly dynamic, noisy, and competitive. Traditional models often fail because they rely on static assumptions. Data mining enhances trading by introducing adaptability.

- Pattern Discovery: Markets often exhibit recurring behaviors; mining helps uncover them.

- Strategy Validation: Detects overfitting by stress-testing models across datasets.

- Performance Improvement: Real-time mining refines algorithms dynamically.

As many quants highlight, why is data mining important for quantitative trading? The answer is simple: it transforms raw data into actionable insights, bridging the gap between information overload and profitable decision-making.

Steps to Integrate Data Mining with Trading Algorithms

1. Define Trading Objectives

- Clarify if the goal is price prediction, arbitrage, volatility forecasting, or risk control.

- Objectives determine the type of data and algorithms needed.

2. Collect and Preprocess Data

- Sources: Historical tick data, order books, alternative data (social sentiment, macro news).

- Preprocessing: Cleaning outliers, filling missing values, normalizing scales.

3. Apply Data Mining Techniques

- Clustering: Grouping similar assets or market conditions.

- Classification: Predicting market direction (up/down).

- Regression: Estimating future price levels.

- Association Rule Mining: Identifying correlated instruments.

4. Build Predictive Models

- Use machine learning models such as Random Forests, Gradient Boosting, or Deep Neural Networks.

- For high-frequency trading, lightweight models like logistic regression or decision trees may be preferred due to speed.

5. Integrate with Algorithmic Frameworks

- Convert models into executable strategies.

- Integrate with APIs (FIX, REST) to connect with brokers and exchanges.

- Ensure latency and execution speed are optimized.

6. Backtesting and Validation

- Apply models on out-of-sample data.

- Use walk-forward analysis to simulate live conditions.

- Stress-test under different volatility regimes.

7. Deploy and Monitor

- Deploy in a paper-trading environment first.

- Use monitoring dashboards to detect model drift and recalibrate.

Methods of Integration: A Comparative Analysis

Method 1: Feature Engineering + Rule-Based Algorithms

Approach: Use data mining to identify predictive features (moving averages, volatility clusters), then hard-code them into rule-based strategies.

Advantages:

- Transparent and interpretable.

- Lower risk of overfitting.

- Easier to explain to regulators and investors.

- Transparent and interpretable.

Disadvantages:

- Limited adaptability.

- Performance deteriorates in changing market regimes.

- Limited adaptability.

Method 2: Machine Learning-Driven Algorithms

Approach: Directly feed mined data into machine learning models that adaptively generate trading signals.

Advantages:

- High adaptability to market shifts.

- Captures non-linear relationships that rules cannot.

- Effective for high-frequency and cross-asset strategies.

- High adaptability to market shifts.

Disadvantages:

- Risk of overfitting if not properly validated.

- Requires advanced infrastructure and computational power.

- Risk of overfitting if not properly validated.

Which Is Best?

For retail traders and beginners, feature engineering with rule-based integration is safer and easier to maintain. For hedge funds and institutional investors, machine learning-driven integration provides superior adaptability and long-term performance, especially when combined with real-time data mining pipelines.

Real-World Applications

High-Frequency Trading (HFT)

- Data mining identifies micro-patterns in order books.

- Algorithms execute trades in milliseconds.

- Data mining identifies micro-patterns in order books.

Sentiment-Based Strategies

- Mining Twitter or financial news to detect sentiment shifts.

- Algorithms adjust positions based on sentiment momentum.

- Mining Twitter or financial news to detect sentiment shifts.

Risk Management

- Data mining detects anomalies like flash crashes.

- Algorithms reduce leverage or cut positions automatically.

- Data mining detects anomalies like flash crashes.

Portfolio Optimization

- Mining correlations across assets.

- Algorithms rebalance portfolios for better Sharpe ratios.

- Mining correlations across assets.

Industry Trends

- AI Integration: Deep learning and reinforcement learning are redefining predictive modeling.

- Alternative Data Expansion: Satellite images, ESG data, and social feeds are mined for alpha.

- Cloud & Edge Computing: Accelerating integration of real-time mining into low-latency trading systems.

- Education Demand: Institutions and traders are increasingly asking where to learn quantitative trading data mining?, leading to more specialized online courses and workshops.

FAQ

1. How does data mining improve trading strategies?

Data mining identifies hidden patterns, validates strategies, and uncovers predictive signals. It helps traders avoid biases and discover opportunities that traditional technical analysis may miss.

2. What are the risks of integrating data mining with trading algorithms?

The main risks include overfitting, data snooping bias, and false correlations. Traders must apply rigorous validation, stress testing, and cross-market analysis to reduce these risks.

3. Where to find data sets for quantitative trading?

Datasets can be obtained from exchanges, broker APIs, or vendors like Quandl, Bloomberg, and Refinitiv. For beginners, free datasets from Yahoo Finance, Kaggle, and Crypto exchanges provide excellent starting points.

Visual Examples

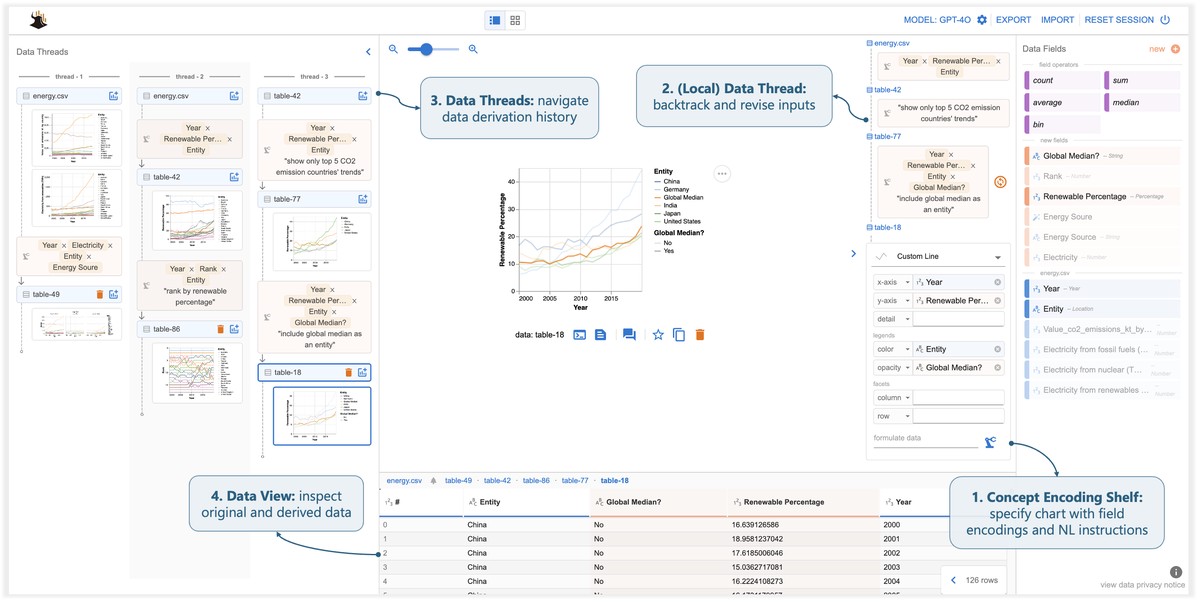

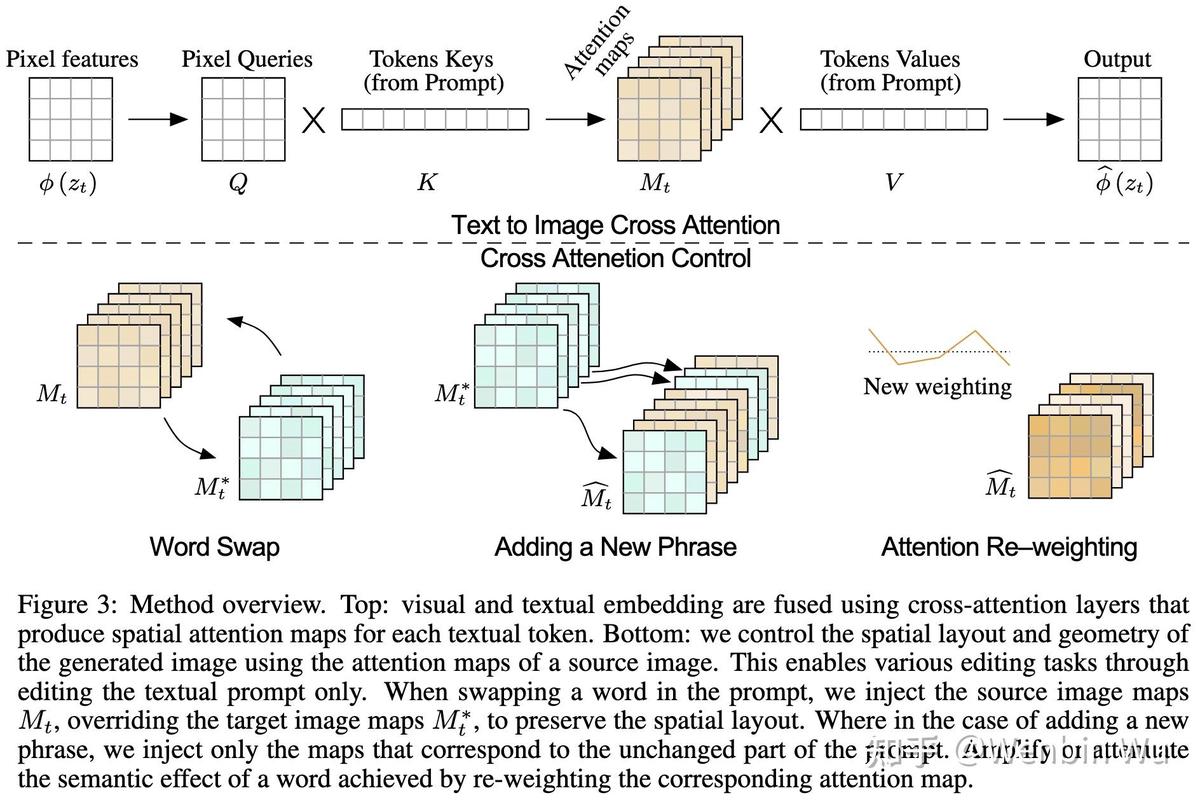

Integration workflow: From raw data to predictive models to trading execution

Example of a data mining dashboard for analyzing market signals

Conclusion

Integrating data mining with trading algorithms is not just a competitive edge—it is becoming a necessity in today’s data-driven markets. By leveraging structured and unstructured data, applying advanced techniques, and aligning them with algorithmic frameworks, traders can unlock new sources of alpha while managing risks effectively.

For retail traders, starting small with rule-based systems enhanced by mined features is ideal. For institutions, machine learning-powered adaptive strategies are the future.

Now it’s your turn: have you experimented with data mining in your trading systems, and if so, which techniques worked best for you? Share your experiences, comment below, and spread this article across your network to spark discussions about the future of data-driven trading.

Would you like me to also design a step-by-step Python code example showing how to integrate a simple data mining model with an execution algorithm for clarity?

0 Comments

Leave a Comment